Industry Outlook

Baker Hughes (BKR), with its diverse portfolio of long-cycle and short-cycle businesses, believes that it can withstand the current energy price volatility. The management expects the supply-demand balance in the global oil markets to tighten in 2023 owing to China’s recovering economy, the growth in non-OECD demand, and OPEC managing a stable price level. Moreover, it sees the current capex cycle as durable and less sensitive to commodity price swings. On a more optimistic note, it expects a “double-digit” increase in global upstream spending.

One of the critical assumptions that BKR’s management harps on is the shift toward developing natural gas and LNG. It sees the “multi-decade growth opportunity in gas is steadily improving.” Its key focus area would be the gas reserves in Africa, the Middle East, and the Eastern Mediterranean. It estimates that 20 MTPA of LNG projects have already reached FID in 2023 and may reach 65 to 115 MTPA by the end of the year. It also believes that the recent declines in global LNG prices will induce demand. It sees new international opportunities expanding project visibility through 2026 and beyond.

New Order Growth & Digital

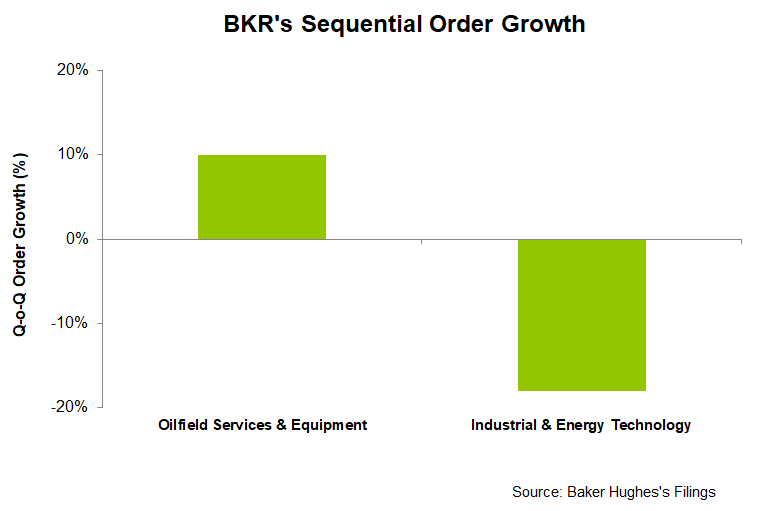

In Q1 2023, increased orders for subsea & surface pressure systems primarily accounted for BKR’s order growth, as outlined in our short TAKE THREE. Among the most significant orders in Q1 were a subsea tree contract with Azule Energy in offshore Angola and a multi-year contract from Wintershall Dea for integrated well construction and completion services.

The IET segment, despite lower order booking, recorded multiple bookings in LNG in Qatar, which is part of its two LNG “mega trains” representing 16 MTPA of additional capacity. BKR will also supply gas turbines and centrifugal compressors in Sempra Infrastructure’s Port Arthur LNG Phase 1 project in Texas. It also received orders for smaller-scale LNG facilities during Q1.

A key differentiating feature for BKR in Q1 was $300 million of New Energy order booking. It received a contract to supply CO2 compression solutions from Petrobras, which will render it to deliver primary compression services for all Petrobras’ FPSO vessels. It also received a major clean ammonia plant project planned by Nutrien in the US. Plus, it received an order to supply four pump skids to enable CO2 capture in the blue hydrogen production facility for a hydrogen energy complex in Canada. The company’s Condition Monitoring product line in digital enablement has received several orders over the past few quarters in the Middle East for a gasification combined cycle complex. Similar orders are in place in Europe also.

In Digital, the company has recently announced Leucipa – a platform-agnostic digital solution that would enable field production automation, connect artificial lifts, fluids, and chemicals, and lower costs. It has also announced a collaboration with Corva, a third-party digital solution on a similar path.

