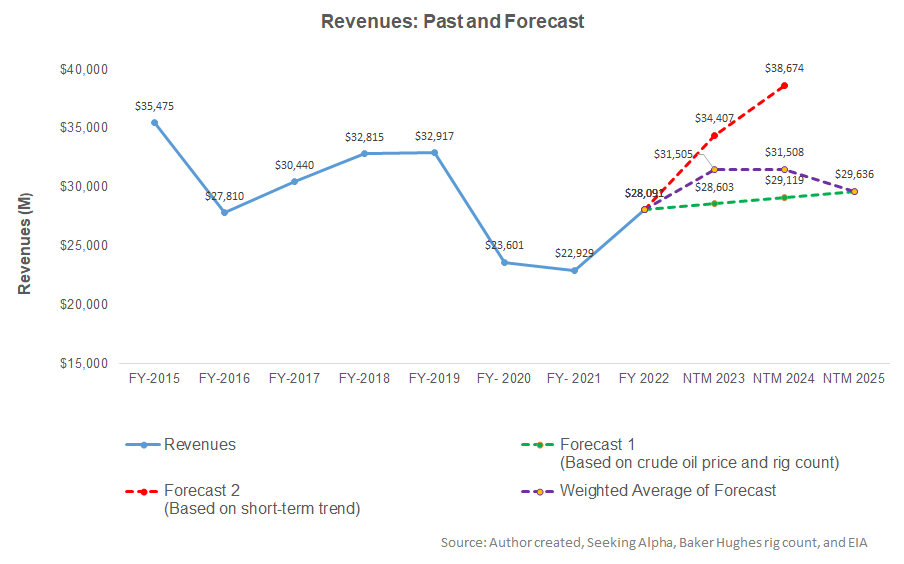

- Our regression model suggests SLB’s revenue estimate is upward trending in NTM 2023 but may slow down considerably after that.

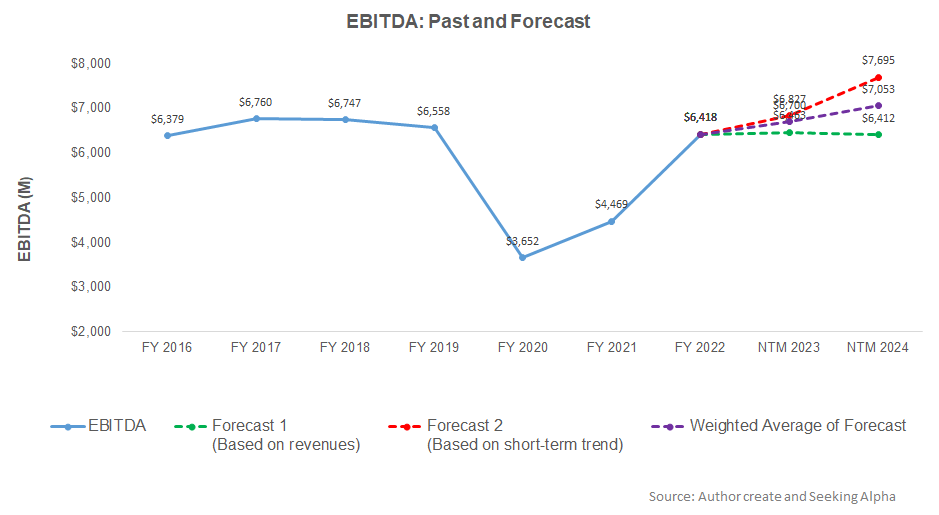

- EBITDA will increase more consistently in the next couple of years.

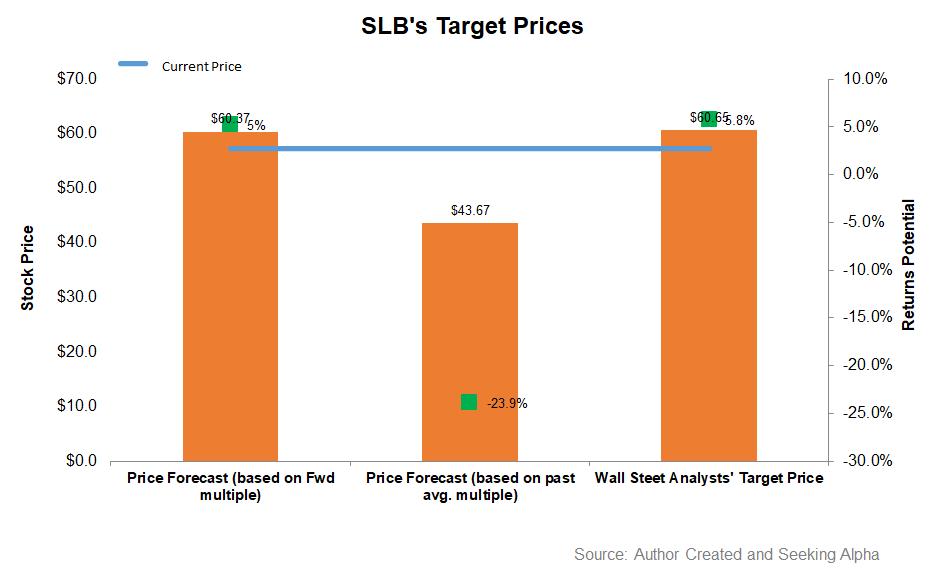

- The stock is reasonably valued at the current level.

