We have been discussing the ongoing volatility in global markets given the confluence of bearish and bullish factors. If you have a look at my Market Sentiment Tracker 2022 (see the video below) we can observe that the number of bullish and bearish factors are almost evenly divided. Therefore, the Market Outlook remains volatile. It can swing either way and in the past week it has turned towards the bearish side. Supply fears were dominated by demand concers, geopolitical risk factors by lockdowns in China feeding further into recessionary fears.

Then funnily enough by the end of the same week oil prices rose 4 percent on – guess what – supply concerns and geopolitical factors as after imposing a price cap on Russian oil, Putin has threatened to stop supplying everything!

Moving ahead, I believe we will see oil prices rising once again as energy security will surface and the world will get tensed over the energy scrum between Germany and Russia. However, anticipated increase in Fed’s monetary policy will continue to put downward pressure on oil prices. Subsequently, I expect oil markets to remain range bound.

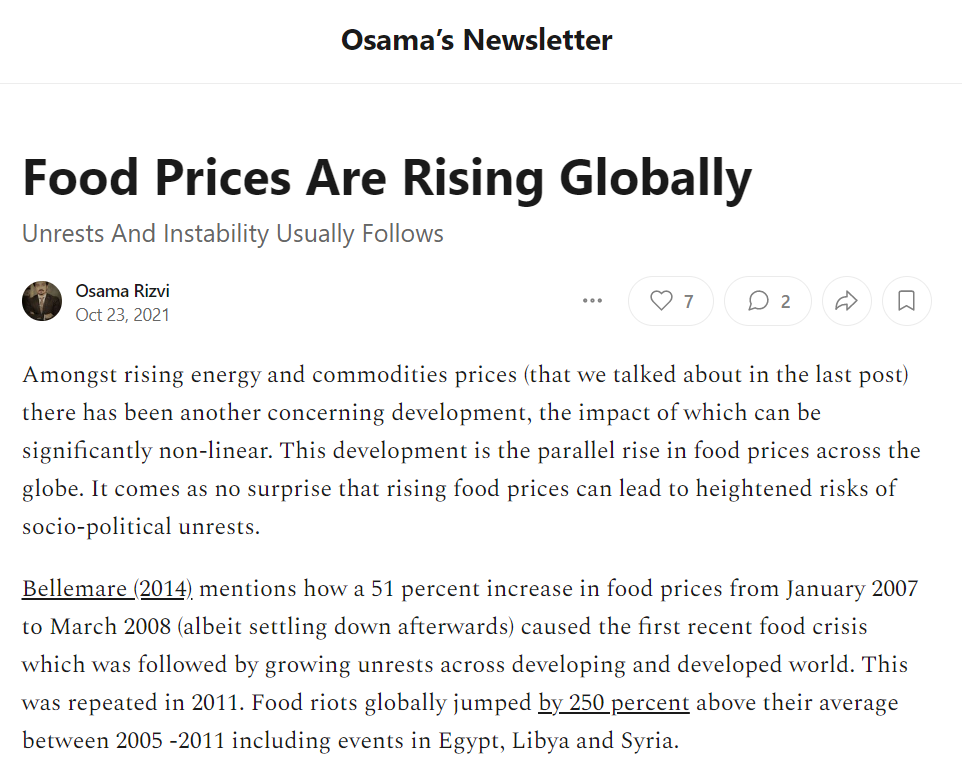

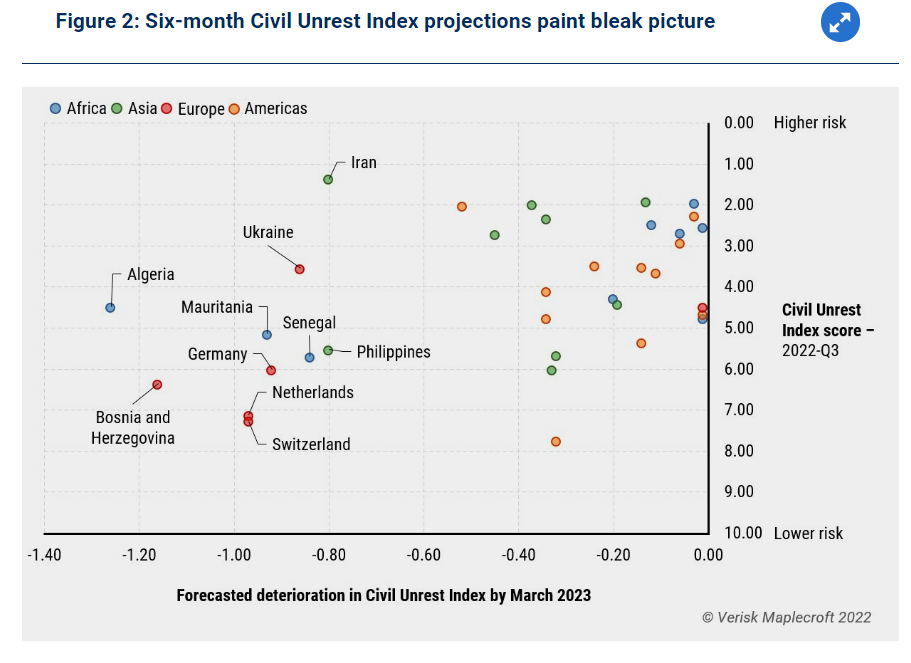

Shifting topics, we also released a special report on growing Food Insecurity. Mark has been talking about this highly important issue from last year, post Covid-19. I have tried to follow and write about it as well. You can read my Substack entry here. Growing food insecurity can and has already increased the risks of social and civil unrests. According to a report by Maplecroft this has already been happening in many countries across the world and chances are that the process will escalate. This is bad news for developing countries as they already grapple from rising debt, heatwaves, floods and whatnot.

A snapshot from the above mentioned report:

I will make this a short entry. But here is another important reading by Mark that you can go through in regards to food insecurity:

Have a great Sunday and productive week ahead!