Leaders are gathering in Sharm el Shiekh, Egypt for COP27, that is underway amongst a cacophony of promises and debris of old, unfulfilled ones. While oil and gas industry continues to come under a lot of criticism for subsidies, there is another camp that believes that the industry is not getting enough support. This has especially been realized as the current energy crisis have swept across the world where countries are scrambling to source natural gas and LNG along with coal (at highest prices ever) while as the date for Russian oil ban get nigh (5th December) and concerns regarding an impending supply crunch heightened. This is the backdrop against which the COP27 is taking place. New promises are being made but it is better to also have a look at the previous unfulfilled ones.

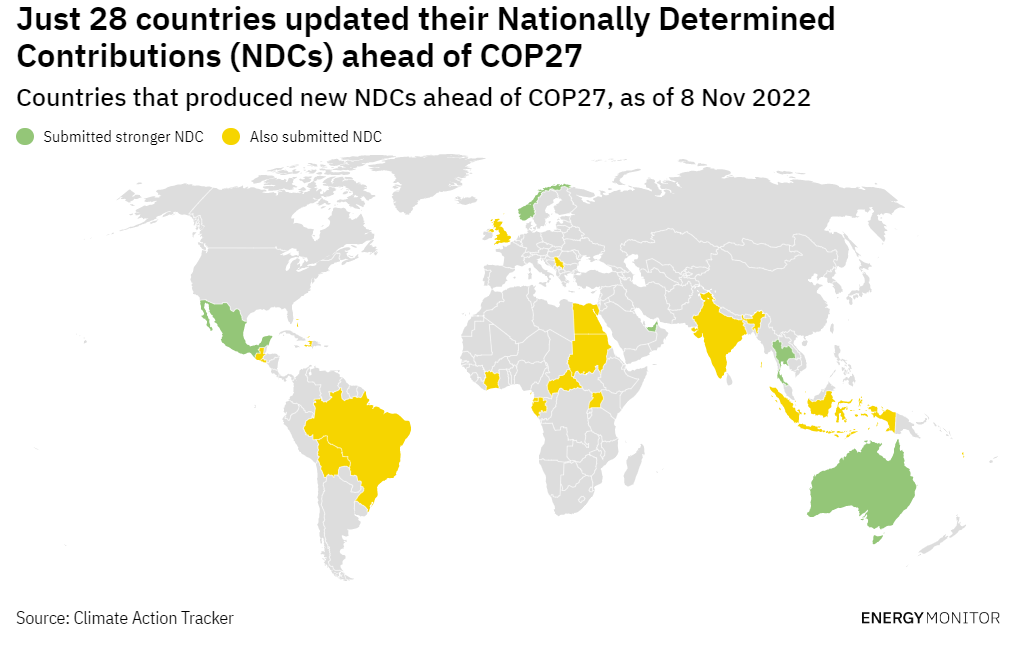

At COP26 it was decided that every country will contribute in what are called Nationally Determined Contributions (NDCs) which were to be updated before COP27. However, only 28 countries were able to submit these NDCs and only 5 of those improved upon the previous one. This is illustrated in the graph below.

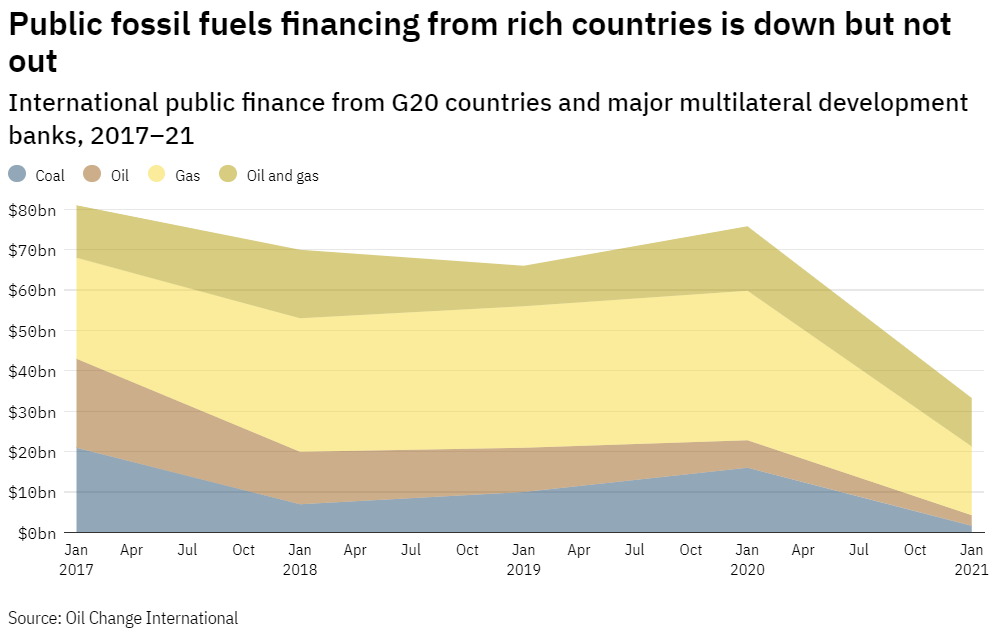

Climate financing has also been an important area where countries haven’t performed well. Moreover, in terms of its pledges for renewables, U.S. lags behind significantly with a $358m investment in comparison to $2.6bn for fossil fuels between 2019 – 2021.

But the fact of the matter is, and as reinforced by the current energy crisis, that we cannot afford a decrease or curtailment in investment in oil and gas industry. Global economy depends too much on it. A hasty transition to renewables – which won’t be happening any time soon even if we try – will be catastrophic. What is the solution to this? As always and in most of the cases across the world – the answer is balance. There are different theories and framworks to do this but all depends upon the political will of the government to do so. Now that is a separate discussion that whether it is the job of the government or private businesses to do so. I believe both. But without government intervention there exists no possibility for this to happen.

There will be more promises at the COP27 but once again all or most of them will stand against the reality of the world. The most important dimension that is required to be instilled in policy making moving forward is that of pragmatism. I am an energy transition realist. We all should be. For the betterment of the world.