It has been a very interesting week with some good, more bad and neutral news. Let’s start with the good news. We might see a cessation of hostilities in Yemen war as Saudi Arabia is coming closer to a ceasefire. This topic warrants a complete article as there are so many moving pieces to it, however, I do believe that it is an extension of the recent diplomatic coup (as some have been calling it) that China was able to pull of in the form of a rapprochement between Iran and Saudi Arabia.

Saudi Arabia has offered concessions to the Houthi rebels including lifting the blockade, reopening the port and allowing flights into Sana’a. China may have played a crucial role in the negotiations as they brokered a deal for rapprochement between Saudi Arabia and Iran, which was necessary for the Yemen ceasefire to take place. The role of China in the peace deal highlights America’s absence from the negotiations. A vacuum, where-ever it is, has to be filled.

There is another development and I believe it is very important to investigate the claims as a result of that. BRICS have announced that they will be launching their own currency. That’s a very significant news indeed but it isn’t tantamount to it being replacing the dollar! After Twain the following lines are most suitable for US $.

“Reports of my death are greatly exaggerated” – US DOLLAR

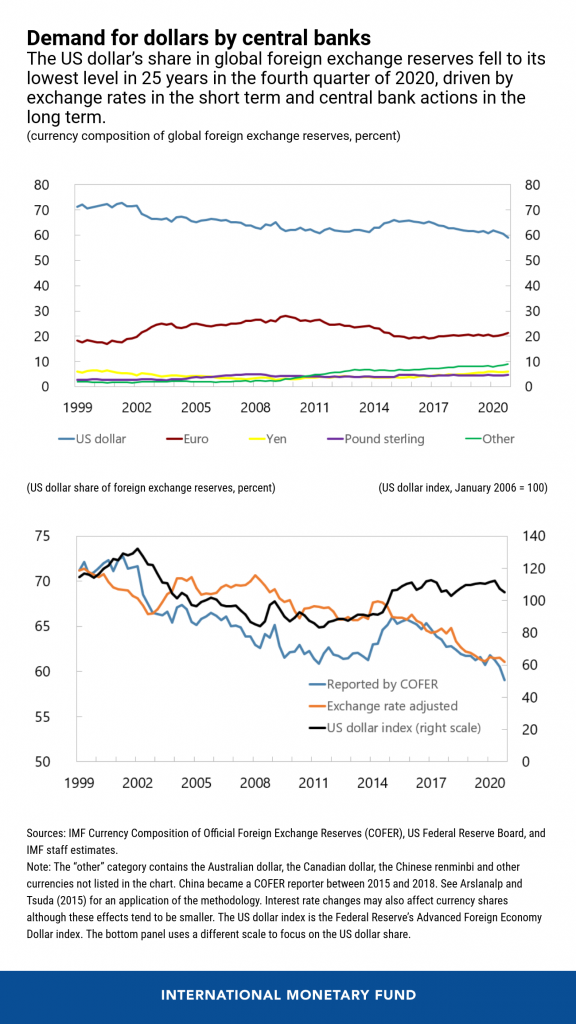

The U.S. dollar has been the world’s dominant currency in international trade and finance for several decades. According to the International Monetary Fund (IMF), as of 2021, the U.S. dollar accounted for nearly 60% of all known central bank foreign exchange reserves. In contrast, the euro accounted for just over 20%, while other major currencies such as the Japanese yen and British pound accounted for less than 5% each. By 2023, these figures almost remain the same.

The dollar’s dominance can be attributed to several factors. Firstly, the U.S. has the world’s largest economy by nominal GDP and a long history of political and economic stability. Secondly, the U.S. dollar is the most widely used currency in international trade, representing approximately 80% of all global foreign exchange transactions.

Another critical factor contributing to the dollar’s dominance is the depth and liquidity of U.S. financial markets. The U.S. stock market has the world’s largest market capitalization, and the U.S. bond market is the largest in the world. This makes it easy for investors and central banks to buy and sell U.S. assets, which supports the dollar’s value.

Despite concerns about the sustainability of the dollar’s dominance, there are currently no other currencies capable of replacing it. The euro, introduced in 1999, has not yet achieved the level of stability and depth required to challenge the dollar’s dominance. Similarly, the Chinese yuan, which has been gaining popularity in recent years, is still subject to capital controls and other restrictions that limit its use in global markets.

Furthermore, many countries have invested heavily in U.S. assets and financial markets, making it challenging for them to switch to another currency without incurring significant costs. The dollar’s position as the world’s primary reserve currency is likely to remain secure for the foreseeable future. The U.S. economy and financial markets remain the largest and most liquid in the world, and there are currently no other currencies that are capable of replacing the dollar.

Finally what did OPEC+ do last weekend? I wrote a piece about it on Oilprice. Here is a summary.

- OPEC+ announced a surprise production cut of 1.16 million barrels per day, causing an 8% rally in oil prices and bullish sentiment in the market.

- However, the reasons behind the cuts are actually bearish, as there is oversupply in the market and a lack of imminent demand resurgence.

- Some have been skeptical of a rebound in demand due to clouds of a potential global economic slowdown, and recent data supports this bearish sentiment.

- OPEC+ producers are being cautious about oil prices and aiming for a level that avoids budgetary issues, given the grim economic outlook.

- The markets are misinterpreting the production cuts as bullish, while they are actually due to bearish market conditions.

I will be speaking about these issues in the upcoming Monday Macro View.

Happy Sunday and Happy Reading!!!