Iran’s Jask Port is increasingly becoming a focal point in the country’s oil export strategy, especially as tensions with Israel intensify. The port, located on the Gulf of Oman, is designed to handle up to 1 million barrels per day and offers a crucial alternative to the Strait of Hormuz, through which 90% of Iran’s oil traditionally flows. Recent developments at Jask indicate that 11 of the terminal’s 20 planned crude storage tanks are now complete, providing 5.5 million barrels of storage capacity. Moreover, in other news development, Nabors Industries (NBR) announced the acquisition of Parker Wellbore. Parker provides franchises of tubular rentals, well construction services, and drilling rigs. Meanwhile, real disposable incomes in China rose by 4.1% year-on-year, reflecting solid household earnings growth, while the propensity to consume was at 66.7% for the first nine months.

1. MMV: What is happening in Iran’s Jask Port – PREMIUM

Iran’s Jask Port is increasingly becoming a focal point in the country’s oil export strategy, especially as tensions with Israel intensify. The port, located on the Gulf of Oman, is designed to handle up to 1 million barrels per day and offers a crucial alternative to the Strait of Hormuz, through which 90% of Iran’s oil traditionally flows. Recent developments at Jask indicate that 11 of the terminal’s 20 planned crude storage tanks are now complete, providing 5.5 million barrels of storage capacity. Although this is a fraction of the terminal’s planned capacity of 20 million barrels.

Read the article above to learn about this in more detail.

2. MST: U.S. Retail sales, Eurozone cut rates and China’s indicators improve – PREMIUM

This week’s Market Sentiment Tracker digs deeper into the recently released economic data. Retail sales rose in the U.S. to 0.4% in September, maintaining momentum from the unrevised August figure, while core retail sales jumped 0.7%. Real disposable incomes in China rose by 4.1% year-on-year, reflecting solid household earnings growth, while the propensity to consume was at 66.7% for the first nine months. Eurozone industrial production surged in August, with France and the Netherlands showing notable growth at 1.4% and 2.2% month-on-month, respectively.

READ MORE TO FIND ABOUT THE DIRECTION OF THE GLOBAL ECONOMY.

3. Primary Vision Insights – ENTERPRISE

The latest INSIGHTS by Mark Rossano Brent futures fell to just below $73 and the bottom of our range. We expected to see a sizeable drop once the concerns of an Israeli retaliatory attack faded a bit. The U.S. had a decent EIA number with some make-up data following the shifts in the GoM and weather-related pivots. The bigger factor here is the move up in U.S. crude production, and this is the level we believe we exit. There is some potential for upside into 13.7M barrels a day. The Russian shadow fleet rising is going to keep buyers (China and India) away from the rising cost of the Iranian barrels. Find out more in the latest installment.

4. Nabors Industries: Key Takeaways – PREMIUM

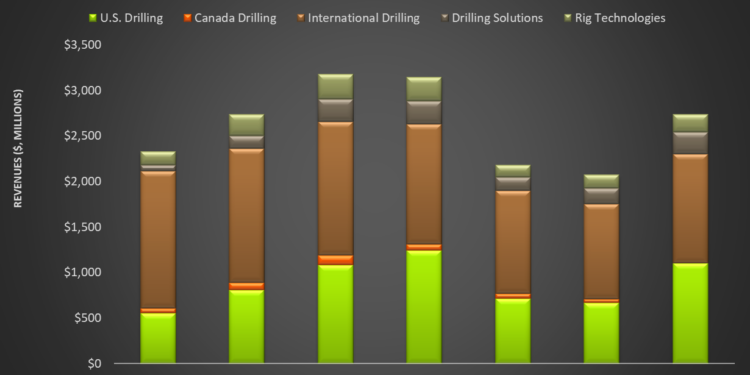

Nabors Industries (NBR) announced the acquisition of Parker Wellbore. Parker provides franchises of tubular rentals, well construction services, and drilling rigs. NBR expects to see international growth, with 13 rigs scheduled to deploy through early 2026 in the Middle East and Latin America. Avik Chowdhury has really done a great job in this article in highlighting incredible details about Nabors industry outlook.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co