- LNG project FIDs can double in 2023 – a likely boost for Baker Hughes.

- Spectacular growth in the IET segment order booking in Q4 paves the way for robust revenue growth in 2023.

- It plans to achieve an EBITDA margin of 20% in the next two to three years.

- Although free cash flow decreased in FY2022, it expects to return 60%-80% of FCF to shareholders through dividends and share buybacks.

Market Outlook And Industry Growth

Baker Hughes’s (BKR) management is confident about the outlook for the energy sector in 2023. As we pointed out in Primary Vision’s various discussions before, years of under-investment in the sector, the need for energy independence in light of the geopolitical turmoil, and falling capacity will keep supply low. Although there is a possibility of lower demand given the economic recession shaping up around many parts of the world, the supply concern is strong enough to keep energy prices elevated in the medium term. Despite the supply chain challenges, upstream capex will likely increase again in 2023. You may read more about BKR in our previous article here.

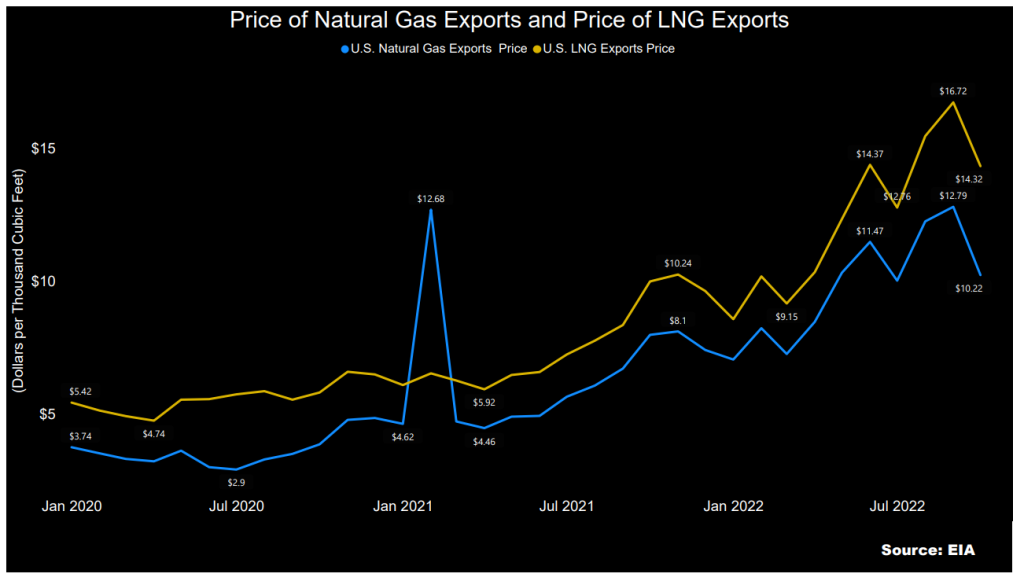

Baker Hughes will particularly benefit from the secular rise in natural gas, and LNG prices will likely remain elevated following the target to achieve lower emissions. It expects significant growth in new project sanctions in 2023, which can spill over to 2024. In 2022, the company estimated 36 MPTA in new LNG FIDs, which can rise to 65 to 115 MTPA of LNG projects in 2023 – a significant growth. So, BKR is at an advantage because of its capabilities in this operation. It can also see growth in brownfield activity, which can advance its new modular concept.

