OPEC+ provided a nominal cut of about 100k barrels a day, but none of the countries are producing above or even at the new quota. Saudi Arabia has been producing below 11M barrels a day, so to get a cut at these levels won’t be a huge shift to the market. West African nations are WAY below the new quota, so when you look at the adjusted quotas for September there really is no change.

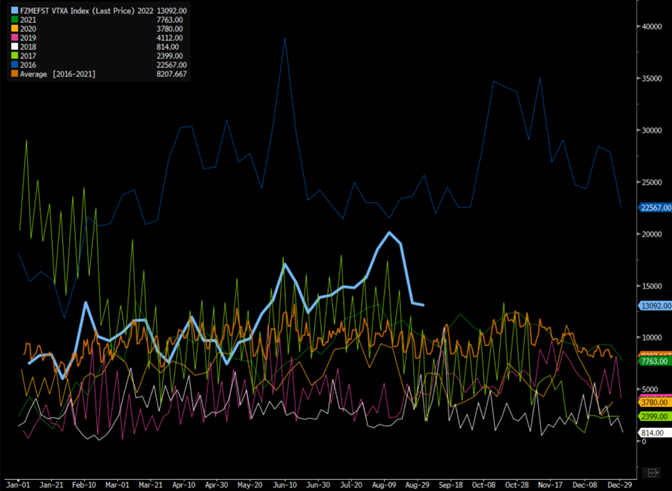

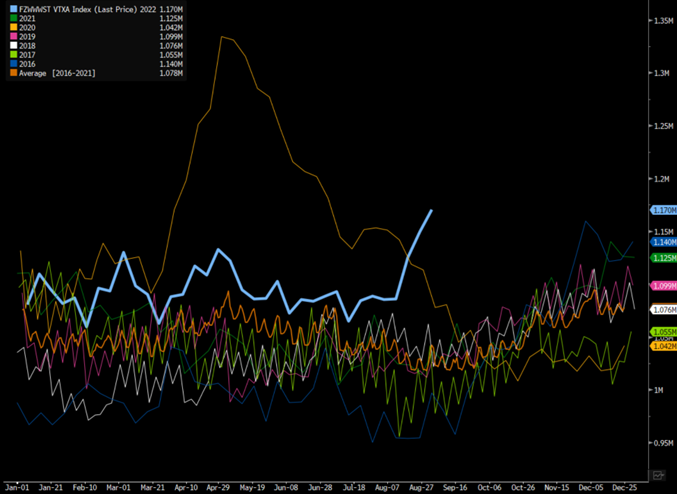

The “cut” doesn’t change the physical market, which still has a record amount of crude on the water with a significant amount remaining in the Middle East and West Africa. The below chart shows the Middle East, which is still well above 2020/2021 levels while still below the 2016 surge. The physical market has started to show more pressure driven by sluggish demand out of China and other Asian nations. Russian crude has been flowing into Asia, which has further displaced crude flows (especially Middle East) as normal crude flows change. This has left more Middle East crude on the water mixed with the pressure from elevated OSPs (Official Selling Prices).

