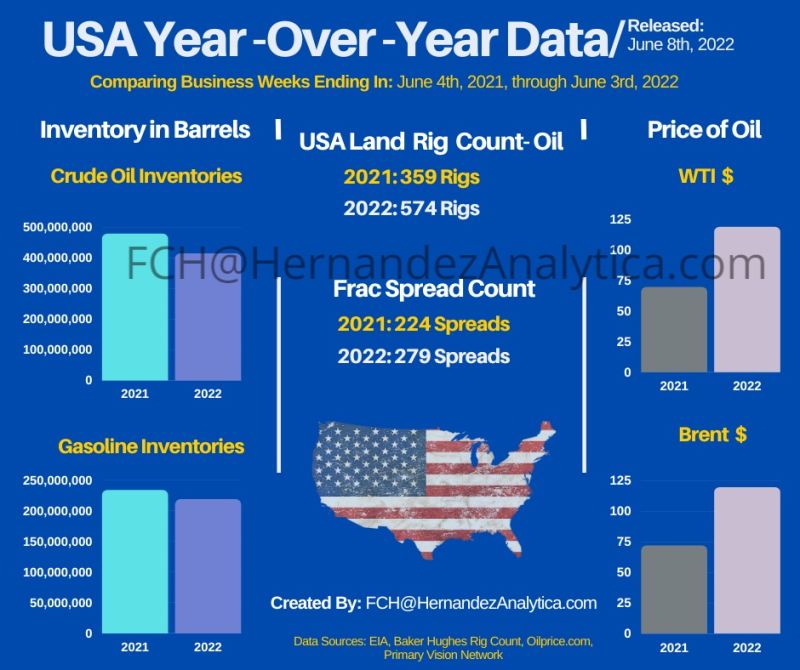

I have captured industry data is captured, as it relates to the previous business week.

The oil rig count remains at the same level as last week. Prior to this, it had increased for 9 consecutive weeks. Also, the price for Brent and WTI crude has increased by over 45.00 USD over the course of a year.

The below information that further complements the #infographic:

(Oil Rig Count: Baker Hughes report)

• June 4th, 2021: 359

• June 3rd, 2022: 574

(Primary Vision Network – Frac Spread Count)

• June 4th, 2021: 224

• June 3rd, 2022: 279

(Oilprice site: #WTI price:)

• June 4th, 2021: 69.62 USD

• June 3rd, 2022: 118.67 USD

(OilPrice site: Brent Crude price)

• June 4th, 2021: 71.89 USD

• June 3rd, 2022: 119.41 USD

(EIA Crude Oil Inventories: agency reports with a week delay)

• May 28th, 2021: 479,270,000 Barrels

• May 27th, 2022: 414,733,000 Barrels

(EIA Gasoline Inventories: agency reports with a week delay)

• May 28th, 2021: 233,980,000 Barrels

• May 27th, 2022: 218,996,000 Barrels