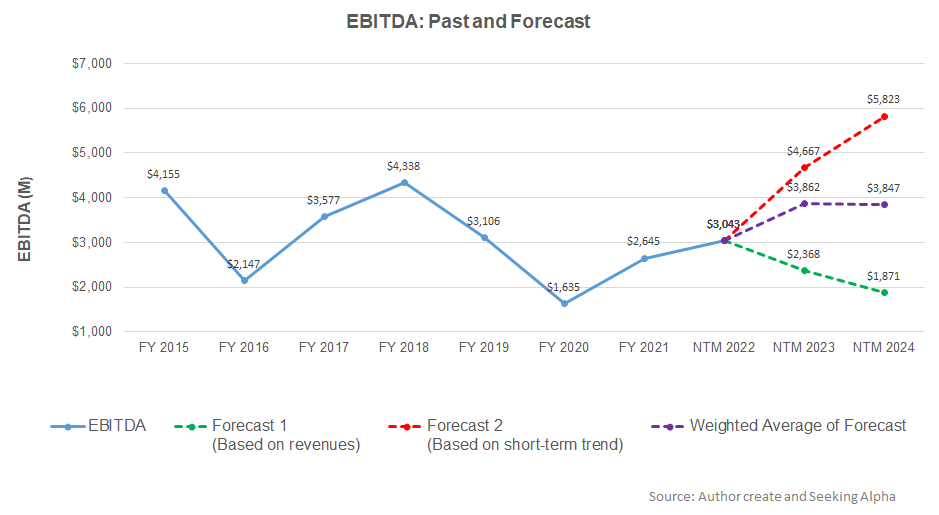

- Our regression model suggests an increase in revenues in NTM 2023 and a deceleration in NTM 2024.

- EBITDA can increase sharply in NTM 2023 but will fall flat after that.

- The stock is slightly undervalued at the current level.

Part 1 of this article discussed Halliburton’s (HAL) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Based on a regression equation among the crude oil price, global rig count, and HAL’s reported revenues for the past seven years and the previous eight-quarters, revenues will increase by 14% in the next 12 months (or NTM 2023). However, the model suggests it may decelerate in NTM 2024 and decline in NTM 2025.

Based on the regression model using the average forecast revenues, the company’s EBITDA is expected to increase by 27% in NTM 2023. The growth rate can come to naught in NTM 2024.

Target Price And Relative Valuation

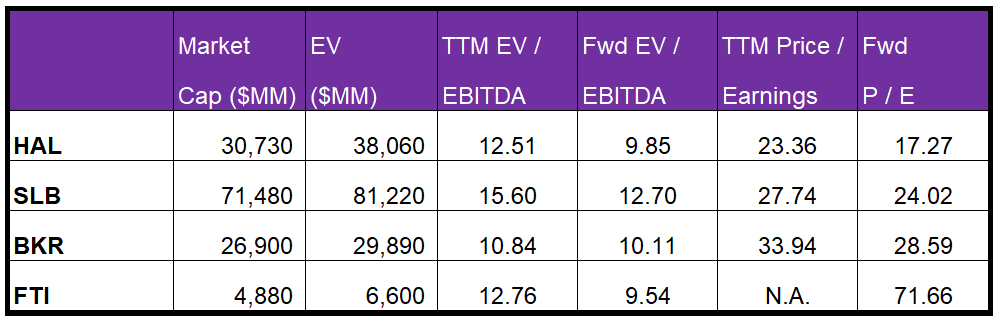

Returns potential using HAL’s forward EV/EBITDA multiple (10x) is higher (1% upside) than returns potential using the past average multiple (20% downside). The Wall Street analysts have considerably higher return expectations (21% upside).

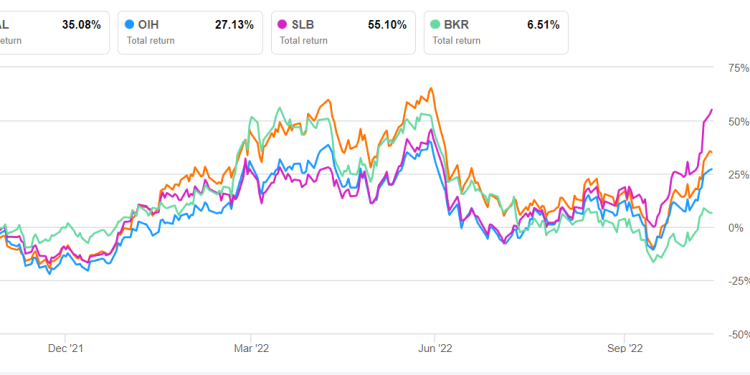

Halliburton’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is slightly steeper than peers because sell-side analysts expect HAL’s EBITDA to increase more sharply than its peers in the next four quarters. This typically results in a marginally higher EV/EBITDA multiple than peers. However, the stock’s EV/EBITDA multiple (12.5x) is lower than its peers’ (SLB, BKR, and FTI) average of 13.1x. So, the stock is undervalued versus its peers at this level.

Analyst Rating

According to data provided by Seeking Alpha, 22 sell-side analysts rated HAL a “Buy” or “Strong Buy” in the past 90 days, while three of them rated it a “Hold.” Only one rated a “Sell.” The consensus target price is $42.3, which yields 20% returns at the current price.

What’s The Take On HAL?

After Q3, Halliburton’s management conceded that its sales will increase in 2023 due to stronger inbounds for calendar slots while the demand for specialized equipment sets will be high. Along with legacy energy production, unconventional energy and offshore vs. onshore production cycles will play a crucial role. Outside North America, strong demand for HAL’s services in Saudi Arabia, UAE, Qatar, Iraq, and Kuwait in the Middle Ear and Brazil & Guyana in Latin America will drive its topline. Over the medium to long term, e-fracking and smart fracking equipment will become more prominent drivers in HAL’s portfolio.

The free cash flow improvement in 9M 2022 allowed Halliburton to deleverage its balance sheet further. However, more work is required in this aspect because the company’s leverage remains too high for comfort. The stock is marginally undervalued versus its peers at this level. Given the current energy supply dynamics, investors might want to hold the stock for medium to long-term gains.