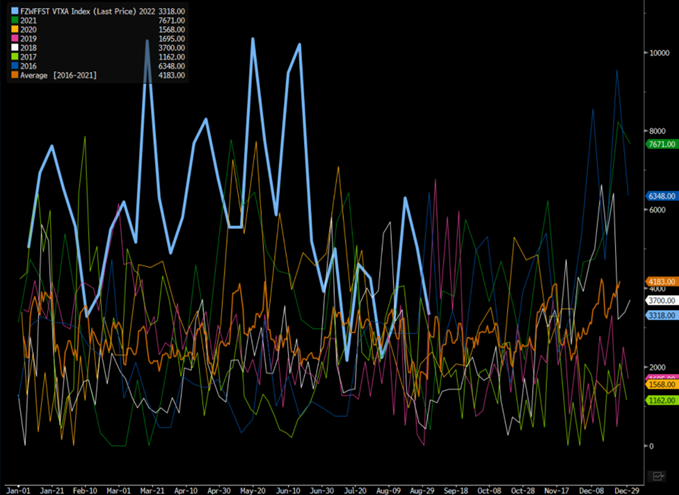

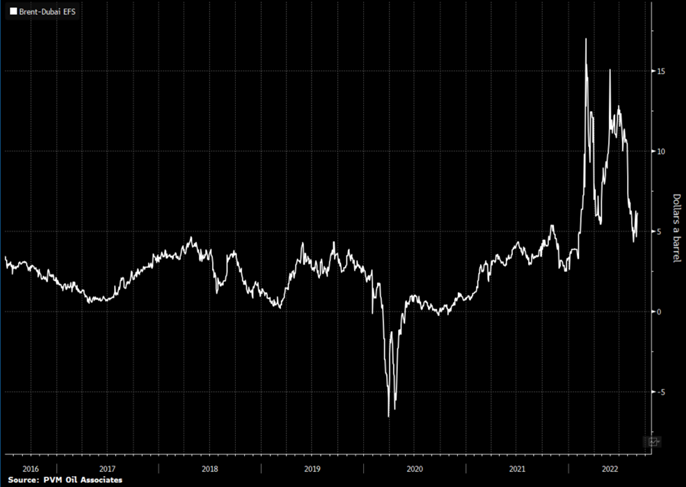

West Africa has seen some additional demand for their floating crude as they cut prices and Brent vs Dubai normalized a bit. Prices tightening between Brent and Dubai made Middle East (especially Saudi Arabia) very expensive and furthered hindered their flows into the market. They have to compete with discounted Russian barrels as well as cheaper West Africa crudes that only got more attractive with the weakening of Dated Brent and their price cuts.

Brent vs Dubai has bounced a bit off the comments from OPEC+, but at Dubai $6.14 cheaper it still puts Middle Eastern grades out of the money. The question now shifts to- what will KSA do with their OSPs heading into October. Saudi Arabia and Kuwait have increased their refining capacity with more to follow that will put more product on the market instead of crude. As we talked about last year and the beginning of this year, the goal of the GCC nations since 2014 was to sell more “high value” hydrocarbons and not the feedstocks. This has played out with more refining capacity built, the SABIC/ Saudi Armaco deal, and additional petrochemical facilities coming online.

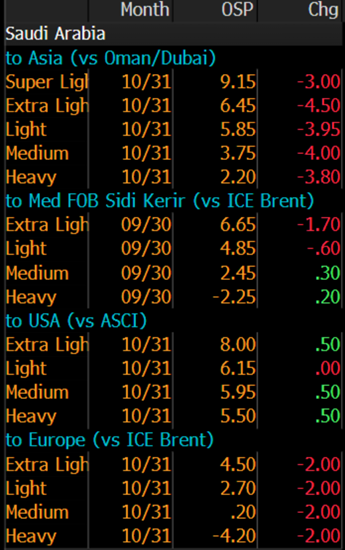

In fun Saudi Arabia fashion, they “cut” OPEC+ production by 100k barrels while also slashing their OSPs. We have said since they announced the surge in pricing how foolish it was to push OSPs to those levels. As we predicted, it resulted in a big increase in floating storage as buyers evaporated. KSA made the same mistake they made in May when Brent vs Dubai ripped to a $15 spread. For some reason, they believed the price would stay there- which dropped like a rock once KSA lifted OSPs. They have still maintained elevated prices but have at least gone out and cut prices into Asia and Europe. It’s unlikely it will compete into Asia given the slowdown in purchases from China but provides a bigger signal to other producers in OPEC and especially the GCC (Gulf Cooperation Council). KSA also cut OSPs to Europe, which could open up some additional flows from the Middle East into Europe.

It’s important to remember that even with a cut- OSPs are still at highest prices ever. It isn’t like Saudi through down the gauntlet and starting a price war- instead they just came down closer to reality.