Necessary cost reductions

Earlier in 2022, BKR set a $150 million cost reduction target, expected to be achieved between Q2 2023 and Q4 2023. Some of the savings would emanate from business restructuring (aggregating four operating segments into two), yielding the additional advantage of removing duplicative spending and an overall leaner corporate structure. It benefited by $15 million in Q1.

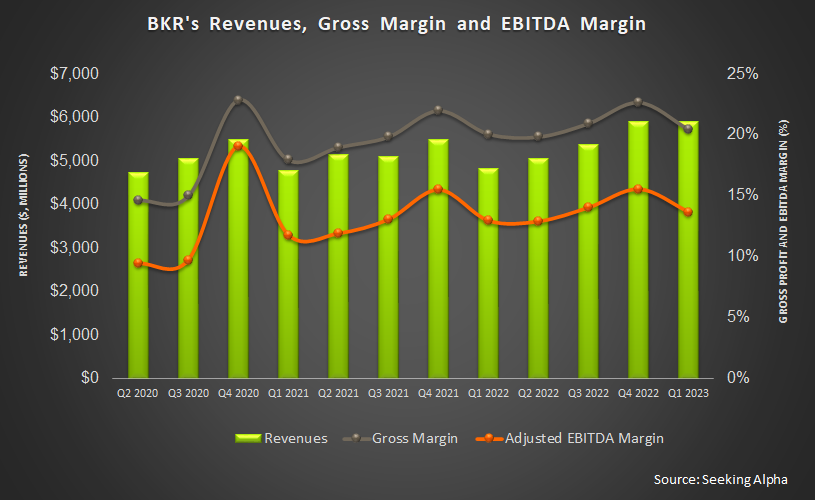

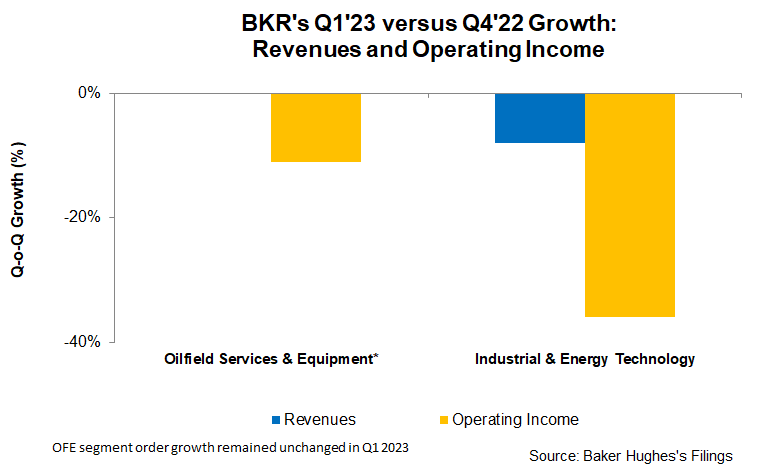

Despite all the efforts, BKR’s gross margin and adjusted EBITDA margin took a hit in Q1. Sequentially, it shrank by 220 basis points and 190 basis points, respectively. The typical seasonality is set in North America, weighing down activity levels. The primary driver for the activity slowdown is the natural gas price weakness.

Baker Hughes 2023 Outlook

The management expects Q2 revenues to fall between $6.1 billion and $6.5 billion, while adjusted EBITDA can vary between $845 million and $905 million. This means the management expects quarter-over-quarter revenues and adjusted EBITDA to increase by 10% and 12%, respectively.

Full-year, the company revised its North American drilling and completion spending to a “low-double digits” increase compared to the previous estimate. In the OFSE segment, the management expects international markets to offset the North American sluggishness, resulting in a mild performance improvement. In the OFSE segment, the well-construction product line would be the strongest growth driver, followed by the completion, intervention, and measurement product line.

