The global economy seems to be grappling with multiple crisis these days from an ecological one that is persistent in its nature to a slowdown in economic activity (also turning into a perpetual one), and from geopolitics making a comeback on the center stage to rising deficits lying the foundation for the next big crisis – things seem to be in a flux. In this update, we will have a look at the global economy while focusing on Eurozone and also see where is the debt of G7 heading to.

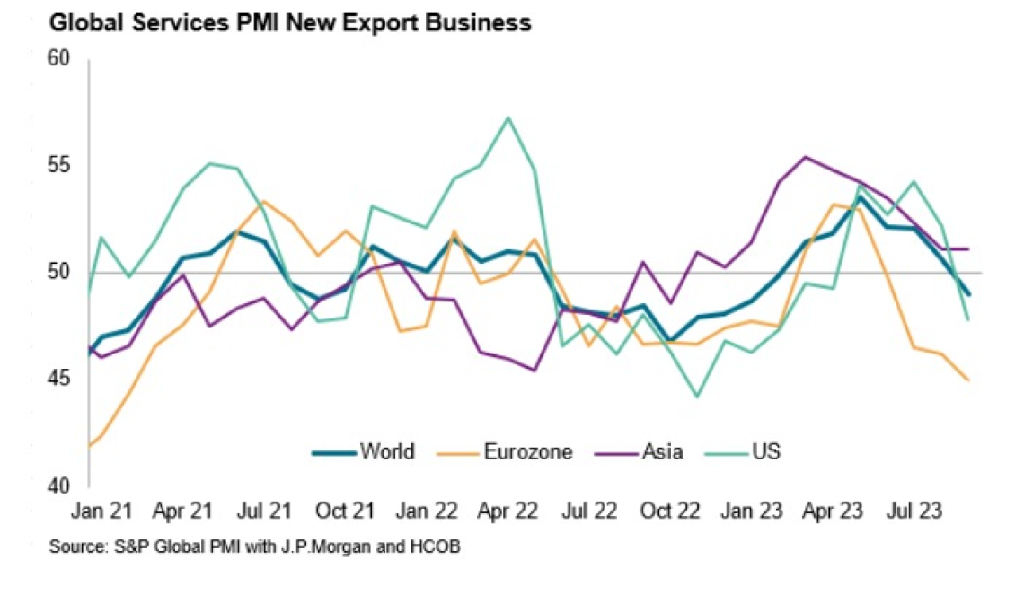

Kicking things off with this very important and interesting chart from Mark’s insights. We have recently observed that while manufacturing PMIs have been heading lower there was still some strength left in the services side. However, that seems to be chipping away as well. This key indicator has turned negative with more downside pressure coming from U.S. and Europe.

