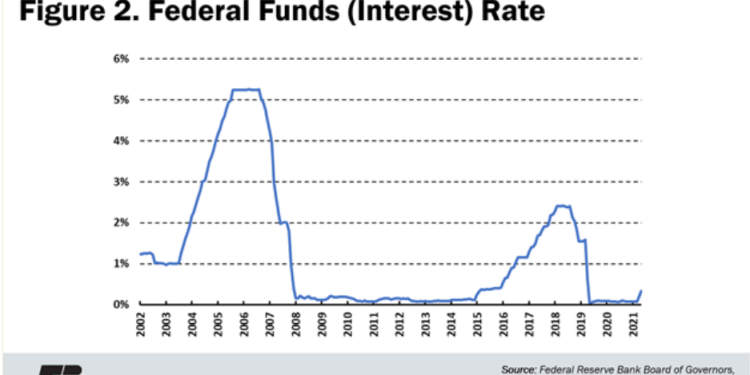

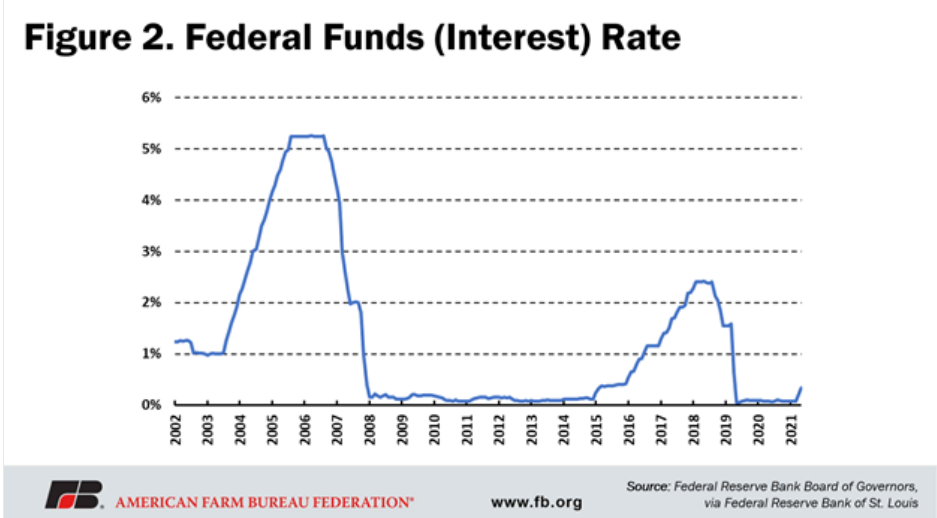

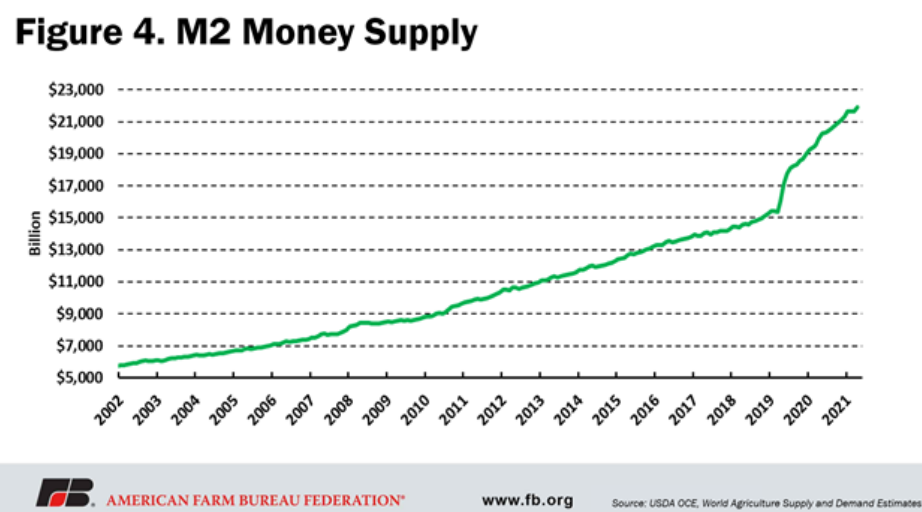

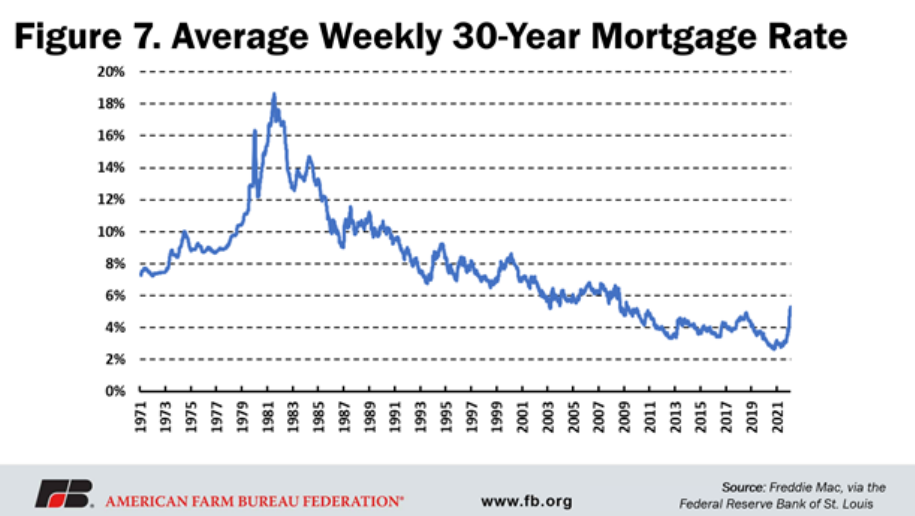

Amongst many other news coming out of the global economy, there is one that is really interesting: falling oil prices. Let’s try to cut through the noise of prices and just look at what is happening at the moment: Due to the Russia Ukrainian War the world has been enveloped in an inflationary spiral where everything food to energy keeps getting expensive. Even sans the invasion we would have seen a somewhat similar levels of prices increase as there has been an unprecedented amount of increase in money supply. Not only it was that but lower for longer interest rates by the Fed and other central banks across the world also encouraged an uptick in mortgage loans, leveraged money and other such items. All of these developments set the stage for what’s happening right now.

