By Osama Rizvi

The year 2022 have received its fair share of problems from 2021. Amongst these, the problem of supply chain disruptions and inflation are the ones most concerning for the global economy and also the focus of this short article. The recent Omicron variant has led to new problems and amongst other things have exacerbated the already pressing issue of shortages of workers. This also includes the truck drivers, responsible for delivering items to stores ensuring their availability. It is also important to mention that there are opposite point of views when it comes to making vaccines mandatory for lorry drivers and if it becomes a condition we should expect further problems. Lack of workers in meat processing units has lead to KFC reducing down their menu.

IT is telling that just before Omicron hit U.S., the House Agriculture Committee had six members raising alarms over the impending labor shortage issue categorizing it as the most “immediate” concern for supply chains. Backlogs are another issue and shortage of people at ports that process the documents etcetera are also adding to the concerns.

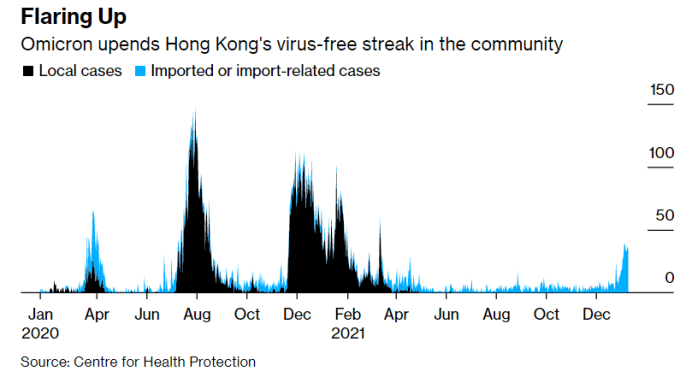

Omicron, as mentioned, isn’t helping. Have a look at the chart below by Bloomberg, that talks about the challenges Hong Kong is facing.

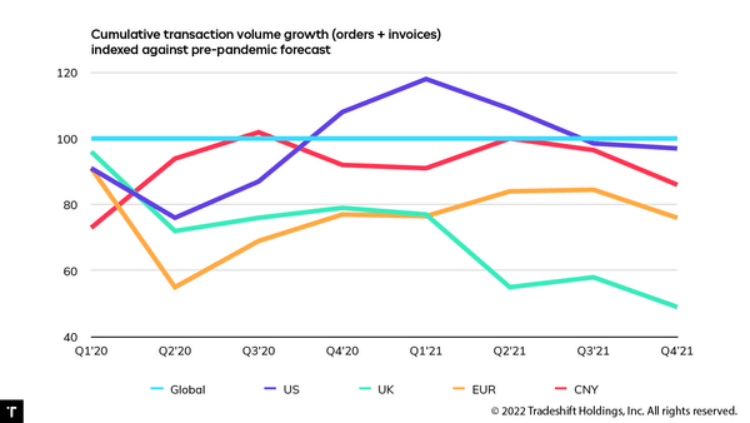

However, there have been some relief. Data from Q4 (U.S.) Activity approved and recovered, so does global order volumes falling only a 0.5 points in the said quarter.

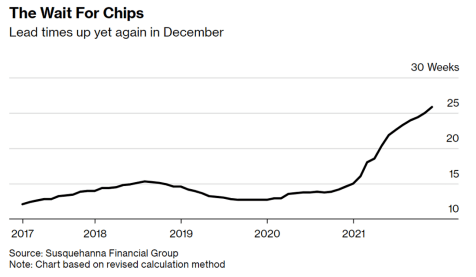

That said things are still tricky when it comes to one of the most important component of the modern economy: semi-conductors. Mark Rossano talks about this in one of our recent shows here.

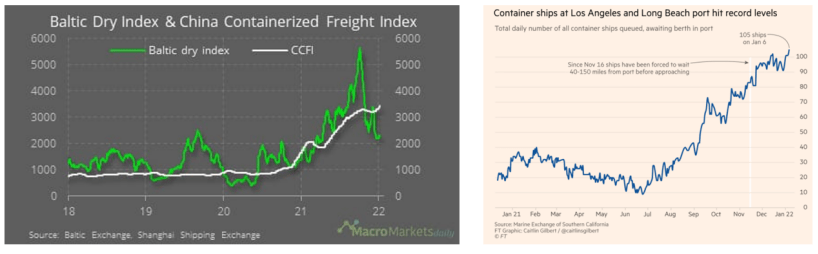

Baltic Dry Index (BDI) and China Containerized Freight Index (CCFI) remains on the higher side with some slight reductions. Fall in BDI has also not been due to any good reasons. The index fell to a one year low only because of low demand for vessels.

