Recently we have discussed various reports coming out of the IMF and OPEC+ along-with IEA. I thought it will be a good idea to also go through the salient features of the highly important Global Financial Stability Report released in April by IMF. In the article below, I have steered clear from numbers and percentages and focused on the bigger picture takeaways.

Here are some of the observations:

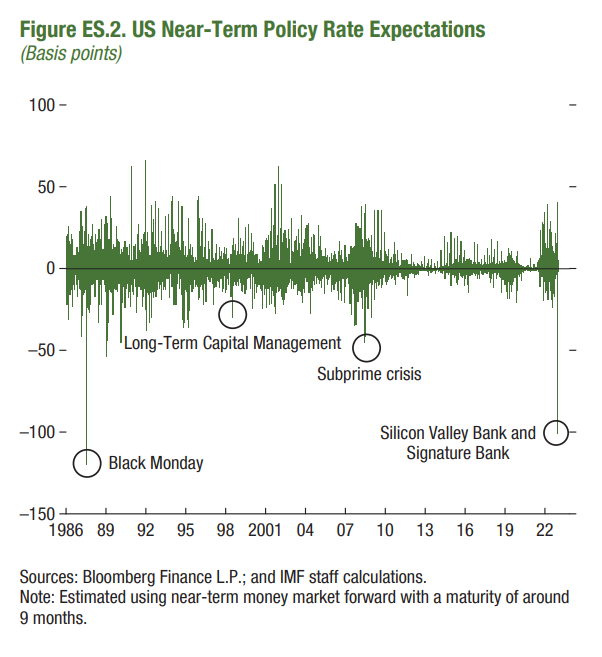

The economic trajectory of 2023 has been tumultuous, marked by high inflation and turmoil in the financial sector. The Global Financial Stability Report has attempted to capture this trajectory, which has been characterized by the wedlock of higher inflation and interest rates, along with the failures of prominent banks such as Silicon Valley Bank and Signature Bank in the US, and the loss of market confidence in Credit Suisse in Europe. These events have brought to light the prevailing challenges posed by the interaction between tighter monetary and financial conditions, and the buildup of vulnerabilities, which continue to pose a constant threat to global financial stability. The magnitude of these events, similar to the Black Monday crash of 1987, has caused a sell-off of risk assets and a significant repricing of monetary policy rate expectations.

Since the release of the Global Financial Stability Report in October 2022, financial stability risks have significantly increased as severe tests have been placed on the resilience of the global financial system. Vulnerabilities that were previously flagged in the report, such as increased exposures to liquidity, duration, and credit risk, have been amplified by new technologies and the rapid spread of information through social media.

Policymakers have responded forcefully to reduce market anxiety following the recent turmoil in the financial sector, but strains are still evident across institutions and markets. The question remains whether these events are indicative of more systemic stress or simply isolated challenges arising from tighter monetary and financial conditions. While regulatory changes have made the financial system more resilient, concerns remain about hidden vulnerabilities not only at banks but also at nonbank financial intermediaries.

Investors’ fears about losses on interest rate-sensitive assets have led to a sell-off of banks in the US, while in Europe, banks that trade at significant discounts to their book values have been impacted the most. However, emerging market banks have managed to avoid significant losses in their securities portfolios. The recent events have highlighted the rapid disappearance of funding amid a loss of confidence, which could raise funding costs for banks and restrict their ability to provide credit to the economy. This could result in a decline in the lending capacity of US banks by almost 1 percent in the coming year, reducing real GDP by 44 basis points, assuming all else remains equal.

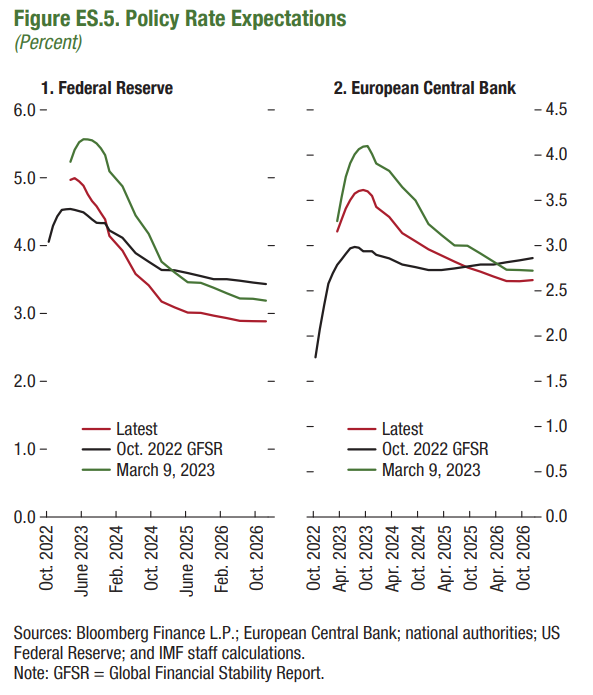

The quagmire ahead is further compounded by the difficulty for central banks to manage inflationary pressures due to the recent stress in financial markets. Despite significant increases in interest rates in advanced economies, inflation has remained uncomfortably high. Central banks, which had increased their securities holdings during the pandemic, are now starting to reduce their balance sheets, posing challenges for sovereign debt markets, particularly as debt levels are high and liquidity is poor. The impact of tighter monetary and financial conditions could be amplified by financial leverage, mismatches in asset and liability liquidity, and high levels of interconnectedness within the non-bank financial institution (NBFI) sector and traditional banking institutions.