Between March 2020 to the end of year 2021, there was an addition of $6.4 trillion by the Fed – this amounts to a 42 percent increase in 22 months. Besides thsi, there was also the pandemic emergency programs that totaled a staggering $6 trillion – giving approxmiately $11,400 to a family of four. For comparison the spending as a result of the 2008 financial crisis was £900 billion.

Have a look at the sharp rise in mortgage rates:

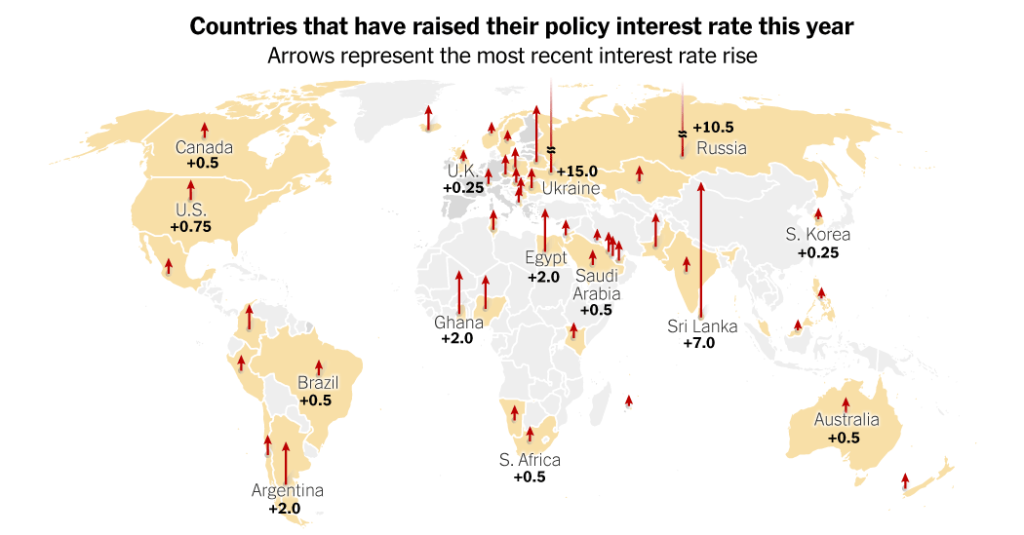

The second phase of what is happening is the reaction to the first one. As a result of all the money floating around, the inflation picking up – breaking records of decades – the central bankers across the world had to increase interest rates. In the first 6 months of 2022, there were 83 interest rate hikes! Now when you combine this aggressive interest rising cycle with a plethora of loans in different forms, that spells trouble! As a result of these manoeuvres, inter alia, the Emerging Markets started to suffer seriously.

