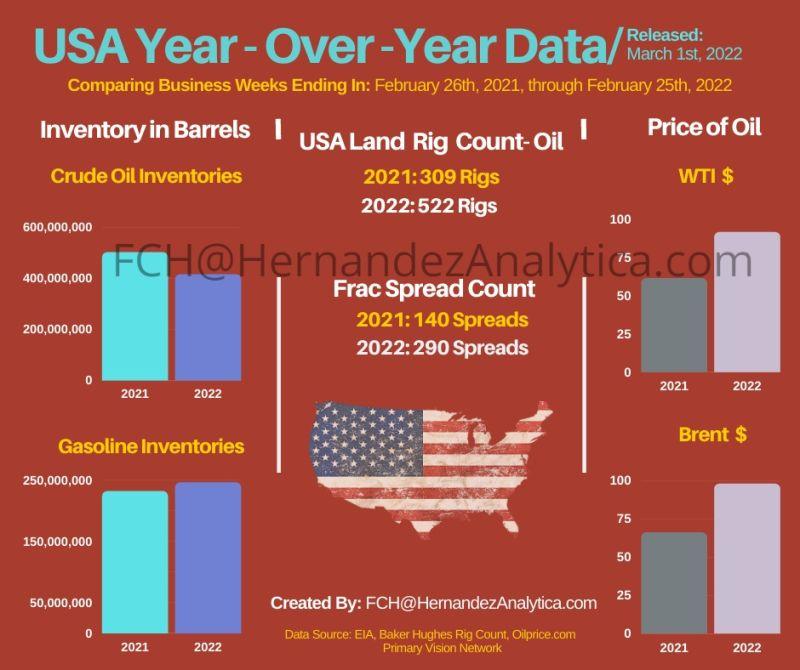

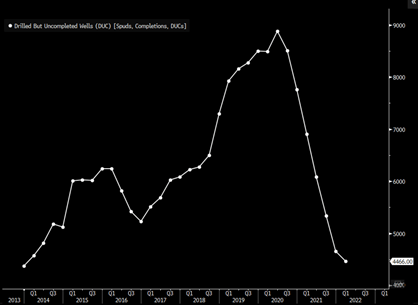

Next week we will do a broad update on inflation globally as the leading indicators remain elevated especially as energy/food prices remain at the highs… more to come! U.S. completion activity officially took out last year’s high of 274 frac spreads by already getting to 275 spreads. This is spot on where we believed we would be regarding activity in February, but the biggest question next is- when do we get to 300? The additional 25 spreads are going to take longer as OFS companies address the need to repair horsepower and continue hiring personnel. The additional 25 spreads will take a bit longer to hit vs the 6 weeks to bounce back to the highs. We are looking at an April event as weather improves and DUC (Drilled but uncompleted) inventory picks back up. There was another decline, but the “rate” of the decline has slowed. We will see this continue to slow and over the next 2 months actually start seeing additions vs drawdowns.

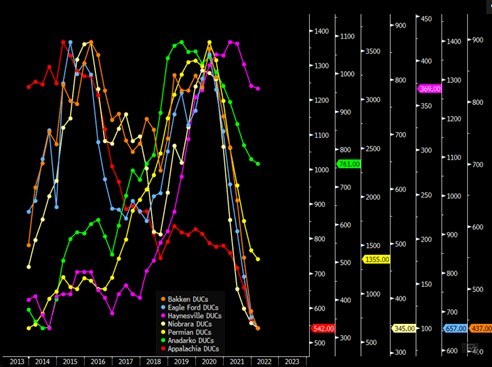

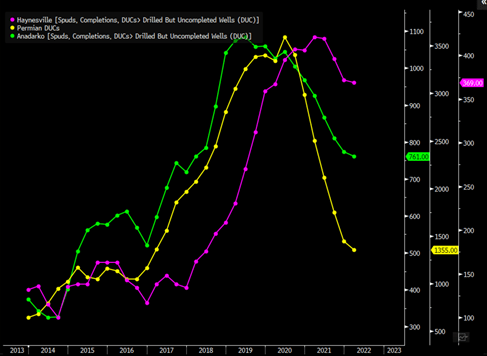

There has been a steady decline across all the regions with the Anadarko, Permian, and Haynesville still not at the previous lows. We already believed these three areas were going to see the most growth in the near term, and when you look at available running room- it still exists.

