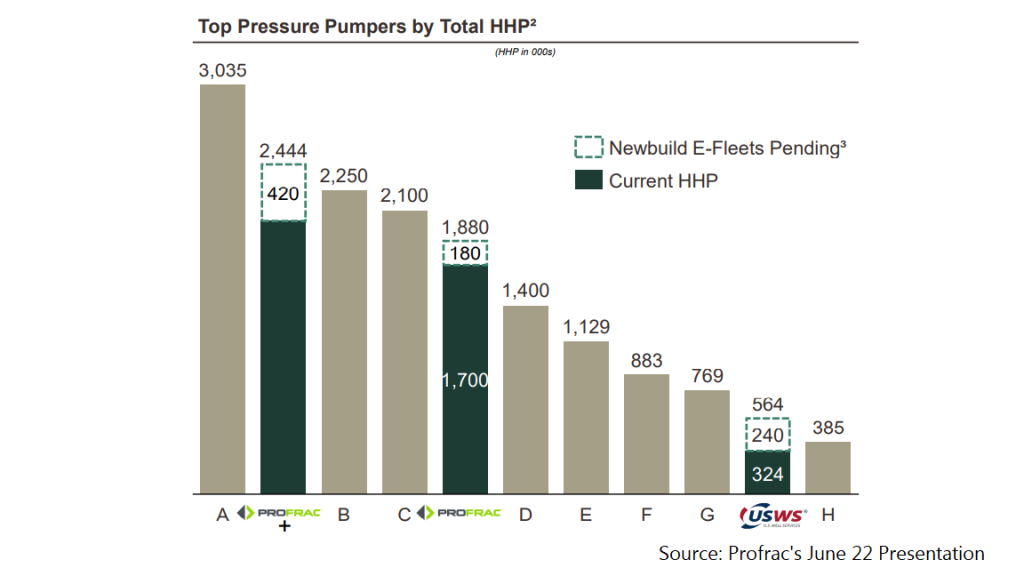

- The USWS and FTSI acquisitions have made ProFrac one of the top players in the pressure-pumping industry.

- By the end of 2022, it will have 12 electric fleets – one of the largest in the industry.

- In another acquisition, the company’s backward integration strategy received a shot in the arm by adding three million tons of annual sand production capacity.

- The recent acquisitions augur well with the company’s strategy of backward integration and retiring older generation diesel frack fleet to refurbish the Tier IV and electric fleets.

- However, its leverage has gone high following the acquisitions

ProFrac: Incorporation And IPO

ProFrac Holding Corp. (PFHC) was incorporated in August 2021 following a corporate reorganization. In May 2022, it completed an initial public offering and raised combined net proceeds of $303.9 million. Through three reportable segments – Stimulation services, Manufacturing, and Proppant production, it provides hydraulic fracturing, completion, and other services to leading upstream oil and gas companies in the North American unconventional shales. Its active fleets went from 17 before the FTSI acquisition to 31 after. The company’s average active fleet count for Q1 2022 was 21.7 fleets. As of March 31, 2022, it had an installed capacity of 34 conventional fleets.