The problem is differentials continue to weaken across the crude complex. West African crudes are being seeing pricing pressure as buyers dry up, and this is against a very reduced loading schedule.

PLATTS:

- Unipec offered to sell 950k bbl of Olombendo for Oct. 3-4 loading at $3/bbl more than Dated Brent: person monitoring window

- Dropped from +$3.50 on Sept. 6, +$4.65 on Sept. 5

- Vitol offered 450k bbl of Mandji for Nov. 1-5 arrival on CFR Augusta basis at Dated -$2.45/bbl

- Declined from -$2/bbl on Sept. 5

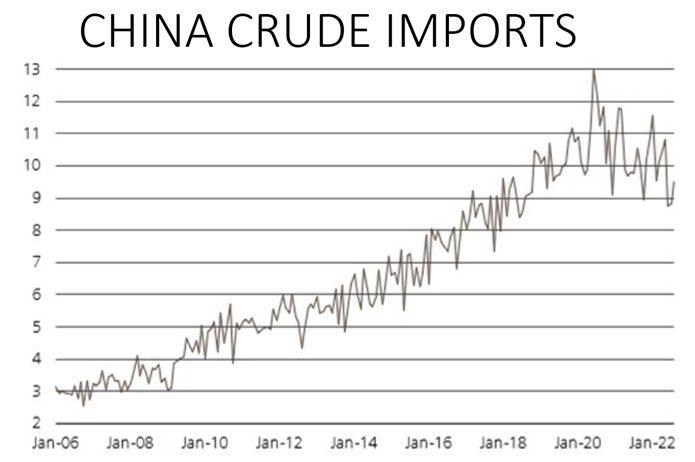

There have been some offers in Forties pulled as buyers remain fleeting with more cuts coming in Europe. We still haven’t seen much stability in crude pricing, which calls into question Saudi’s comments about the “disconnect” between physical and financial contracts. When the statement came out, I assumed they meant that financial contracts were “stronger” vs physical markets. Apparently, they meant the oppositive- but the straight drop in crude prices with more cuts in physical markets show the direction. The physical markets are coming into the shoulder season with more uncertainty coming out of China with renewed lock downs and reduced oil imports and refining activity. China crude imports were 9.54M barrels per day in August vs July’s 8.83M barrels per day. This is well below last years imports of 10.53M barrels during the same period. The drop is driven by renewed lockdowns, elevated storage, and drops in refining activity.

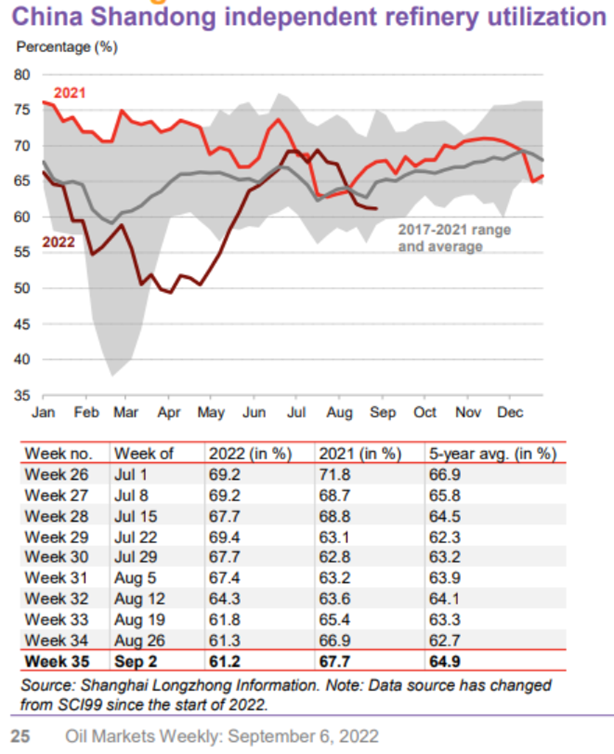

Refining activity within China has dropped across the board, but teapots have seen the biggest drop while SOEs and large privates never saw the same type of increase. The broad drop-in refining activity has pushed crude imports down, and with the new lockdowns will remained low.

