1. PRIMARY VISION INSIGHTS – THE RECESSION NARRATIVE* – PREMIUM ONLY

In this past weeks Primary Vision Insights, Senior Analyst Mark Rossano tackles the OPEC+ production cuts, due to continued weakening demand and geopolitical uncertaintly. As a result, refining margins are falling and some refiners are being forced to cut production. The global economy is signaling a slow-down and with pressure on central banks and rising rates, Mark continues delivering the inputs you need to understand THE RECESSION NARRATIVE.

2. IMPORTANT HAL, LBRT, SLB & BKR NEWS* – PREMIUM ONLY

HALLIBURTON: TAKE THREE

Halliburton (HAL) implemented new digital initiatives and projects in Q1 2023. Its Completion and Production segment saw revenue rise, while Drilling and Evaluation segment saw revenue fall. Despite some hindrances, management is optimistic about the company’s future.

SCHLUMBERGER: TAKE THREE

SLB’s Q1 key projects and clean energy initiatives showcased growth, while segment revenue declined, management remains optimistic about Q2; impressive cash flow growth occurred despite increased leverage.

LIBERTY: TAKE THREE

LBRT deployed its first digiFleet in Q1, showcased steady fundamental metrics, and anticipates stable pricing in Q2 despite challenges, while continuing to strengthen its position through innovative solutions.

BAKER HUGHES: TAKE THREE

BKR’s Q1 showcased weak order growth but advanced new energy bookings, segment revenue and profit declined while management remains optimistic, and impressive cash flow growth occurred with a stable balance sheet.

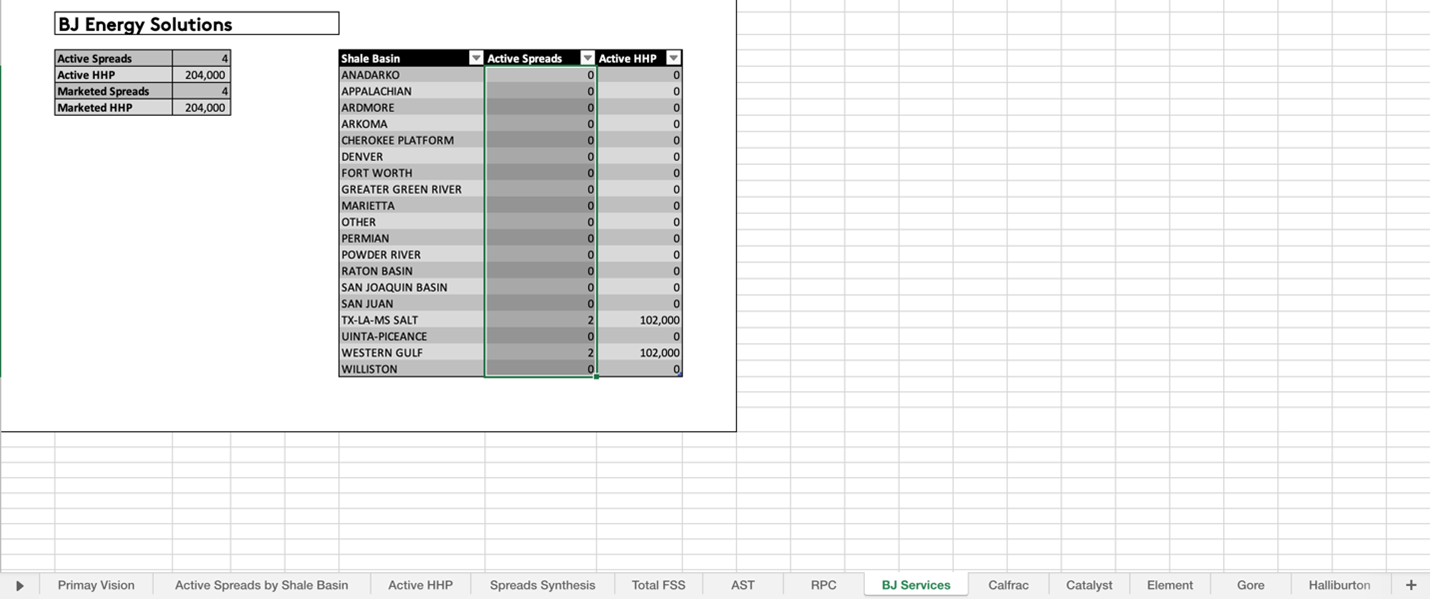

3. MASSIVE FRAC SUPPLY UPDATE** – ENTERPRISE ONLY

- Covers 21+ companies with detailed horsepower and spread data by pumper by basin

- Available in Excel format for sorting and filtering

- Click here to get a free sample: info@primaryvision.co

*Premium

**Enterprise Subscribers

Learn more about a subscription here or email us directly: info@primaryvision.co