- Increased demand can lead to full utilization of Precision Drilling’s Super Spec drilling rig in early 2023.

- The positive impact of technologies, increased efficiency, and higher fixed cost absorption mitigated higher operating costs over the past years, which can lead to a higher operating margin per rig in the near term.

- In Kuwait, it has recently received four contracts, including the reactivation of two large rigs.

- Free cash flow turning negative is a concern; however, the company maintained its plans to slash debt significantly between 2022 and 2025.

Canada Business Outlook

In Canada, energy activity in the conventional heavy oil and clearwater activity is accelerating. PDS expects its rig utilization in Canada to reach 100% in Q1 2023. Many customers are locking Super Triple’s rates by long-term take-or-pay contracts. This gives customers guaranteed access to a rig, a steady income opportunity, and a tight work schedule, and helps workforce planning. Apart from AlphaAutomation services, the other technology that PDS’s management looks forward to includes EverGreen products. These products include battery systems, fuel monitoring apps, and lighting systems.

The positive effects are visible in PDS’s operating performance. In Q3, its Canada business recorded a daily operating margin of $10,034, which exceeded its prior guidance. Higher day rates, Alpha Technologies, and Evergreen Solutions revenue, and increased labor and cost recoveries expanded the margin. In Q4, it expects the average daily operating margins to increase by 20% compared to Q3, while in Q1 2023, it can increase further by 13%.

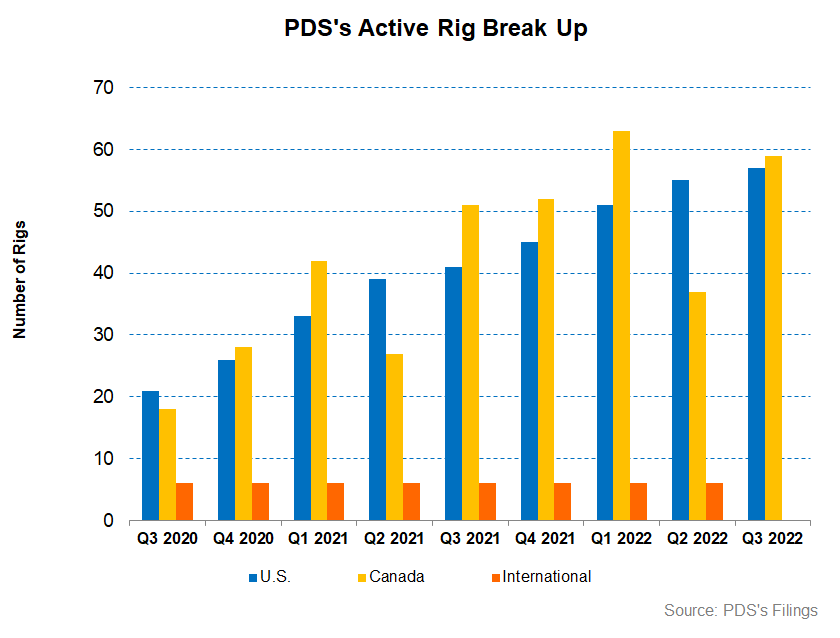

Oil Price In Canada And Some Challenges

The WCS (Western Canada Select)–WTI (West Texas Intermediate) spread is a crucial indicator of Canadian energy companies’ performance. The WTI price averaged $97 a barrel from January to October, 46% higher than a year ago. WCS averaged ~$81, or 50% higher than a year ago. Since the spread improved (i.e., the spread contracted) in 2022, expect the impact to be positive on PDS in Q3.

Here are some of the challenges faced by the company in the current environment. The continued labor and supply inflation and higher maintenance costs in the oilfield industry have increased PDS’s operating costs. The company has invested substantially in capital equipment, as evidenced by the rising capex over the past few quarters. It estimates that the cost of fitting rigs with similar equipment has increased by 40% in the past eight years. During this period, the efficiency of the rigs provided by the company has also increased significantly. Precision’s drilling fleets are estimated to be 55% faster than they were eight years ago.

US Market Outlook

Many US Customers look to replace older legacy rigs with PDS’s Super Triple rigs, following the positive impact of Alpha Technologies. In the US, revenues from these rigs are approaching $40,000 per day from upper $30,000 a day earlier, which can push its operating margin per rig higher in 2023. So, its management expects the Super Triple fleet to be fully utilized during 1H 2023.

In Q4, it expects the average daily operating margins to increase by 19% compared to Q3, while in Q1 2023, it can increase further by 13%.

International Market Outlook: The company recently received four contracts, including the reactivation of two rigs, which brought its total rig count in Kuwait to five. The additions are large 3,000-horsepower Super Triple rigs with an operating margin profile like the North American rigs. Eight PDS rigs’ entire fleet remains under a five-year contract, which should stabilize its cash flows.

