- Schlumberger plans to improve the revenues and adjusted EBITDA margin handsomely in 2022

- Technology-led services and clean energy initiatives will drive the top line in the medium to long term

- Its deleveraging and free cash flow improvement may favor investors’ sentiment

Analyzing The Recent Trend

In the Q4 2021 earnings conference call, the management discussed the foundation of solid multi-year upcycles at length. At least on the demand side, the recipe for growth is already in place: the steady normalization post-pandemic, shrinking spare capacity, and declining inventory balances. Add a tight oil supply and see how the crude oil price zoomed over the last quarter of 2021 and early 2022. Not to mention that the geopolitical tension in Eastern Europe is not helping, either.

SLB’s management also expects the short-cycle activity resurgence to give way to more FIDs, and service pricing has begun to improve. The long-cycle capacity expansion plans are already underway in the international market, mainly offshore and deepwater drilling. In 2022, capex in North America can rise by 20%, estimates the company. In the international markets, it can go up by low-to-mid teens compared to 2021.

The Q1 2022 Outlook

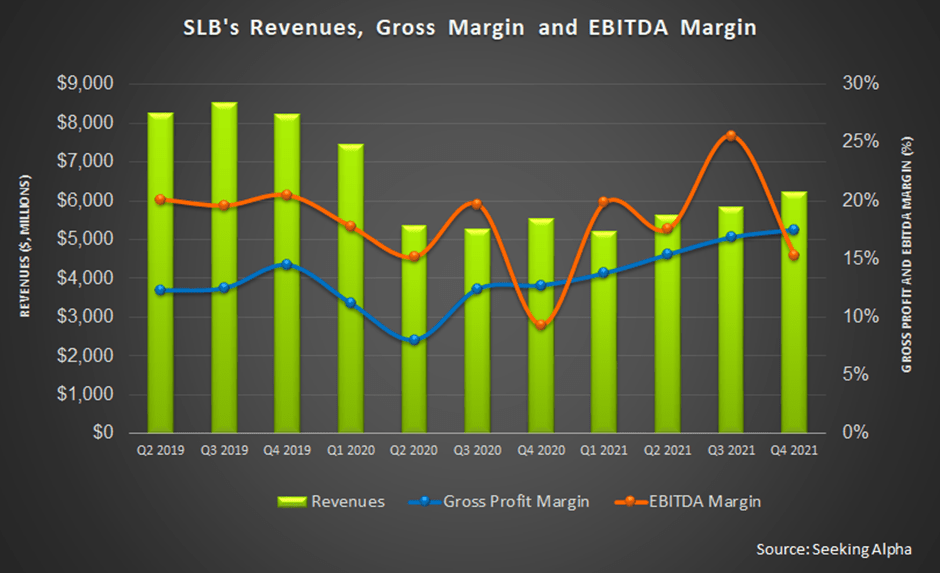

Assuming the growth drivers lace the oilfield services industry, SLB’s revenue growth can reach the mid-teens in 2022. The EBITDA margins can exceed Q4 2021 by at least 200 basis points on a full-year basis. In Q4, it recorded an adjusted EBITDA margin of 22.2%. However, the COVID-related disruptions and the typical seasonality can affect the Q1 topline, particularly in the Digital & Integration segment.

The industry growth trajectory can lead to a double-digit return on sales and double-digit free cash flow margin in FY2022. Beyond this year, it expects to reach or exceed the target of a 25% adjusted EBITDA margin in FY2023.

