As we couldn’t film the ECON show this week, I have taken up this task to give you a very brief overview of where things are in the global economy. Let’s start with our favorite, inflation. Price spikes across the world in all domains continue, from energy to food. This is creating much problem not only for the consumers as it eats away at their savings and salaries but also for the governments that are finding it difficult to continue public sector development (increase government spending) without accumulating more debt. Why? As inflation surges, inter alia, their currency loses value making it difficult for them to 1) import 2) service their debt (which as I have mentioned in my previous articles, is at record high). Central banks are in a fix as well, they can’t seem to find that pace where rising interest rates will not have adverse effects on a global economy that is already a bit shaky in terms of its recovery as war between Ukraine and Russia and its aftermaths continues to put downward pressure on all fronts (especially food – it has also raised the risk of a recession). Overall, this tightening cycle can bring about a $410 bn “global financial shock“.

As such banks are on a net interest rate raising cycle. Bank of England has raised interest rates with warnings of an upcoming recession as inflation in the country is expected to surpass 10 percent! UK’s economy is expected to shrink by 0.25 percent next year with a slow growth period expected for the next two. Policymakers in the UK are also considering to increase energy cap by another 40 percent by end of year making the average household bill about £2,800. BoE interest rate now stands at highest since 2009. Unemployment is expected to touch 5 percent by 2024 from 3 percent today.

If we talk about the European economy as a whole indicators are showing tough times ahead. All of a sudden “Recession” has become a buzzword. Many CEOs of some of the top firms in Europe has shared their fears that Europe might be headed towards a recession with the CNBC recently. Inflation in eurozone touched 7.5 percent in March, a record high level. Retail sales have fallen sharply. Interestingly,unemployment in the bloc recently hit a record low at 6.8 percent but I believe that it will take some time for the effects to appear in the job market. PMI in the eurozone fell to 15 month low while number of new orders for manufacturing increased only in a “subdued” manner. This is partially because of the lingering supply chain issues as a result of lockdowns in China.

Speaking of China, COVID remains a concern there. Asian games were cancelled as a result of fears regarding another covid spike. The second largest economy’s services sector shrunk by the second highest magnitude due to COVID. The Caixin’s PMI index fell to 36.2 from 42 in March – a reading below 50 indicates slowdown in acitivity. Services sector accounts for 40 percent of country’s economy and constitutes more than half of its GDP. Moreover, spending during Labor day fell by 43 percent as compared to last year. Domestic trips also fell by 30 percent.

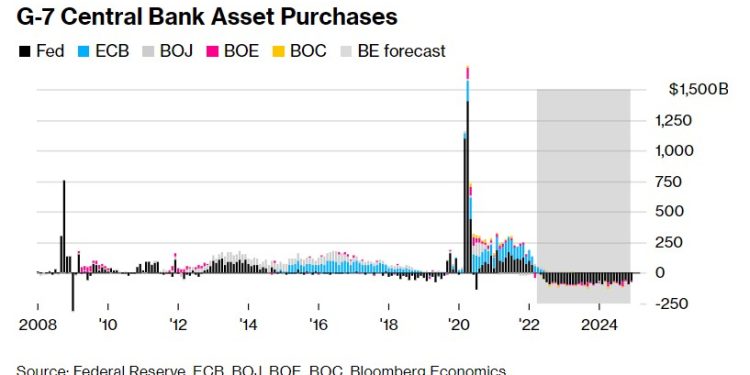

As I mentioned in the beginning, central banks of G7 will shrink their balance sheets by $410 billion as compared to last year where they added $2.8 trillion to the economy. Such a policy shift will have consequences across the board. We have now started to feel the initial tremors. If we look at the energy markets specially crude oil, things look worrisome. Russia has given another warning to EU while the later is getting serious about banning Russian oil and gas. With Russia’s output already down by 1 mpbd and expected to go down further by 3 mpbd, and OPEC+ only agreeing for a modest increase of 432,000 bpd, a oil supply shock can cause markets to roil globally.

All in all, the point of writing this article was to highlight where do we stand and possibly to show where we might be headed – not sure given extreme uncertainty in the markets.

That said, have a great weekend! See you next week with our usual set of shows!