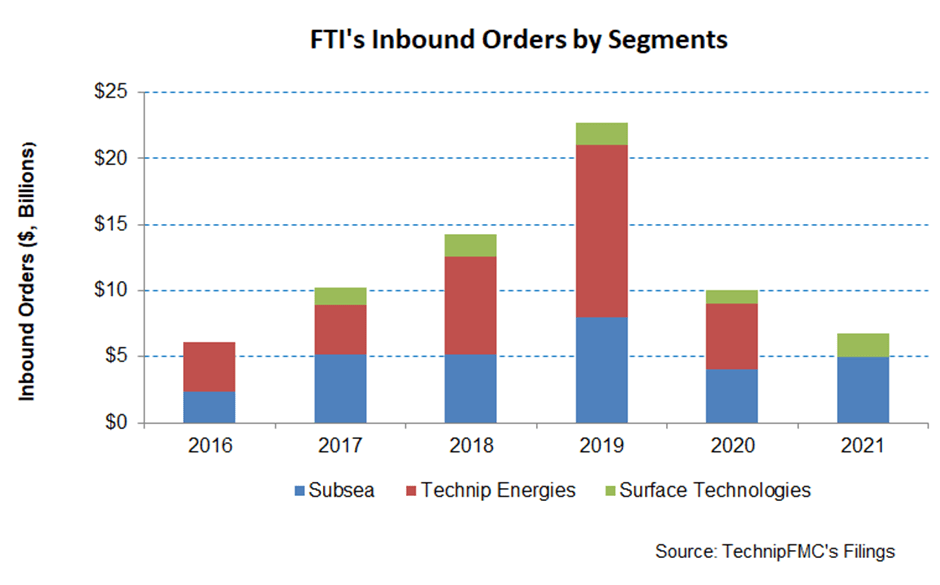

- FTI’s inbound order to strengthen further, indicating better revenue visibility in FY2022

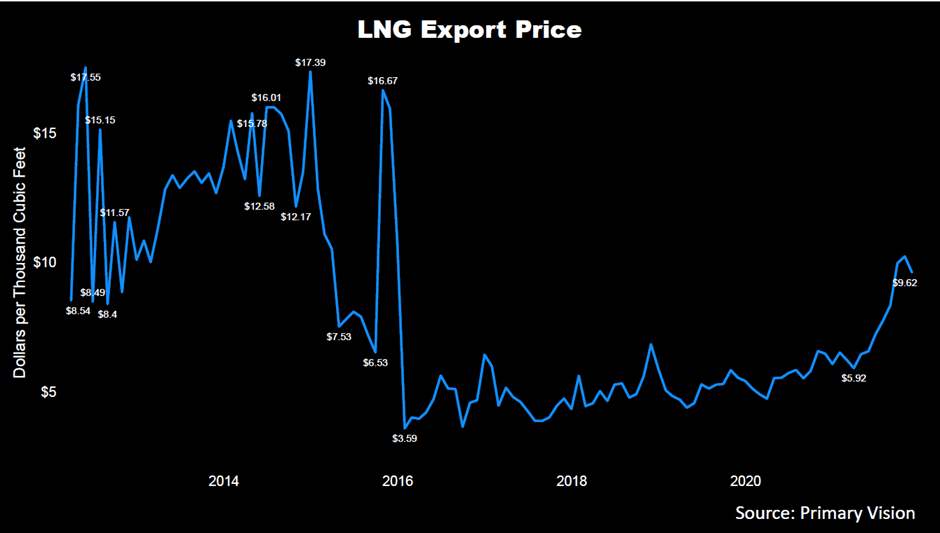

- A higher US LNG export and LNG price will benefit FTI’s order book in the medium term

- Renewables will become a substantial part of the company’s product and service portfolio

- Expect free cash flows to deteriorate as the company increases capex in FY2022

New Energy Venture and iEPCI Boost Backlog

The main area of concentration for FTI is the formation of new energy ventures. Although the legacy oil & gas will remain a significant part of the energy mix, investment in renewable energy and transitioning to the alternative energy market has caught investors’ fancy. The company plans to build its new initiatives on offshore wind, wave and title energy, hydrogen, and greenhouse gas removal. Its management expects to realize $1 billion inbound orders in new energy ventures by 2025. By 2030, it sees an addressable market of $80 billion.

