- Liberty plans to deploy two more digiFrac electric fleets in early 2023 following the strong frac market demand.

- LBRT can see frac prices improving as the share of ESG-friendly frac fleets rise in its portfolio

- Despite the supply side tightness, the management undertook a $250 million share buyback program in Q2, which shows its confidence in its outlook.

- Buoyed by higher cash flows, it plans to invest heavily into digiFrac fleets and PropX sand handling in FY2022

The Industry And Frac Fleet Growth

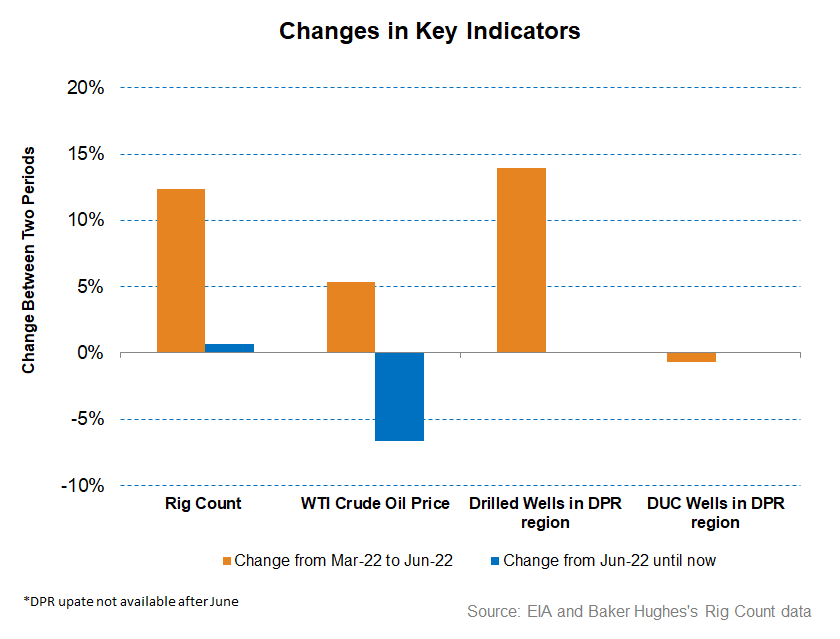

The crude oil price has weakened in Q3 after it remained steady in Q2, following concerns over demand in the short term. The US rig count, which increased steadily in Q2 (12% up), is consolidating in Q3. The drilled well continued to strengthen in Q2. As discussed in my previous articles on Halliburton (HAL), Schlumberger (SLB), and Baker Hughes (BKR), the long-term energy upcycle will benefit North America and other international regions following years of underinvestment. While the general economy is in the doldrums owing to higher inflation, rising interest rates, and the Russian invasion of Ukraine, the energy market has no shortage of incentives following “years of under-investment.” A limited OPEC spare production capacity and a lack of refining capacity on the one hand and demand rejuvenation on the other have created a demand-supply mismatch. So, energy prices will likely remain elevated in the near to medium term.

With this background, LBRT expects to deploy two more digiFrac electric fleets in early 2023 following the strong frac market and customers’ review of the frac demand. This will break the company’s decision to refrain from reactivating fleets after the 2020 downturn. Strategically, LBRT will not reactivate fracks at the spot price and will seek long-term relations with the customers. Earlier in the year, the company reactivated fleets having Tier 2 diesel equipment that came with the OneStim acquisition. However, it will focus on deploying the digiFrac electric fleets that offer full automation of the pumping equipment on the digital side, offering intelligent rate and pressure control systems, as we discussed in our previous article.

Share Buyback And Challenges

Liberty is focused on free cash flow generation and maximizing returns. Its acquisition of SLB’s OneStim pressure pumps is an example of growth while maximizing returns. The management has maintained its constructive outlook, leading to a $250 million share buyback program in Q2. The program reflects maximized shareholder values and shows management’s estimate of a dislocated stock price, which means the management expects the stock price to gain strength in the medium to long term.

If we look at the potential challenges, LBRT or many other oilfield services companies face uncertainties over the degree or intensity of the current recession and the tightness in the oilfield equipment supply. The supply side is more uncertain as tight equipment availability, supply chain issue, and labor constraints limit frac fleet availability. While the challenges remain, LBRT, with its suite of ESG-friendly frac fleets, find opportunities due to its emissions reductions and considerable fuel savings measure. Because Liberty was disciplined in committing to fleet reactivations, its frac fleet is nearing full utilization.

Q3 Outlook And Forecast

In Q3, LBRT’s management expects an 18% revenue growth compared to Q2, driven by fleet reactivations. The Q3 results will also benefit from the accrued contribution of the fleet deployed in the latter part of Q2. Plus, incremental pricing will also help improve the Q3 results. The company’s margin should also improve from the contribution of integrated fleets and net pricing increases. However, the ongoing supply chain issues and increases in raw materials and labor costs will mitigate its margin expansion partially.