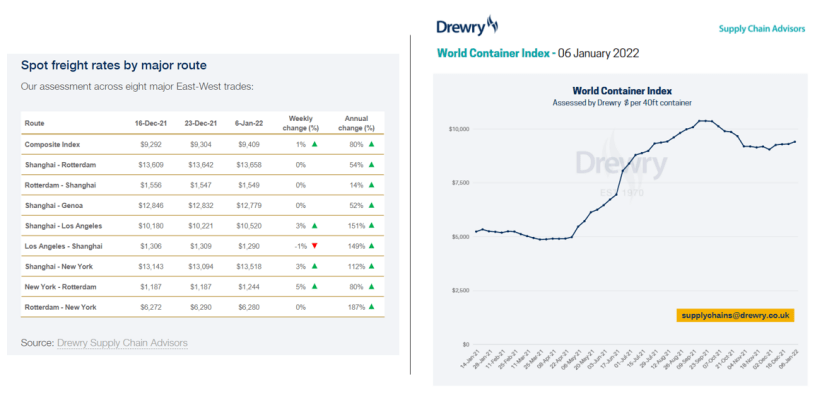

The spot rates in shipping industry are still concerning high and according to Xeneta’s market outlook for 2022, they will continue to be so for the whole year. Shanghai Containerized Freight Index registered an increase of 76 percent in the last week of December 2021 versus 2020.

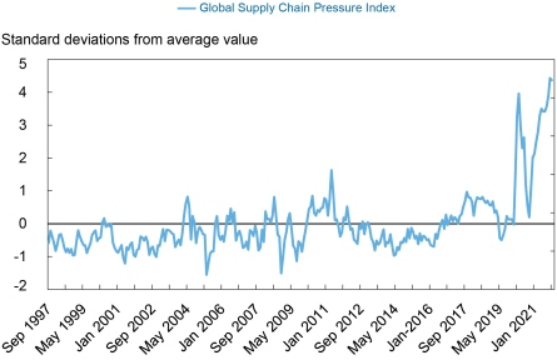

Another interesting indicator, a mixture of many others, called Global Supply Chain Pressure, developed by the New York Fed, highlights growing pressures faced by global supply chains and businesses.

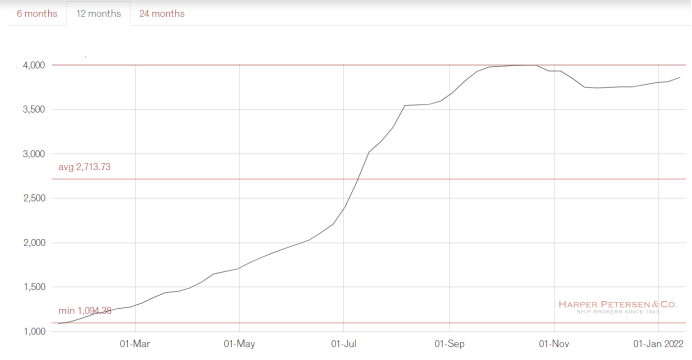

Rates in the charter markets for shipping containers are also well above average and, even after falling down, near highs. Data from Harper Petersen Charter Rates Index shows this:

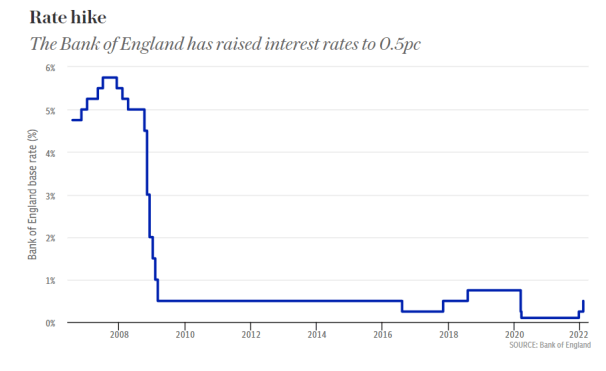

On the other hand, inflation continues to make headlines for all the wrong reasons. Bank of England (BoE) rose interest rate one more time as they expect inflation to hit 7 percent. Shoppers are facing serious challenge as “shop inflation” has doubled on MoM basis and prices are highest in 10 years. Interestingly, the increase cannot only be attributed to perishables or food items albeit food prices is at more than a decade high. Non-food items such as furniture, flooring and other goods and services contributed to this increase. Food inflation increased 2.7 percent in January while non-food inched up by 0.9 percent.

Eurozone inflation hit 5.1 percent but the European Central Bank (ECB) has resisted any increase in interest rates. The bank has said that inflation will fade out with time however, we all know that is not how smooth matters in real world are. Inflation in Turkey has hit the highest in 20 years standing at a staggering 50 percent. Australia is facing similar crisis with impending elections where, in the past 10 years the prices of “non-discretionary items” has increased by 26%. The phenomenon is, as we can see, global.

With all this in mind, and as we have been saying from months now, it isn’t difficult to see that a correction in markets and consumer sentiments might be due (this is my personal view). The stage seems to set for this.