In 2021, FTI concentrated on the iEPCI (integrated engineering, procurement, construction, and installation) projects, primarily in the Subsea segment. Much of the company’s order growth came from increased adoption of iEPCI and the continued strength in LNG and downstream project sanctioning. During Q4, it implemented two projects in Ghana and Malaysia involving subsea studio digital solutions through iEPCI and the Subsea 2.0 platform. Approximately 67% of the company’s total inbound orders ($1.6 billion) were from the Subsea segment in Q4 2021. In Brazil, it has announced several awards for long-term vessel charters, a contract to supply subsea manifolds, and an award for delivering equipment and services for the Búzios 6-9 fields.

By 2025, the company expects to see a multi-year subsea upcycle with potential inbound valuing $8 billion. The subsea inbound order can grow by 30% in 2022. A key offshore activity indicator, subsea tree awards can exceed 350 in 2022. Much of the growth can come from the North Sea, Gulf of Mexico, and West Africa. The company has pinned its hope high on Subsea 2.0, which can account for 50% of the company’s total subsea tree orders.

FY2022 Outlook And Forecast

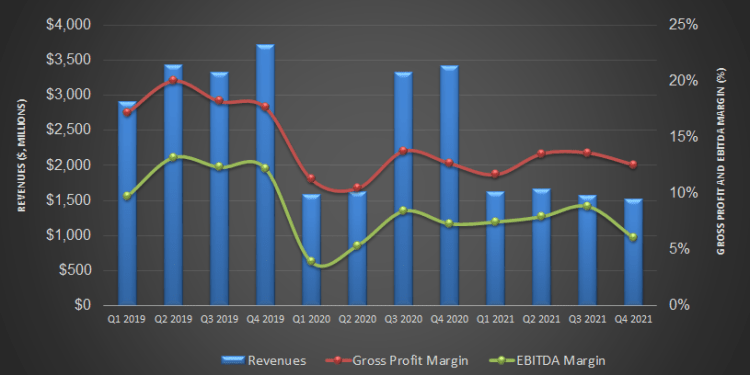

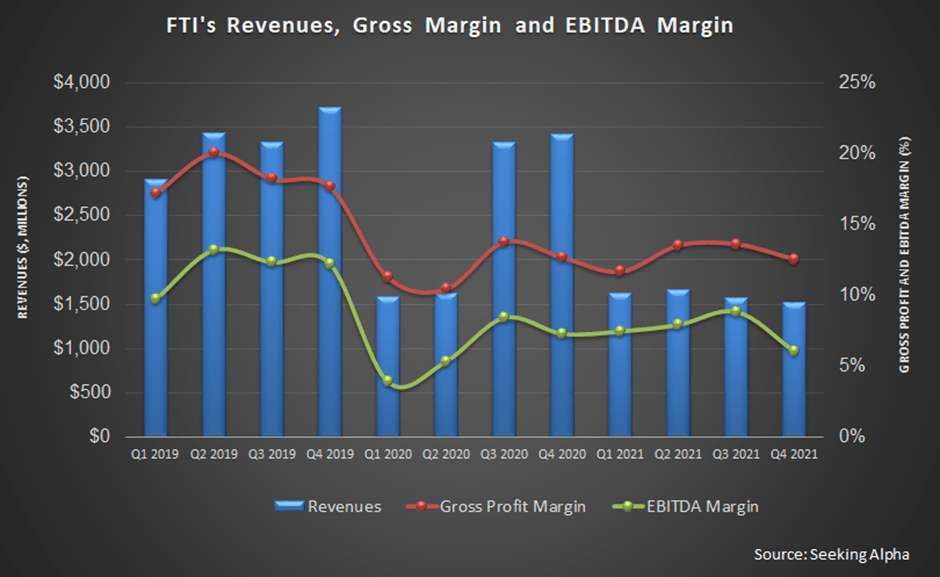

FTI’s management expects revenues in the Subsea segment can increase by 1.3% in FY2022. An estimated 85% of revenue is supported by scheduled backlog and services, indicating high revenue visibility and confidence in realizing the target. The adjusted EBITDA margin will also increase from 9.1% in FY2021 to a range of 11%-12%.

In the Surface Technologies segment, the revenue growth can be steeper (14% increase at the guidance mid-point) in FY2022. Much of the growth will be concentrated in North America, which would account for 35% of the segment revenue. The adjusted EBITDA margin will expand, too. However, its new international manufacturing capacity investment can lower the profit margin by 100-200 basis points.

LNG Price Moves Up In 2022

In the past year, the US LNG export price has increased by ~43% until December 2021, although it was lower than the previous month. US LNG exports are still higher than in any month before December 2021, which has led to such prices. We expect high US LNG exports to continue in 2022 as Europe gradually decides to walk away from Russian LNG exports. This can mark the beginning of a new era in the LNG market and keep the LNG price strong in the near term.

Renewables Projects

FTI is steadily establishing itself in the renewable energy space to remain competitive. Since the company has expertise in Subsea engineering, it can efficiently integrate it with renewable energy capability. In January, it forged a partnership in offshore renewables for a proposed development project with a total capacity of ~500 megawatts. Recently, it has announced a hydrogen storage MOU to accelerate the development of underground storage and utilization of green hydrogen.