Part 1 of this article discussed SLB’s (SLB) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

A regression equation-based model on the relationship among the crude oil price, global rig count, and SLB’s reported revenues for the past seven years and the previous four quarters suggests revenues to increase by 12% in the next 12 months (or NTM 2023). For the short-term trend, we have also considered seasonality. However, revenues will remain unchanged in NTM 2024 and decline by 6% in NTM 2025.

The company’s adjusted EBITDA can increase by 5% in NTM 2023. Based on the average forecast revenues, the model suggests the company’s EBITDA will decrease steeply (17% down) in NTM 2025.

Target Price And Relative Valuation

Returns potential using SLB’s forward EV/EBITDA multiple (14.2x) is higher (5% upside) than the returns potential using the past average multiple (24% downside). The Wall Street analysts have mild returns expectations (6%) at this level.

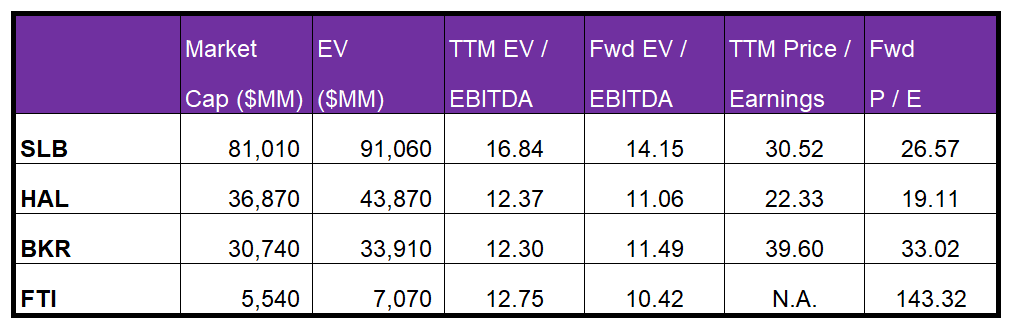

SLB’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is higher than the peers because the company’s EBITDA is expected to increase more sharply than its peers in the next four quarters. This would typically reflect a higher EV/EBITDA multiple than the peers. The company’s EV/EBITDA multiple (16.8x) is higher than the peers’ (HAL, BKR, and FTI) average of 12.5x. So, I think the stock is reasonably valued at the current price.

What’s The Take On SLB?

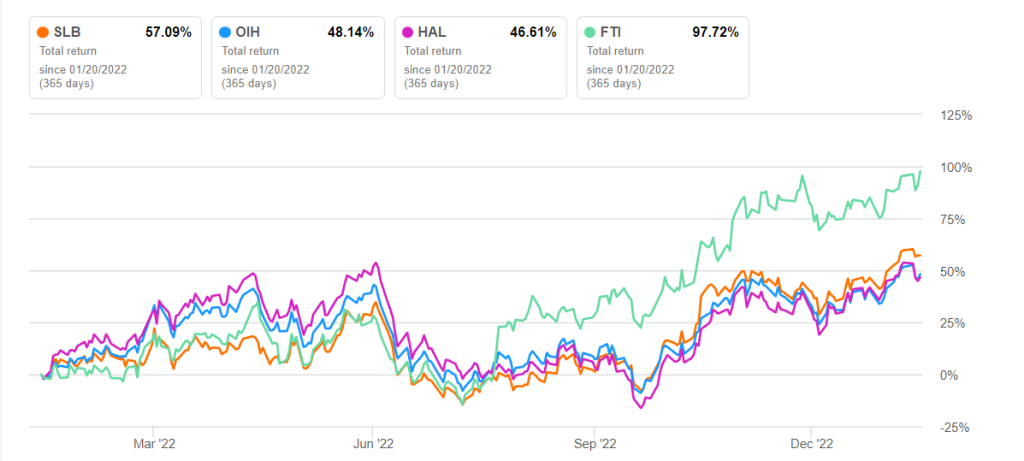

SLB’s management views that reinvigorated capex can roll the international market forward in the near term. At the same time, its outlook on North America brightened at the start of 2023 compared to the previous quarter. The Middle East, offshore Latin America, and Africa would become the mainstay driver. In 2023, the SLB’s management expects to see 15% revenue growth, while EBITDA can also expand by mid-20 percent. In clean energy, carbon solutions, hydrogen, geothermal and geo-energy, critical minerals, and stationary energy storage would be the long-term prospect for the company. So, the stock outperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

In Q4, the company’s Production Systems revenue segment revenues moved slowly because of relatively muted valves and subsea production systems sales. Its free cash flow was also down in FY2023 versus the previous year. However, the deleveraging process received a boost with the sale of investments. The management also expects the operating margin to boost cash flows in 2023. With a healthier balance sheet, the management was confident enough to raise the dividend. The stock is reasonably valued compared to its peers. Given the current momentum, we think the stock has a positive bias over an extended period.