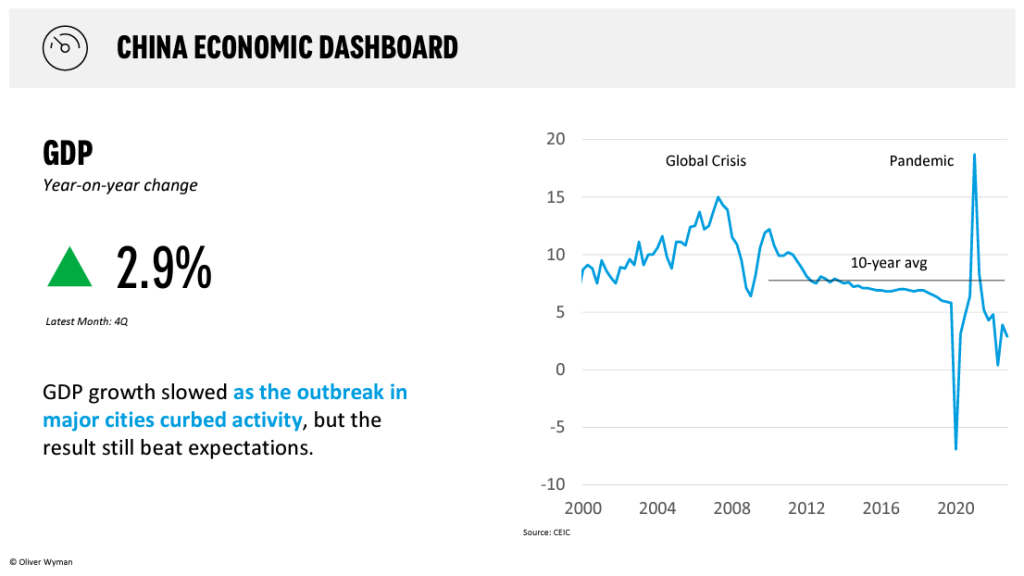

China is reopening and I have been trying to follow every development there. In the last week we tracked some data points and saw what it will mean for the global economy if the second largest economy opens up.