FTSI Acquisitions And Inorganic Growth

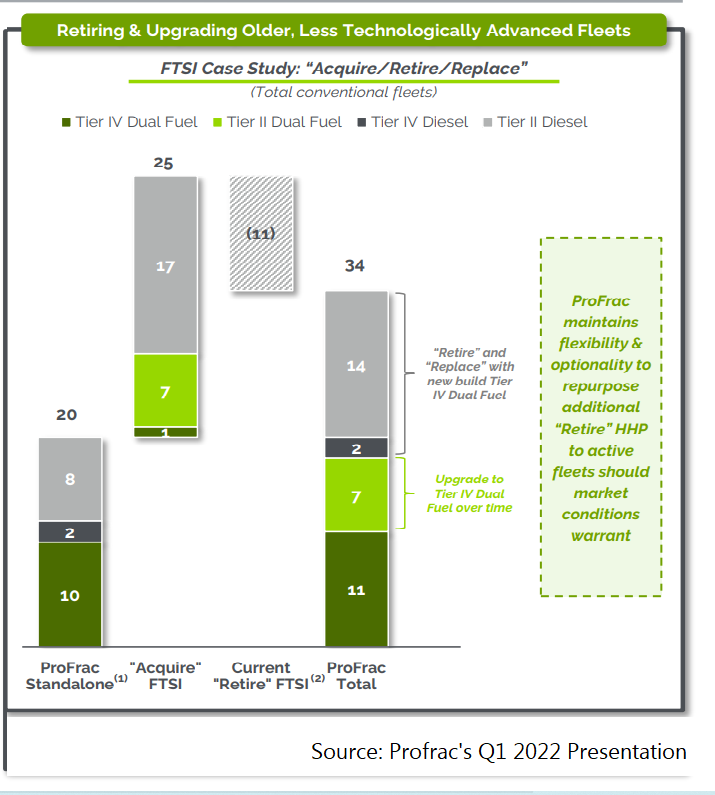

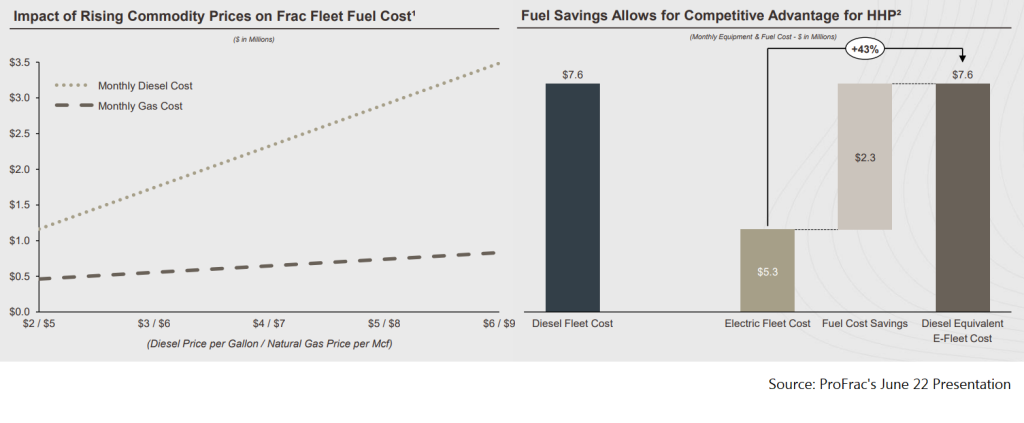

ProFrac leaped into the forefront of pressure pumps and fracking when it acquired FTS International (FTSI) in March for $332.8 million. It established PFHC as one of the top players in pressure pumping with 31 active fleets with a capacity of ~1.5 million HHP. Following its core strategy of providing vertically integrated services, it provides stimulation services while keeping a manufacturing base for proppant production. Its main aim is to follow an “Acquire/Retire/Replace “policy. The policy involves acquiring an older generation diesel frack fleet at a low price, then retiring old fleets so that more economical and efficient equipment is refurbished and redeployed at a higher margin. It replaces the legacy fossil-fuel-based pumps with dual fuel or electric technology. Eventually, it looks to build a two-tier fleet vertically integrated with supply chain management, standardized equipment, and fuel cost savings.

The FTSI acquisition expanded ProFrac’s presence from four to six regions. It also cannibalized some legacy FTSI equipment (650K HHP) as spare parts. It refinanced its revolving credit facility and a term loan with the acquisition. As a result of these benefits, it has achieved annual cost savings of $55 million. So, it can mitigate supply chain constraints and achieve high equipment utilization rates, low emissions, and improved profitability.

USWS Acquisition And Electric Frac

In June, ProFrac acquired U.S. Well Services (USWS). It issued 7.5 mm shares at an exchange ratio of 0.0561x to 1 for USWS’s common stock, senior convertible notes, and convertible preferred shares. According to the company’s estimates, the combined company would be one of the top providers of electric frac services, with 12 electric fleets. It will also expand its total active fleet to 44 by year-end 2022, including 13 Tier IV Dual Fuel fleets and three Tier IV diesel fleets. It will also deploy 28 NextGen fleets by the end of the year. ProFrac’s fleets are located across Permian, Appalachia, Eagle Ford, Mid-continent, and East TX/LA.

