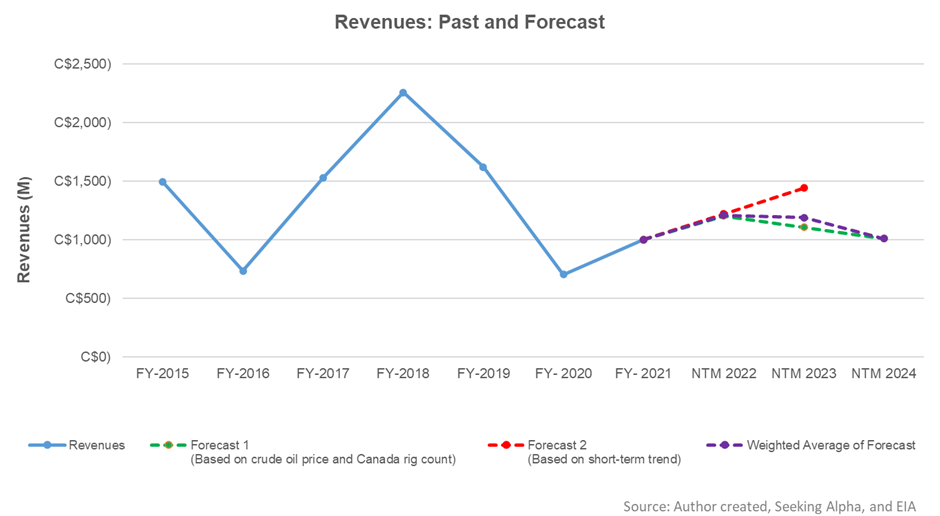

- Revenue estimates suggest higher revenues in NTM 2022, but the topline can flatten or decrease afterward

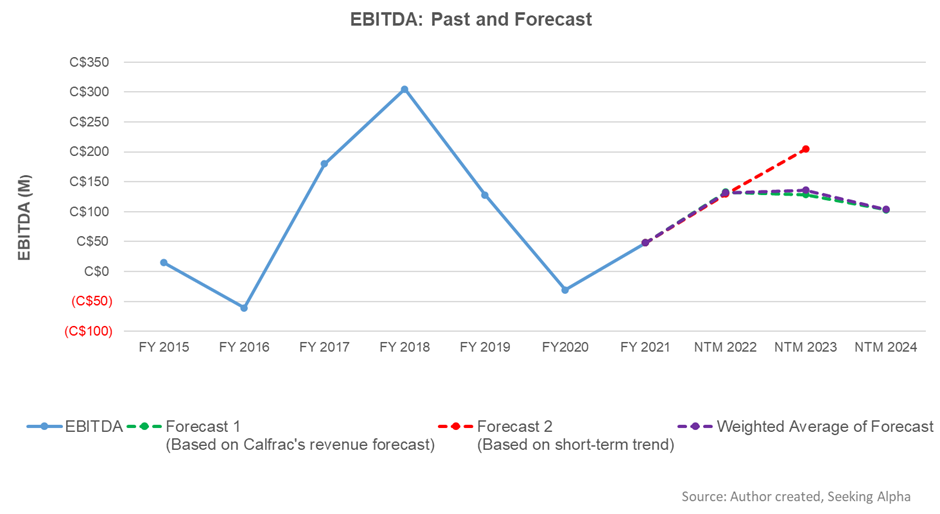

- EBITDA can increase significantly in NTM 2022 and decelerate afterward

- The stock is reasonably valued versus its peers

In Part 1 of this article, we discussed Calfrac’s outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and Canada rig count) and Calfrac’s reported revenues for the past seven years and the previous four-quarters, I expect its revenues to increase in the next 12 months (or NTM) in 2022. The growth rate can decelerate or may even fall in the following year.

Based on the same regression models and the forecast revenues, I expect the company’s EBITDA to step up substantially in NTM 2022. The model suggests the EBITDA growth rate will slow down significantly in NTM 2023.

Target Price And Relative Valuation

Returns potential using Wall Street analysts’ estimates is lower (32.5% upside) than returns (52% upside) using the forward EV/Revenue multiple (4.77x) from the stock.

Calfrac’s forward EV-to-EBITDA multiple contraction versus the adjusted EV/EBITDA is significantly sharper because its EBITDA is expected to increase more sharply than its peers in the next year. This should typically result in a higher EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple (12.7x) is higher than its peers’ (NBR, TOLWF, and NINE) average of 11.2x. The stock is reasonably valued at this level compared to its peers.

What’s The Take On Calfrac?

Calfrac has started the year with a strong tailwind in the US. Calfrac’s US operation ramped up as it doubled its frac fleet in that region. The company’s Canada operation has remained steady in 2022 but may see another fleet added during the year. The falling idle capacity in the fracking market has also helped improve pricing in the industry.

However, the company does have a few roadblocks. As Russia’s Ukraine invasion continues, the company’s operations in Russia face uncertainty and may also see revenues falling. While frac fleet and coiled tubing reactivation are rising, so does the reactivation cost. Also, this led to a much higher working capital requirement, resulting in negative cash flows. So, the stock significantly underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, the stock has sufficient upside from the rising activity level in the industry. Investors can hold with the prospect of higher returns in the medium to long term.