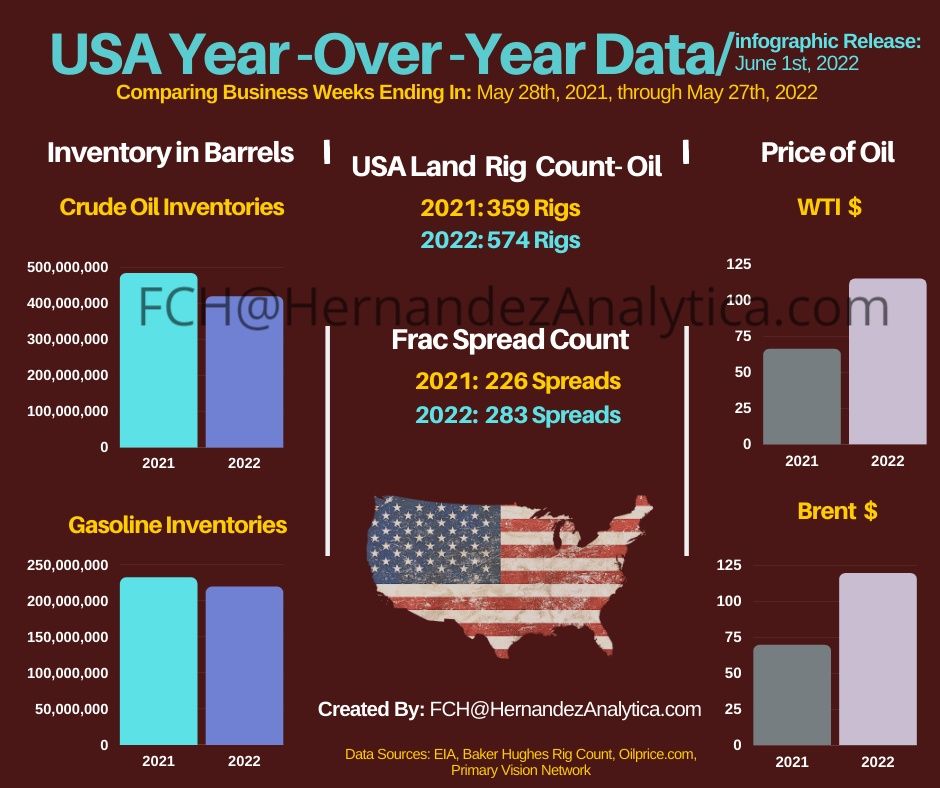

I have captured industry data, as it relates to the previous business week.

As such, the oil rig count has dropped by 2 after having increased for 9 consecutive weeks. Also, the price for Brent and WTI crude has increased by over 45.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• May 28th, 2021: 359

• May 27th, 2022: 574

(Primary Vision Network – Frac Spread Count)

• May 28th, 2021: 226

• May 27th, 2022: 283

(Oilprice site: #WTI price:)

• May 28th, 2021: 66.32 USD

• May 27th, 2022: 115.07 USD

(OilPrice site: Brent Crude price)

• May 28th, 2021: 69.63 USD

• May 27th, 2022: 119.43 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• May 21st, 2021: 484,349,000 Barrels

• May 20th, 2022: 419,801,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• May 21st, 2021: 232,481,000 Barrels

• May 20th, 2022: 219,707,000 Barrels