A Brief History of Asset Restructuring And Divestment

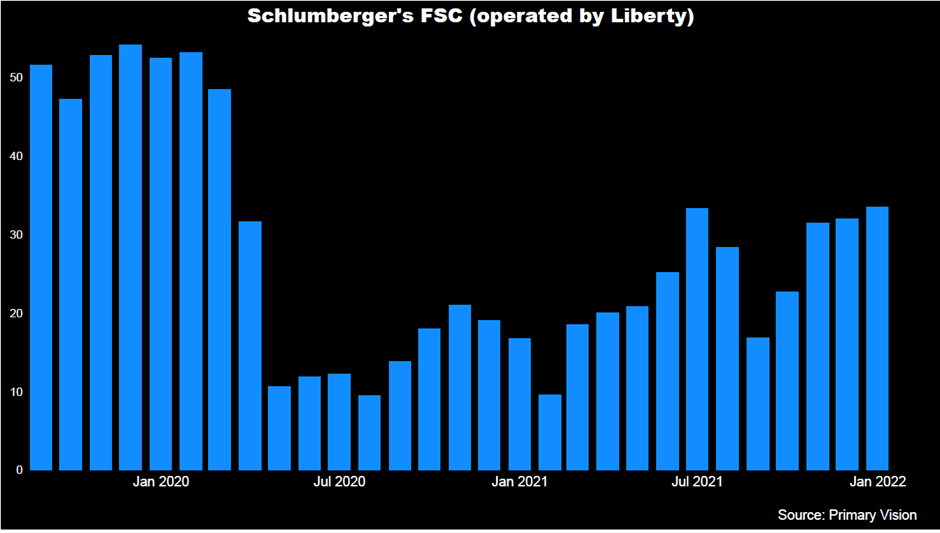

Since 2020, Schlumberger has been restructuring its outfit based on various divisions, supporting a basin-specific innovation goal. Advancing the scale-to-fit strategy further, it agreed to divest the North American low-flow artificial lift business in a cash transaction in 2020. Also, during the year, it shed the OneStim pressure pumping, pump-down perforating, coiled tubing business, and the Permian frac sand business to Liberty Oilfield Services (LBRT) in exchange for an equity interest in Liberty. As of December 31, 2021, it had a 31% equity interest in Liberty. These transactions are expected to enhance its EBITDA margin, lower capital intensity, and accelerate the path to its financial goals.

Equity participation in LBRT ensured that SLB reaps the North American unconventional shale and frac spread count recovery. The company provides frac equipment services like well completions, fluids and tools, stimulation, and artificial lift, among others. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 290 by the end of February and has gone up by 24% since the start of 2022. Schlumberger’s FSC, which Liberty operates, doubled between January 2021 and 2022. Although the energy prices are conducive to increased drilling, it can face downward pressure in the short term due to higher utilization and frac pricing per stage shooting up too high too soon. Due to supply chain disruption, the delays can also affect proppant deliveries and operators’ pull back.

Strategy: The Digital Fuel

Schlumberger’s management mainly relies on two drivers to propel growth in the medium to long term. It reckons that technology has become significantly more critical in the changing energy scenario. Among its initiatives includes remote services and digital inspections (DELFI cognitive E&P environment and the Agora edge AI (artificial intelligence) and IoT (internet of things) solutions. By the end of 2021, it had 240 commercial DELFI customers, which translated into a 160% growth over the previous year. Also, the DELFI cloud platform saw a tenfold increase in compute-cycle intensity. In January, the DELFI platform was selected by Northern Lights JV to streamline subsurface workflows and longer-term modeling and surveillance of CO2 sequestration. These tools will help reduce cycle time, improve performance, and lower carbon intensity.

SLB has invested substantially in creating a New Energy portfolio consisting of low-carbon or carbon-neutral energy technologies, including hydrogen, lithium, energy storage, carbon capture and sequestration (or CCS), and geothermal power. While it has been running some of these for as long as two decades now, In June 2021, it announced its commitment to achieving net-zero greenhouse gas emissions by 2050. In the more immediate term, it plans a 30% reduction in fuel use and electricity consumption by 2025. It launched the Transition Technologies portfolio to reduce flaring, electrification, and well construction emissions with an eye on this. In November 2021, Genvia, an SLB JV in clean hydrogen technology, signed pilot project agreements for decarbonization in multiple industrial sectors.

