The story of non-OPEC oil production remains the most relevant to the global oil and gas industry. A fallout from such developments may reverberate to OPEC+ production cuts and therefore impacting the whole supply-demand dynamics. This update covers the recent developments of the shale industry and how new technology is helping it remain resilient.

1. TIME TO VOTE: YOUR INSIGHTS MATTER – FREE

Recently, the Frac Spread Count has experienced an 11% drop over the past three months, reflecting the fluctuating nature of the global economy and its impact on the energy sector. On May 17th, 2024, the count stood at 263, but by August 17th, 2024, it had declined to 234.

Poll: Where do you predict the Frac Spread Count will be on November 19th, 2024?

Below 230

275 or more

250 to 275

230 to 250

2. MMV: New Technology to Help Shale Industry – PREMIUM

The U.S. shale industry has seen significant advancements in drilling technology, which are now poised to unlock vast reserves of previously inaccessible oil. Chevron’s recent success with its $5.7 billion Anchor project in the Gulf of Mexico exemplifies the impact of these technological advancements. Read the article above to find out more !

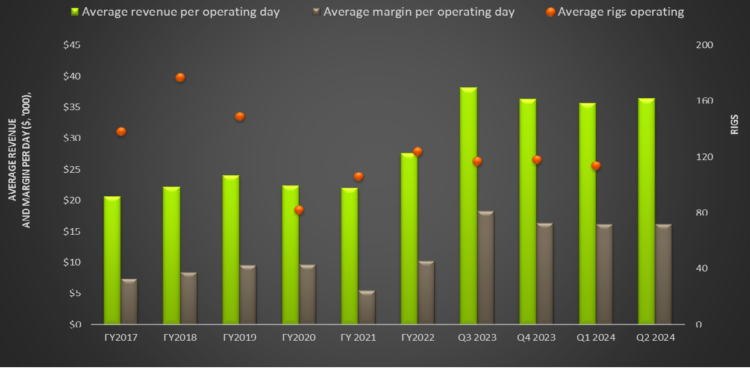

3. Patterson UTI’s Perspective in Q2: Key Takeaways – ENTERPRISE

This article delves deeper into the industry and its current outlook. PTEN’s management expects drilling and completion activity in natural gas basins to improve in 2025. In the near term, however, it faces constraints regarding natural gas takeaway capacity in West Texas and New Mexico and the market squeezing due to the operators’ M&A activities. Avik Chowdhury discusses the indsutry dynamics in detail.

4. Market Sentiment Tracker: More Signs of a slowdown – PREMIUM

This installment of the Market Sentiment Tracker looks at the two largest economies of the world and tries to highlight further signs of an upcoming slowdown. Goldman Sachs has trimmed its recession odds for the U.S. to 20% from 25%, reflecting slight optimism. In the energy sector, M&A activity jumped 57% last year, driven by consolidation. On the flip side, expectations for the Federal Funds Rate by year-end have dropped from 4% in July. Read out the article to find out more!!

*Premium Subscribers

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co