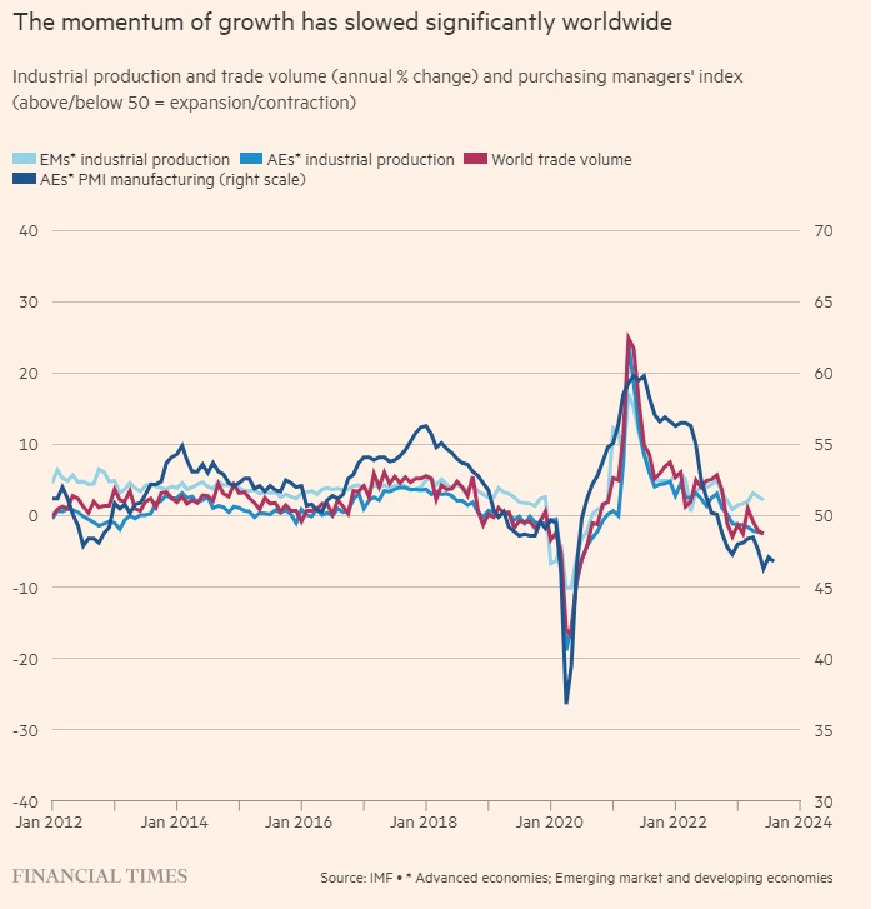

Other important global indicators also point towards a slowdown in economic activity. For instance, look at this simple yet powerful chart below.

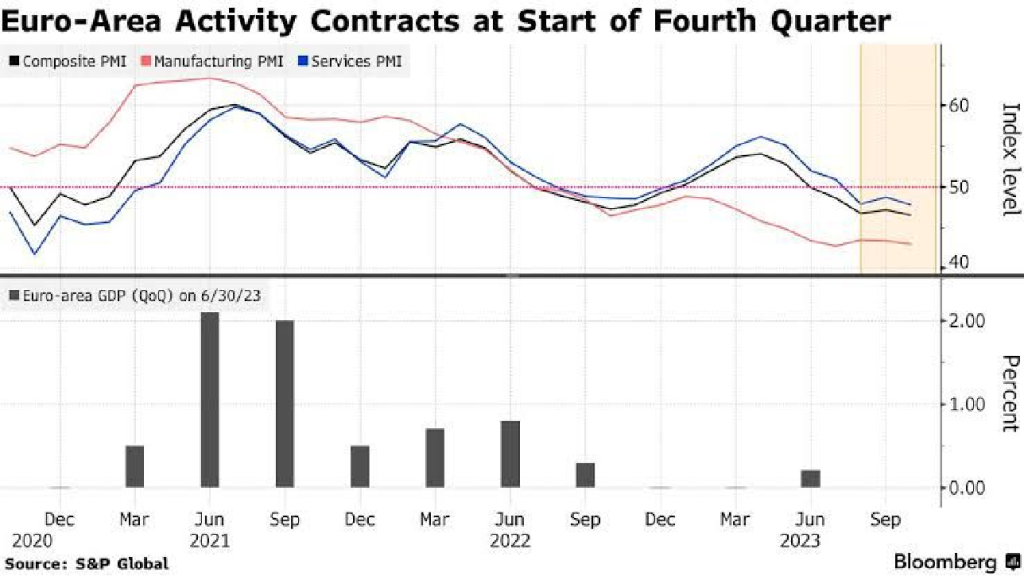

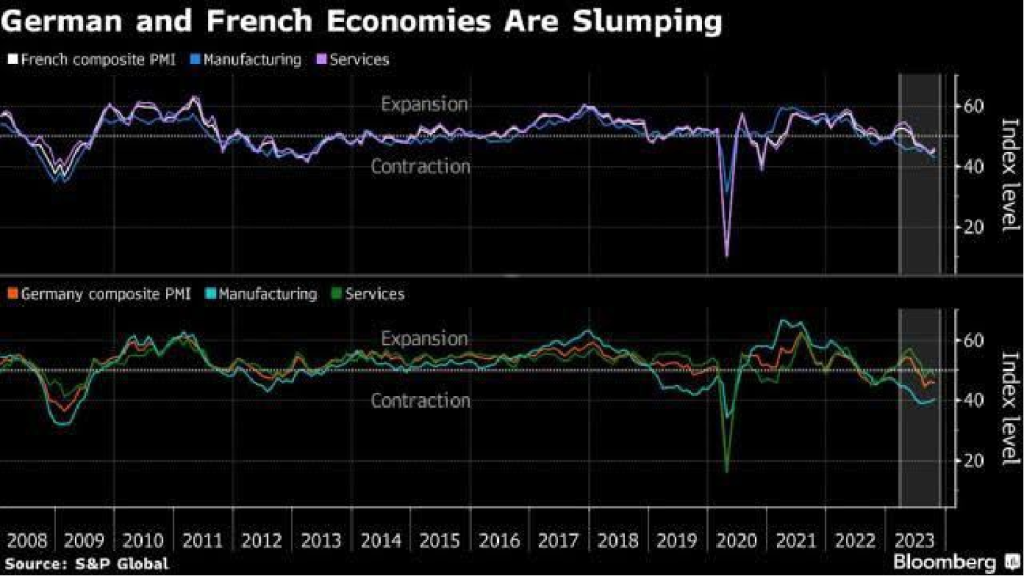

If we focus on Europe then the recent economic data continues to disappoint.