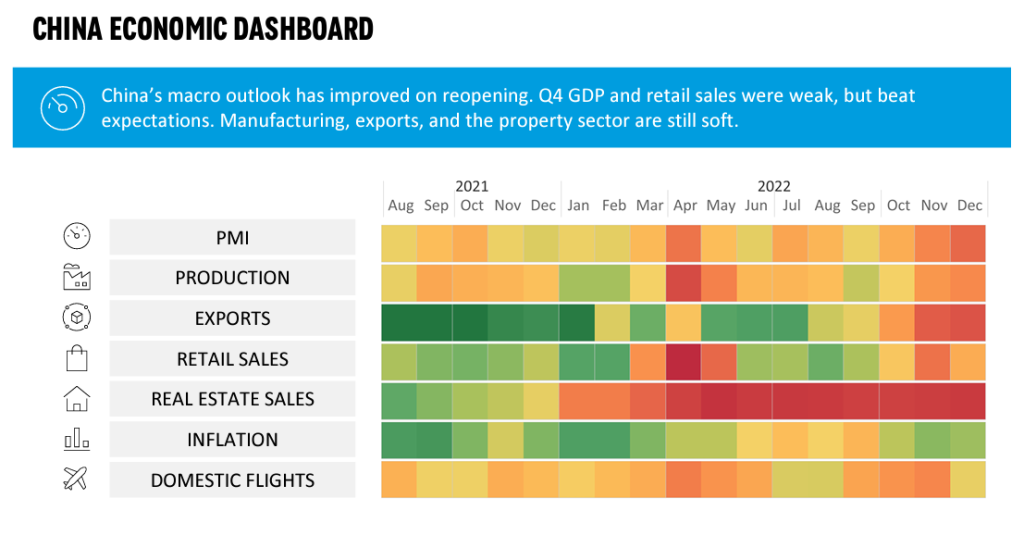

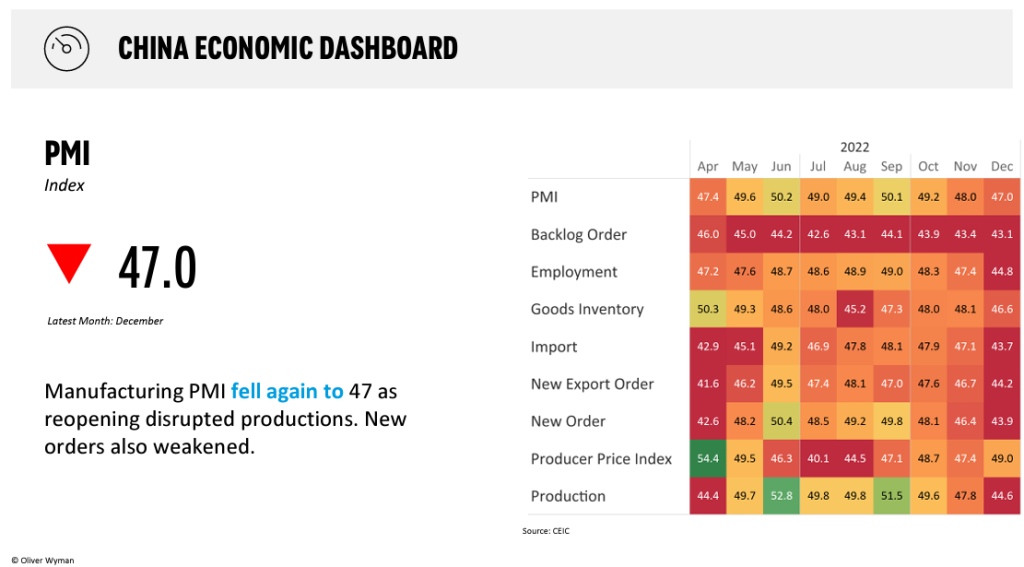

Varying estimates continue to prevail in the global sentiment. The following charts show a balanced point of view.