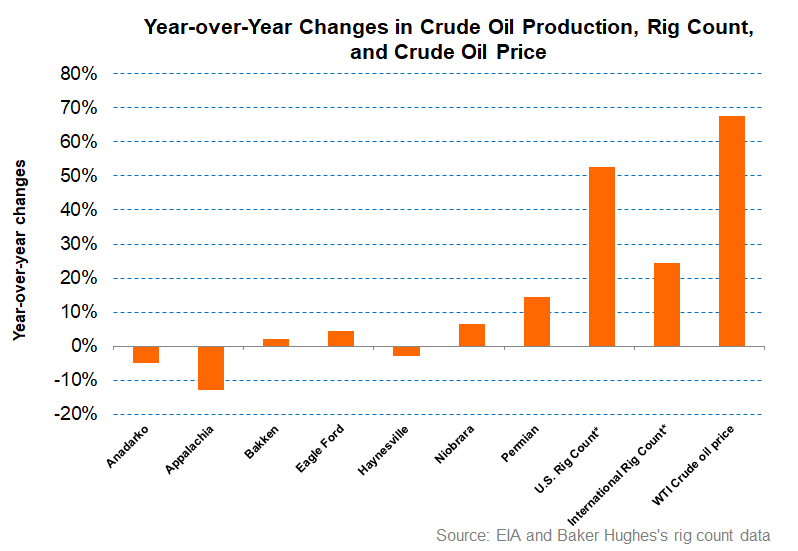

Industry Indicators Are Changing Sharp

In the past year until January 2022, the key US unconventional Basins, on average, saw a marginal (1% up) in tight oil production. The US rig count recovery outperformed the production growth. According to the EIA’s Drilling Productivity Report, the US shale oil production is due for a steeper growth (2.1% rise, on average) by March. According to the EIA’s Short Term Energy Outlook, the Brent crude oil price can increase marginally in Q1 compared to the current level due to the geopolitical tension and inflation but may come down considerably (~14% lower) by Q4 assuming the current situation improves and the central banks step in to control the inflationary pressure.

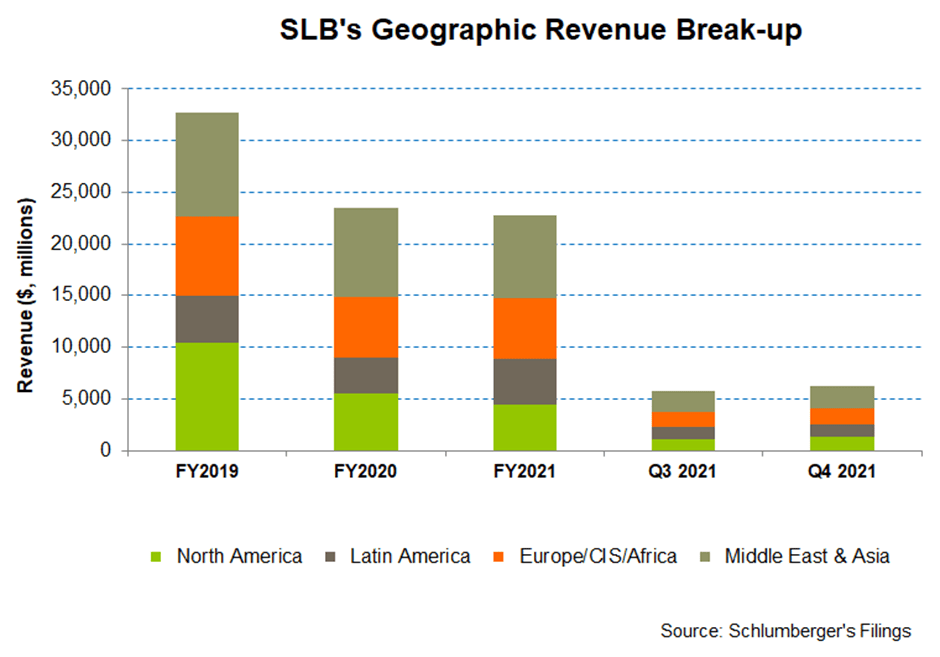

From Q3 to Q4 of 2021, SLB’s revenue share from international operations contracted marginally to 79.3%. In North America, it benefited by leveraging its new division and basin re-organization. Although all the geographies saw higher revenues in Q4 than Q3, North America recovered the most (up by 13%), followed by Europe/CIS/Africa (7% up sequentially).