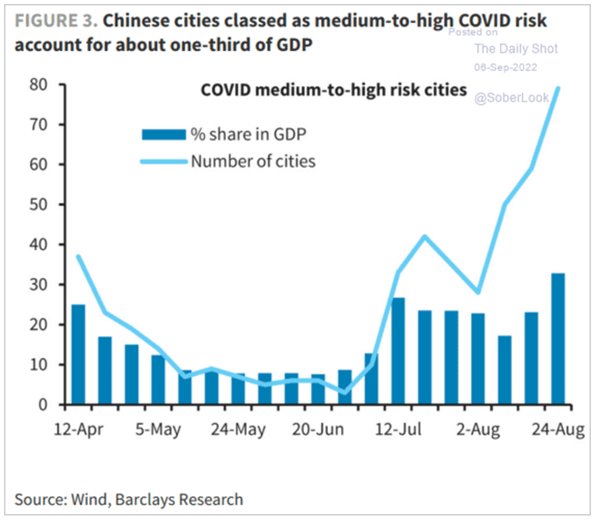

According to Trivium (below), the problems are expanding with more cities being put into lockdown. It will also impact the second largest holiday in China “Mid-autumn Festival” (2nd largest behind Lunar New Year). Sept. 10-12 is China’s mid-autumn festival, the country’s second-most important holiday after the Lunar New Year. The anti-virus measures have taken a major toll on the economy, travel and society in general, but China’s ruling Communist Party says they are necessary to prevent a wider spread of the virus. Lockdowns are going to hit travel plans hard and keep the demand for refined products well below normal levels.

Omicron subvariants are proliferating across the country, causing further lockdowns and economic disruptions.

From August 29 to September 4, China reported (NHC):

- 2,380 new domestically transmitted symptomatic infections, up from 2,105 in the previous 7-day period

- 9,844 new domestically transmitted asymptomatic infections, up from 8,625 in the previous 7-day period

Record-breaking impact: The current COVID wave is the most geographically widespread since the pandemic started two and a half years ago (Caixin).

- On Thursday, a total of 103 cities reported new COVID infections.

- On Saturday, 33 cities were under partial or full lockdown, affecting over 65 million residents.

China is under siege by a multitude of Omicron subvariants (Caixin):

- Chengdu, Shijiazhuang, Guiyang, and Tibet are battling BA.2.76.

- Shenzhen reported cases of BF.15.

- Liaoning, Xinjiang, and Hainan are reporting a range of different BA.5 subvariants.

Multiple major cities are tightening COVID protocols:

- Tianjin and Shenzhen suspended in-person classes for all elementary and secondary schools (The Paper 1 & 2).

- Shenzhen locked down six districts and required negative test results for people leaving the city (The Paper 3).

- Beijing banned from entry individuals who’ve traveled to places reporting new cases in the past seven days (The Paper 4).

- Hangzhou increased mandatory testing to enter public venues from every seven days to every 72 hours (The Paper 5).

- Chengdu extended its citywide lockdown, yet again, for three more days for most of the city (The Paper 6).

The bottom line: COVID lockdowns continue to slow China’s economic momentum and jeopardize global supply chains.

The below chart puts into perspective how many cities are currently under some form of lockdown. The “medium-high” risk cities have risen, and the spread of COVID has increased the actions taken by local governments to stop the spread. It will result in very depressed economic activity and underlying crude demand.

Russia has been pushing more crude into the Asian markets, but now the G7 has introduced a “cap” on Russian crude purchases into Europe and the rest of the world. So essentially, the G7 wants countries to “opt-in” to the decision to limit the amount they will pay for their crude. Now- this legitimizes Russian crude because it gives countries an “option” to purchase it LEGALLY. Russia has said they will not sell oil to countries that decide to go this route, BUT there are ways to get around those restrictions. By increasing the purchase of Russian crude, it will also drive the price higher for people not joining the cap. For example, India and China will be able to still pay above the cap price, but as crude is now “Technically” allowed to flow- prices will move higher. It will still be below market rates, but there will be more competition for Russian flow.