Rising interest rates by the Fed makes dollar strong. A stronger dollar is a curse for EMs as their trade and above all the debt servicing becomes more expensive. Now with more than a $100 trillion rise in pandemic debt and 80 percent coming from EMs, that becomes a serious issue. The imports become expensive and the national exchequer starts to drain. This happened in Sri Lanka as it declared sovereign default. This became a serious issue in Pakistan as the reserves reached a record low at $8.99 billion – not enough to cover even a month of imports. Meanwhile, the lingering supply chains issues and inflationary pressures made everything expensive. That has caused a number of socio-politico issues as people took to the streets to protest against, especially, the rising food prices. Ecuador, Peru, Ghana, and many other countries witnessed it.

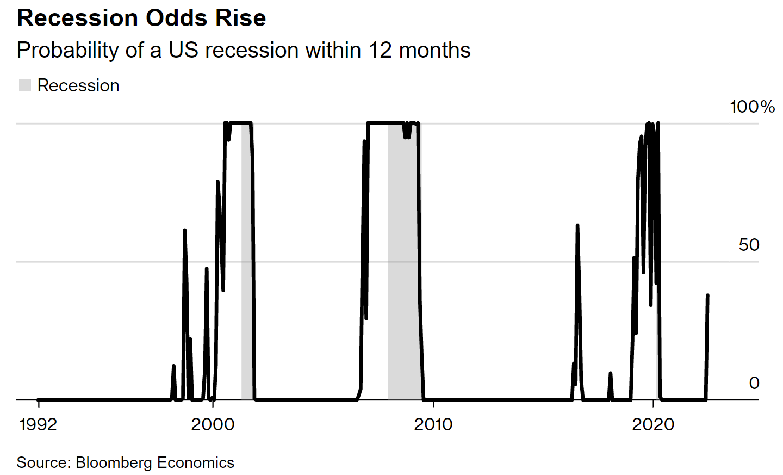

These developments started to take the form of structural issues. This is where the fears of recession were pronounced.

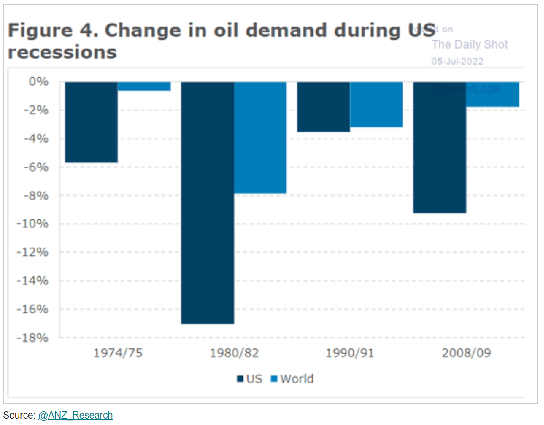

In parallel, supply concerns in the oil markets were/are well established. OPEC+ has failed to meet its production quotas multiple times and I have written about it many times before. However, now prices took a breather as the expectation of demand destruction took the center stage. The jury is still out there that whether this will cause a demand destruction or not.

I will not be commenting on where the oil prices are headed. JP Morgan says $380, Citi group sees a collapse at $65. I believe both are possible. The geopolitical events aren’t promising in terms of a de-escalation between Russia and Ukraine. Finland, Sweden are almost about to become part of NATO as they complete their accession protocols. Moldova and Ukraine have been assigned candidacy. While Russia has not voiced any concern on these developments but Putin has made clear that if NATO builds infrastructure then Russia will “respond in kind”. These events can have serious consequences for global energy markets as the tussle between Russia and Europe gets serious.

Time will tell!

(I wrote the same on my Substack)