The past week, like many other recent weeks, was full of news (mostly bad). The global economic system is under serious pressure and I have written mulitple times that the system as a whole might be nearing exhaustion. One of the key events was Russia cutting off gas supplies to Poland and Bulgaria as both countries didn’t agree to use ruble for the payment. This development can have extremely non-linear consequences as the world and especially the EU already grapples with a serious energy crisis. The observation that this can help accelerate energy transitions doesn’t carries much weight. When we talk about transitions we need to take into account the whole political economy of it. For one, as the impetus for transitions gain traction, the metals that are required for this process are getting expensive. Moreover, the clean energy supply chain remains highly carbon intensive. But we won’t be going into the detail of this (may be in another post!).

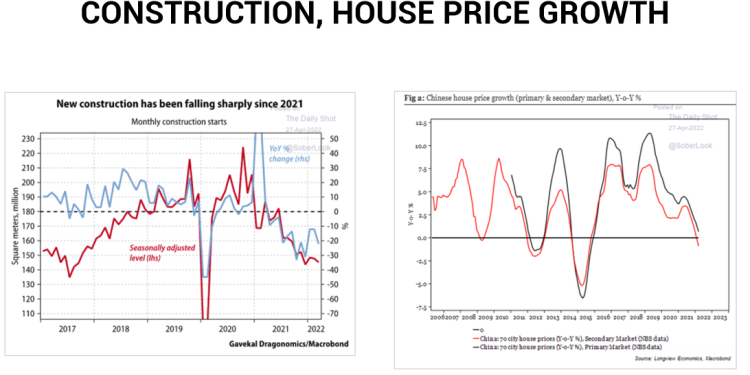

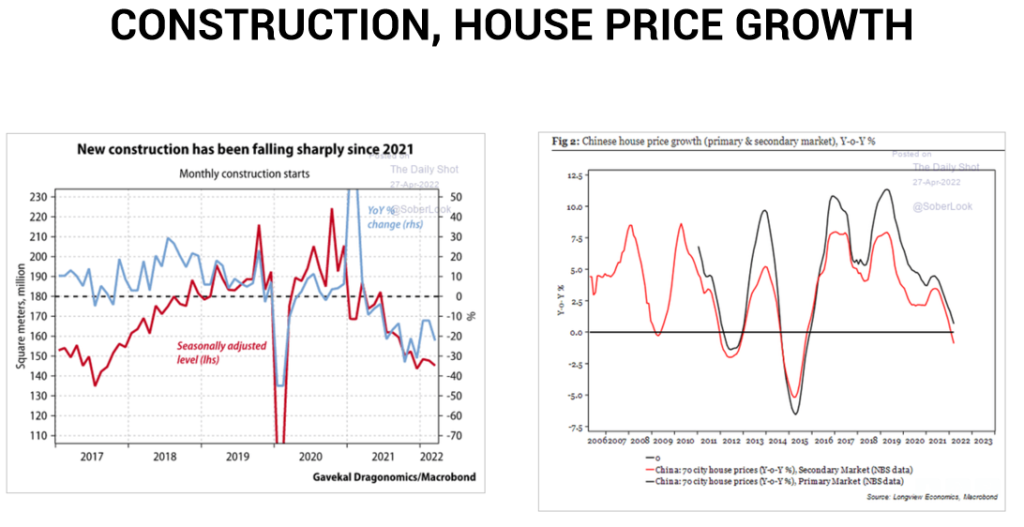

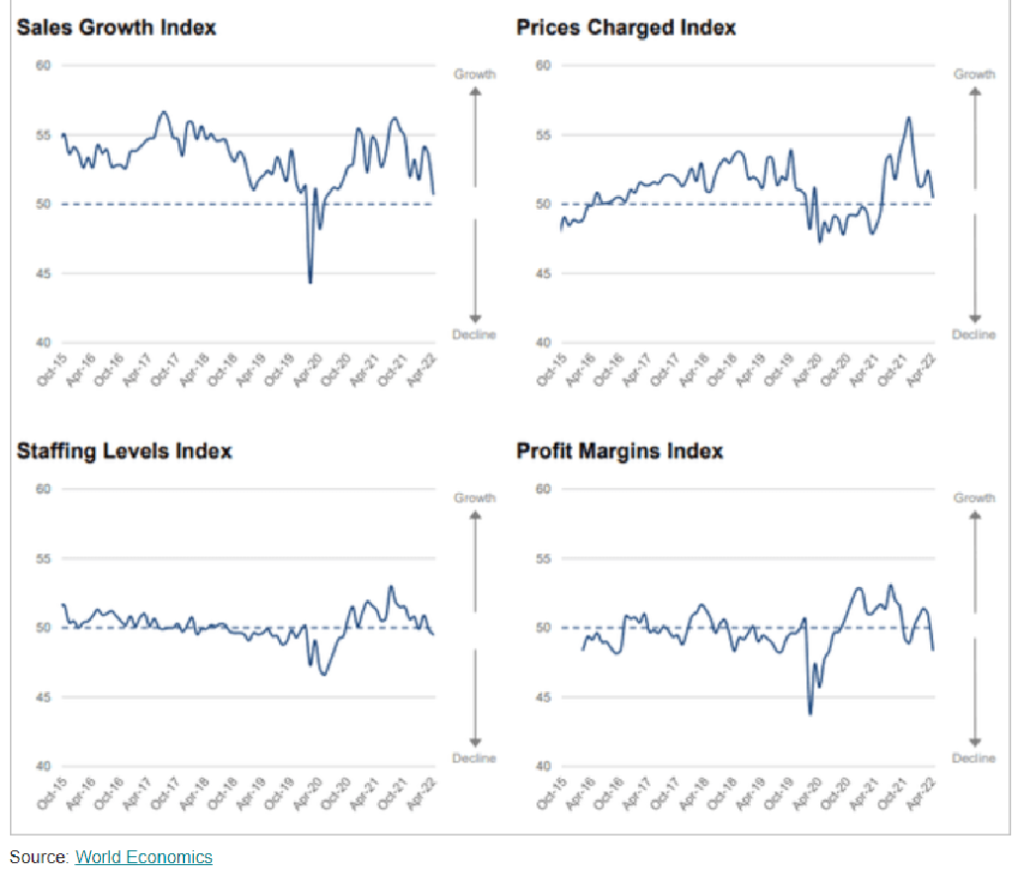

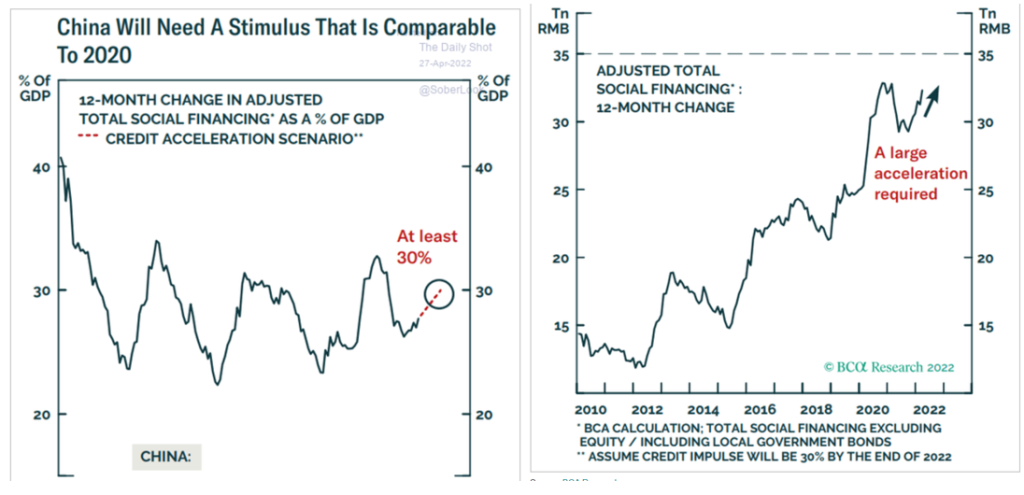

Another significant thread to track is a slowdown in Chinese economy. IMF has recently cut its growth estimates for China from 5.5 percent (as per Chinese estimates) to 4.4 percent. China has been trying to support growth as it recently reduced the reserve requirment ratio for banks making $82bn of liquidity available in the market. This comes against the backdrop of a resurgence in COVID19 cases as amongst the top 100 cities by GDP all but 13 remain under some type of lockdown. Supply chain concerns have continued to lingered on and this recent spike in COVID19 cases in China can cause further issues or prolong the process of recovery of global supply chains. Chinese currency is also under-pressure and has fallen 4.2 percent this month – largest drop ever since the end of U.S. dollar peg (from 1994 to 2005).