Russia claims they won’t sell crude to those that opt into the caps, but they will likely soften that stances because countries/companies are now free to purchase the crude. If you remember, Shell was “shamed” for buying Russian volume and turned around to donate the profits to charity. By creating a legitimate angle to purchase, the ability to publicly ridicule goes away. In order for companies to compete against China/India, they can create multiple bank accounts to purchase Russian volume. They will be the “cap price” from one and a kicker from another. It will likely clear through multiple accounts or be delivered in a different form to adjust the paper trail.

For those that have followed the crude markets, characters within the industry can come up with VERY creative ways to get around both physical and financial sanctions. This is complicated even further by the countries that aren’t willing to go along with the price cap- so Russia still has some negotiation capacity to get a higher price from countries participating. Another option comes from the perspective of the Middle East. For example, Saudi Arabia could import Russian crude and process it in their refiners and increase the exports of their local produced crude into the market. This would provide a great arbitrage on both refined products and increase crude sales. Physical traders have tried to explain the difference in the physical vs financial markets. The physical market is a Souq (Bazaar) or essentially a marketplace consisting of countries and companies around the world. Some are small and others are massive, but it isn’t regulated the same way the financial markets are by a governing body. The deal terms are private to the buyer and seller and the terms/ conditions to vary. Any type of price cap can be overcome in many ways as the industry is never shy of questionable characters or shady dealings.

Another fun side note- the G7 is made up of Canada, France, Germany, Italy, Japan, the UK, and the US. The U.S. and Canada have banned all Russian flows, which was more symbolic for Canada (doesn’t import anything) and stopped diesel flows into the East Coast for the U.S. Even though the G7 has said countries should do this, it still must be ratified by the EU, which consists of 27 countries. Under the rules of the EU, every country must agree to the proposals in order for it to be approved. Hungary has been the biggest hold out for every level of sanctions given their reliance on Russia for many natural resources. This means that Europe can still shoot down the proposal or they can agree to it (in order to legitimize Russian crude) and make some backroom deals to increase flow. The next few weeks are going to be very sloppy when it comes to crude price as volatility is going to be all over the place given OPEC+ decisions to cut as well as price cap uncertainty.

While the financial markets bounce around, the physical market still has a record amount of crude on the water between floating storage and transit. We don’t see much strength (if any) coming back into the physical crude markets between shoulder season (slowing demand) and the sheer amount of crude on the water.

Russia finally announced what we all expected- they will officially stop flows through Nord Stream 1 indefinitely. Gazprom was supposed to complete maintenance last week and bring Nord Stream back into operation on Saturday but claimed they found new problems with some compressors. Russia finally shook off any regard for lying, and now said that gas flows will be stopped indefinitely until all sanctions are lifted. There are many parts of Europe that are ahead of schedule for filling up storage, but this creates more concern as Europe prepares for winter.

This is an interesting case of game theory. Russia has been relying on this cash flow to help finance the war in Ukraine, and by providing natural gas to Europe (albeit at reduced rates), it kept Europe from putting all out sanctions. This was the last bargaining chip- so what keeps Europe and her allies from levying even more sanctions and limitations. It is obviously complicated by the crude markets (described above) as well as other commodities flowing from Russia. Europe still has other pipelines to get natural gas from Russia, but this specific pipeline was pivotal to German’s plan to fill storage and avoid forced rationing. There has already been economic run cuts, but this could be passed down from the government now.

I do love the view that price caps will work as they have been proven ineffective and an economic disaster every time they are implemented. The U.S. in the 70’s is just one of many examples of the epic failures they usher in.

“In response to Moscow’s tightening supply squeeze, the EU is weighing new gas benchmarks and price caps as the 27-nation bloc looks at drastic measures to combat spiking energy costs. Ministers are due to debate on Friday the form of a planned emergency intervention in the energy market.”