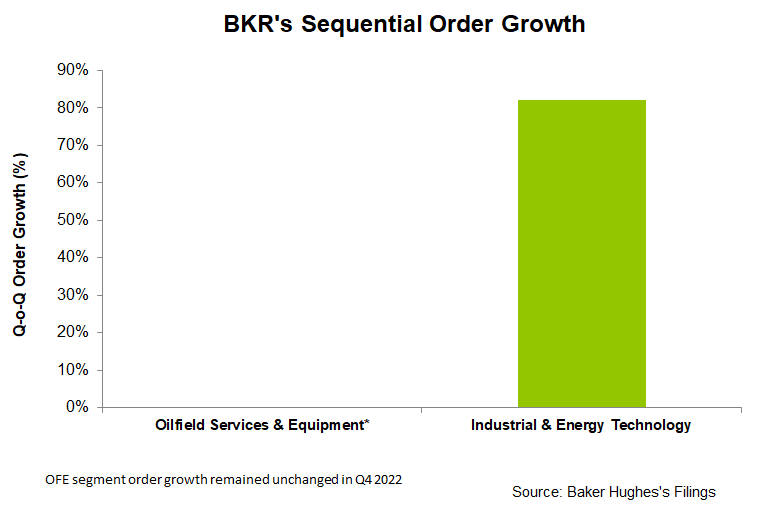

Order growth

In 2022, BKR booked $3.5 billion in LNG equipment orders while its new energy orders increased tremendously (by $400 million, or 50% up) versus a year ago. However, in Q4, the order was significantly skewed toward the IET segment (82% growth from Q3), while the OFE segment orders dried up. New orders in IET are expected to stay between $10.5 billion to $11.5 billion in 2023, which can drive its revenues in 2023 and 2024. In 2023, IET will have a robust pipeline of new orders in LNG, onshore/offshore, and new energy.

Analyzing Strategies And a Key New Tech Project

BKR focuses on LNG, onshore/offshore production, and new energy in both business segments (OFSE and IET). It has developed or acquired businesses around hydrogen, carbon capture, clean power, and geothermal in new technologies. The previous technology acquisitions of Met Power and Mosaic will help realize the commercialization of these businesses. To drive margin, it has restructured the corporate structure. It plans to reduce operating costs by $150 million in 2023 while improving operating efficiency. Over the next two to three years, it aims to achieve an EBITDA margin target of 20% in OFSE and IET and deliver a return on invested capital of 15% and 20%.

In the new energy, it booked an order from Malaysia Marine and Heavy Engineering to supply CO2 compression equipment in Q4. This large offshore CCS facility can reduce CO2 emissions by 3.3 MTPA. BKR will deliver four trains for low-pressure booster compressors and reinject the separated CO2 into a dedicated storage site.

The Natural Gas Market

The natural gas export price increased by 43% in the past year until October 2022. The LNG export price outpaced the gas export price during the same period. The EIA expects natural gas spot prices to average $5.00/MMBtu in 2023 or 25% below the 2022 average due to the Permian and Haynesville regions. A decline in domestic consumption of natural gas and flat LNG exports can keep prices down in 2023.

Oilfield Services & Equipment: Outlook And Performance

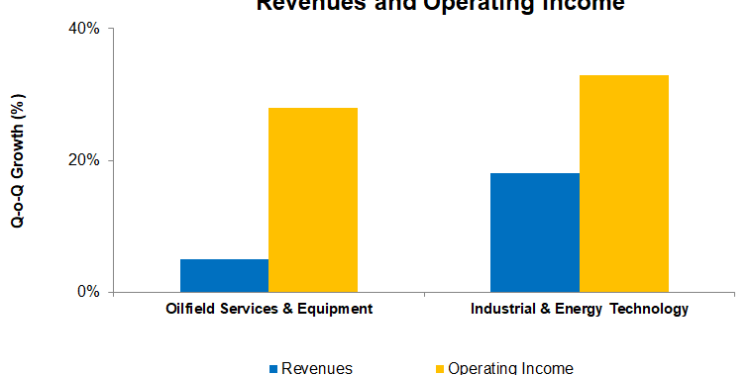

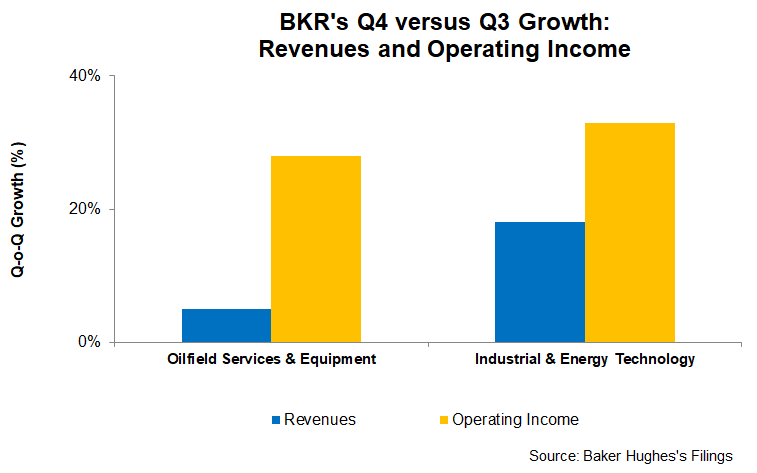

In Q4, revenues in this segment increased by 5% compared to a quarter ago, while the operating profit registered a 28% rise, following a volume and price hike. The growth was balanced between North American and international operations. Latin America, the Middle East, and Asia led international markets. So, BKR’s OFS segment expects to achieve an EBITDA margin of 20% in the next two to three years. In the short term (in 2023), the segment revenue can reach “double-digit” growth.

