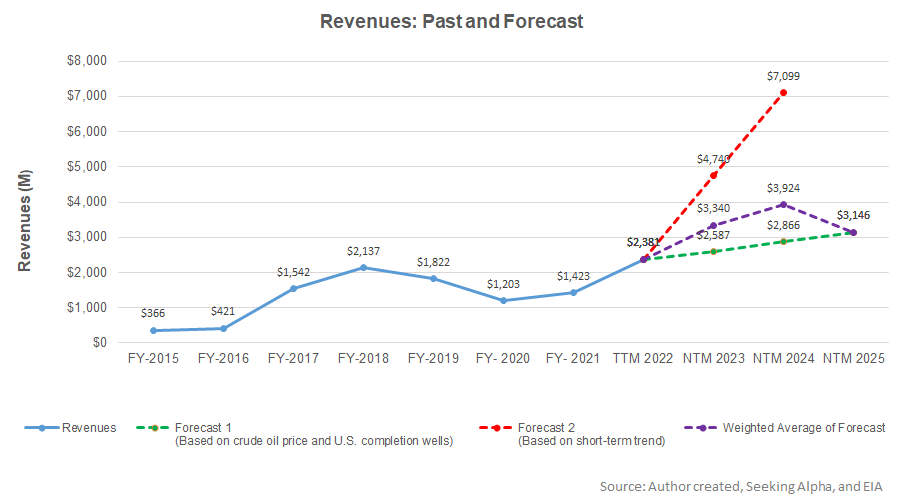

- The regression estimate suggests NEX’s revenues will go higher sharply in NTM 2023 but may decelerate in NTM 2024

