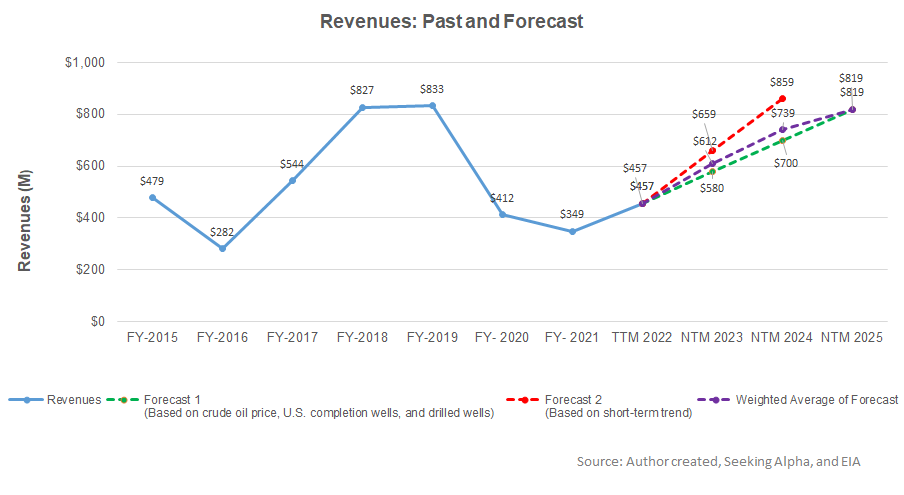

- Regression estimates suggest 34% revenue growth in NTM 2023, but the rate can decelerate over the next couple of years

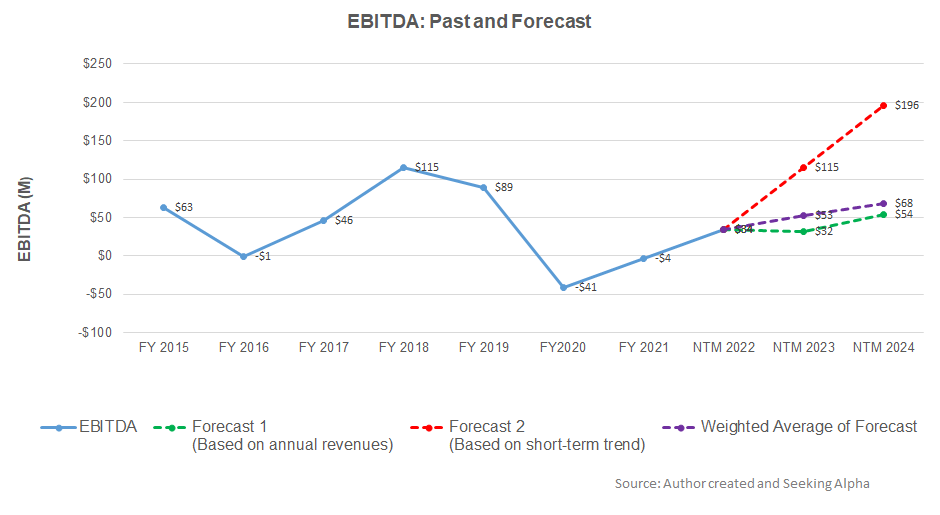

- The EBITDA growth rate is 56% in NTM 2023 but may fall in NTM 2024

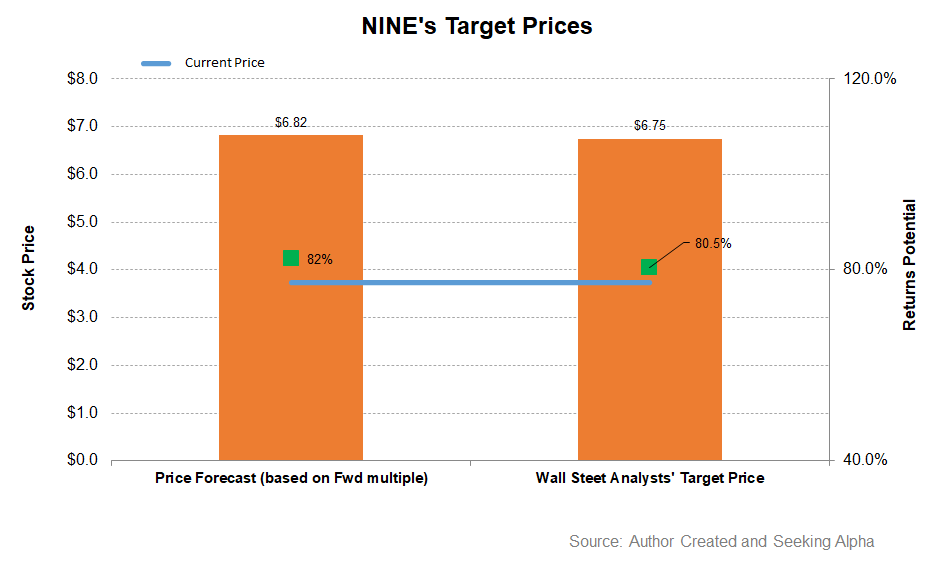

- The relative valuation suggests the stock is undervalued; the model also suggests a positive upside bias at this level

Part 1 of this article discussed the Nine Energy Service’s (NINE) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation between the crude oil price, US completion and drilled wells, and NINE’s reported revenues for the past seven years and the previous eight quarters, I expect revenues to increase by 34% in the next twelve months (or NTM) 2023. The growth rate can decelerate to 21% (sequentially) in NTM 2024. It can slow down even more to 11% in NTM 2025.