Just to zoom in a bit more on those three regions, we have already seen the pace of drawdowns slow, and we will see them turn positive over the next two months. These are three areas that are going to remain a big driver of growth given LNG (Haynesville), NGLs (Anadarko), and oil/liquids (Permian).

Rig additions will continue to outpace frac spread counts especially with logistic problems that are hitting hard. Sand (proppant) availability is getting really tight, and we are hearing that some operators are being limited to only 3-5 stages per day due to the shortage. Even though price dictates activity should spike, there are a lot of hurdles in the way of hitting that expansion.

1) Labor remains a hurdle as wages continue to rise and attracting talent remains a challenge. The oil & gas space has seen a lot of volatility over the last decade, and with wages surging in all areas (construction, trucking, and other industries) many are looking to avoid the boom-and-bust cycle. This is limiting the availability of experienced hands, and to try to offset this concern companies are offering big wage bumps with signing bonuses and stage bonuses. But, as stages are limited for other reasons (sand and logistics)- it will be harder to achieve those key targets.

2) Equipment has been cannibalized in the yard over the last two years while the cost of raw materials and final products. Everything from steel to machined parts have increased in cost making the whole process more expensive. Supply chains have also delayed the delivery of promised items (transmissions to fluid ends) that hinders the deployment of new or refurbished equipment.

3) Availability of equipment is also an issue. There can be spare horsepower in say Appalachia but no available spreads in the Permian. Does it make sense for an OFS company to move it from one region to another? In the market, it may appear there is an available spread, but it isn’t in the right location.

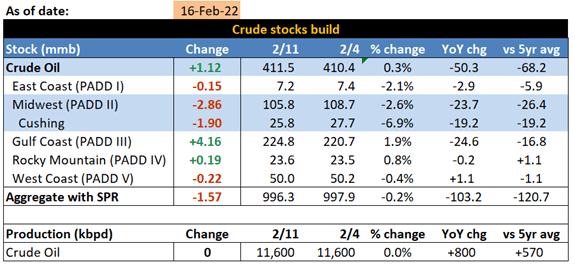

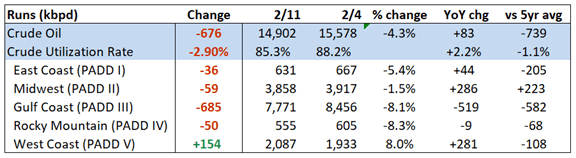

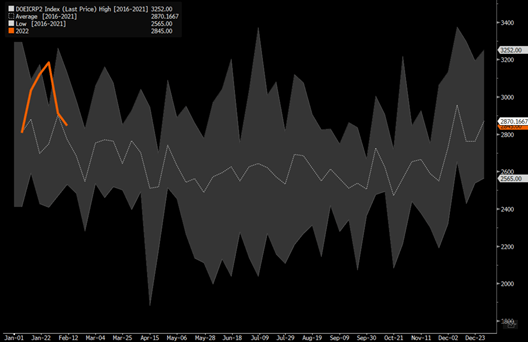

U.S. crude builds are in an interesting spot as refined products build in PADD2, but refiners continue to maintain their elevated runs. We have seen gasoline cracks go negative in the region, which will likely cause a slowdown in some of the draws. PADD2 and cushing has been a big driver of the draws, but as we see cracks coming down, PADD 2 imports remaining elevated, and refinery runs dipping.

