Here is the quick and dirty for the insights this week- a much broader review will come over the next two weeks as we progress into Q4.

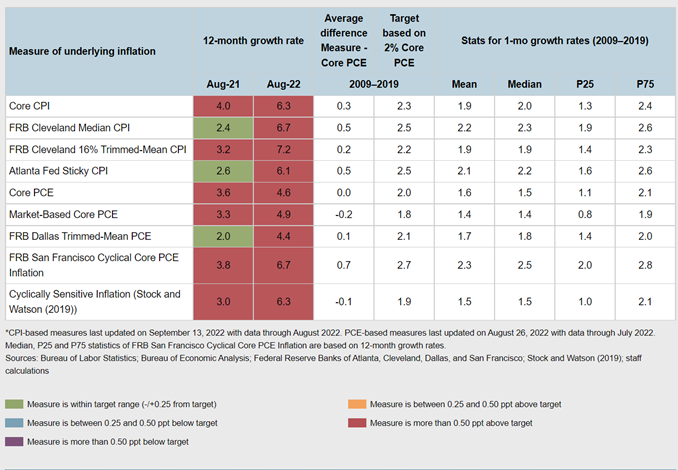

- Inflation remains a problem as we saw core surprise to the upside (again). Core CPI sitting at 6.3% with the Cleveland Median and 16% trimmed Mean all well above demonstrates we still have more upside to these flows.

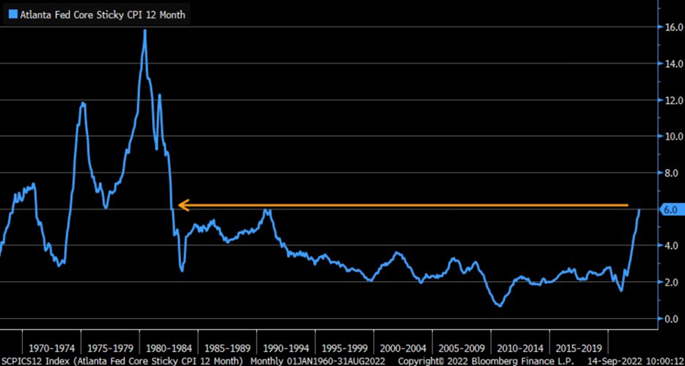

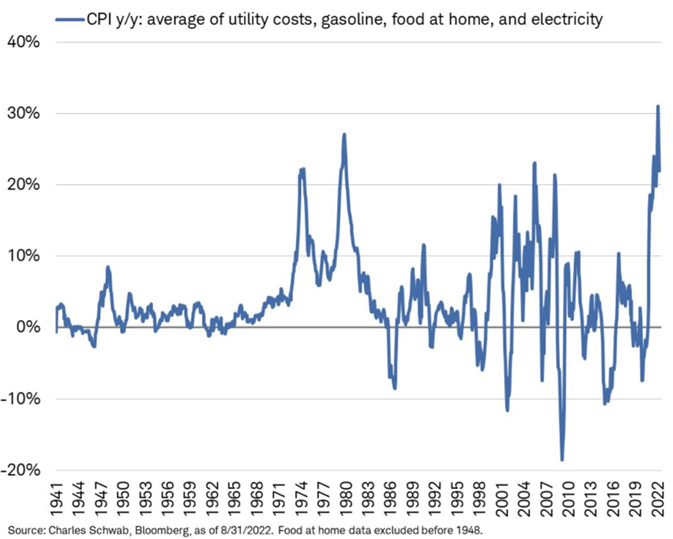

The below chart just puts into perspective how aggressively we have seen “Sticky” inflation spike. Even as gasoline prices adjust- it won’t be able to push the sticky side lower. Especially as OER moves higher again. Consumers continue to struggle under higher staples’ costs … average of utility, gasoline, food, and electricity CPI components +22% y/y in August vs. +25.7% prior; moving in right direction but still incredibly high.