“French President Emmanuel Macron is calling for a sharp 10% reduction in the country’s energy use in coming weeks and months to avoid the risk of rationing and cuts this winter, amid tensions with supplier Russia over the war in Ukraine. Macron warned Monday that forced energy savings might have to be considered in coming months if voluntary efforts aren’t sufficient. He said energy rationing plans are being prepared “in case’ and that “cuts will happen as a last resort.” “The best energy is that which we don’t consume,” the French leader said at a news conference, where he urged French businesses and households to save energy, including by turning down heating and air conditioning.”

Germany has also agreed to keep two out of three nuclear power plants- for emergencies and only until April 2023. This is laughable given the fact that wood and coal sales are through the roof as citizens and corporations panic about electricity and heat availability. Germany is claiming this will be the last extension and “only for emergencies”, which is all laughable given the truth about the situation. Europe is in trouble, and at some point- they have to wipe away the ignorance to keep people from freezing and electricity available for industrial use. An economy can’t survive without electricity and realistically they need “affordable” power. The sheer cost of operation will push many small businesses into bankruptcy as well as force large corporations to cut utilization rates or just shutter capacity all together.

There is endless talk about price caps (ceilings) and rationing of power and natural gas. There have been countless studies done on the FAILURE of price caps to stop price appreciation. Instead, it creates artificial shortages by limiting the ability to pass on price. For example, if the French government limits my price of power to say $100 but doesn’t limit my input cost- I will be squeezed in the middle. If the most I can charge is $100 by my costs surge to $200- why would I continue to operate at such a loss? The government could attempt to keep capping prices along the supply chain, but we have seen that end in epic disasters all around the world.

India and China will still be able to set the price of crude, and if the price cap is set at $30 by the G7/ EU- countries will have to pay the difference between $30 and whatever India/China set the price at. It also opens up the availability of insurance and ships able to move the crude around the world. The biggest hurdle was always the availability of insurance/ ships. By creating a legitimate path, the options are endless to keep volume moving.

India is also in discussion with Russia to take additional LNG supplies as Europe also reduces the purchase of Yamal cargoes. Total and Shell are still involved in Russian LNG, and India is looking to buy-in to some of that capacity. Exxon has been trying to exit following sanctions, and India could provide a viable exit. But, Russia will struggle to expand and maintain flows if Western companies permanently exit.

- Anticipates total investment in India’s gas infrastructure sector at $60 billion by 2030

- India aims to increase proportion of gas in energy mix from 6% now to 15% by 2030, and this is achievable: minister

- India will look at the details of the proposed price cap on Russian oil

In the meantime, India and most of Asia will be happy to take the additional LNG flows that Europe is pushing back into the market. As more Russian LNG flows into Asia, there will be additional Qatar, U.S., and Australian cargoes available to flow into Europe. For some of the cargoes, miles per ton will be higher and cost more- but it will enable some to be available. If we just take India LNG as an example, U.S. LNG contracts don’t have destination clauses- which means they can be sold anywhere in the world and don’t have to end in a specific location. So, India can make a deal to take discounted LNG from Yamal Russia and resell U.S. LNG into the European markets at healthy premiums. This will enable India to buy Russian volumes at a discount and sell their U.S. cargoes at elevated prices.

On the refined product side, the U.S. pulled in more gasoline ahead of Labor Day weekend- in line with many expectations.

US gasoline imports from Europe rise to an eight-week high in the seven days through Sept. 1, according to bills of lading and ship-tracking data compiled by Bloomberg. European gasoline arrivals in the US jumped 76% w/w to 376k b/d, the highest since early July. The bigger issue is the amount of gasoline that is sitting in global storage. We have been discussing gasoline cracks flipping negative and now it has started: “Well last week in both Northwest Europe and in Singapore, gasoline cracks went negative. Gasoil/diesel is all that is holding the refinery system up.” As the natural gas and electricity prices spike in Europe (again), it will be difficult for the gasoil crack to keep up and likely result in more cuts.

There is no shortage of pain developing in the market.