The runs have been elevated in PADD2 for an extended period of time, and we will start to see some reductions in the region as PADD3 starts to pick back up this week and the front end of March.

Gasoline builds continue to rise in PADD2, which will also be a pressure point as they are now negative (once factoring in NG costs). We are seeing some of these pressure points that will cause a dip in run rates and will put more crude in tanks. This is a bigger deal because PADD2 has carried the lionshare of the drop in crude draws in the country.

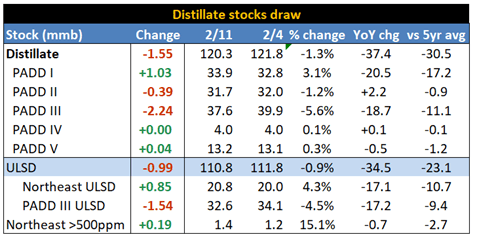

The same can be said for distillate in the region. There has also been a decent pick-up of deliveries into New York harbor that has driven down the price in NY. New York Harbor prompt ultra-low sulfur diesel saw itspremium over Nymex ULSD futures fall by more than 90% since the beginning of last week as warmer weather reduced fuel demand for heating and power generation.

• NYH ULSD reached 0.5c/gallon over Nymex on Friday, down from 7.25c/gallon on Feb. 7

o This premium is still higher than the five-year average for this time of year, which is a discount of 0.5c/gallon

• Diesel premium narrowed following warmer weather as well as an influx of European and Russian supply

• Distillates stockpiles in NYH rose last week for the first time in four weeks to 17.1m bbl, EIA data show

• Regional fuel suppliers are turning their focus from diesel to gasoline as the seasonal transition begins in March

This is what we called out in the EIA show as a likely backdrop from warming on the East Coast and additional imports hitting the market. PADD2 has also seen some broad builds in the products area, which will again push rates lower.

PADD2 crude imports will remain elevated given the price disconnect with Canada and the need for heavier barrels. The fact that we have pipelines operational will make it cost effective and create a steady flow of imports.