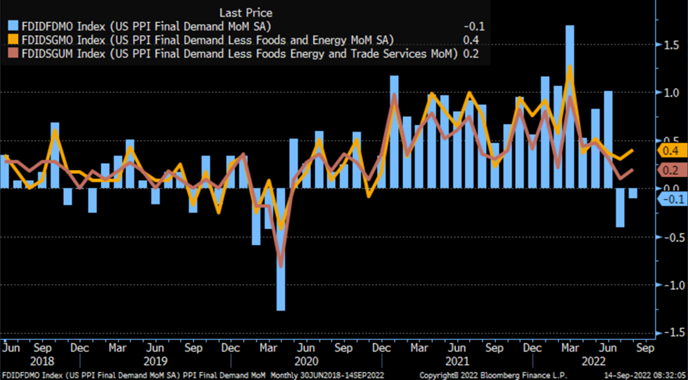

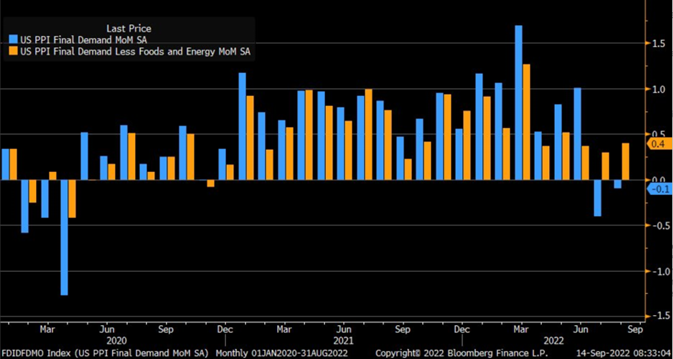

PPI surprised to the upside on the core front, which puts more certainty around “sticky” and “Core” inflation staying on the upward trend. We have highlighted how PPI provides a leading indicator to the inflation part of the puzzle. So even the PPI for Final demand dropped- we still had a big spike on the core front- so more pain ahead for a struggling consumer.

Divergence worth noting: August PPI -0.1% m/m vs. -0.1% est. & -0.4% prior; core PPI +0.4% vs. +0.3% est. & +0.3% prior.

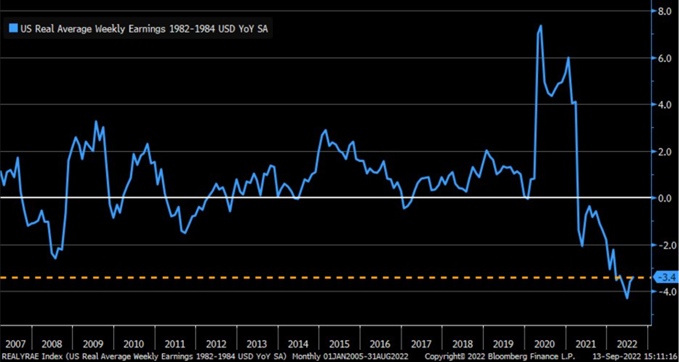

A consumer that was hit AGAIN with negative wages- Real average hourly earnings fell by -3.4% y/y in August; an improvement from -3.6% in July but hard to cheer given rate remains considerably weak (and negative).

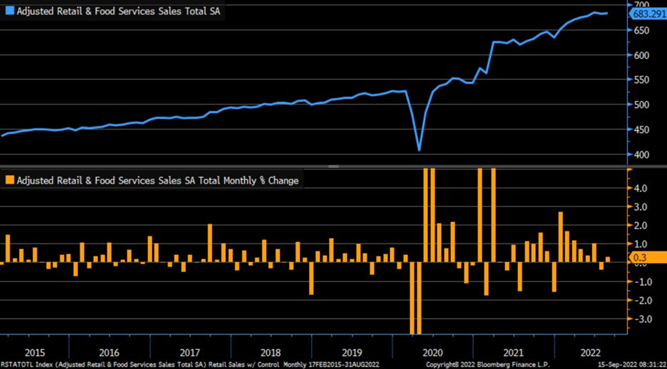

This was reflected again in retail sales that saw more pressure as sales were .3% and adjusted for inflation about .2%. The bigger problem was on the CORE front that came in at 0% and adjusted for inflation hit -.6%.

August retail sales +0.3% vs. -0.1% est. & -0.4% in prior month (rev down from 0.0%); sales ex-autos -0.3% vs. +0.4% prior; sales ex-autos and gasoline +0.3% vs. +0.3% prior (rev down from +0.7%) … control group 0.0% vs. +0.4% prior.

The control group is the one that is causing the most concern as it relates to consumer strength and underlying pain. When we look at diesel, electricity, and other core entities- there will be more pressure.

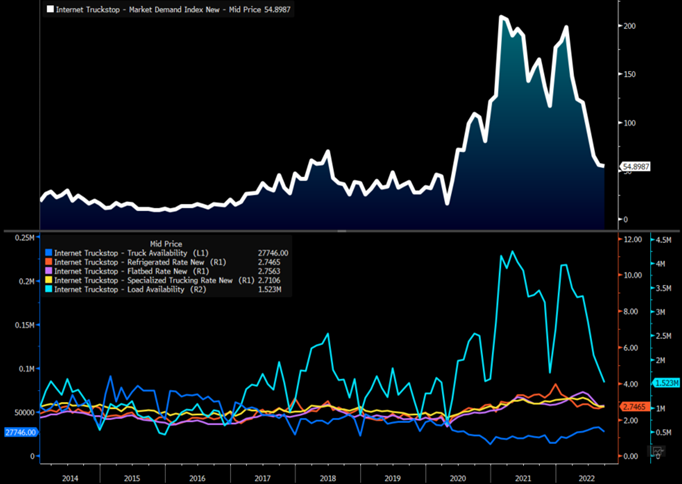

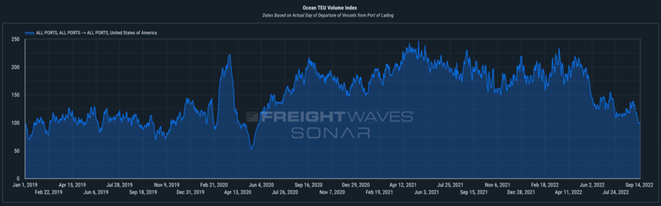

- A lot of this pain is being driven by diesel, and the shortages that remain in the market. Trucking demand has flatlined a bit, which will remain over the next few weeks. But, it will trend lower as we have a slowdown on imports.

