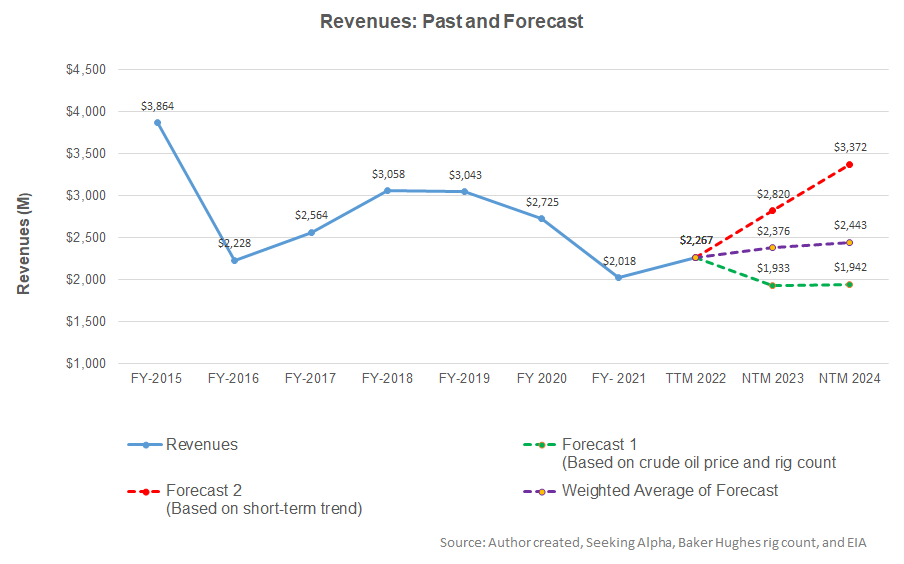

- The linear regression suggests that NBR’s revenue estimates are stable in the next two years.

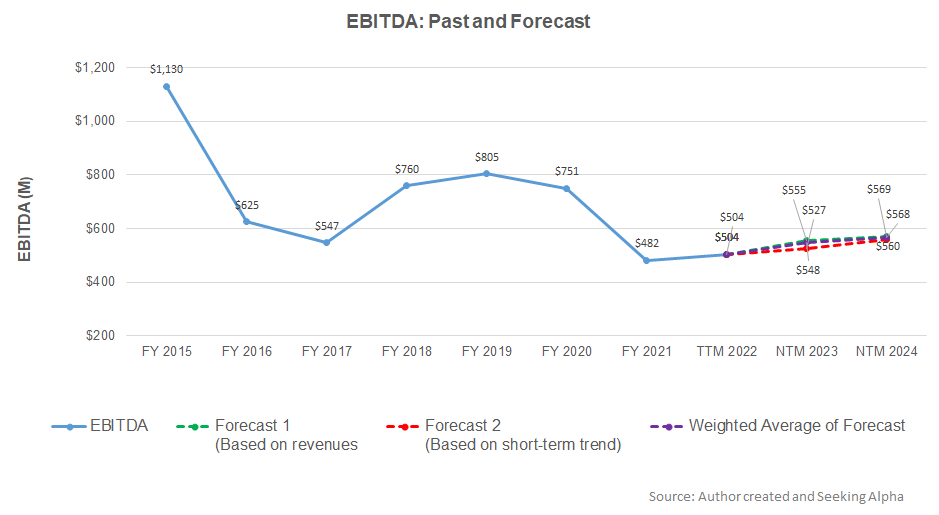

- EBITDA can increase in NTM 2023, but the growth rate can decelerate in the following year.

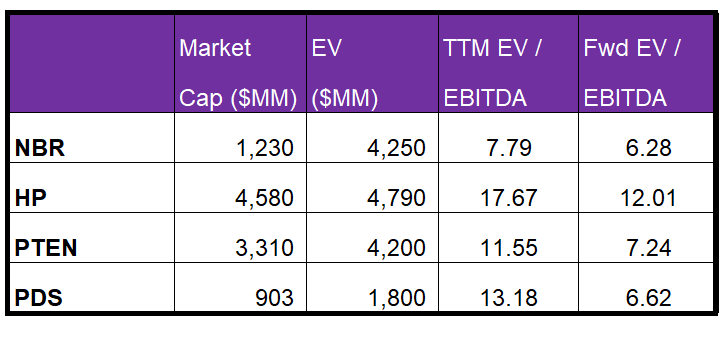

- The stock is reasonably valued versus its peers at the current level.

Part 1 of this article discussed Nabors Industries (NBR) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and NBR’s reported revenues for the past seven years and the previous four-quarters suggests that NBR’s revenues will remain steady in the next couple of years.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase in the next 12 months (or NTM) in 2023. In NTM 2024 also, the model suggests the company’s EBITDA will remain steady.

