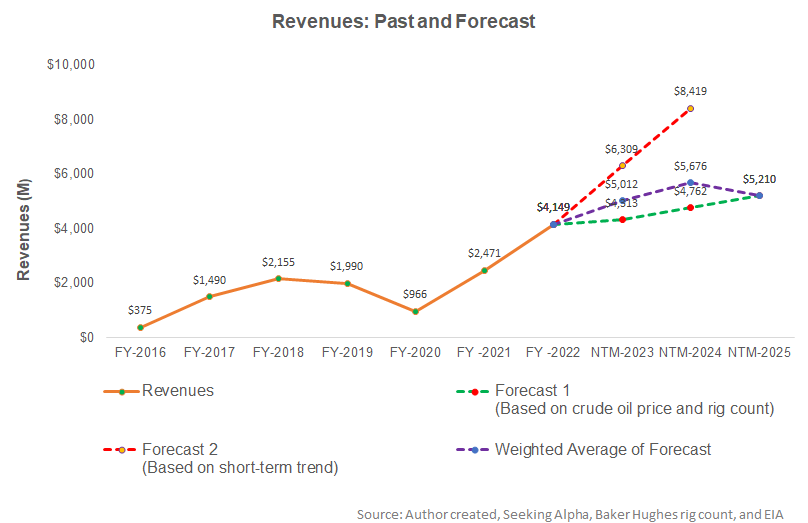

- Our regression model suggests that Liberty’s revenues will rise steadily in NTM 2023 but can change path in the following years.

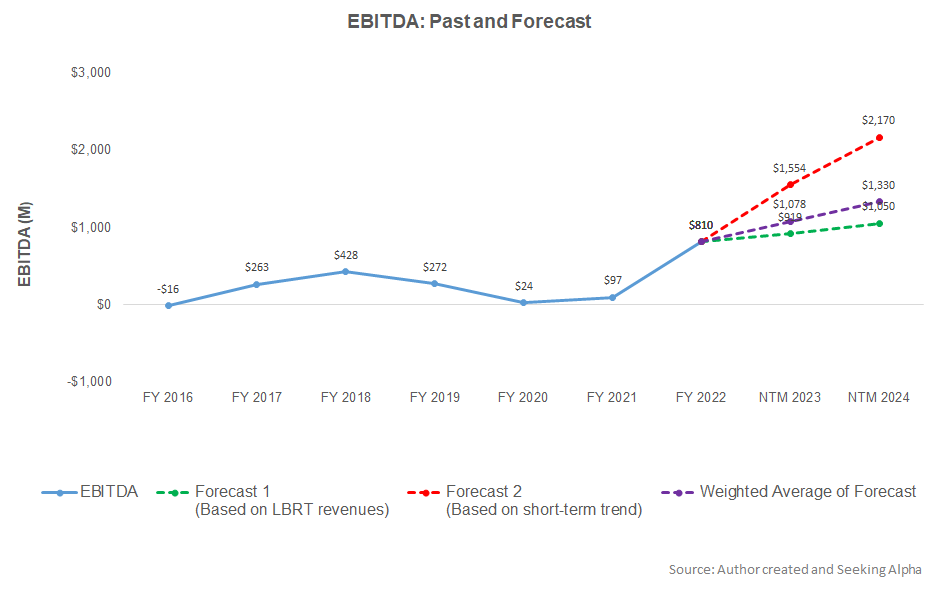

- EBITDA can rise sharply in NTM 2023 but may decelerate in NTM 2024.