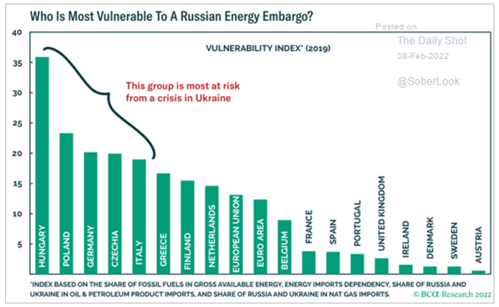

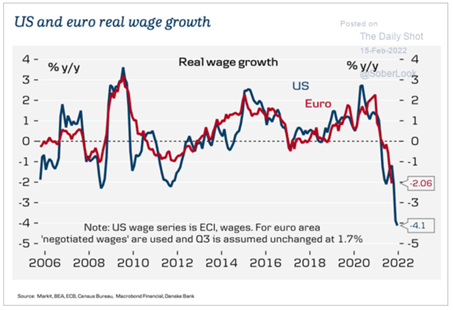

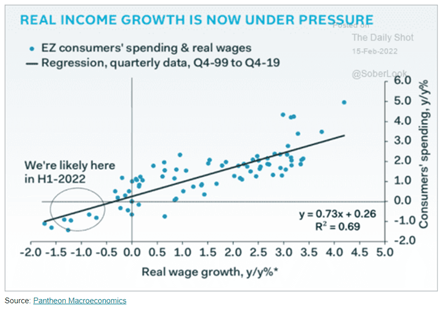

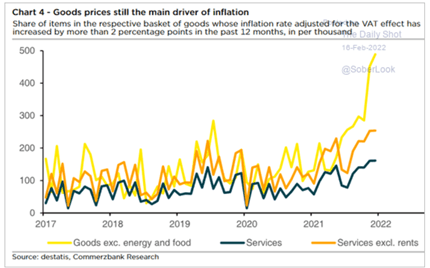

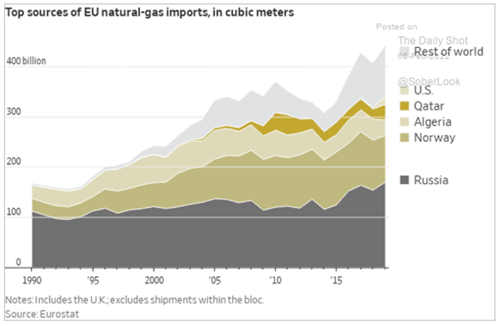

On the product side, LNG exports will be a big driver of U.S. activity even after the Ukraine-Russian conflict. There is a growing demand for natural gas in the market, and the Russian-Ukraine event just highlights again the importance of diversifying exposure and availability. Europe remains beholden to Russia on their energy needs across natural gas, crude, and refined products. Hungary and Poland have been actively diversifying over the last 5 years, but even with them trying to increase their options- it takes time and billions to adjust. Germany’s exposure is broad and given their importance to European growth- it becomes a problem for general European growth as inflation increases across all sides: manufacturing to the consumer. We are already seeing real wages get crushed in Europe, and the rising cost of energy is not going to help anything in the region.

Real wages are getting hit hard in Europe with a straight drop across the board. All of the leading indicators point to another shift higher and will force the ECB to take action.

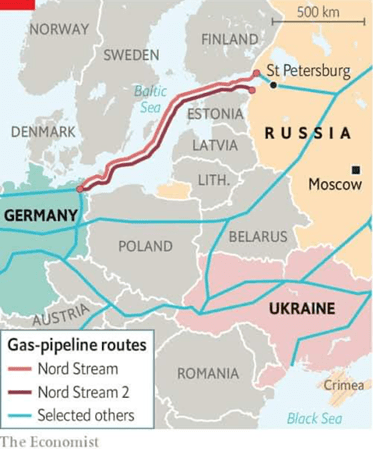

It is hard to diversify when there is so much pipe capacity in the region that provides (normally) the lowest cost of delivery. But at the same time, Russia relies heavily on the pipelines that traverse Ukraine to support their economy. Russia’s economy is heavily levered to their energy markets, so it isn’t just Western Europe that is hit hard by reductions in volumes and elevated costs reducing demand. Under sanctions, Poland could just as easily stop shipments that would negate the Belarus pipe while Ukraine shuts everything down. The unknown would be Nord Stream 1 and how Germany would interact with Russian sanctions. This is why we have seen Russian credit default swaps (CDS) and market get hit hard due to fears over the economic abilities of the country by losing one of their biggest buyers.

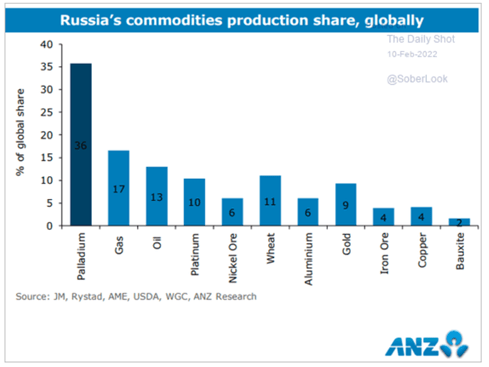

It also hits in other areas besides just straight energy and shows up against a broad spectrum of products. Some of these items are pivotal in the construction of cars and steel and just general manufacturing. This will just drive-up costs within Europe, but also something that hits the Russian economy hard as well.

Russian natural gas provides the baseload capacity for the whole region with a large part of LNG acting as the swing factor. There is no way to effectively replace the base load capacity that Russia provides- especially in peak seasons. The growth of LNG helps reduce some of the most extremes, but there isn’t enough available to ensure normal operations throughout Europe. These are things that aren’t lost on both sides of the aisle when evaluating “next steps.”

