Oil markets have certainly been on a bumpy ride so far. Wild swings were a norm in the second half of the year 2022. Trders and observers were (are and will remain) torn between two camps. One fearful of the fall in investment in oil and gas and therefore forseeing an oil supply crunch that would rally prices. The other side taking in account the condition of global economy see a further slowdown in consumption in the coming year and therefore a fall in oil demand aka demand destruction. Between these two extreme ends are the daily news item churning out data points of various countries that continue to swtich the collective mood as people shift from one camp to another.

Talking about oil demand, OPEC’s recent estimates kept it unchanged. The global oil demand will grown at 2.2 mbpd in 2023 reaching 101.8 mbpd. But there is an ‘if’ to it – this will happen if the overall geopolitical framework improves which will of course involve some progress in Russia-Ukraine conflict and its resolution and containment of COVID-19 in China. On the other hand, the report also highlights that the supply in November increased by 43,000 bpd making the total at 101.5 mbpd which is 3.2 mbpd higher than previous year.

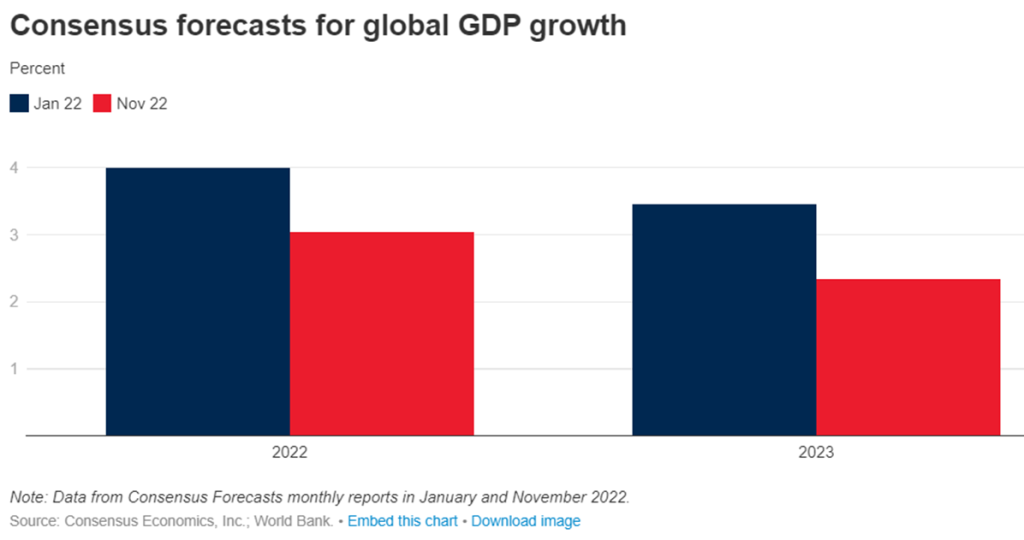

So far the lockdown policy in China is unclear and given the recessionary outlook for 2023, I do not see a supply crunch or a demand rebound. What are some of the factors that might bring in an another oil price rally?

- G7 oil price cap creates more tension – so far the G7 oil price cap has not produced a lot of drama. Countries seem to be complying. Smuggling is happening as usual. In fact Russia is also complying and have refrained from drawing the ire of European countries as the current shipments being sent to India from the country are under the G7 price cap mechanism. According to Financial Times own analysis about 7 tankers were loaded after December 5 carrying 5 million of crude to India and these were insured by western companies (which means they are price cap compliant).

2. Falling Spare Capacity

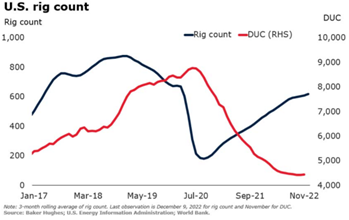

3. Outlook for Shale Oil

4. Geopolitical tensions (Taiwan issue, Iranian aggression etc)

These are some of the other developments that might result in an oil price rally provided a certain pattern of these variables is at place.

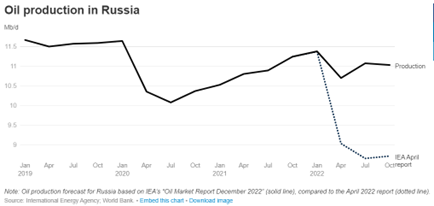

Apart from that an expected fall in Russian oil production might also add to the worries of a supply crunch. So far the fall has been a meagre 0.3 mbpd. This is a drastic contrast from the expected 3 mbpd by IEA.

On the other hand, U.S. is expected to add around 1 mbpd of production in the coming year accounting for half of increase in global oil produce.

Alongwith that China’s lockdown can take anywhere between 2 – 3 months and 3 – 6 months to finally conclude. In the former case there will be a sharp spike in cases while in the latter the lockdowns will remain in place for long. In both scenarios oil demand recovery will be very gradual. At maximum China can add upto 1 mbpd of demand. But China has also been recently filling up its coffers with cheap oil so in case prices go up we might not see strong buying from China.

Global economic oultook remains shady. I will cover more indicators and estimates regarding recession in the upcoming blog! I also discuss all of this tonight on Monday Macro View! See you there!