In the euro area, business operations declined due to a decrease in demand, affecting the entire region. This indicates a challenging start to the fourth quarter and raises concerns about a potential recession. The HCOB’s flash euro zone Composite Purchasing Managers’ Index (PMI), put together by S&P Global and recognized as a reliable indicator of economic well-being, dropped to 46.5 in October, down from 47.2 in September, marking its lowest point since November 2020.

In Europe’s biggest economy, business performance shrank for the fourth consecutive month. This decline was evident in both manufacturing and services, as indicated by its PMI. In France, which is the euro zone’s second-largest economy, business activities continued to contract in October. The PMI data revealed a slight improvement from September’s almost three-year low. Meanwhile, in the UK, which is not part of the European Union, businesses experienced a drop in activity this month, highlighting potential recession concerns before the Bank of England’s upcoming interest rate announcement.

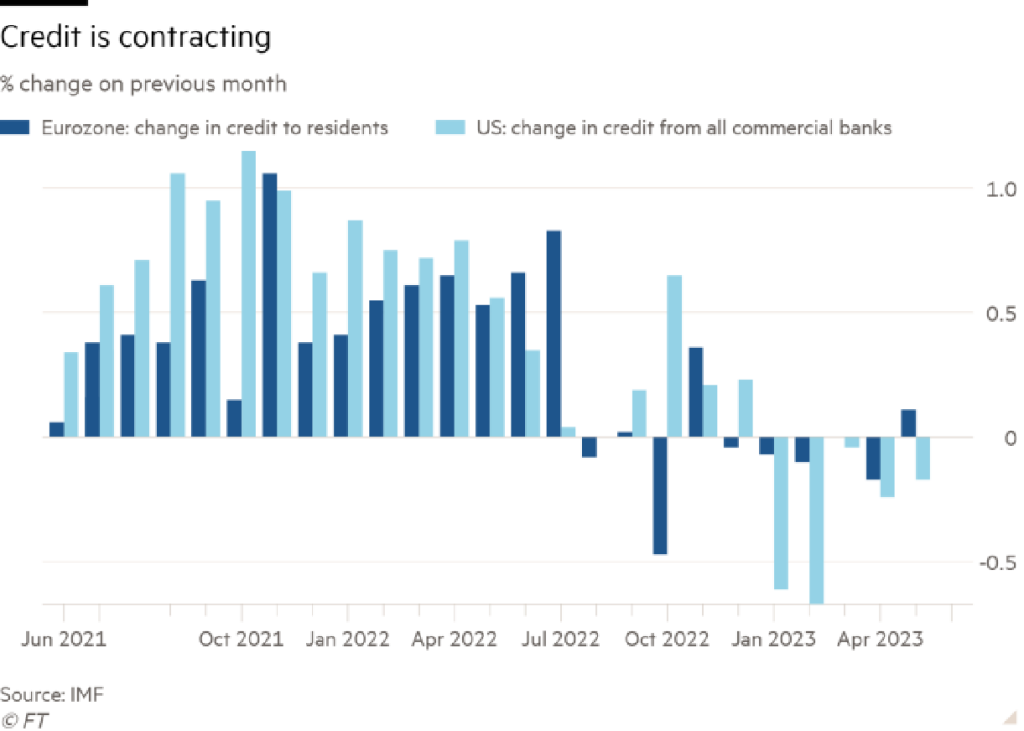

As global credit tightens and debt and deficits surge, economies worldwide are grappling with challenges. Over 80% of these economies are now confronting dimmer prospects compared to 15 years ago, states the fund. The reasons for this downturn range from reduced productivity rates to a deceleration in population growth.