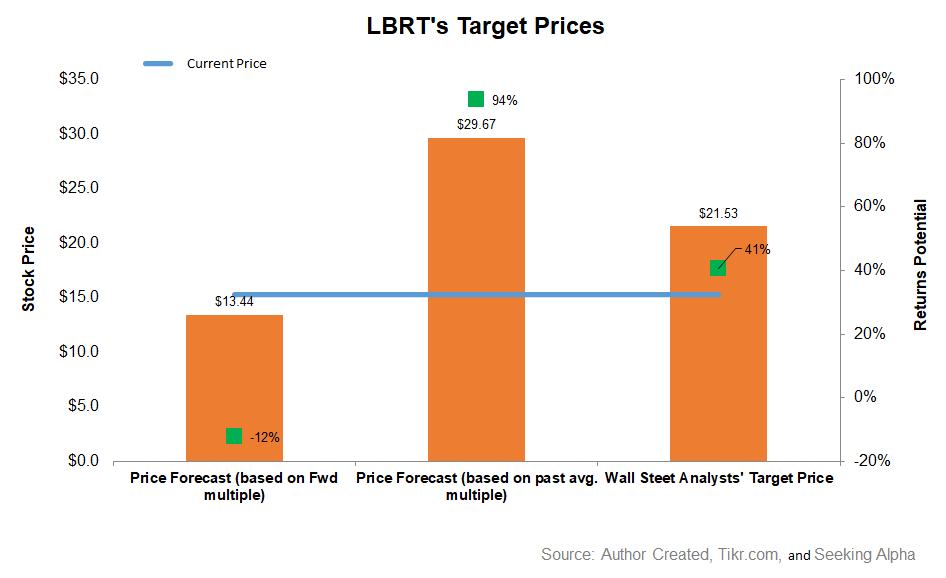

- The stock is undervalued versus its peers.

In Part 1 of this article, we discussed Liberty Energy’s (LBRT) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Revenue Forecast

Based on a regression equation between the crude oil price, rig count, and LBRT’s past eight-year revenues, its topline can increase sharply (by 21%) in the next 12 months (NTM 2023). The growth rate will decelerate to 13% in the following year and can decline by 8% in NTM 2025. For the short-term trend, we have also considered seasonality.

A regression model based on the forecast revenues suggests that the company’s EBITDA can increase by 33% in NTM 2023. In NTM 2024, the model indicates that the EBITDA growth rate will decelerate to 23%.

Relative Valuation And Target Price

Here is an analysis of LBRT’s relative valuation using its forward EV/EBITDA multiple. The returns potential (12% downside) using the forward EV/EBITDA multiple (2.5x) is lower than the sell-side analysts’ expected returns from the stock (41% upside). The returns potential using the past average EV/EBITDA multiple is much higher (94% upside).

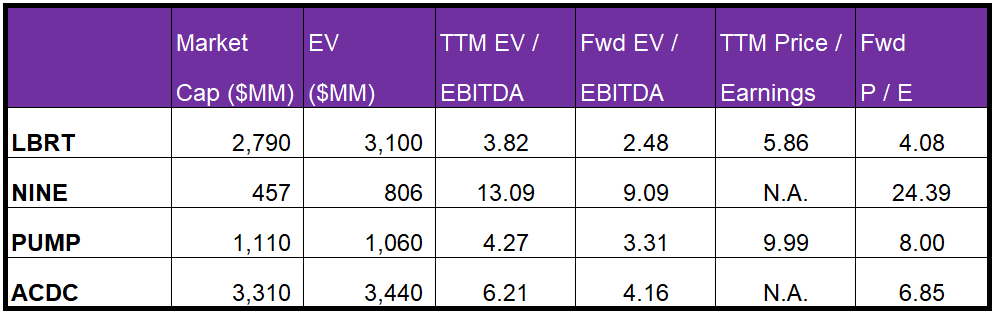

LBRT’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers because its EBITDA would rise more sharply than its peers in the next four quarters. Its EV/EBITDA is lower than its peers’ (NINE, PUMP, and PFHC) average (7.9x). So, we think the stock is undervalued versus its peers (with an EV/EBITDA of 10.3x) at this price level.

Analyst Rating

According to data provided by Seeking Alpha, nine sell-side analysts rated LBRT a “Buy” or “Strong Buy” in the past 90 days, while seven of them rated it a “Hold.” None of the sell-side analysts rated a “Sell.” The consensus target price is $21.5, which yields 41% returns at the current price.

What’s The Take On LBRT?

LBRT’s suite of ESG-friendly frac fleets will benefit from high demand in the current environment due to its higher efficiency standards. It is deploying its first fleet of digiFrac. The frac service pricing is expected to remain high in the short to medium term. Although supply will remain tight, the company’s management considers the Russia-Ukraine conflict, natural gas activity softening, and an elevated recession risk to create road bumps in the near term. So, LBRT’s stock price underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year.

Over the long term, it focuses on improving sand and logistics. On the balance sheet side, its low leverage (debt-to-equity) will protect it from any potential pressure on cash flows. The stock is undervalued versus its peers at the current level. The management has increased the share repurchase program to address the price dislocation issue. Investors should stay invested or buy the stock with an expectation of higher returns in the medium-to-long term.