- Our regression model suggests that the revenue will increase by ~20% in each of the next two years.

- EBITDA can increase sharply in NTM 2023 but can remain unchanged in the following year.

- The stock is reasonably valued versus its peers at the current level.

Part 1 of this article discussed Patterson-UTI Energy’s (PTEN) outlook, performance, and financial condition. In this part, we will discuss more.

Linear Regression Based Forecast

Observing a regression model based on the historical relationship among the crude oil price, rig count, and PTEN’s reported revenues for the past eight years and the previous four quarters suggests that its revenues will increase by 21% in the next 12 months (or NTM 2023). In NTM 2024, it can grow further by 19% but may decline in NTM 2025.

Based on the regression models and the average forecast revenues, the company’s EBITDA will increase by 22% in the next 12 months (or NTM) in 2023. In NTM 2024, the model suggests the company’s EBITDA growth will remain firm.

Target Price And Relative Valuation

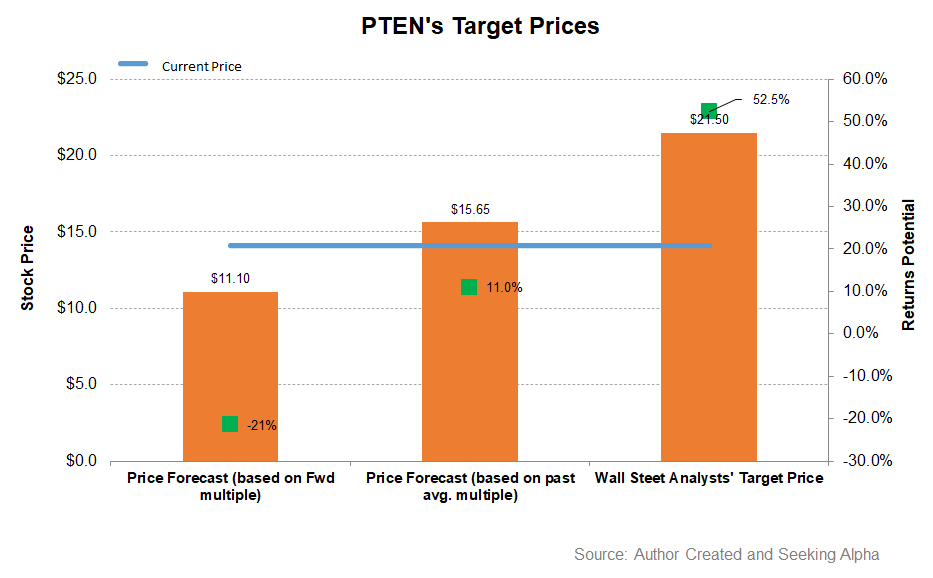

The stock’s return potential using the past five-year average EV/EBITDA multiple (8.9x) is higher (11% upside) than the return potential using the forward multiple (21% downside). Wall Street’s sell-side analysts’ expected returns (52.5% upside) are lower.

What Does The Relative Valuation Imply?

Patterson UTI’s current EV/EBITDA multiple is 5.6x. The stock’s past five-year average EV/EBITDA multiple was 8.9x. So, it is currently trading at a discount to its past average.

PTEN’s EV/EBITDA multiple is lower than its peers’ (NBR, HP, and LBRT) average. Because PTEN’s forward EV/EBITDA multiple contraction is less sharp than its peers, it typically reflects in a lower EV/EBITDA multiple than its peers. So, the stock is reasonably valued at the current level.

Analyst Rating And Target Price

According to data provided by Seeking Alpha, nine sell-side analysts rated PTEN a “buy” in the past 90 days (including “Strong Buy”), while seven of the analysts rated it a “hold.” None of the analysts rated it a “sell.” The consensus target price is $21.5, suggesting a 52% upside at the current price.

What’s The Take On PTEN?

PTEN, going into 2023, will continue to reprice rig contracts at the more favorable leading-edge day rate. In the pressure pumping business, it plans to convert legacy pressure pumps to Tier 4 dual fuel to reduce costs and emissions. Robust demand generated by high demand and high utilization would increase leading-edge pricing in 2023.

However, in the short term, it does not expect any change in leading-edge pricing, which would limit the operating margin expansion. Plus, it faces headwinds in the natural gas business following natural gas prices’ spectacular fall over the past couple of months. The volatility in energy prices can force it to exit a few natural gas-heavy operations. So, it underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, the rise in future day-rate drilling revenue warrants steady topline growth in 2023. The stock is reasonably valued at the current level. Investors might expect the stock to move sideways before the drivers become more robust and generate higher returns in the medium term.