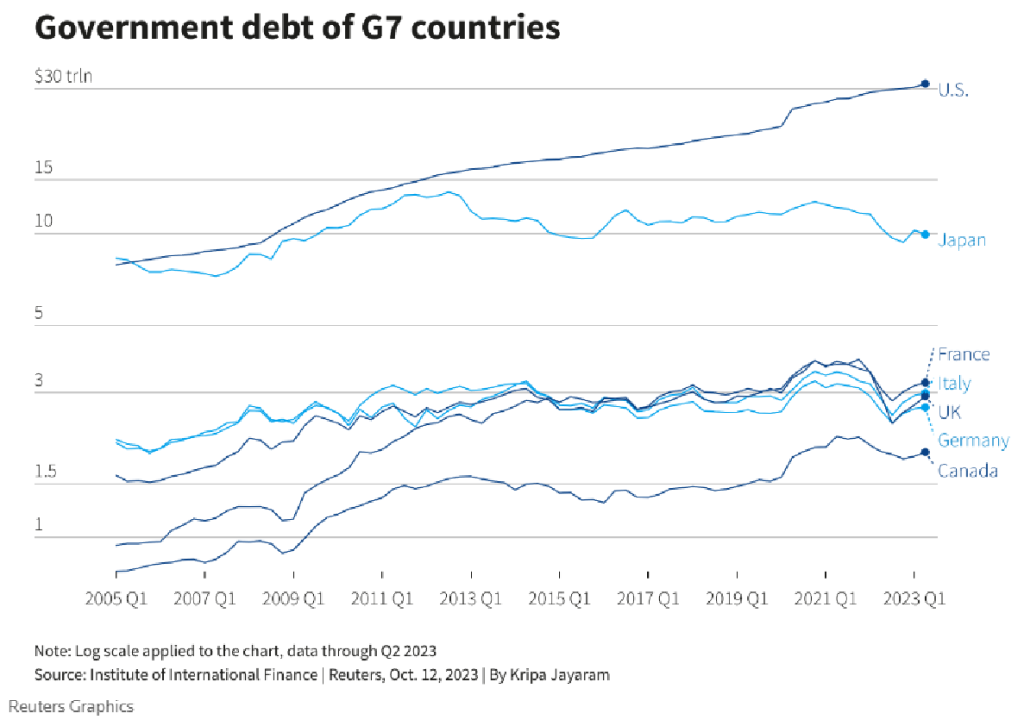

Amid the backdrop of global credit contraction and escalating debt and deficits, there’s an added layer of financial concern. The worldwide public debt ratio is on track to approach 100% of the gross domestic product by the decade’s end. This trajectory has reignited worries about the long-term viability of such debt levels and may cause an “inconvenient” period for the G7 countries.

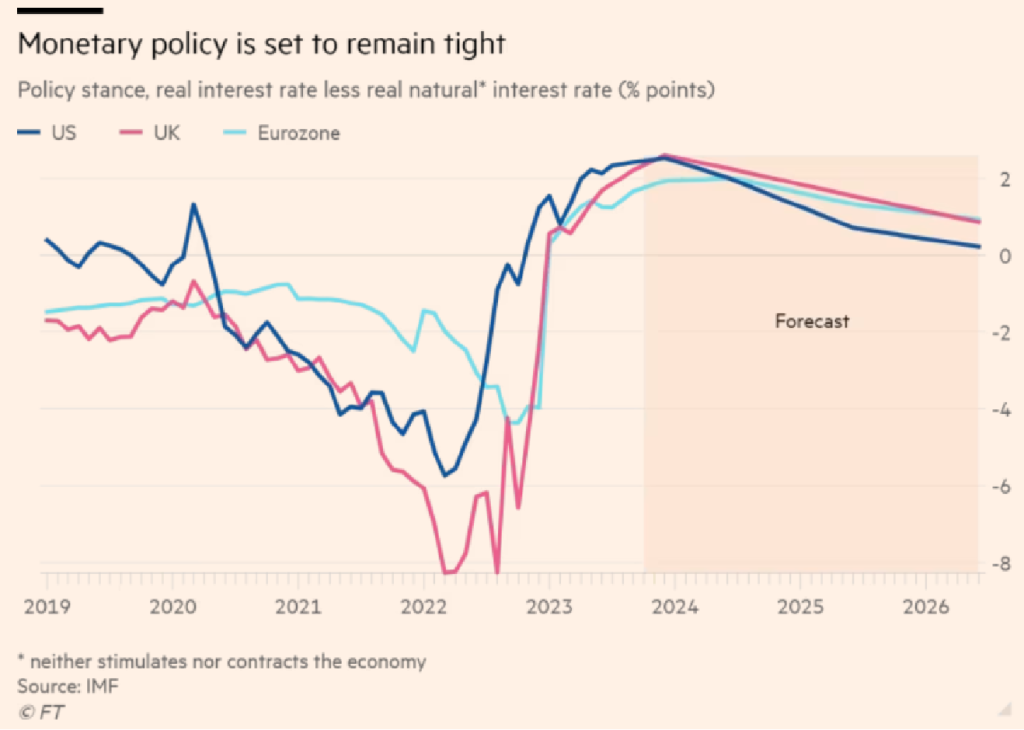

Finally moving forwards, we cannot be very hopeful as to when will this end. One important indicator to this is the end of global monetary policy tightening and given that core inflation still remains high in many countries, we might have to wait painfully longer than what most people expect for a turnaround in global economic recovery.