Target Price And Relative Valuation

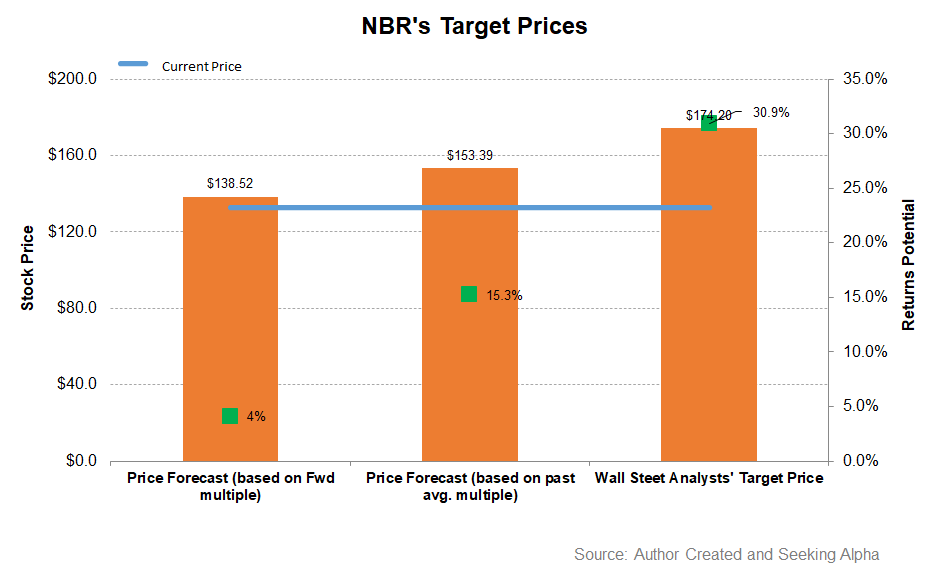

The stock’s returns potential using the past five-year average multiple (7.4x) is higher (15% upside) than the returns potential using the forward EV/EBITDA multiple (7.8x). In comparison, Wall Street’s sell-side analysts expect even higher returns (31% upside) from the stock.

NBR’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers, typically resulting in a lower EV/EBITDA multiple than peers. The company’s EV/EBITDA multiple (7.8x) is lower than its peers’ (HP, PTEN, and PDS) average of 14.1x. So, the stock is reasonably valued versus its peers at this level.

What’s The Take On NBR?

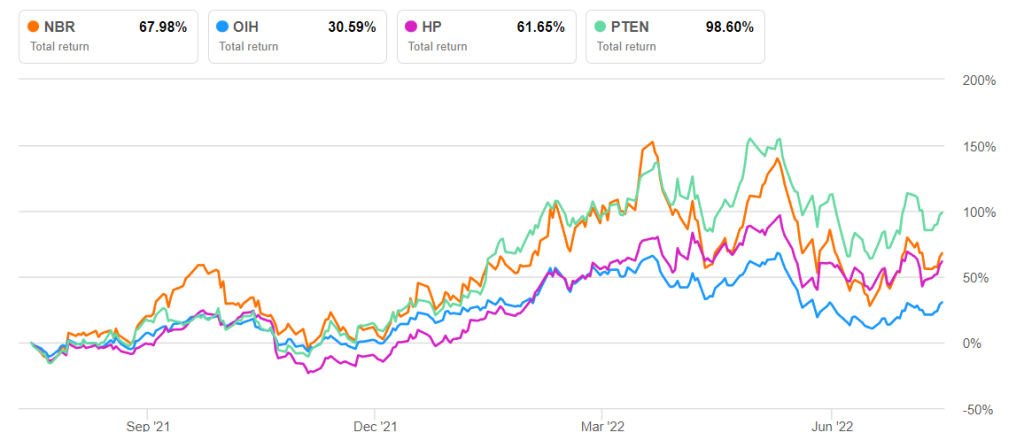

NBR currently focuses on repricing the fleet towards the current leading edge, upgrading the substructure of the Saudi Arabia rigs, deploying NDS services and technologies, and ESG and energy transition. It also invests in new technologies like carbon capture and hydrogen injection. Because leading-edge rates are increasing in the US following the upward drilling activity, the company’s margin is expected to increase in the medium term. Also, its international operations in Saudi Arabia are expected to see margin recovering fast. As the positive factors strengthened, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Although the stock is reasonably valued versus its peers, the robust fundamentals can allow investors to stay invested. However, the recession possibility and a resulting global energy demand fall are two critical challenges for the company. Its cash flows dwindled in 1H 2022. Its balance sheet is highly leveraged, making debt reduction initiatives difficult.