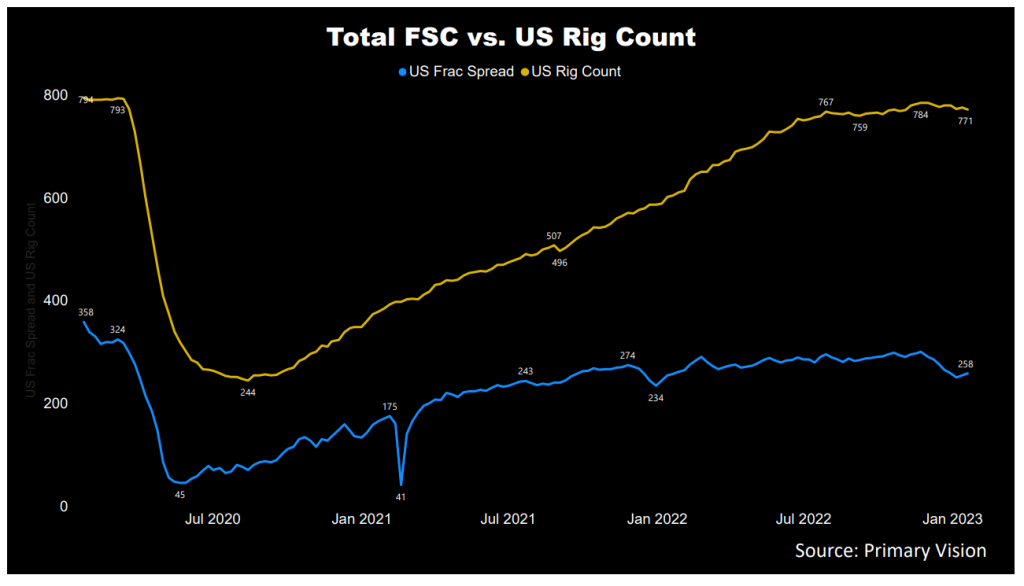

In this context, investors might be interested in knowing the frac spread count changes – a key indicator for oilfield services companies. According to Primary Vision’s forecast, the frac spread count (or FSC) reached 258 by the third week of January and has remained unchanged in the past year. The unchanged count is neutral for BKR’s 2023 outlook.

The Industrial & Energy Technology Growth Drivers

In Q4, the segment revenues increased more sharply than the other segment (by 18%), while the operating income zoomed (33% up) during the quarter. A remarkable higher order increase was the primary catalyst for growth (82% up, quarter-over-quarter). Much of the order growth was concentrated in Gas Technology – Equipment product line.

In 2023, it expects margin improvement in its chemicals business as the Singapore plant becomes fully operational. The segment can also see an EBITDA margin of 20% in the next two to three years.

Dividend

BKR’s annual dividend is $0.76 per share, amounting to a 2.45% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.18%) is lower than Baker Hughes’s.

Cash Flows And Debt

BKR’s cash flow from operations was ~$1.9 billion in FY2022, a 20% fall compared to a year ago. Although year-over-year revenues remained nearly flat, adverse changes in working capital led to the drop in CFO. As a result, free cash flow (or FCF) dropped even more sharply (39% down) in the past year. Despite that, the management expects free cash flow generation to improve and return 60%-80% of FCF to shareholders through dividends and share buybacks.

Baker Hughes’ debt-to-equity (0.46x) is significantly lower than the peers’ average (0.72x), although some of its peers are aggressively downsizing debt, as we discussed in our SLB article here. During Q4, it repurchased shares worth $101 million, continuing with its previously announced program.

Learn about BKR’s revenue and EBITDA estimates, relative valuation, and target price in Part 2 of the article.