- Schlumberger plans to increase revenues and adjusted EBITDA at a considerably high rate in FY2022

- As the oilfield equipment supply capacity tightens in North America, international markets go through an up-cycle and will support the revenue and margin growth.

- While many indicators in North America and international markets support further growth, some concerns over the demand side weakness prevail.

- Higher earnings can help SLB deleverage the balance sheet, but free cash flow deterioration can cause concerns.

Industry Drivers: Domestic And Global

Our previous Schlumberger (SLB) article discussed how its management expected multi-year upcycles with critical short- and long-term trends. After Q2, the management has turned slightly conservative, although it continues to back the overall momentum. While upstream spending is due for a rise in North America and OPEC, the demand side is caught between a global economic slowdown concern and energy security, higher breakeven price, and long-term oil and gas production capacity growth. As a result of these factors, the oilfield equipment supply capacity can tighten in North America. The international markets go through an up-cycle and will support revenue growth and margin expansion. SLB’s management expects to see robust short-cycle activity in North America.

In the international basins, investments by the upstream operators and IOCs are likely to accelerate, resulting in short-term production growth and mid-to-long-term capacity expansion. An improved pricing dynamics will support the growth trajectory and the margin improvement in 2H 2022. Among SLB’s strategic journey toward digitization, steady growth in production systems will benefit its Digital & Integration segment. So, following increased investment in international basins, the growth rate in this market can pick up in 2H 2022.

The Q3 And FY2022 Outlook

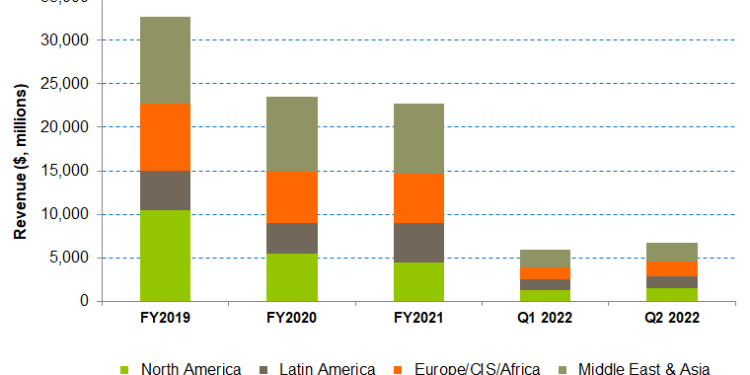

SLB’s international business grew faster than its North American counterpart in Q2. While year-on-year revenue growth was 20%, the international markets clocked a 50% growth. The management expects a sustaining and robust growth momentum with an inflection point in the near term.