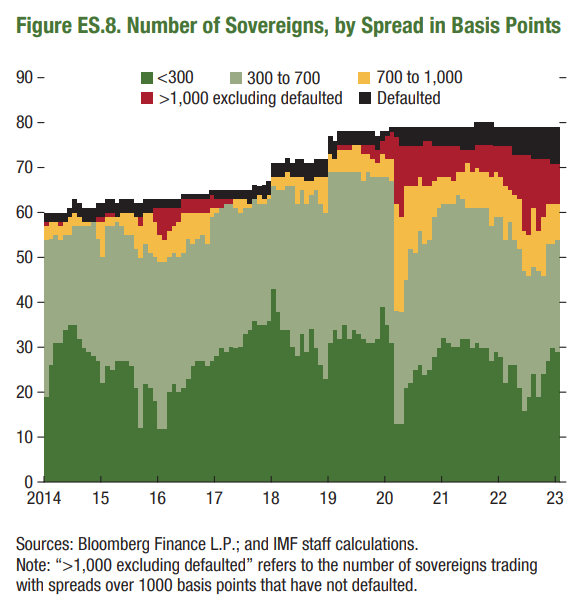

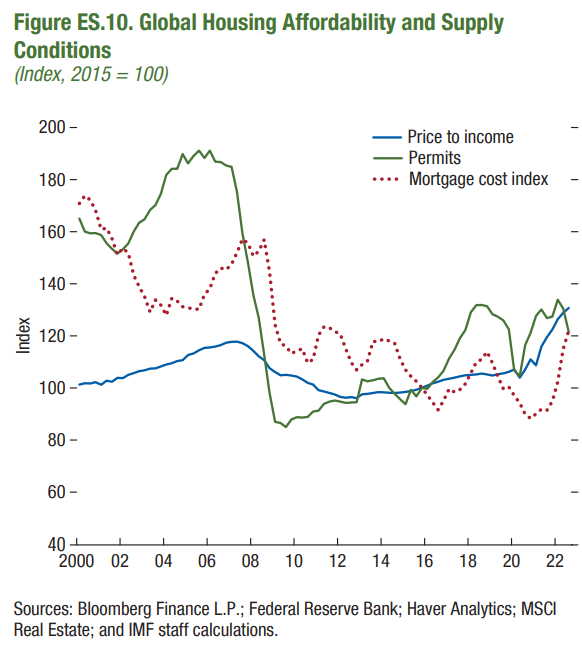

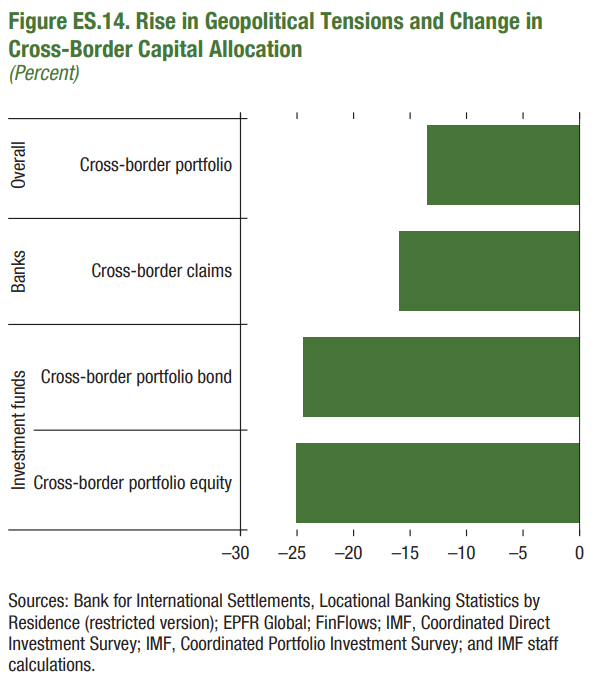

While large emerging markets have managed to cope with the tightening of monetary policy in advanced economies so far, they could face significant challenges if the current strains in financial markets persist and lead to capital outflows. Sovereign debt sustainability metrics continue to worsen around the world, particularly in frontier and low-income countries, with many of the most vulnerable facing severe strains. In addition, households, which accumulated significant savings during the pandemic, are now facing heavier debt-servicing burdens, eroding their savings and leaving them more vulnerable to default. The steep increase in residential mortgage rates has also cooled global housing demand, with economies that have larger shares of adjustable-rate mortgages recording the largest declines in real prices. Small firms and emerging market corporates are likely to be more adversely affected as they lack alternative sources of financing to bank lending, the standards of which have already started to tighten.

Furthermore, global coordination and cooperation among central banks, regulatory bodies, and policymakers are crucial in managing the current economic challenges. Information-sharing and collaborative efforts can help identify and address hidden vulnerabilities in the financial system, prevent contagion effects, and promote stability.

In addition to macro-prudential measures, addressing the issue of elevated debt levels in certain sectors, such as commercial real estate and emerging market corporates, is essential. Policymakers should implement measures to mitigate excessive borrowing and speculative activities in these sectors, while also promoting sustainable lending practices. This may include setting appropriate loan-to-value (LTV) ratios, stress testing for potential shocks, and monitoring the quality of credit.

Another crucial aspect to consider is the impact of climate change on financial stability. Policymakers and financial institutions need to assess and integrate climate-related risks into their risk management frameworks. Climate change poses significant risks to the stability of the financial system, including physical risks such as damage from extreme weather events, transition risks from changes in policy and technology, and liability risks from legal and reputational repercussions. The financial sector should proactively incorporate climate risk assessments and disclosures into their decision-making processes to better manage these risks.