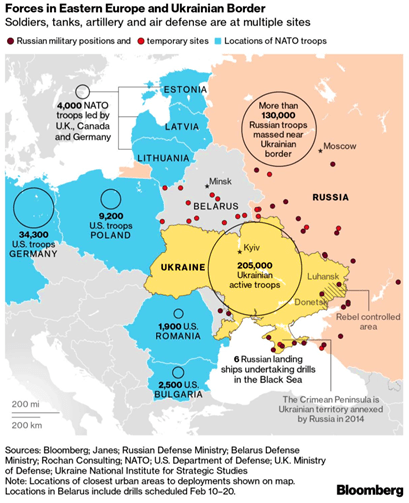

Russia still has a large part of their military forces around Ukraine but have started shifting some assets around following the completion of military exercises. Some of them are being pulled back, but it appears that others are being redeployed to the Eastern front of Ukraine. We will need to see how much is being shifted to the Luhansk/Donetsk region which is “rebel held.” There has already been mortars and shelling exchanged in the area with a current move to evacuate civilians from the area into Russia. This could be a prelude to a bigger exchange/combat, or another move on the chess board for Putin to get more concessions. If there is an initial attack, this would make the most sense because Russia could launch across the Crimean Peninsula and hit the region from multiple angles into an area that Russia already claims to be theirs based on the populace. This would also increase the water access that Russia currently has in the region and impacts Ukraine’s ability to use the water ways further- effectively tightening an economic noose. A common phrase is all logic goes out the window to go to war- and we can outline a lot of economic pitfalls that would befall both sides, but there is always anger, pride, and history at work driving today’s actions. We still think there will be a “clash” that will be the flashpoint of the conflict which will then lead to a de-escalation. Russia needs the U.S. to help deter the expansion of China, and Russia can’t afford to have 100k troops deployed to enforce an occupation. It leaves their eastern flank wide open for Chinese expansion, and I don’t think Putin wants to leave that exposure for too long. China already claims large parts of that region as their own, and without the ability to quickly move assets to the area- it could be a temptation that Putin doesn’t want to provide Xi.

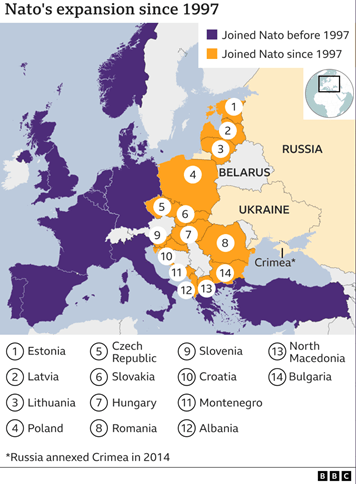

One of the upfront asks from Putin is the adjustment of NATO and guarantees that the Ukraine will never join the union. Russia made a demand that NATO go back to the 1997 status quo, which would essentially remove 14 countries from the treaty. Both sides know this is a non-starter, but it gives you an idea how Russia views the expansion east of NATO and they want to maintain some buffer along the borders. They also made demands that specific military equipment (including nukes) never get deployed to these locations- especially in Ukraine. This is a concession that I think has a lot of negotiation power to provide some buffers/comfort for Russia.

In the meantime, Russia continues to drive home the likelihood of a broader conflict with movements in Luhansk and the region Donbass/Donetsk. There is more footage of residents being shuttled out of the region and moved into mainland Russia. The head of the Donetsk government has ordered the evacuation ahead of the Ukraine offensive (his words) as more pressure is put on that specific region.