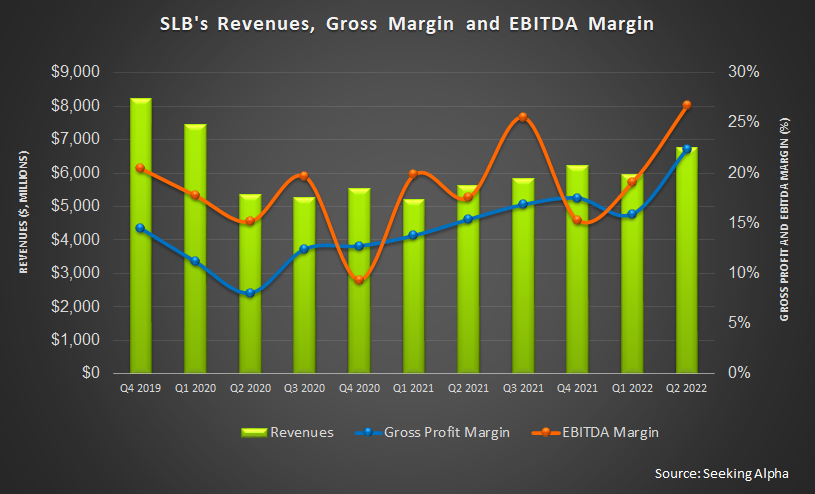

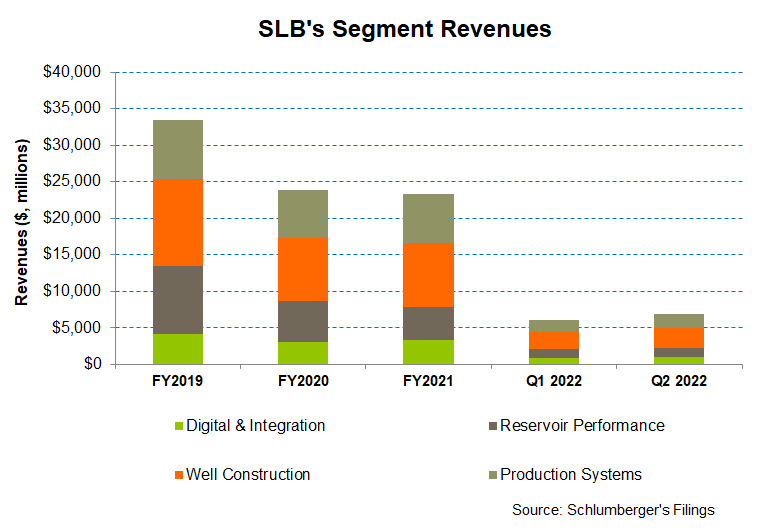

In FY2022, its revenues can reach $27 billion, which would be a 17.5% hike compared to a year ago. The adjusted EBITDA can increase by at least 25% during this period. In comparison, revenues decreased marginally in FY2021 versus a year ago, although EBITDA increased by 23% during this period. So, with continued short cycle activity in North America and accelerated investments in most of its international operations, its revenue growth can reach ” high-teens” in 2H 2022 versus a year ago.

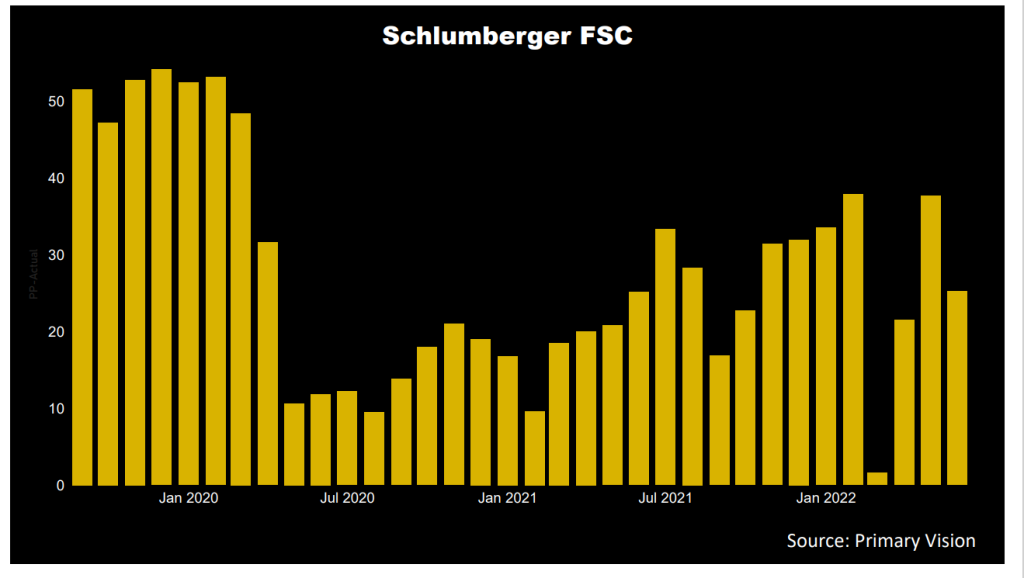

Frac Spread Count

According to Primary Vision’s forecast, SLB’s frac spread count (or FSC) decreased in June compared to the previous month. Its June FSC count is also lower than the 1H 2022 average, which is somewhat disappointing with the industry’s recent focus on hydraulic fracturing. Earlier, Schlumberger sold a majority stake in its Permian frac sand business to Liberty Oilfield Services (LBRT).

