- Our regression model suggests that the revenue growth estimates are sharp in the next two years.

- EBITDA can increase sharply in NTM 2023 but can decelerate in the following year.

- The stock is reasonably valued versus its peers at the current level.

Part 1 of this article discussed Patterson-UTI Energy’s (PTEN) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and PTEN’s reported revenues for the past seven years and the previous four quarters suggests that its revenues will increase by 30% in the next 12 months (or NTM 2023). In NTM 2024, it can grow further by 21% but may decline in NTM 2025.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase by 38% in the next 12 months (or NTM) in 2023. In NTM 2024, the model suggests the company’s EBITDA growth can decelerate.

Target Price And Relative Valuation

The stock’s return potential using the past five-year average EV/EBITDA multiple (9.1x) is lower (24% downside) than the return potential using the forward multiple (4% upside). Wall Street’s sell-side analysts’ expected returns (15% upside) are much higher.

What Does The Relative Valuation Imply?

Patterson-UTI’s current EV/EBITDA multiple is 9.3x. The stock’s past five-year average EV/EBITDA multiple was 9.1x. So, it is currently trading in line with its past average.

PTEN’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. Because PTEN’s forward EV/EBITDA multiple contraction is less sharp than its peers, it typically reflects in a lower EV/EBITDA multiple than its peers. So, the stock is reasonably valued at the current level.

Analyst Rating And Target Price

According to data provided by Seeking Alpha, 11 sell-side analysts rated PTEN a “buy” in the past 90 days (including “Strong Buy”), while three of the analysts rated it a “hold.” Only one analyst rated it a “sell.” The consensus target price is $22.2, suggesting a 15% upside at the current price.

What’s The Take On PTEN?

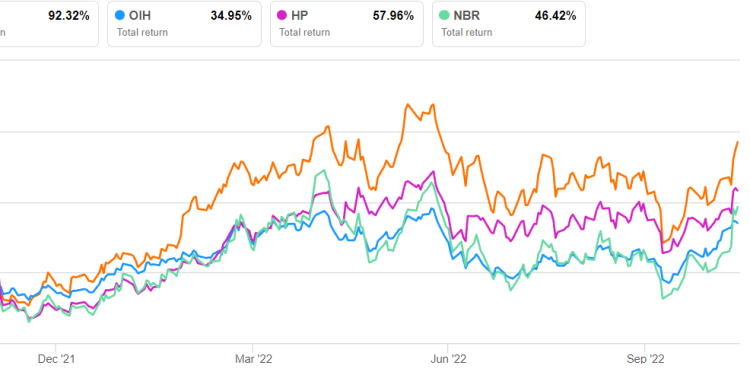

PTEN, during the rest of 2022 and going into 2023, will benefit from rapid improvements in pricing and acceleration of rig upgrades. Riding a multi-year upcycle, the company will increase the number of rigs under term contracts, thus improving profitability. Recently, it has purchased a Tier IV engine and reactivated its 13th frac spread. A lower capital intensity following the retooling of high-spec rigs will also improve its operating profit margin in the coming quarters. One of its key strategies is to raise shareholders’ returns through dividends and share buybacks. So, it outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, because the OFS industry lags behind its drilling counterpart, the crude oil price volatility and the relatively short duration of the energy cycles would bring headwinds to PTEN’s growth potential. Nonetheless, the balance sheet is robust, with sufficient liquidity. The stock is reasonably valued at the current level. Investors might like to hold the stock with an expectation of moderate returns in the medium term.