Subsea Segment: Performance And Outlook

FTI’s Subsea segment revenue declined by 5.8% in Q4 2021 compared to Q3 2021. The segment operating income decreased steeply during this period. Lower productivity in Africa and Australia and a seasonal decline in services activity in the North Sea led to the subdued performance in this segment. It is essential to learn how the rig count has moved this year to understand the segment operating performance. As of now, the US rig count has gone up by 14% in Q1. The international rig count has gone down marginally, although it is still up by 16% compared to a year ago. The renewed thrust over increasing production following the ban on Russian oil can tighten energy supply while demand grows, leading to a sustained level of high crude oil prices.

Surface Technologies Segment: Analyzing Recent Performance

FTI’s Surface Technologies segment exhibited a mixed performance in Q4 2021. Quarter-over-quarter, the segment revenues increased by 7.4%, although the operating income decreased by 27%. Investment in new international manufacturing capacity increased expenses, contributing to the income fall. Inbound orders in the segment increased handsomely by the end of FY2021 compared to a year ago.

One key order accounted for much of the order growth. FTI has won a multi-year contract from Abu Dhabi National Oil Company (or ADNOC) to provide wellheads, trees, and associated services. Investors may note that FTI has expanded its manufacturing capabilities in Saudi Arabia and looks to strengthen its position there.

Cash Flows and Balance Sheet

FTI’s cash flow from operations (or CFO) declined by 7% in FY2021 compared to a year ago. Led by a modest revenue decrease in this period, the adverse effect of the timing differences on project milestones and vendor payments led to the fall in CFO. However, capex, too, decreased, leading to an unchanged free cash flow in FY2021 versus a year ago. In FY2022, its projected capex is $230 million, or at least 20% higher than FY2021. So, with a lower CFO and a higher capex, I expect FCF to stay weak in FY2022.

FTI’s debt-to-equity ratio (0.59x) is lower than its peers’ (SLB, BKR, HAL) average of 0.90x. It reduced its net debt following a net inflow of $251 million to sell a portion of its ownership stake in Technip Energies. As of December 31, 2021, its liquidity (cash plus investments plus availability of borrowings under the revolving credit facility) was $2.9 billion.

Learn about FTI’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.