Market Trends

MMV: What is happening with U.S. oil production?

U.S. oil production has long been a topic of intense debate. We’ve heard the bullish calls—some even expecting U.S. production...

Read moreMST: Jobs are becoming difficult to find

First of all, I want to apologize for the delay in publishing the MST for this week as I am...

Read morePrimary Vision Insights – Enterprise Subscribers

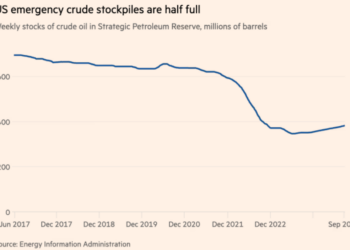

We still hold to our $73-$77 price target because the physical market doesn’t support the current rally above $77.

Read moreThe Long Read: Is China’s Economy Really in Trouble?

One of the major themes that has determined the direction of the global economy (and also oil prices) is the...

Read moreProFrac Holding’s Perspective in Q2: KEY Takeaways

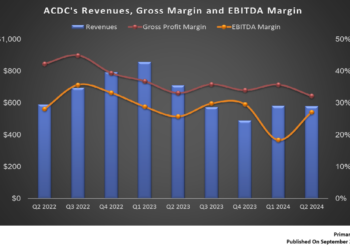

ACDC will invest in diesel substitution equipment, utilizing natural gas. Average active fleet declined in Q2. Utilization deteriorated in Q2...

Read moreMST: Eurozone continues to face slowdown – what comes next?

China's economic policymakers have implemented fresh interventions to bolster confidence. The People’s Bank of China cut the benchmark interest rate...

Read moreMMV: Permian Inventory, Russian Fuel and Lower 48

The question of what lies ahead for oil markets remains more pressing than ever as we witness a series of...

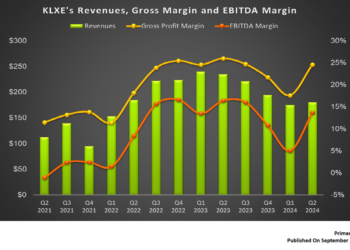

Read moreKLX Energy Services’ Perspective in Q2: KEY Takeaways

Downhole technology portfolio saw traction recently. Significant impact of cost reduction expected in Q3. Cash flwo stability due to diversification.

Read morePrimary Vision Insights – Enterprise Subscribers

The crude markets have been battling back and forth across demand destruction. OPEC+ cuts, supply disruptions, and geo-political tension. We...

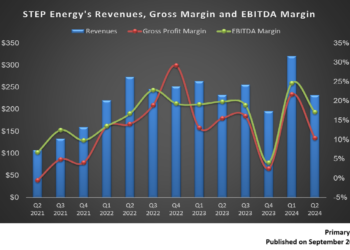

Read moreSTEP Energy’s Perspective in Q2: KEY Takeaways

Anticipates slowdown in Q4 from clients' capex exhaustion. US performance can be challenging. Shifts assets to profit-generating regions; to start...

Read more