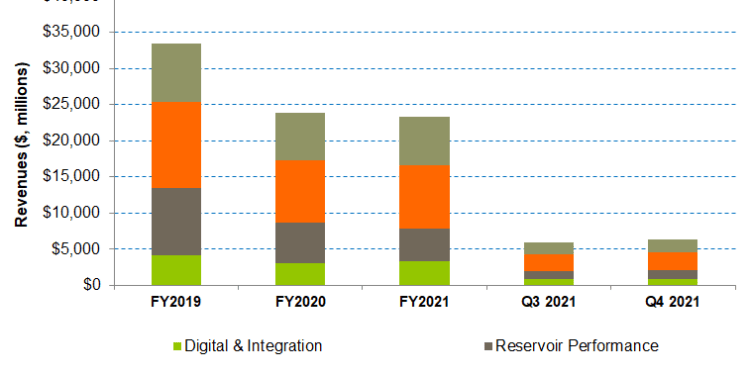

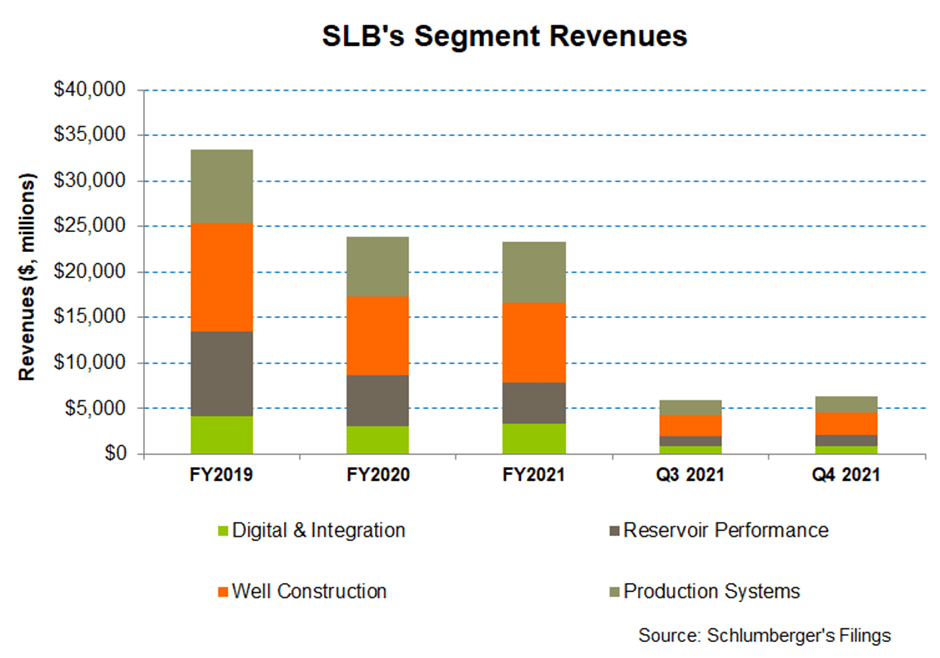

Analyzing Q4 Segment Performance

In Q4 2021, Schlumberger’s Digital & Integration segment revenues increased by 10% compared to Q3 due to higher digital and exploration data licensing sales. Although a pipeline disruption in Ecuador impacted the APS projects adversely, it expanded its operating margin by 268 basis points.

Quarter-over-quarter, SLB’s Reservoir Performance segment revenue growth was 8% in Q4, following higher intervention and stimulation in the international offshore markets. However, the operating margin remained flat from Q3 to Q4 in this segment.

Revenue growth in the Well Construction and Production Systems segments was more moderate (5%) from Q3 to Q4. Higher land and offshore drilling, new offshore projects, and year-end sales accounted for the topline improvement. In Well Construction, the operating margin improved due to increased activity and pricing gains. However, in Production Systems, margin depleted following global supply pressure and logistic constraints.

FCF and Capex In FY2022

SLB’s free cash flow (or FCF) more than doubled in FY2021 to $3.0 billion compared a year ago. Significantly higher cash flow from operations (or CFO) improved FCF. Although revenues decreased marginally in this period, implementing the capital stewardship program and receiving the $0.5 billion US federal tax refund caused the CFO to increase. Its FY2022 capital expenditure budget (includes APS and multiclient) is ~$2.0 billion, 15% lower than the FY2021. SLB will follow a much less capital-intensive strategy than in the previous cycle despite the budget hike. Assuming a revenue growth by a “mid-teen” percentage will amount to a capital investment-to-revenue of 7.5% versus an average of 12% between 2009 and 2014.

The company’s debt-to-equity is 0.93x, higher than peers’ (HAL, BKR, and FTI) average of 0.8x. In the past 12 months, it reduced gross debt by $2.7 billion, which helped increase its financial flexibility.

Dividend And Dividend Yield

Schlumberger pays an annual dividend of $0.50 per share, a 1.24% forward dividend yield. In comparison, Halliburton (HAL) pays a yearly dividend of $0.48, which amounts to a forward dividend yield of 1.49%.

Learn about SLB’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.