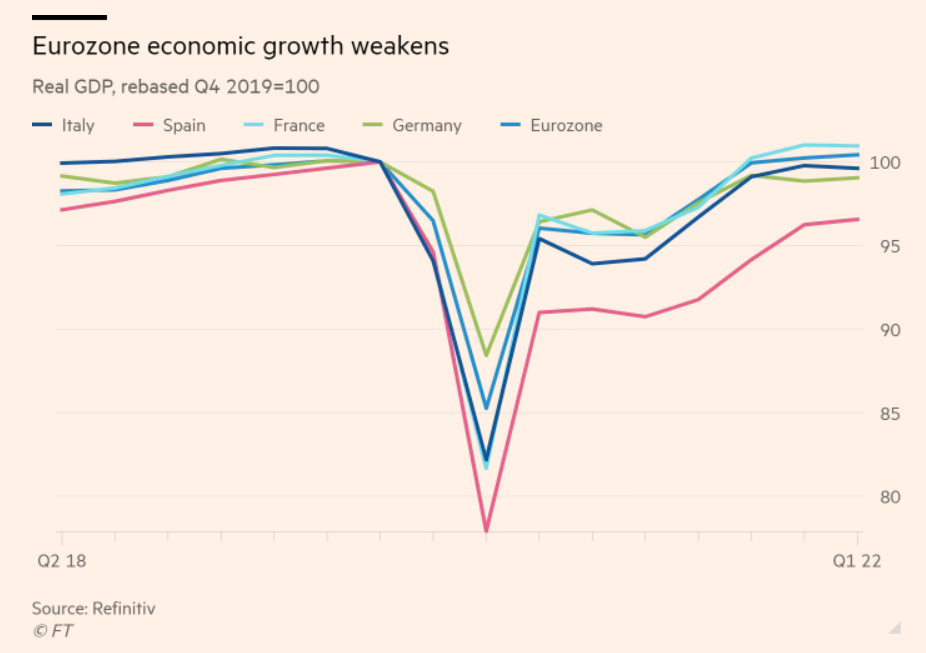

Coming to the growth in EU:

We will start it off with this chart below.

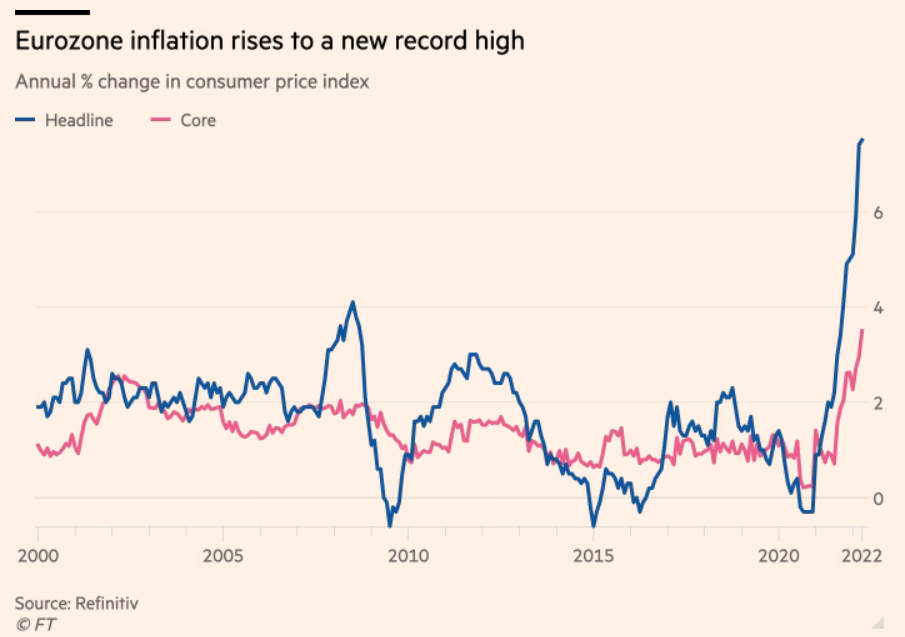

The growth in 19 countries in the Eurozone grew by 0.2 percent as compared to 0.3 percent in the first three months. Italian growth contracted while inflation in the eurozone is at a record at 7.5 percent as energy prices have risen 38 percent.

Some think that France is already in stagflation. Germany has registered a growth of 0.2 percent as the pace of activity slowed down especially as an aftermath of Russia – Ukraine invasion.

I will resist going down my usual recession reminders. It is well established that if not a recession but a significant correction is headed our way!

Wishing everyone a great weekend!!!

(From Osama’s Newsletter)