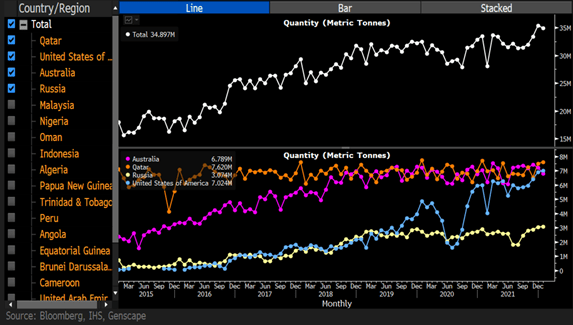

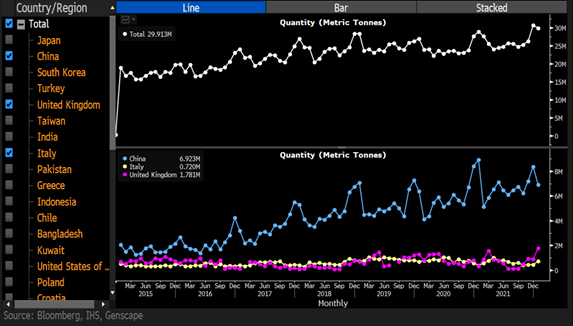

Now back to LNG- the U.S. is at a record for exports with more to come with the last Cheniere train 6 coming online at Sabine Pass. There is more construction taking place at Corpus Christi, Golden Pass, and Calcasieu that will keep natural gas moving off our coast. LNG exports globally have hit a record with the U.S. continuing to climb higher with more to come. This will increase the availability of cargoes, but demand is growing around the world- so it isn’t something that can just directly sail to Europe. Europe also has its own limitations when it comes to storage and regasification capacity to bring on more LNG directly. This will keep pricing robust and keep henry hub as a preferred place to purchase NG vs Brent/ TTF/ JKM.

The imports into the world will keep growing, and after Europe/UK shuttered some of their NG storage capacity the volatility will keep growing. The import backdrop below keeps expanding- especially for the U.S.

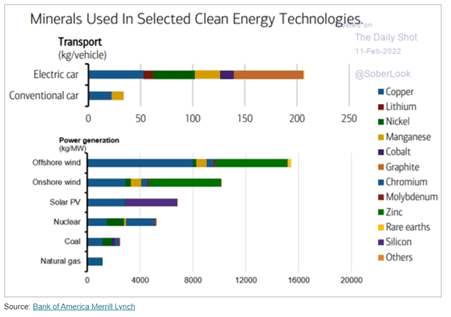

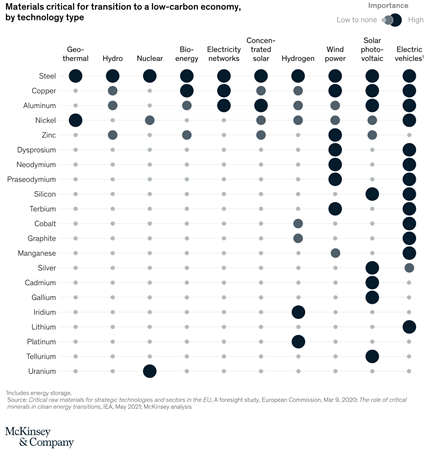

LNG and natural gas is finally coming back into favor, and I think it should given the backdrop of where “green” products originate. There are a significant amount of minerals used in the construction of the most basic “green” product. Each one has to be mined, processed, and shipped which requires a significant amount of fossil fuels to achieve. It is important to put this in perspective because each fossil fuel process (ICE vehicle) obviously has its own footprint- but are we just changing who “owns” the pollution vs actually cleaning up the environment? It is really important to be honest and evaluate the “Cradle to Grave” impacts of each process to find the best/ most efficient option. I have said time and time again the importance of a basket approach and looking at ways to incorporate all forms of solutions as we work on bringing new technology up to speed.

