This update brings you some significantly interesting articles that intend to answer important questions. The most important theme next year is the impact of Trump on U.S. oil production. We assess the spectrum of options at Trump’s disposal and what challenges he might face in such an undertaking. There is also a bonus article that speaks about the future of Keystone Pipeline.

1. Can Trump Really Boost U.S. Oil Production? – PREMIUM

There are multiple factors that might hinder further boost in production. The global demand is the most important element as the world is expected to be oversupplied with oil. Secondly, pipeline capacity is another technical reality that cannot be ignored. Lastly, the refineries need an overhaul too as most were built to refine heavier grades as compared to the lighter grade that has witnessed a record increase in production.

Read the article above to learn about this in more detail.

2. Future of Keystone Pipeline – FREE

The Keystone XL pipeline has become a hallmark of political and environmental contention, a project whose journey encapsulates the shifting dynamics of energy policy, economic necessity, and climate awareness over the past two decades. Market conditions have shifted significantly since the pipeline was first proposed. The political climate surrounding Keystone XL remains fraught. Any attempt to revive the project would undoubtedly face fierce resistance from environmental groups, indigenous organizations, and local communities, all of whom have successfully mounted legal challenges in the past. Read more about this important pipeline in our Free to Read article.

3. TechnipFMC’s Perspective – PREMIUM

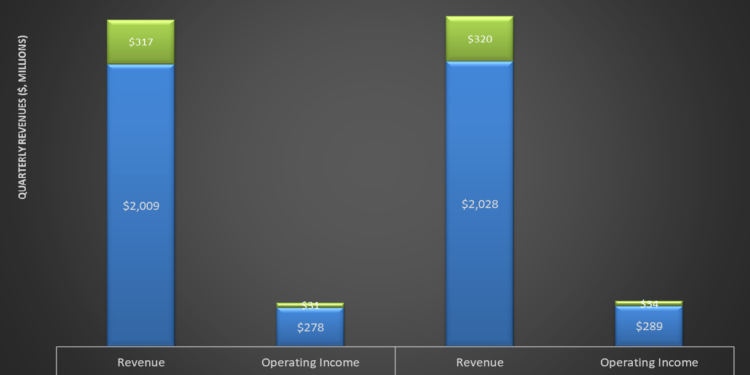

In Q3, FTI had an inbound order of $2.46 billion, which was 20% lower than a quarter earlier. In Q4, however, FTI expects some headwinds. Its Subsea revenues can decline by “low-single-digits” sequentially. It is important to find out re the health of these companies as they together will determine the demand supply dynamics of the largest producer of oil. Read Avik Chowdhury’s takeaway on FTI.

4. MST: Germany in Trouble, Resilience in China, and U.S. economy still strong – PREMIUM

China’s industrial sector demonstrated resilience in October, growing by 5.3% year-on-year, propelled by improved manufacturing activity. Eurozone’s economy continues to be in a bad shape. Germany’s IFO Business Climate Index rose to 86.5 in October, signaling slight optimism after five months of decline. The U.S. economy holds its ground with an annualized GDP growth of 2.8%, bolstered by robust post-pandemic consumption trends and a 3.4% surge in home sales.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co