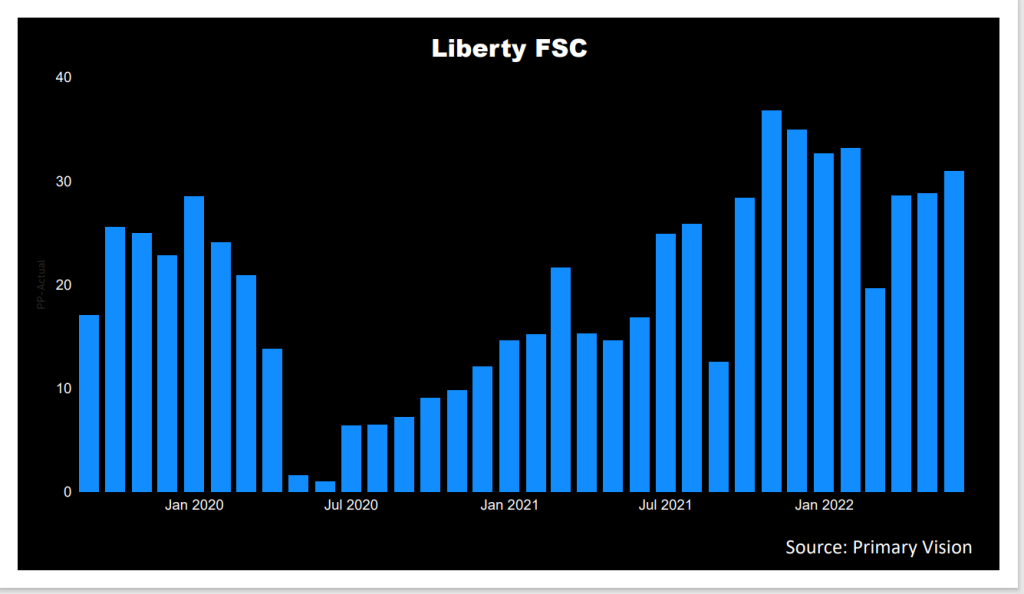

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 290 by the third week of July and has increased by 24% since the end of 2022. Year-over-year, Liberty’s FSC increased by 82% until June. In Primary Vision, we expect to see 300 active completion crews by the first week of August.

What Were LBRT’S Q2 Drivers?

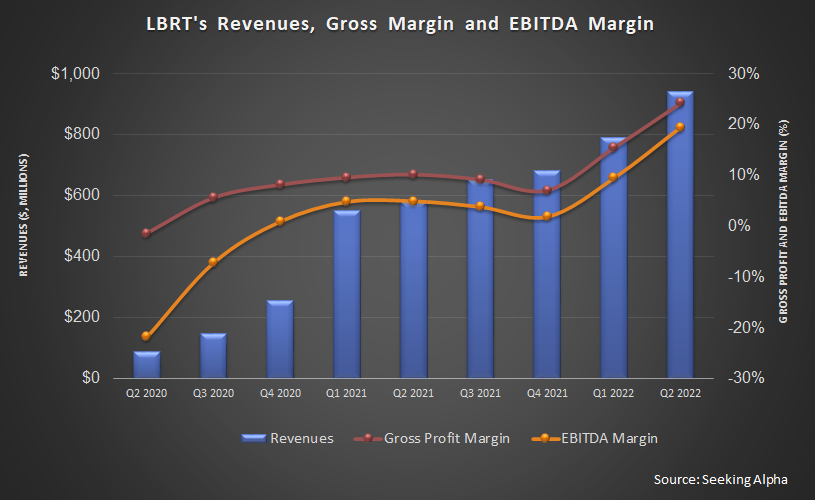

From Q1 2022 to Q2 2022, LBRT’s revenues increased by 19%, driven primarily by the rise in energy activity and an improved sales mix. On top of that, fleet reactivation at increased pricing contributed to the revenue growth. The EBITDA growth was even more remarkable in Q2 (144% up). Pricing has recovered following a rise in its customers’ long-term development needs. As a result, it reactivated several of its recently acquired fleets from the OneStim transaction (with Schlumberger).

As a result of these changes, the company turned around from a loss to generating net profit. In Q2, its net income per share was $0.55 compared to a net loss of $0.03 in Q1.

Cash Flows And Debt

LBRT’s cash flow from operations (or CFO) increased sharply (by 281%) in 1H 2022 compared to a year earlier, led by higher revenues. Capex, too, increased sharply (231% up), leading to negative and deteriorated free cash flow (or FCF) in 1H 20222. In FY2022, it plans to increase capex by 163% compared to FY2021. Apart from frac fleet reactivation, much of the hike in capex will account for the incremental spending, additional digiFrac fleets, and PropX sand handling of wet sand equipment. LBRT’s liquidity amounted to $263 million after it increased our borrowing capacity in July. The company’s debt-to-equity (0.19x) is lower than many of its peers in the fracking services industry.

Learn about LBRT’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.