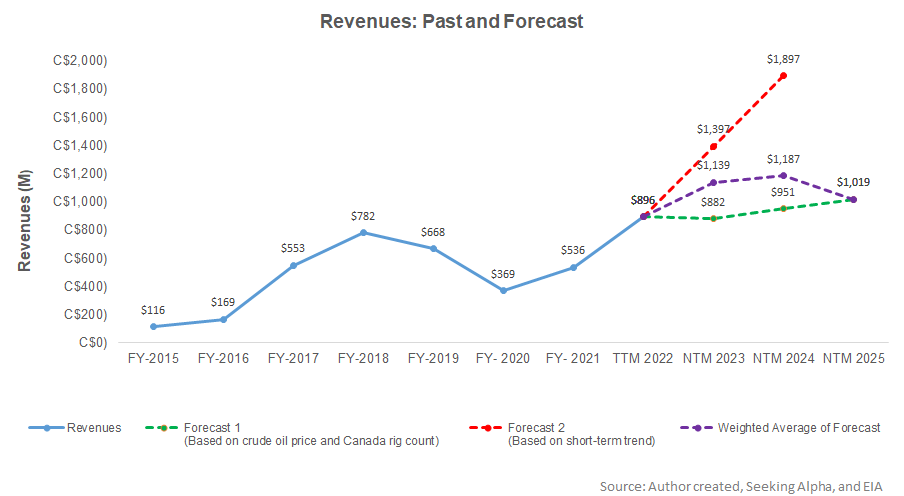

- Our linear regression model suggests strong revenue growth in NTM 2023, but the rate can decelerate rapidly in NTM 2024 and a decline in NTM 2025.

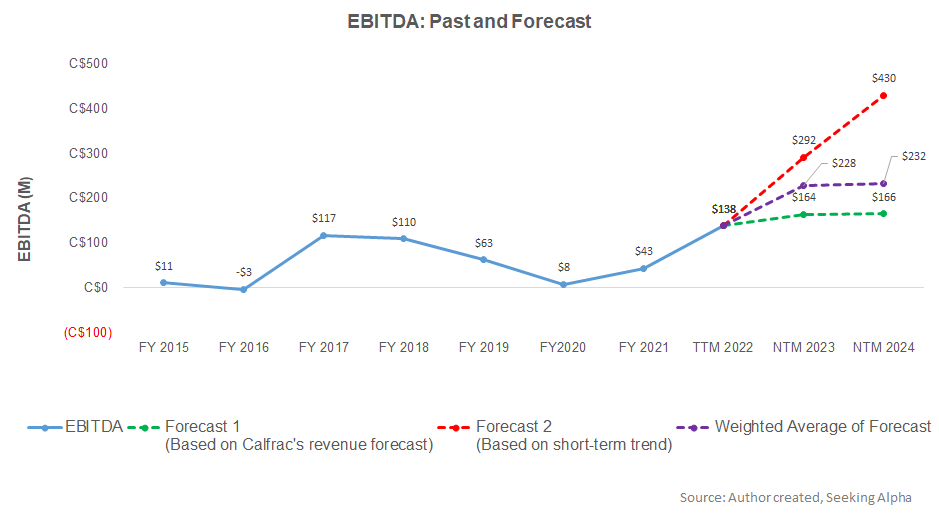

- EBITDA growth rate can decelerate in NTM 2024 after a steep hike in NTM 2023.

