- NexTier Oilfield’s fleets were “sold out,” and it does not plan to deploy additional horsepower in 2022. However, it may activate its first electric fleet in early 2023.

- It focuses on becoming a significant player in the delivery and storage of proppant at the wellsite

- Cash flows have significantly improved in 1H 2022 over the past year

- Although its leverage is higher than its peers, robust liquidity should quell investors’ worries

Utilization And Demand To Remain High

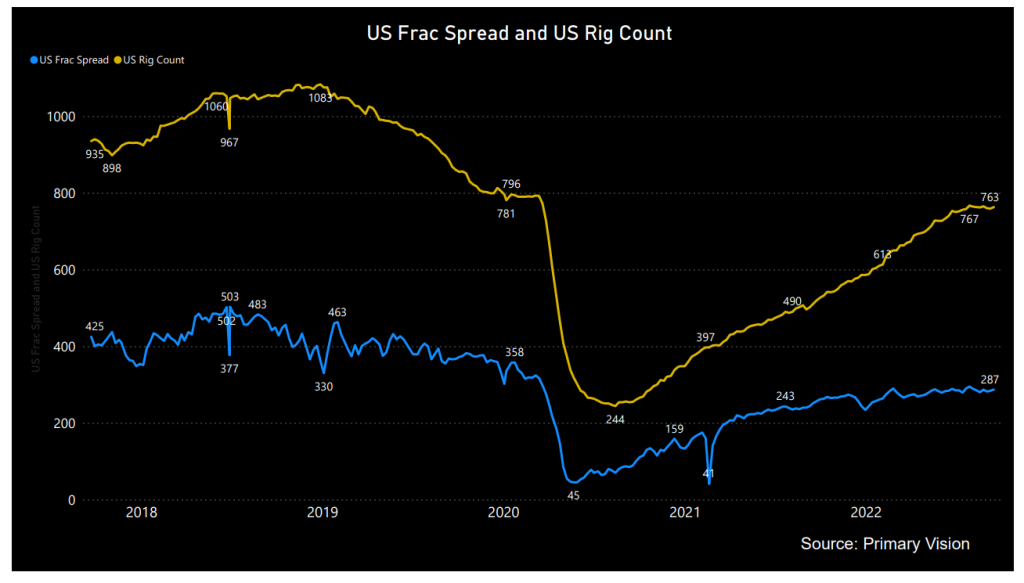

In the Q2 earnings call, NexTier Oilfield’s (NEX) management opined that the US hydraulic fracturing market is at the beginning of a upcycle and will extend further. Because frac utilization is already very high while frac equipment availability is low, the industry struggles to meet demand. The scarcity of frac equipment would take several years of investment to correct the gap, which would keep the price high for an extended period.

In this environment, demand for NEX’s wellsite integration services will stay high while its profitability and margins are set to expand. It has already made investments to convert more than half of its fleet to a natural gas-powered fleet. It deployed the legacy Tier 4 dual-fuel fleet and upgraded the Tier 4 dual-fuel fleet through the Alamo operations in Q1 2022, as I discussed in my previous article. Following the deployment of natural gas-powered equipment fleets, it estimates to have the largest market share in this category in the Permian Basin. So, a solid customer base and high frac fleet utilization should keep its Q3 results strong. As of June 30, NEX’s fleets were “sold out,” and it did not plan to deploy any additional horsepower until the activation of its first electric fleet in early 2023.

2H 2022 Forecast And Strategy

NEX’s natural gas-powered frac equipment pricing is at a premium to its conventional diesel fleets because the cost to fuel a frac fleet with diesel has increased steeply following the steep rise in the crude oil price over the past year. Based on the strong demand for wellsite integration services and the recent pricing hikes, NEX’s management expects Q3 revenues to increase by 8%-10% compared to Q2. However, it expects the Well Construction and Intervention Services segment topline growth to moderate following the sale of the Coiled Tubing business.

In August, NEX acquired a sand hauling, wellsite storage, and last mile logistics business, which will be combined with its existing last mile logistics assets to create a significant player in the delivery and storage of proppant at the wellsite. The company aims to establish a leading position in the last mile logistics capabilities, pitching it right against industry leaders like Solaris Oilfield Infrastructure (SOI).