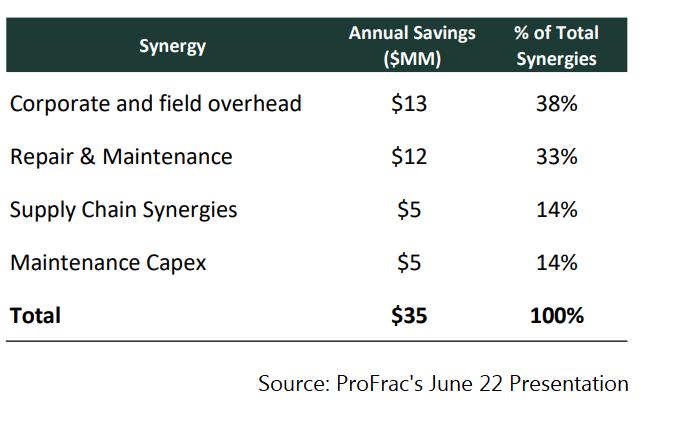

Here is the summary of USWS at the start of the year (before acquisition). In 2021, the company signed a license agreement with ProFrac, by which ProFrac gets a license to make or lease certain products of USWS in 20 operating fleets. All its fleet are electric pressure pumps. It declared plans to roll out the Nyx Clean Fleets starting Q1 2022. By Q3 2022, it planned to deliver four Nyx fleets, which will take its total fleet count to nine. Investors may note that electric fleets offer significant cost savings by eliminating diesel fuel consumption. There is an indirect advantage also. E-fleet fuel cost is typically less sensitive to changes in natural gas pricing than diesel fleet. In 2023, it aims to achieve $35 million in annual savings from reducing corporate expenditures, eliminating redundant costs, and consolidating facilities.

Vertical integration Through Acquisitions

Extending the vertical integration rationale, PFHC acquired SPS Monahans – the West Texas subsidiaries of Signal Peak Silica, for $90 million in June. Through that Acquisition in the Permian, ProFrac aims to consolidate supply chain components, lower costs, and improve our operating margins. SPS Monahans provides ~3 million tons in annual sand production capacity. By Q3, it would expand the company’s operations to three in-basin sand mines.

Key Indicators

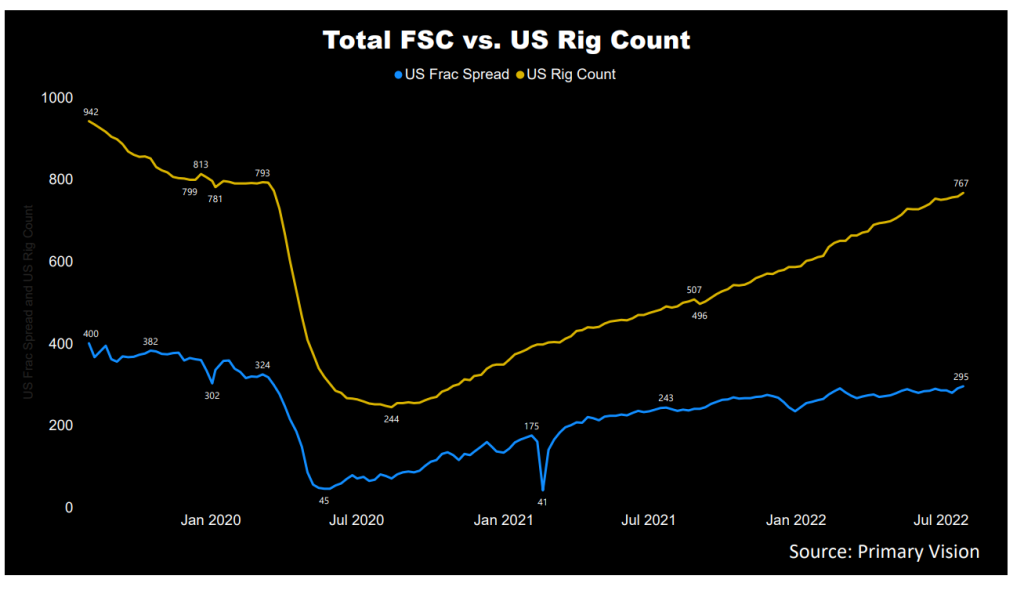

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 290 by the third week of July and has increased by 24% since the start of 2022. As Matt wrote in the latest Primary Vision Insights, “When we review horsepower, there are about 325 usable spreads in the U.S., with the last 15 being far below optimal.” In the aftermath of the Ukraine crisis and COVID normalization, the crude oil price steadied in Q2 but faced demand-side uncertainty from the looming economic slowdown. The US rig count, drilled wells, and completed well counts continue to strengthen in 2022, although the drilled-but-uncompleted (or DUC) wells have been coming down. By the start of 2022, many oilfield services companies, including Halliburton (HAL), Schlumberger (SLB), and Liberty, believe that an energy upcycle has begun following years of underinvestment. The tightness in supply and the upstream operators’ logical response to the energy price rise mean supply will rise.