Based on the regression model, I expect its EBITDA to improve by 56% in NTM 2023. The model suggests that EBITDA growth will decelerate to 28% in NTM 2024.

Target Price And Relative Valuation

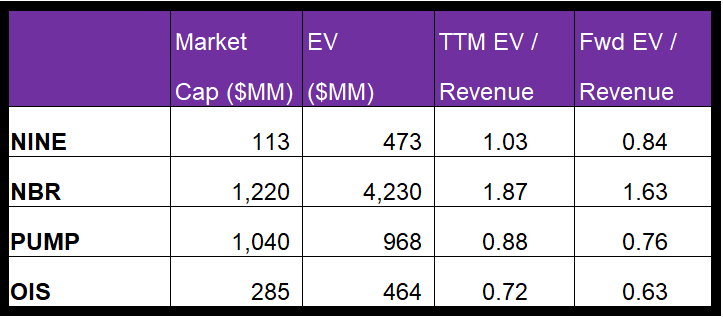

EV has been calculated using NINE’s EV/Revenue multiple. The returns potential using the forward EV/Revenue multiple (0.84x) is higher (84% upside) than sell-side analysts’ expected returns (81% upside) from the stock.

NINE’s forward EV/Revenue multiple contraction versus the current EV/EBITDA is steeper than its peers, typically resulting in a higher EV/Revenue multiple than its peers. The company’s EV/Revenue multiple (1.03x) is lower than its peers’ (NBR, PUMP, and OIS) average (1.16x). So, the stock is marginally undervalued compared to its peers at this level.

What’s The Take On NINE?

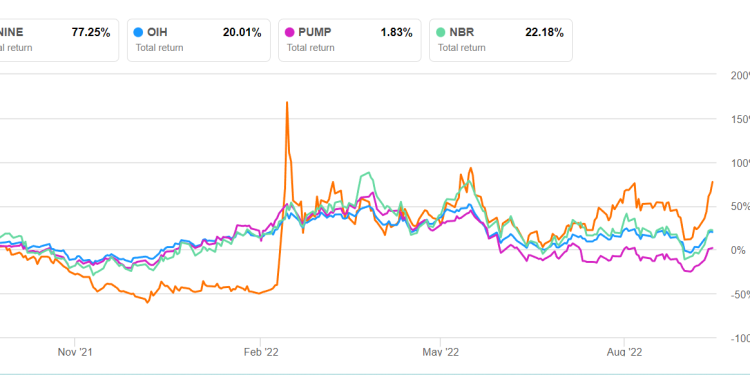

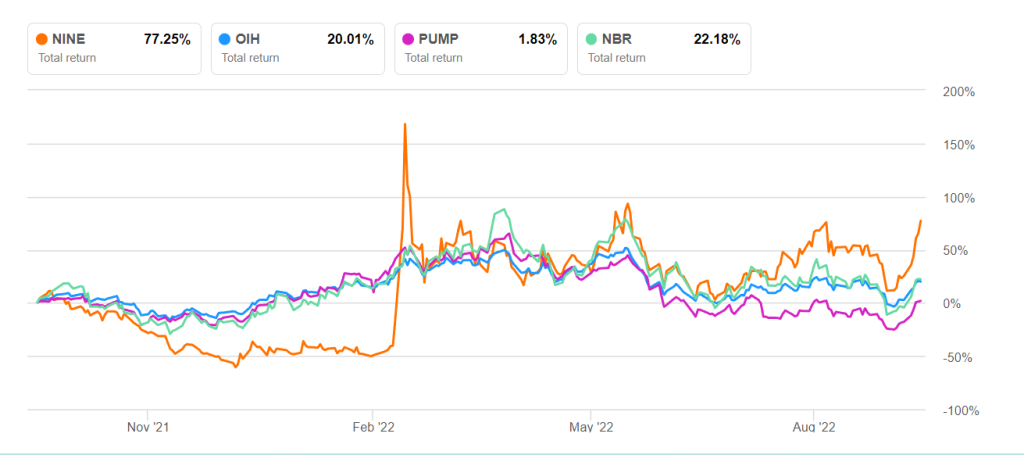

The fracking equipment market will likely see equipment shortage while demand for fracking in the US will persist, boosting pricing for equipment. The supply chain disruption will continue to lead to wage and material inflation. NINE’s geographic and service line diversity and labor-lite strategy would capture a more significant market share in this background. As margins improved, cash flows from operations showed improvements in 1H 2022. The cementing division has evolved as a robust growth driver in the short term. Pricing can strengthen further, and this division’s margin may improve in Q3. As a result of these positive developments, the stock price outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

The outlook on wireline remains challenging because of the difficulties in raising prices in a competitive market. Also, the cementing market looks particularly challenged because supply is restricted due to maintenance work in the US and lower imports from Turkey. It also seems the earlier company estimates of the dissolvable plugs market were overly optimistic although it still has plenty of room to grow. Investors should also stay cautious of the negative shareholders’ equity. Nonetheless, we think the stock’s relative undervaluation should induce investors to hold on to it for a medium-term return.