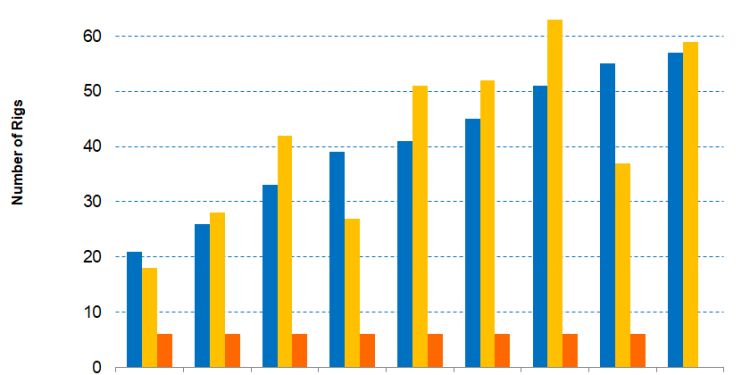

The US active frac spread count went up by 18% year-to-date, according to Primary Vision’s estimates. The rig count increased by 32% year-to-date, while the rig count in Canada more than doubled. The fast recovery in industry activity, especially in Canada, is a positive for PDS.

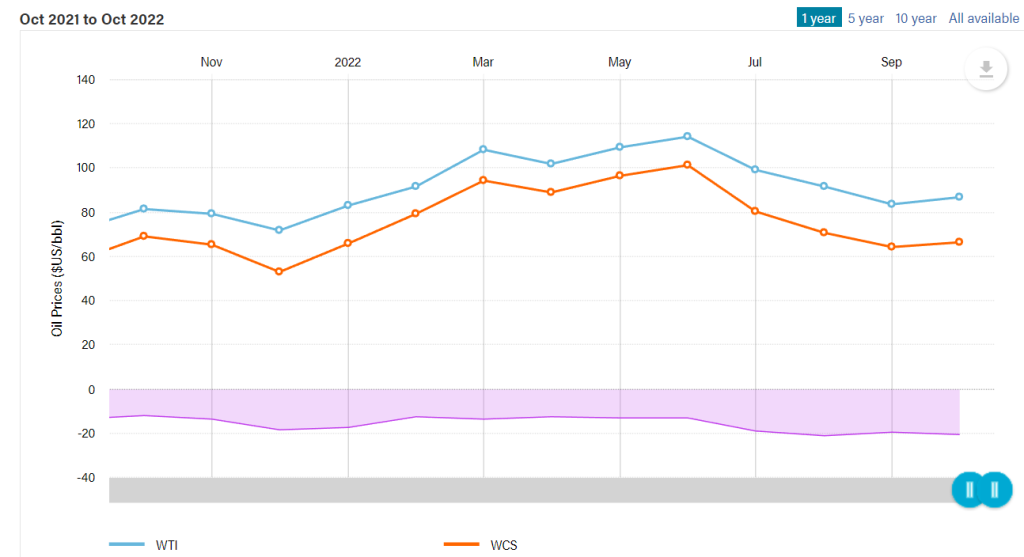

Utilization And Other Key Metrics

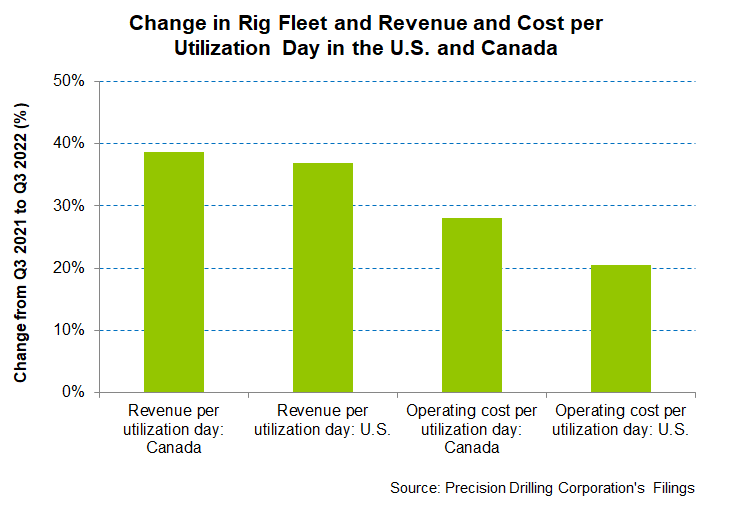

During Q3, PDS benefited from higher day rates and drilling rig utilization days. Between Q3 2021 and Q3 2022, the company added eight drilling rigs in Canada. The average revenue per utilization day increased by 39% in Canada in Q3 compared to a year ago. Operating cost per utilization day fell short of the revenue growth (28% rise), leading to a 520 basis points operating margin expansion.

The company added 16 drilling rigs in the US between Q3 2021 and Q3 2022. The average revenue per utilization day increased by 37% in the US in Q3 compared to a year ago. Operating cost per utilization day went up by 21%, leading to 85% higher operating profit in the past year.

Debt And Cash Flows

In 9M 2022, PDS’s cash flow from operations (or CFO) remained nearly unchanged compared to a year ago, despite the rise in revenues during this period. The company tightens the supply of Super Series rigs, leading to improved pricing and margin in the US and Canada as expiring contracts are renewed. This can lead to higher cash flows. In 9M 2022, capex increased significantly, leading to a negative free cash flow (or FCF) in 9M 2022 compared to a positive FCF a year ago. In Q3, it generated $22 million of cash proceeds from the divestiture of non-core assets.

As of September 30, 2022, the company’s leverage (debt-to-equity ratio) of 1.0x was in line with its peers’ (HP, NBR, PTEN) average of 0.91x. It plans to reduce debt by CAD 400 million between 2022 and 2025. Its net debt to adjusted EBITDA ratio is 3x, while it expects to lower it to 1.5x by 2023-end. The available liquidity was $540 million as of September 30.

Learn about PDS’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.