Industry Indicators Are Fast Gaining Strength

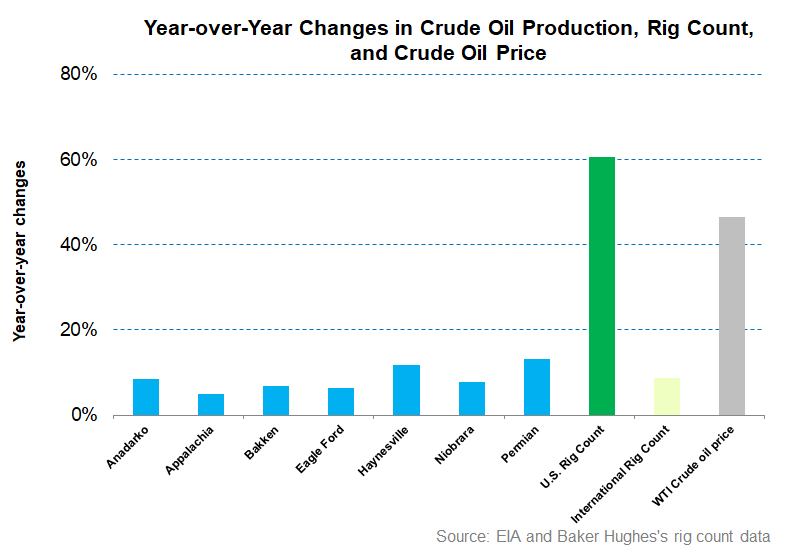

In the past year until June 2022, the key US unconventional Basins, on average, saw an 8.5% rise in tight oil production. However, the US rig count recovery (61% up) significantly outperformed the production growth. According to the EIA, crude oil prices can increase by ~6% in 2022 compared to the current level. By 2023, however, it can decline by more than 9%. The EIA also expects OPEC crude oil production will rise by 2.4 million barrels per day in 2022, but the production growth will decelerate in 2023. The geopolitical situation in Ukraine and the global economic slowdown can lead to this demand destruction.

From Q1 to Q2, SLB’s revenue share from international operations contracted marginally to 77%. However, none of the geographic regions saw any decline. The North American area grew faster (20% up quarter-over-quarter) than the others. Europe/CIS/Africa also made a remarkable sequential recovery. The Middle East & Asia was the slowest to grow. Internationally, all four divisions posted double-digit revenue growth and expanded margins sequentially, led by broadening pricing improvement.

The Key Segment Drivers In Q2

In Q2 2022, Schlumberger’s Digital & Integration revenue segment revenues increased by 11% compared to Q1 2022 because of higher exploration data licensing sales in the GoM. The segment operating income jumped by 30% as profitability in the APS project improved.

Quarter-over-quarter, SLB’s Reservoir Performance segment revenue increased by 10% in Q2 due to increased onshore and offshore activity and improved pricing, particularly in the Northern Hemisphere. It also pushed the operating income up by 22% in this segment. Revenue growth in the Production Systems segment was the highest (18% up) in Q2 as product deliveries, and backlog conversion picked up. Remember, in Q1, deliveries were delayed, and logistic costs increased following the supply chain disruption.

In Q2, SLB recorded an adjusted EPS of $0.50, which was the highest quarterly adjusted EPS since Q4 2015. Quarter-over-quarter, it represents an increase of 34%. However, in Q1, its GAAP EPS was much higher due to the gain relating to selling a portion of Liberty Energy shares and some real estate.

FCF and Capex In FY2022

SLB’s free cash flow (or FCF) turned negative in 1H 2022 compared to a healthy and positive FCF a year ago. Steeply lower cash flow from operations (or CFO) reduced FCF. Although revenues increased in this period, a higher receivable due to the significant revenue growth caused the CFO to decline. Capex, too, raised in the past year. The management estimates working capital requirements will increase in 2022 due to higher inventory in the Production Systems division. So, cash flow can deteriorate in the short term.

The company’s debt-to-equity is 0.83x. Although it is reduced compared to a quarter ago, it is higher than peers’ (HAL, BKR, and FTI) average of 0.74x. During Q2, it sold certain real estate, which improved net debt by $406 million. It has now achieved its previously stated leverage target of 2x net debt-to-EBITDA. Although higher earnings can help deleverage the balance sheet further, a lower FCF can delay the process.

Dividend And Dividend Yield

Schlumberger maintained its annual dividend at $0.70 per share, with a 2.08% forward dividend yield. In comparison, Halliburton (HAL) pays a yearly dividend of $0.48, which amounts to a forward dividend yield of 1.71%.

Learn about SLB’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.