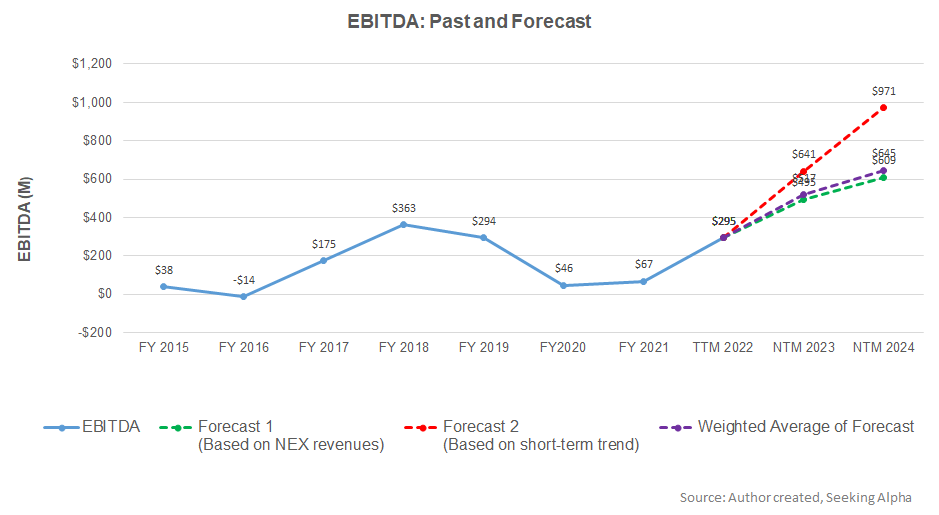

- EBITDA can increase steeply in the next two years

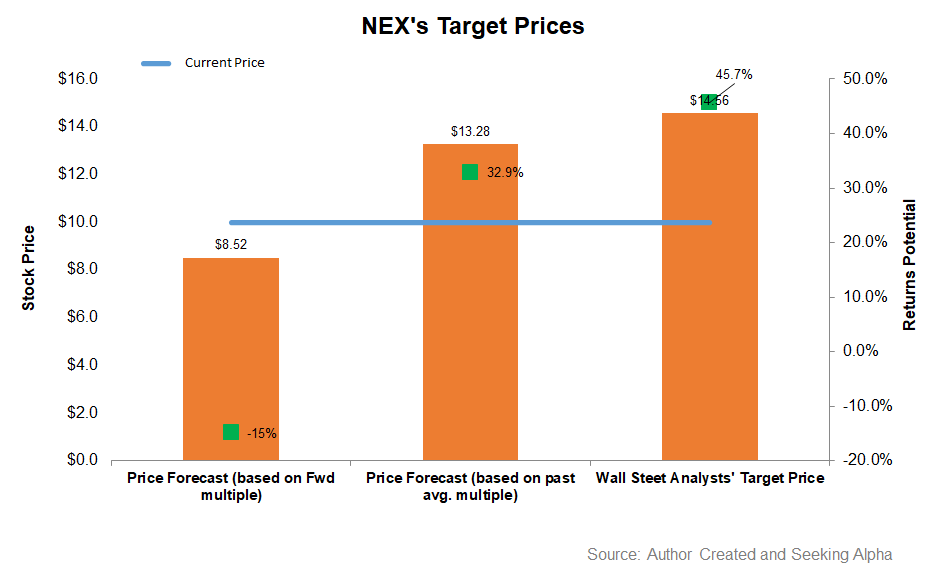

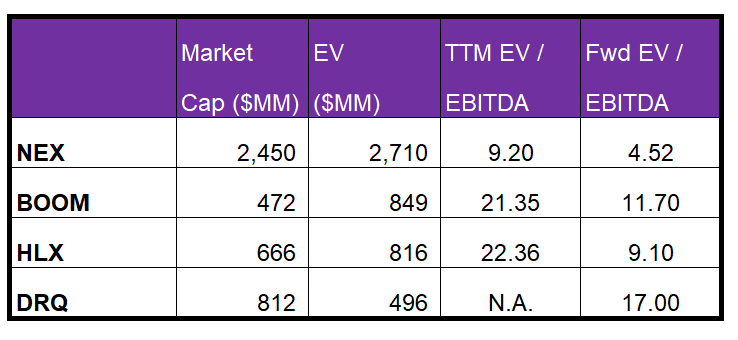

- The stock is undervalued versus its peers at the current level

Part 1 of this article discussed NexTier Oilfield Solutions’ (NEX) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a long-term regression equation between the key industry indicators (crude oil price and drilled rigs) and NEX’s reported revenues, as well as its past four quarter revenues, I expect its revenues to increase sharply over the next 12 months (or NTM 2023). The topline growth can moderate in the NTM 2024.

Based on the regression model using the average forecast revenues, I expect the company’s EBITDA to increase steeply in NTM 2023 and NTM 2024.

Target Price And Relative Valuation

EV has been calculated using the forward and past five-year average multiple. Returns potential (15% downside) using the forward EV/EBITDA multiple (4.5x) is lower than Wall Street’s sell-side analyst expectations (46% upside) and the past average (33% upside) from the stock.

NEX’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is in line with its peers, which typically reflects a similar EV/EBITDA multiple compared to its peers. The stock’s EV/EBITDA multiple (9.2x) is much lower than its peers’ (BOOM, HLX, and DRQ) average of 21.8x. The current multiple is also lower than its five-year average (25.5x). So, relative valuation-wise, the stock is undervalued at the current level.

What’s The Take On NEX?

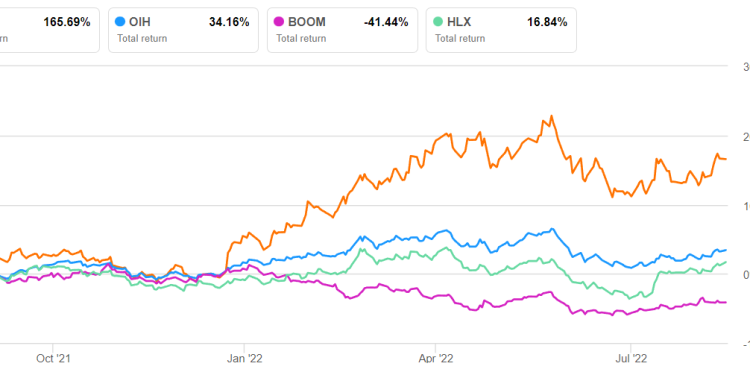

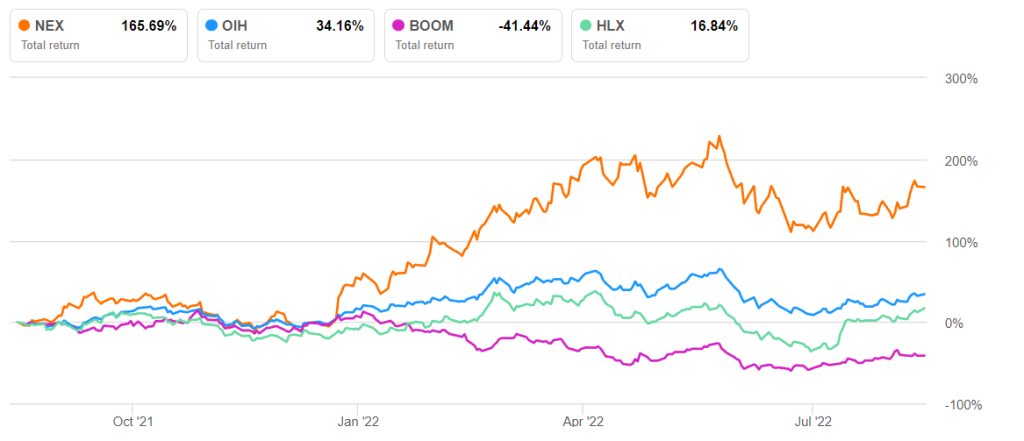

By mid-2022, NEX continues to rise the benefits of the pricing recovery and increased frac fleet utilization in well-completion services, given the demand-supply balance. Following the deployment of natural gas-powered equipment fleets, it aims to capture a significant market share in this category in the Permian Basin. Its fleets were “sold out” by June. It also plans to become a major player in the delivery and storage of proppant at the wellsite following an acquisition in August. The advantages are reflected in the steep rise in revenues and EBITDA in Q2 compared to the previous quarter. So the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

NEX does not plan to deploy any additional horsepower until the activation of its first electric fleet in early 2023. The sale of the Coiled Tubing business may also shave off the topline growth in its Well Construction and Intervention Services segment in the near term. The cash flow improvement is also positive, while robust liquidity will insulate it against the risks of carrying a mildly leveraged balance sheet. The stock is undervalued relative to its peers at this level. Investors might want to venture to buy the stock for an upside in the medium term.