Q2 Outlook

PFHC’s management expects revenues and operating margin to increase in Q2 compared to Q1. It estimates annualized adjusted EBITDA per fleet to be $23-$25 million per fleet, which would be a 42% jump compared to Q1 2022.

Analyzing Q1 Results

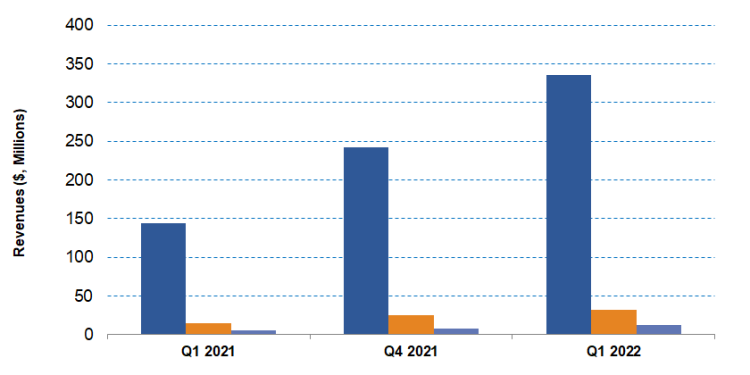

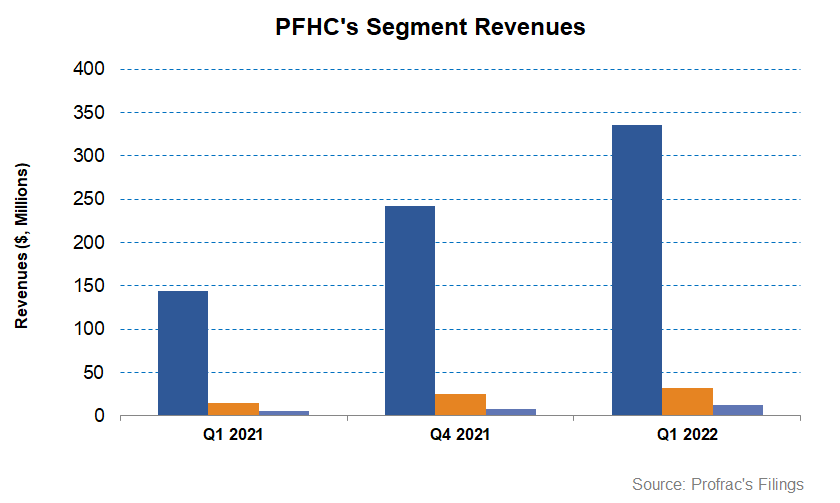

In Q1 2022, ProFrac’s Stimulation Services segment revenues increased by 39% compared to Q4 2021. The top line was boosted by one month of revenue addition from FTSI, which accounted for 14% of the total revenues. The segment EBITDA margin was 22% in Q1 2022.

Quarter-over-quarter, ProFrac’s Manufacturing segment revenue increased by 25% in Q1, while the segment EBITDA margin was 31%. Revenue growth in the Proppant Production segment was the highest (66% up) in Q1. Also, its EBITDA margin was the highest among the segments (64%).

FCF and Capex In FY2022

PFHC’s free cash flow (or FCF) turned mildly positive in Q1 2022 compared to a negative FCF a year ago. Despite a steep rise in capex in the past year and an even sharper rise in cash flow from operations (or CFO), increased FCF. Revenues increased by more than 130% during this period, primarily leading to the CFO’s rise. The management estimates capex will increase by more than 200% in FY2022 compared to FY2021 due to the construction of three electric-powered fleets, the construction of the West Munger sand mine, and the upgrading of Tier II fleets to Tier IV dual fuel fleets.

The company’s debt-to-equity was 2.17x as of March 31, 2022. Its indebtedness increased significantly following the acquisitions of the SP Companies and USWS and included the repayment of approximately $170 million of USWS debt. It is also higher than peers’ (LBRT, NEX, and HAL) average of 0.67x. Deploying higher-margin pressure pumping fleets will improve free cash flows, but not until the burden of higher capex takes its toll in the short term.

Learn about PFHC’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.