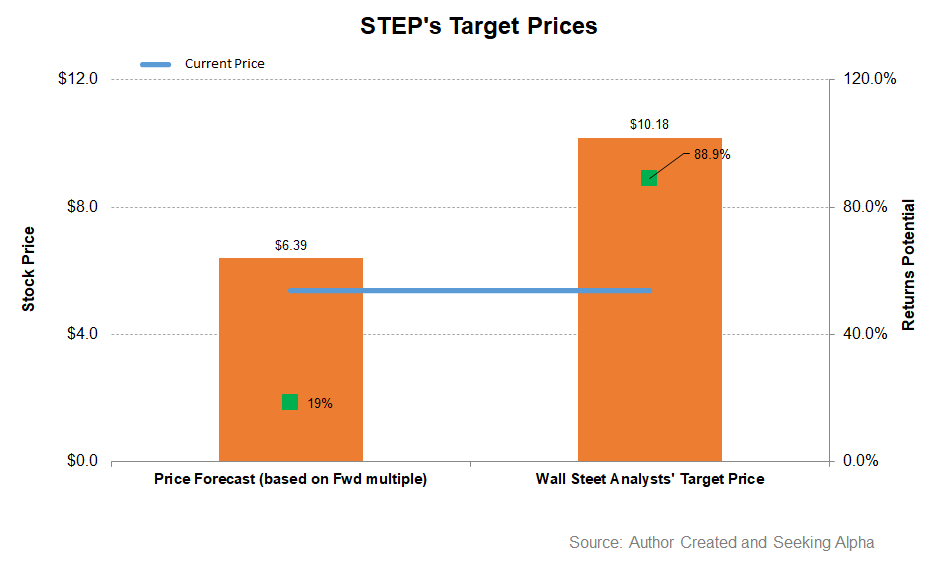

- The model suggests an upside potential in stock returns.

Part 1 of this article discussed STEP Energy Services’ (STEP) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the key industry indicators (crude oil price and Canada rig count) and STEP’s reported revenues for the past seven years and the previous four quarters, we expect its revenues to increase by 27% in the next 12 months (or NTM) in 2023. The growth rate can decelerate significantly (to 4%) in NTM 2024, while revenues can decline in NTM 2025.

Based on the same regression models and the forecast revenues, we expect the company’s EBITDA to increase by 65% in NTM 2023. The EBITDA growth rate can come to a near halt in NTM 2024.

Target Price And Analysts’ Rating

Returns potential using the forward EV/EBITDA multiple (3.0x) is lower (19% upside) than the expected returns using the Wall Street analysts’ expected returns (89% upside) from the stock.

The sell-side analysts’ target price for STEP is $10.2, which, at the current price, has a return potential of 89%. All seven sell-side analysts rated STEP a “buy” or a “strong buy,” and none a “Hold” or a “Sell” in the past 90 days.

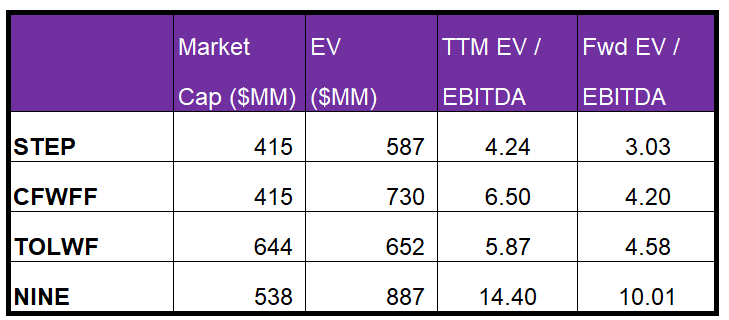

Relative valuation

STEP’s forward EV/EBITDA multiple contraction versus the current EV/EBITDA is in line with its peers, typically resulting in a similar EV/EBITDA multiple to its peers. The company’s EV/EBITDA multiple (4.24x) is much lower than its peers’ (Calfrac, Trican Well Services, and NINE Energy) average (8.9x). So, the stock is undervalued compared to its peers at this level.

What’s The Take On STEP?

STEP will take advantage of the improved pricing following the frac market recovery in North America and will activate the ninth coiled tubing unit in Canada in Q4. Its recent acquisition of the deep coiled tubing in the Southern US will give it further exposure to the LNG market. In its ESG initiatives, it has formed a strategic partnership to help upgrade pressure pumps with dynamic gas blending. Its cross-border business model also facilitates margin growth. So, the stock significantly outperformed the previous year’s TSX Index (SPTSX).

The company’s robust cash flow generation has helped it reduce net debt. In 9M 2022, its free cash flow turned positive compared to negative FCF a year ago. We do not see much upside at this level. Overall, it has shed its debt balance significantly since 2018. Given the low relative valuation, we suggest the stock is a “Buy” with solid upside potential at this level.