Every since the Ukrainian war took place the global order has seem to undergone a fundamental change: realignment of oil flows. This has been accompanied with other auxiliary changes such as shifting alliances, potential of new currency bloc(s), price changes alongwith persistent high inflationary environment all of this operating within a global monetary policy tightening regime.

Recently Pakistan has become the latest country which has been working to get discounted Russian oil. However, there are many challenges. First of all the refineries in Pakistan cannot process heavy sour grade of Russian oil. The cost erosion and corrosion of the machinery/apparatus while doing so overweight the benefits. Moreover the difference between freight costs is huge. 8 dollars for oil from Russia while 2 dollars from Middle east. UAE and other Middle Eastern providers are that counties long term vendors and I believe it will be not wise to incense them by changing supplier at such a crucial time. One of the best ways to do this will be to go through China as the country enjoys good relations with her. This can help Pakistan avoid the diplomatic fallout of such a development however but for now US has said it has no issues.

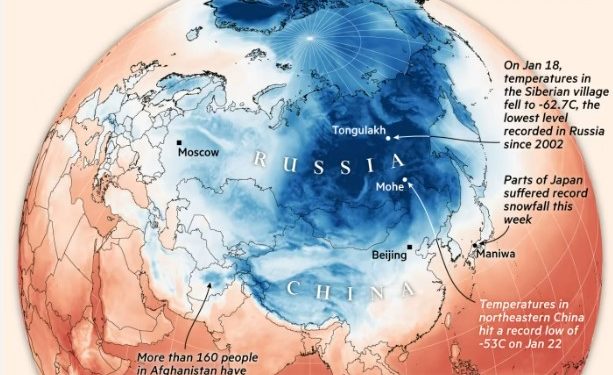

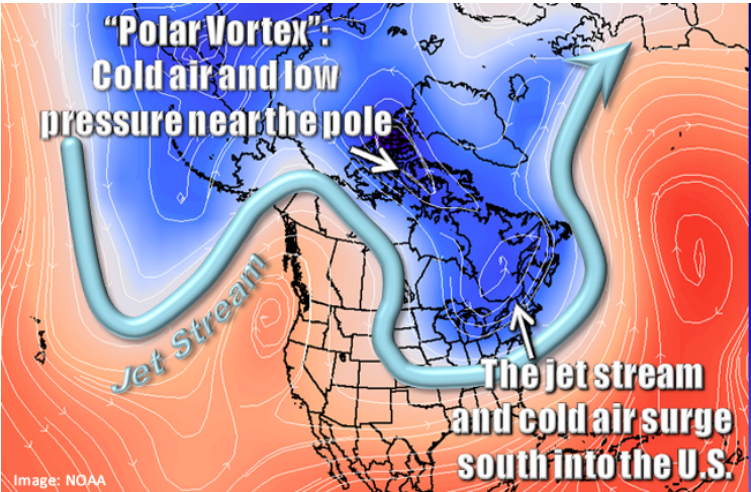

Developing countries continue to bear the brunt of rising energy prices and inflation and falling temperatures. East Asia continue to face unprecedented weather as temperatures are dropping. Many people have died in Afghanistan, around 160, same in China and cold waves in Pakistan and India continues. Temperature in one of the northeastern city of China touched -53 C, highest in recorded history. This is because of the Polar Vortex getting stronger and analysts estimate that it will effect the hitherto mild winters in Europe as well. That will increase the demand in Europe – also reducing their gas inventories – thus raising gas prices. China’s reopening will further increase the prices.

Latest data show that temperatures have starte to fall again. According to a brilliant Twitter thread by Francesco Sassi gas stocks have plunged to 78.35 percent from 81 percent a week ago – gas storage is below 80 percent now. The gas stocks present a positive picture when viewed against last year during the time when tussle with Gazprom was at its peak and the inventory levels were below 40 percent.

This will change in the coming weeks.

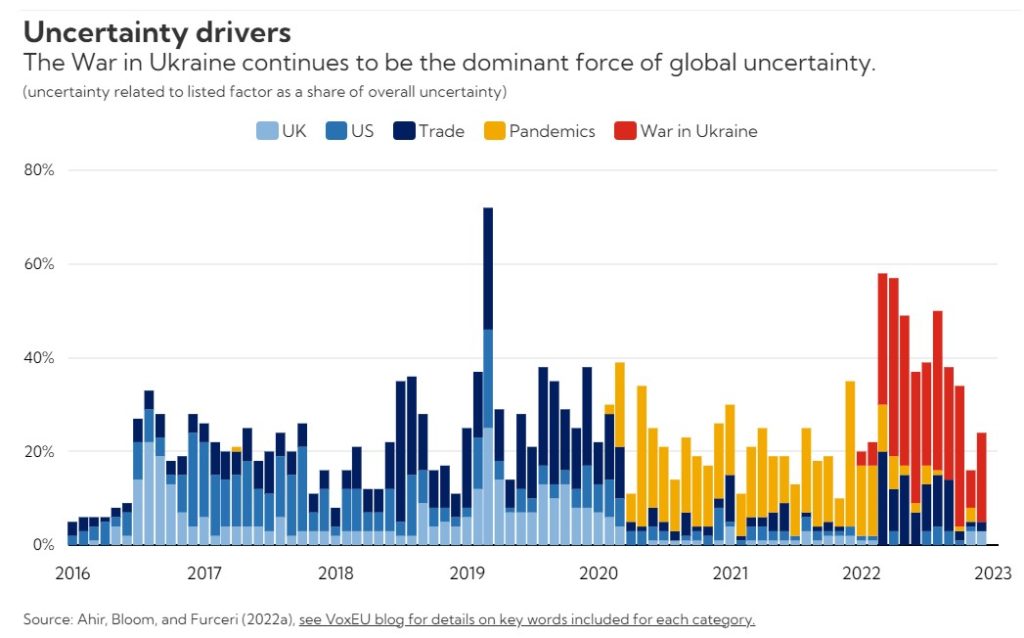

I talk about these topics more in tomorrow’s Monday Macro View. Meanwhile I will leave you with this chart by IMF. Speaks a lot about the global market sentiment.