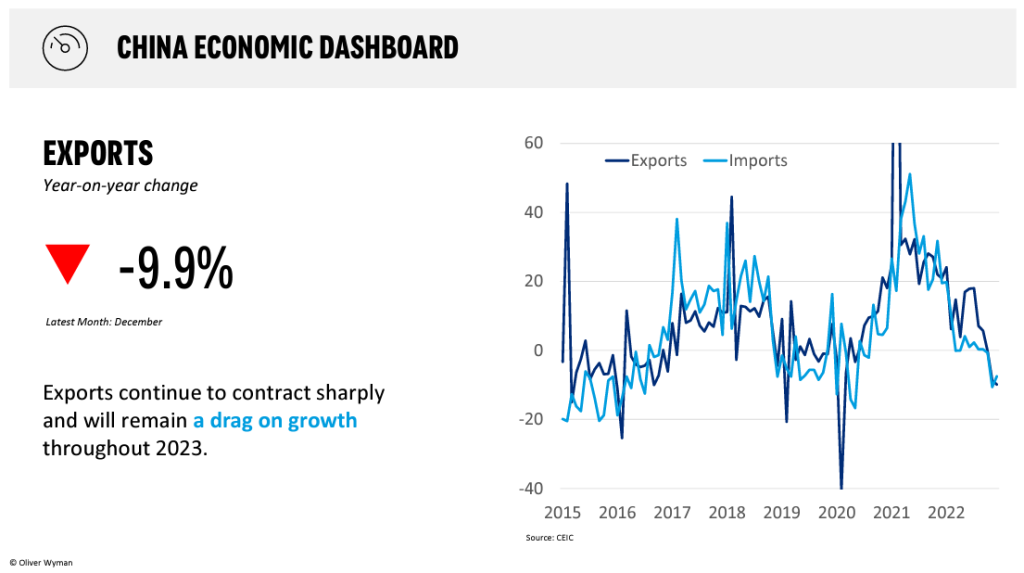

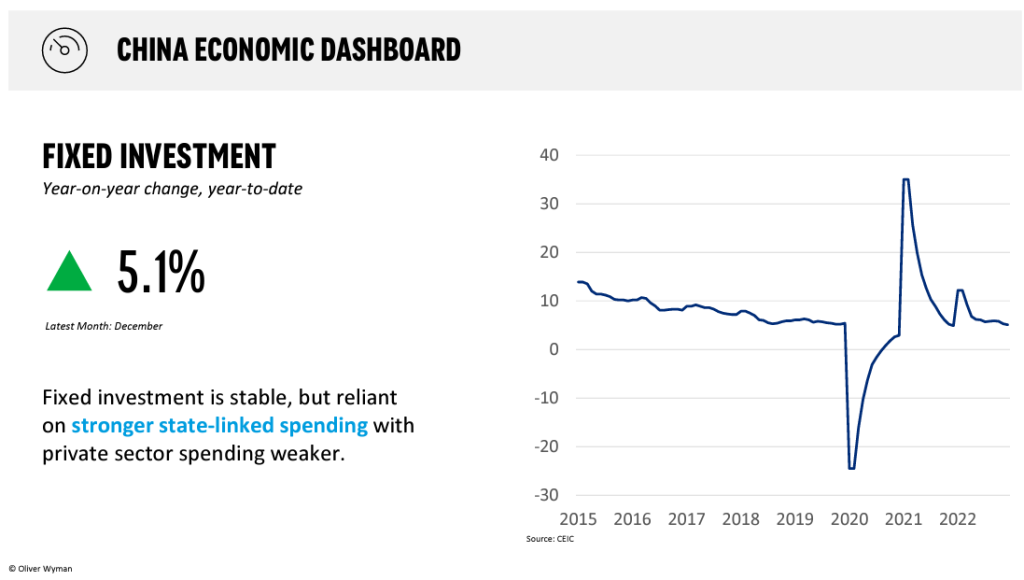

Issues in the property markets remains. Exports have shown weakness in the latest data coming out from China from December. Home sales and start of new construction projects are also stalled.

State spending and private spending are also interlinked:

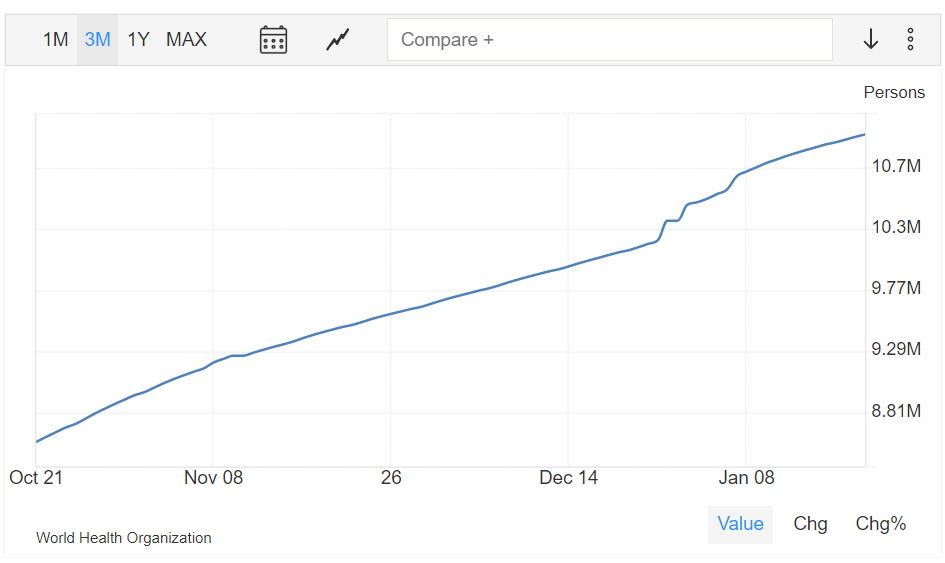

Over 80 percent of population has been effected due to another wave of Covid as per a government scientist from the country. Nearly 60,000 have died since 12th January so far. In only the past 7 days there have been 13000 deaths.

It is important to follow the trend of the rise and fall of virus so as to learn how will affect the market sentiment. I , and we at PVN, have continued to highlight this side.