The Industry Drivers

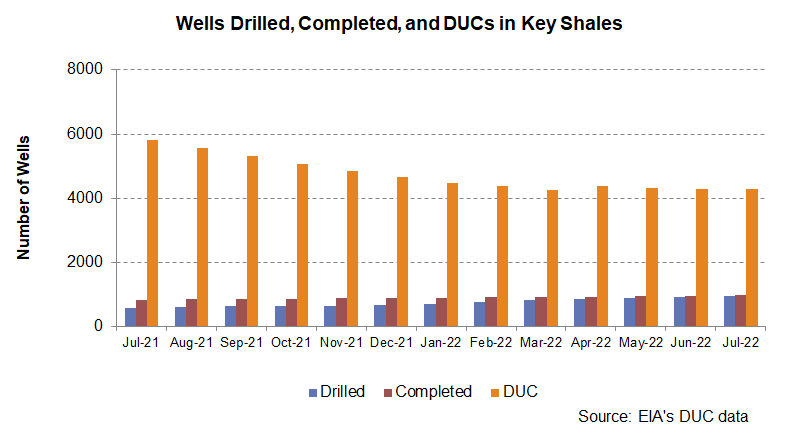

In the past year, the drilled wells increased by 65% until July 2022, according to the EIA’s latest Drilling Productivity Report. In contrast, the drilled but uncompleted wells (or DUC) declined by 26% during the same period. Higher West Texas Intermediate (WTI crude oil) encouraged the drilled and completed well count hike.

According to Primary Vision’s forecast, the frac spread count (or FSC) reached 287 by mid-September and has gone up by 23% since the start of 2022. A higher frac spread count is a positive for NEX’s outlook.

Analyzing The Q2 Drivers

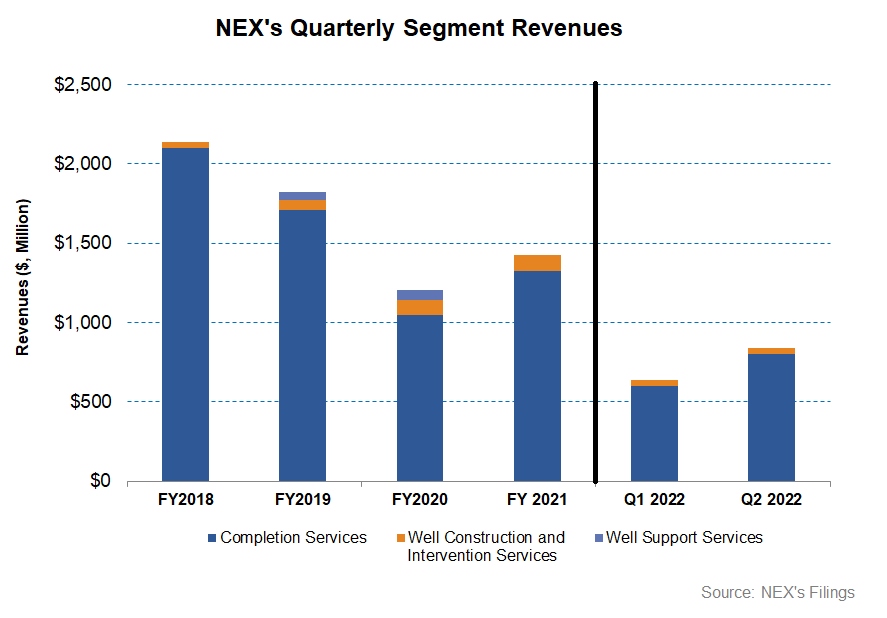

In Q2 2022, NEX’s revenues increased by ~33% compared to Q1 2022 as pricing accelerated faster than previously anticipated. Revenues increased almost equally in both the Completions and Well Construction & Intervention Services segments. The number of active hydraulic fracturing remained unchanged in Q2, but steep efficiency gains and market share gain following its wellsite integration strategy helped improve the topline and operating profit. Investors may note that the reconfiguration of horsepower deployment to simul-frac and zipper frac fleets typically leads to efficiency gains.

The company’s adjusted EBITDA nearly doubled in the past quarter until Q2. Apart from pricing hikes, fewer weather-and-sand-related downtime and strategic repositioning of its fleet pushed the operating margin up. Also, the roll-out of the second phase of Power Solutions, traction in the last mile logistics solutions, and customer addition in the wireline franchise business helped the margin.

Cash Flows And Liquidity

In 1H 2022, NexTier Oilfield’s cash flow from operations (or CFO) turned significantly positive ($147 million) compared to a negative CFO a year ago. Steeply higher revenues, following increased fleet utilization and pricing gains in the frac market, led to the CFO rise. Free cash flow also turned positive in the past year. However, working capital is still draining cash because of the increased activity level.

NEX plans to bolster its maintenance spending by 23% in 2H 2022 to complete the Tier 4 conversion program and continued funding of Power Solutions. However, higher profitability and muted impact from working capital headwinds can set free cash flow higher in 2H 2022 compared to 1H 2022.

The company plans to use the positive free cash flow generation to reduce net leverage and achieve zero net debt by 2023 and in M&A activities. The company’s liquidity totaled $492 million as of June 30, 2022. Its debt-to-equity ratio (0.55x) is much higher than its competitors (BOOM, HLX, and DRQ).

Learn about NEX’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.