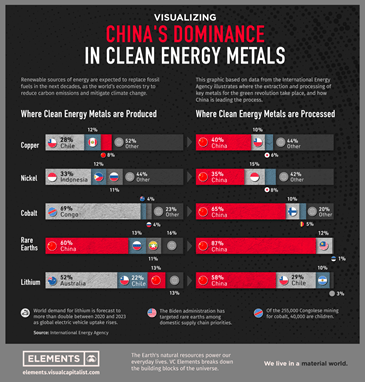

This chart does a great job at driving home just how important many of these minerals are and how onerous some of these processes are. Many of them have seen prices rip higher driven by not only demand but supply issues given geographic locations and other underlying impacts. We need to see extensive investment across some key regions, but can we trust China to be the driver of the exploration, production, and processing? The U.S. has been looking to move further away from China, but yet we are increasing their control of our supply chains by diving headfirst into the green solutions. Some of these products also have more fragile supply chains vs what they will replacing, which will create its own headaches when trying to address shortfalls, bottlenecks, and geopolitical risk.

China also controls a huge amount of the processing capacity for these products- so what happens if they decide they want to increase prices by 30%? What happens if they withhold products? We are looking to diversify aren’t we, but yet we are going to give them MORE control? Can we ensure human rights and they aren’t just blindly polluting in their local region? Every news organization and politician only focuses on the “E” in “ESG.” Are we supposed to ignore the social and governance side? Are you telling me that China crushes it on the “S” and “G” side of the equation? If anyone can honestly say yes, I have some fantastic ocean front property in Oklahoma to sell you.

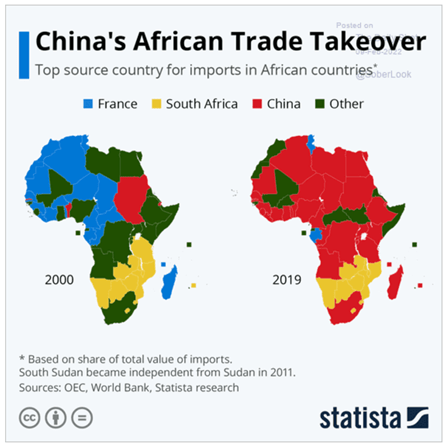

China has been playing the long game in trying to lock up the supply chain under the Belt and Road Initiative. They have invested extensively across the continent, but have completely overestimated the earnings power of the region and some of the projects. China wanted to increase influence in their supply chain and used a form of “Debt Colonialism” to achieve it. They are now taking delivery of projects as collateral because the country/company failed to pay their debt obligations. But, the revenue they are throwing off isn’t even enough to cover even the most conservative estimates. The average project has a multiplier approaching .8, which means that every project is earning about $.80 for every $1 borrowed. These projects can’t even cover principal let alone the interest.

The prevailing view in the market is that China’s debt problem is manageable because the lion share of it is “local.” But what if the projects are international? What happens when the collateral backing the local debt is pledged against 4 other local bonds? The problems are pervasive, which is why the PBoC has limited options to stimulate the economy. The goal has shifted to support the economy with some easing strategies, but it won’t be enough or the same as the last time stimulus flooded in ’14 and ’16. The liquidity and debt problem is a broad issue that they need to address head on- plus all of their targeted approaches to increase spending/consumption at the consumer and small business level has failed since 2019. There is a broad view of additional easing to come, but it has failed to see it hit the markets that need it most.

While the aggregate financing increased, we had a dip in M1 vs M2 which is a leading indicator that some of the stimulus will slow. We have already seen a large portion of the excess cash injected in January being drained from the market. It has happened at a much slower pace vs previous years, but it is still withdrawing in a fairly steady rate.

Inflation has been pretty muted as they push it into the broader market, but the bigger concern is the stickiness around the China Core CPI level. The underlying consumer is struggling throughout China as jobs contract and core inflation remains elevated.

We showed last week the backdrop of the PMI data with employment moving into contraction across the manufacturing and non-manufacturing realm. Here is another data set confirming those numbers with more extreme contraction already happening.