Container freight bound for the US (leaving port of origin) have now dropped below summer 2019 levels. It will take a few months before this shows up in US import numbers, but the outlook is very negative (note: this is supposed to be peak season). This will put more pressure on the trucking front, which should help normalize diesel prices a bit. The problem that will have to be managed is weather… this will still be very complicated given the level of diesel storage around the world. So even as trucking slows- we are still going to see elevated pricing.

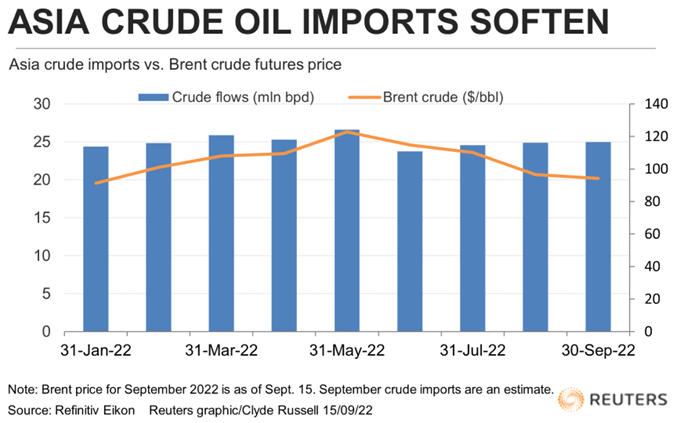

- The crude physical market is still a big overhang with it slowing again. We expect to see more softness as Nigeria and Angola struggle to clear volume.

Market activity was quiet Friday with differentials under increasing pressure, according to traders. There were no bids or offers for West African crude in the Platts window. The availability of some prompt Nigerian barrels for loading this month is adding to the pressure on differentials from weak October sales. That’s because the long delay in selling the September barrels gives buyers a reason to offer lower prices for any of the other available cargoes. We still see more pressure on the physical front with Brent-Dubai holding in at around $5.50.

Asian crude oil imports have softened again putting more pressure on the differential market pushing floating storage up again. We saw diffs fall at the end of September/ 1st week of October that accelerated some sales, but has recently cooled. We expect sales to remain sluggish causing renewed cuts as we head into Oct.

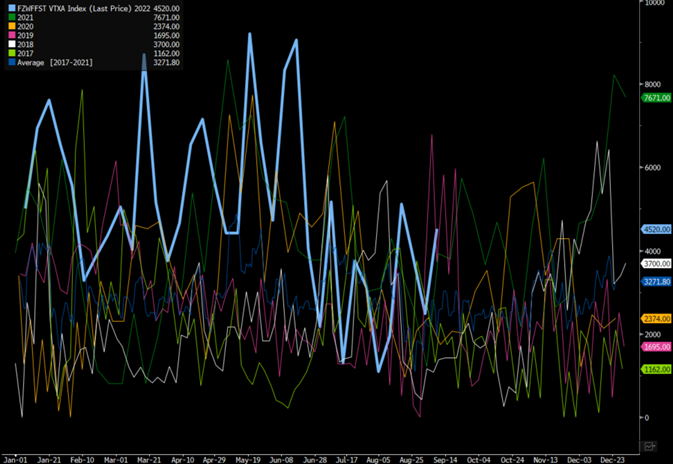

West Africa Crude Oil Floating Storage

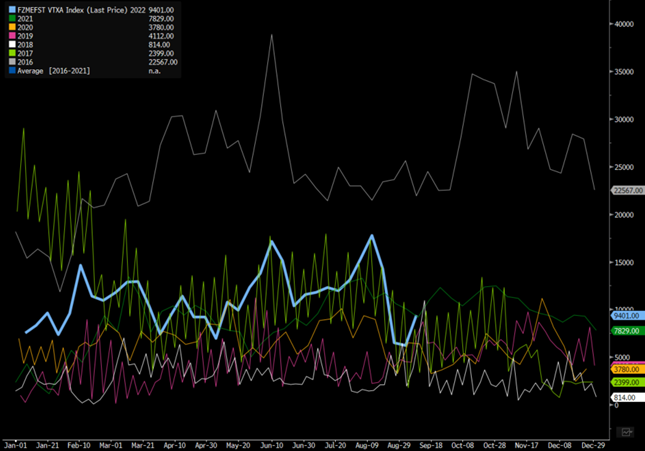

Middle East Crude Oil Floating Storage

The rise in Middle East storage in an important signal to watch and reflects more pressure to come on the differential front. They will start issuing “soft” discounts, which will cause West Africa to be more aggressive on their competition.