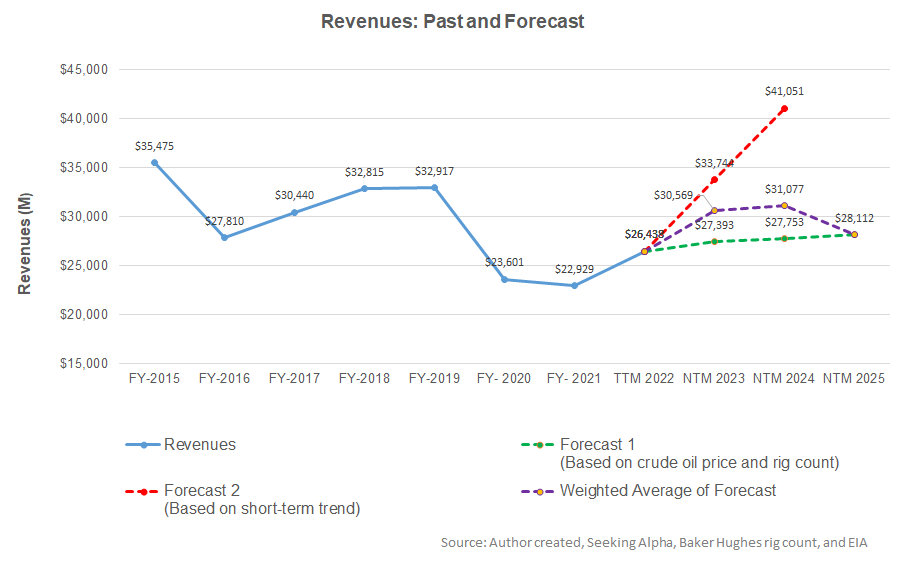

- Our regression model suggests Schlumberger’s revenue estimate is upward trending in NTM 2023 but may slow down considerably after that

- EBITDA will also increase in the next couple of years

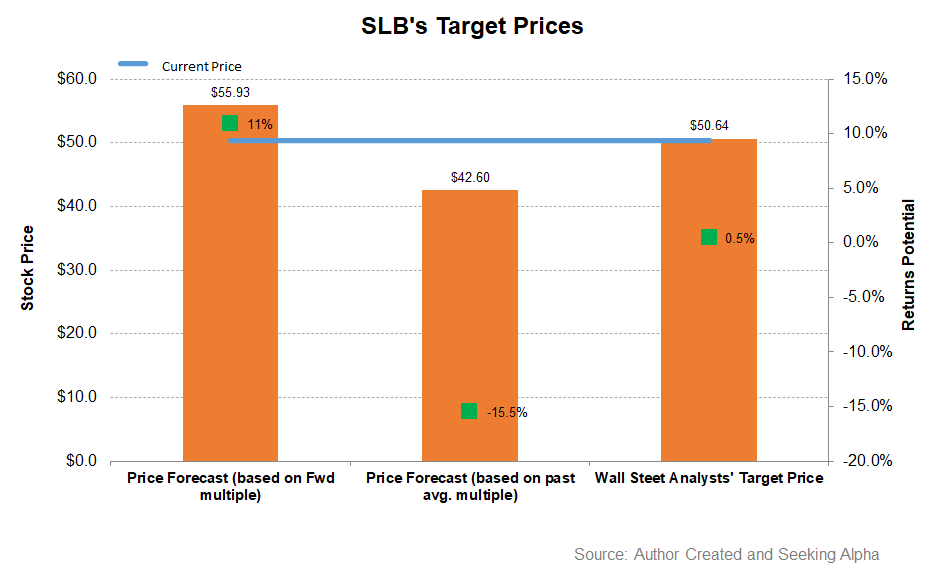

- The stock is reasonably valued at the current level

Part 1 of this article discussed Schlumberger’s (SLB) outlook, performance, and financial condition. In this part, we will discuss more.

A regression equation-based model on the relationship among the crude oil price, global rig count, and SLB’s reported revenues for the past seven years and the previous eight-quarters suggests revenues to increase by 16% in the next 12 months (or NTM 2023). However, revenues will decelerate in 2024 and then decline in NTM 2025.

The EBITDA can increase by 31% in NTM 2023 and 10% again in NTM 2024. Based on the average forecast revenues, the model suggests the company’s EBITDA will decrease in NTM 2025.

Target Price And Relative Valuation

Returns potential using SLB’s forward EV/EBITDA multiple (12.2x) is higher (11% upside) than the returns potential using the past average multiple (15% downside). The Wall Street analysts have nearly zero return expectations at this level.

SLB’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is marginally higher than the peers because the company’s EBITDA is expected to increase more sharply than its peers in the next four quarters. This would typically reflect a higher EV/EBITDA multiple compared to the peers. The company’s EV/EBITDA multiple (15.2x) is higher than the peers’ (HAL, BKR, and FTI) average of 11.4x. So, I think the stock is reasonably valued at the current price.

What’s The Take On SLB?

Schlumberger’s management views that the energy demand will stay robust in the near term, while the typical winter seasonality can slightly distort the outlook in North America. In Q4, the SLB’s management expects to see “mid-20s” year-over-year revenue growth, while EBITDA can also expand. To ensure long-term growth, it has started investing handsomely in developing new capabilities in clean energy, including hydrogen and CCUS (carbon capturing).

A global economic slowdown concern and the adverse effects of year-end seasonality can disrupt the energy sector’s growth path. In Q3, the company’s Digital & Integration revenue segment revenues decreased because of higher exploration data transfer fees. Nonetheless, SLB’s free cash flow recovery in Q3 shows its improving health. The cash flow growth trend can continue in Q4. The stock is reasonably valued compared to its peers. Given the current momentum, we think the stock has a positive bias over an extended period.