These pressure points are happening as China runs headfirst into a big maturity wall in March. There was already another bond entering the grace period on Feb 15th, and the size of the issues only grows as we head into March. Zhenro Properties Group Ltd.’s spiraling bond prices show just how risky it is to invest in Chinese developer debt — even when a repayment looks imminent. The firm’s $200 million perpetual bond was trading at 93 cents on the dollar before it plunged 59.3 cents Friday, after concerns emerged that the firm may not proceed with a planned redemption of the note in March. The borrower’s dollar bonds extended steep declines Monday and its shares were poised for a fresh low after falling about 70% since Thursday. The bond market remains under pressure, which becomes a bigger problem as the government and companies look to roll debt.

The average Chinese consumer has a huge amount of exposure to the property market and will only make the government’s job harder to achieve growth.

Even though debt issuance and credit impulses bounced, it is important to understand what type of debt was the driving force. Depending on the time frame, the credit impulses is moving back to “0” which is what I believe the underlying goal really is- to provide some stability but keep flows moving out of the system.

A large part of that debt was driven by an increase in government bonds and some rolling of corporates, but we are also seeing a bit more from the shadow banking world. The government bond shifts were mostly driven by LGFVs trading between the same provinces to help prop up the numbers. There is more in financial manipulation vs outright expansion of the debt markets.

Property sales are already expected to be much lower in 2022, which will weigh further on government finances- especially at the provincial level as well as for consumers. This is not a situation that clears up quickly or in short order, which has led to the government to consider guiding GDP lower vs last year.

The quarterly report released late Friday cited ‘triple pressures of shrinking demand, supply shocks and weakening expectations’ — echoing the assessment of the Economic Work Conference in December.

The report outlined the guiding principles of the monetary support: adequate, well-targeted and front-loaded.

China’s growth target for 2022 will reflect a tough reality — the economy is slumping, and stimulus will only partially cushion the slowdown.

Bloomberg Economics expect the government to set the goal at around 5.5%, based on our analysis of provincial targets.

• That would suggest the government aims to avoid a cliff-drop in growth after setting the target at 6% last year.

• But it would still underline damage from Covid-19 outbreaks, a property market downturn and regulatory restraints on polluting industries.

• Even 5.5% growth would be challenging to achieve — requiring considerable policy support.

I am not sure the PBoC has the ability to achieve this type of growth without something way more substantial, but as they face a slowing global market and a consumer under pressure with the law of diminishing returns nipping at their heals- growth will be muted.

India’s inflation numbers breached the RBI top line range of 6% with more pressure coming from rising costs along food and energy. Diesel demand remains well below normal, which indicative of more economic pressure with a large part of that driven by a reduction in local demand as exports/imports remain strong.

India’s daily sales of gasoline and diesel rose about 7% each during the first half of February from last month as traffic movement picked up after a sharp decline in coronavirus cases, according to preliminary data from refinery officials with direct knowledge of the matter.

• Diesel sales by India’s three biggest fuel retailers were at 2.65m tons, 6.7% higher than January

• Still, sales were -7% y/y and -14.7% vs Feb. 2020, before the pandemic impacted India

• Gasoline sales during Feb. 1-15 were at 1.04m tons, +7.3% m/m

• That’s +0.1% y/y, but -2.1% vs Feb. 2020

• India’s daily new infections dropped to 30,615 in a day from 167,059 on Feb. 1, after peaking at 347,254 cases last month during the latest wave

• Demand is expected to rise further as restrictions ease and schools and colleges reopen in various parts of the country

• NOTE: India’s Road Fuels Sales in January Fall More Than 12% m/m

• Jet fuel sales were at 192.2k tons, -9% m/m

• That’s -11.4% y/y and -43% vs Feb. 2020

• LPG sales were at 1.32m tons, +2.4% m/m

• That’s +8.6 y/y and +14.5% from Feb. 2020

This is all happening as food prices hit record highs around the world. India (like many Ems) are the most susceptible to the rising prices.

This is only going to continue the problems on the international front when we look at the expansion of food insecurity and rising costs. We will do more next week on global inflation and drivers around the world.