In this latest update we discuss the future of the oil field industry and the impact of price swings, geopolitics and Trump’s announcement on the future of oil prices. Everything is connected. From words to wars and from rhetoric to reality. Let’s dicsuss these themes in detail.

1. MMV: Can Hallliburton’s Global Push Offset North America’s Decline? – PREMIUM

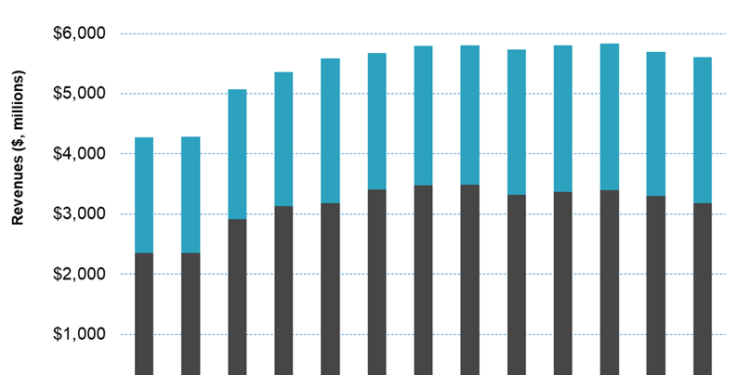

Halliburton, one of the most prominent names in oilfield services, is navigating a period of transition marked by softer North American activity and shifting global demand. The fourth quarter of 2024 proved challenging for Halliburton, with North American revenue falling by 9% to $2.2 billion. The latest Frac Spread Count (FSC) data, combined with the above financial performance metrics and market insights, puts the challenges faced by companies like Halliburton in perspective. Read the full article for learn more.

2. MST: Growth Remains Fragile – PREMIUM

The Eurozone is trying to find its footing, but growth remains fragile. Germany’s business climate index saw a small uptick, signaling cautious optimism. The U.S. economy continues to send mixed signals. The composite PMI output index hit a 32-month high at 55.4 in December, and retail sales grew 0.4%, showing resilience in consumer spending.China’s economy closed out 2024 on a strong note, with Q4 GDP growth hitting 5.4%, its best pace in six quarters. Read the full article to learn about the direction of the global economy.

3. Halliburton’s Perspective in Q4: Take Three – PREMIUM

In the energy business, the company notices a shift in customer activity toward drilling technology, unconventional drilling techniques, well intervention, and artificial lift. Halliburton’s expectation in North America is bearish, with a “low to mid-single digits” revenue decline in FY2025. HAL has a bearish outlook in North America. Lower frac fleet pricing would adversely impact much of its margins. Read Avik Chowdhury’s detailed work to learn more about it.

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co