The IET segment may slow down in Q2 but can back up in 2H 2023 following positive order momentum and an easing of supply chain disruption in Gas Tech and Industrial Tech. Investors may note that the segment is relatively insulated from energy price volatility because project cycle times can last eight to ten years here. Overall, the total company backlog of $26.5 billion and a robust pipeline of new order opportunities in LNG, onshore/offshore production, and new energy would help it achieve or exceed its previous guidance.

Cash Flows & Balance Sheet

BKR’s cash flow from operations witnessed a spectacular rise in Q1 2023. Although the year-over-year revenue rise was moderate, lower working capital requirements led to increased CFO. As a result, free cash flow (or FCF) turned positive from a negative FCF a year ago. Despite that, the management expects free cash flow generation to improve and return 60%-80% of FCF to shareholders through dividends and share buybacks.

Baker Hughes’ debt-to-equity (0.45x) remained nearly unchanged from a quarter ago. The net debt or equity structure did not change much during Q1 2023 from the previous quarter. BKR’s annual dividend is $0.76 per share, amounting to a 2.56% forward dividend yield. Halliburton’s (HAL) forward dividend yield (1.92%) is lower than Baker Hughes’s.

Relative Valuation

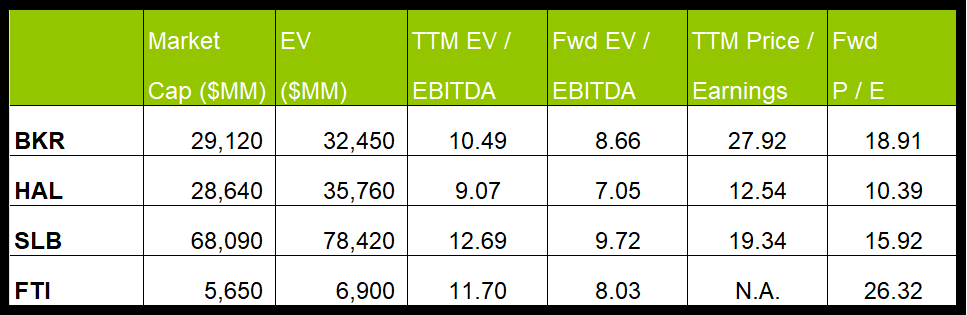

Baker Hughes is currently trading at an EV-to-adjusted EBITDA multiple of 10.5x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 8.7x. The current multiple is slightly lower than its past five-year average EV/EBITDA multiple of 11.2x.

BKR’s forward EV-to-EBITDA multiple contraction versus the adjusted trailing 12-month EV/EBITDA is less steep than peers because the company’s EBITDA is expected to increase less sharply in the next four quarters. This typically results in a lower EV/EBITDA multiple than peers. The stock’s EV/EBITDA multiple is lower than its peers’ (HAL, SLB, and FTI) average. So, the stock is reasonably valued versus its peers.

Final Commentary

As the supply-demand balance in the global oil markets tightens in 2023, non-OECD demand stability would help OPEC manage energy prices, leading to a double-digit increase in global upstream spending. BKR’s management is excited about the long-term shift towards developing natural gas and LNG as the preferred energy choice in the global market. In particular, its key focus area would be the gas reserves in Africa, the Middle East, and the Eastern Mediterranean, where LNG FIDs can improve fast in the coming quarters. The company also received a new order boost in new energy, including CO2 compression and capture, and several orders for the Condition Monitoring product line in digital enablement.

However, in 2023, the natural gas price’s southward shift has forced BKR to look intimately at the cost structure. It has restructured the business and reduced costs to defend the operating margin. Despite the efforts, in Q1 2023, the gross and operating margins could not escape the fallout. Also, the company’s IET segment may slow down in Q2 but can back up in 2H 2023 following positive order momentum and an easing supply chain problem. The company managed its working capital requirements well, and its cash flows improved dramatically in Q1, with a further scope of improvement in 2023. The stock is reasonably valued at this level compared to its peers.