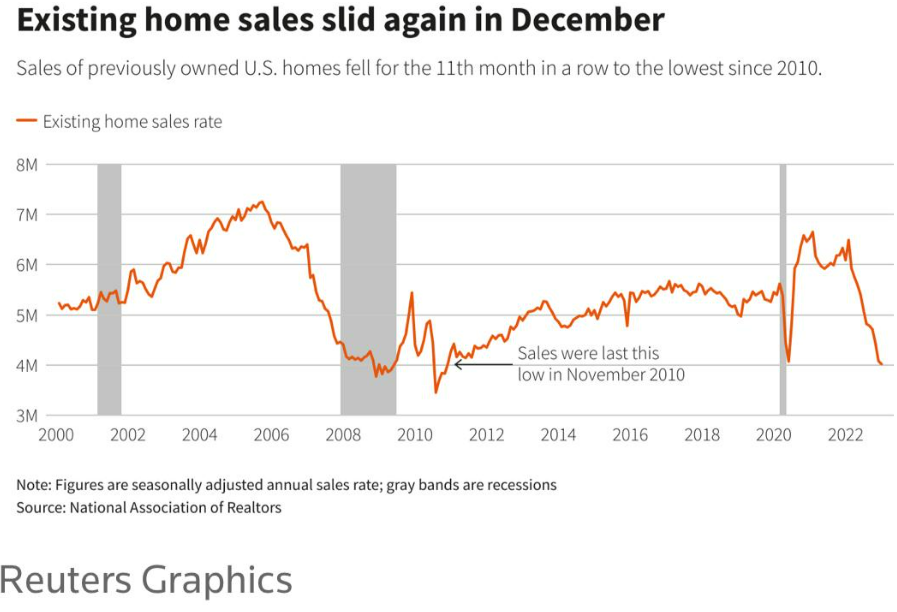

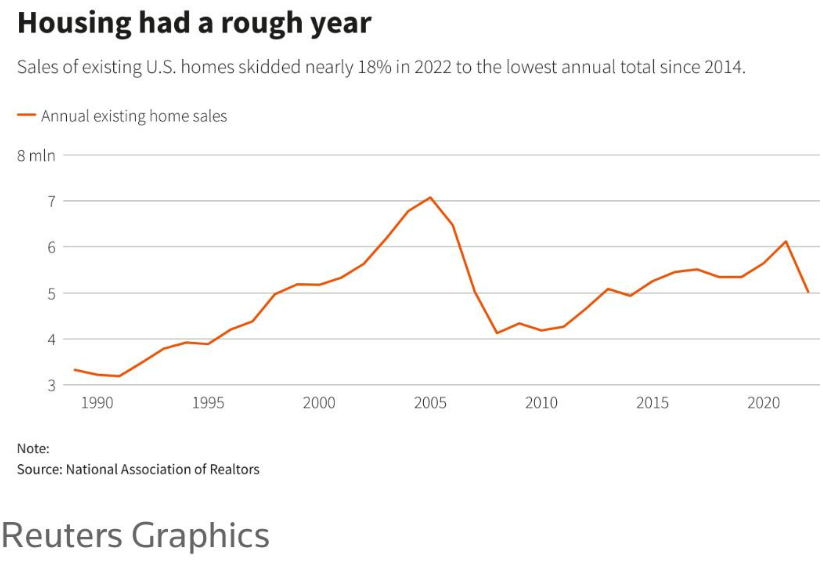

The slow down isn’t confined to China but housing sales in US have also slumped. Sales in the states touched 12 year low. Sales fall 17.8% in 2022, sharpest annual decline since 2008.

Home resales have also fallen by a whopping 36 percent YoY! “They fell 17.8% to 5.03 million units in 2022, the lowest annual total since 2014 and the sharpest annual decline since 2008.”

However mortgage rates have fallen and seem to have peaked at 6.15 percent lowest since September.

So there is some relief but many issues that still exist in the global markets and we will continue to report these through our research articles and insights so that you, our dear reader, can make some informed decisions!

Happy reading! See you all tomorrow for Monday Macro View.