The story of U.S. oil production is a very important thread in the bigger theme of Non-OPEC production. This update discusses whether the U.S. oil supply has peaked? Also, what are the latest developments in the U.S. oil industry? Mark’s latest Insights focus on the global oil markets in connection with the latest trends in macro-economic enviroment. Given what is happening in the world, this is a must read for everyone!

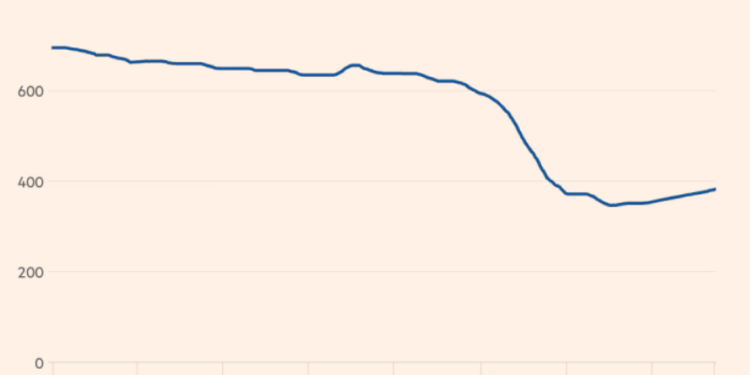

1. What is happening with the U.S. oil production? – PREMIUM

U.S. oil production has long been a topic of intense debate. We’ve heard the bullish calls—some even expecting U.S. production to continue growing for years to come. And yet, the reality on the ground is more complex. As we sit today, the data suggests U.S. oil production is near its peak, but the story is far from straightforward. Read the full article here to learn more about it!

2. Market Sentiment Tracker: Jobs are Becoming Hard to find – PREMIUM

The official manufacturing PMI of China edged up slightly to 49.8 in September from 49.7 in August, signaling continued contraction, though with a slower decline. It’s the fifth consecutive month of factory activity shrinking. Eurozone economic sentiment continues to weaken as headwinds intensify. Private-sector activity contracted in September, with S&P Global’s Composite PMI slipping to 48. Services activity also deteriorated, dropping to 50.5 from 52.9, marking its slowest growth in seven months. In the U.S. Jobs are becoming harder to find as ISM manufacturing PMI contracts for the sixth consecutive month, now at 47.2. Only five out of thirteen industries saw growth in September, indicating broader economic struggles. Spending on construction projects fell by 0.1% in August, dipping to $2.13 trillion, while the Chicago Business Barometer rose slightly to 46.6 in September but remains in contraction for the tenth straight month.

3. Primary Vision Insights – ENTERPRISE

The latest INSIGHTS by Mark Rossano provides the best mix of original and brilliant analysis combining geopolitics, macro-economy and oil markets. It comes with extremely insightful charts that really put things into perspective.

4. Profrac Holding’s Perspective in Q2: Key Takeaways – PREMIUM

In June, ACDC acquired Advanced Stimulation Technologies, a small frack service provider. The acquisition enhanced its earnings profile and improved its position in one of the most active onshore regions in the US. The company will invest in next-generation equipment that enables diesel substitution, utilizing natural gas as the primary fuel source. What does mean for the company? Read Avik Chowdhury’s latest to find out.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co