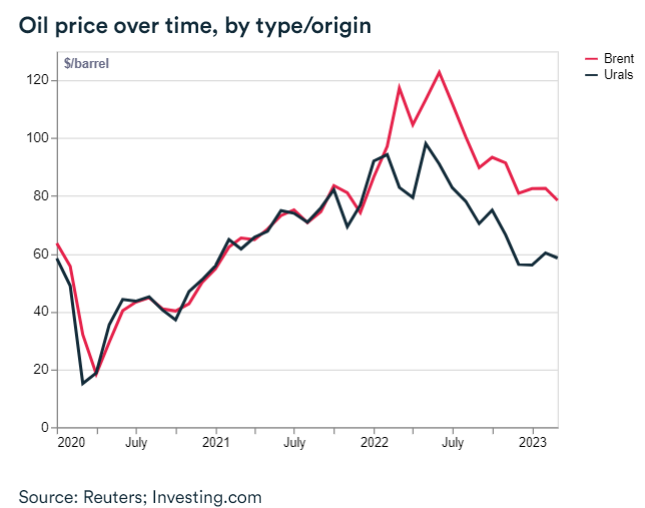

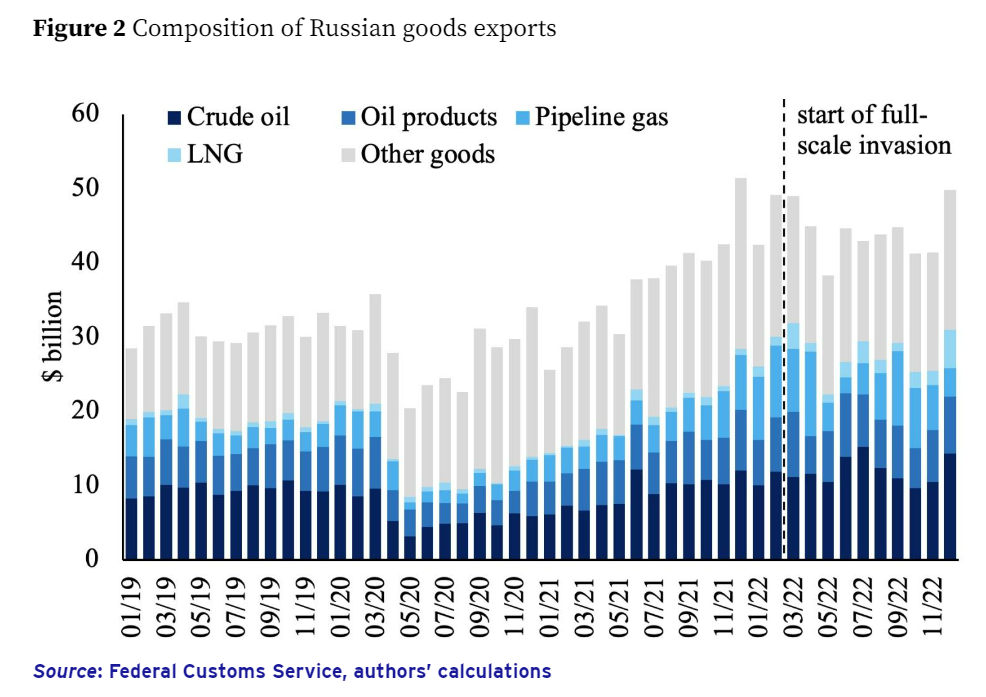

There are many important nodes that we need to track and trace in order to stay ahead of the curve regarding global economy. One of them is Russia and the state of its economy as it directly pertains to the global oil markets. Any news regarding a more than expected rise or fall in oil production coming out of the third largest producer of oil can cause wild swings in the [oil] markets. In this article I will try to do a deep dive into the latest about Russian economy so that we can refresh our knowledge regarding this important node of the global economic narrative.

In March 2022, the World Bank predicted that the sanctions would cause Russia’s GDP to fall by 11%, investment to fall by 17%, inflation to rise to 22%, and exports and imports to fall by 31% and 35%, respectively. The National Institute of Economic and Social Research (NIESR) predicted a 12% reduction in Russia’s GDP in 2022, with an inflation rate of around 20% by the second quarter of 2022. By the end of 2022, these numbers were being revised downwards, with the World Bank estimating a fall in GDP of only 4.5% for 2022 and inflation of 13.9%, and the International Monetary Fund (IMF) estimating a real GDP decline of 2.1%.

However, and quite interestingly, recently the IMF now is forecasting a small increase in real Russian GDP in 2023, but doubts remain as to whether Russian consumers will benefit.

To interpret these changing estimates of real GDP growth, economists compare them to what Russia’s GDP growth would have been in the absence of sanctions. Prior to the invasion of Ukraine, the World Bank had forecast that Russia’s real GDP growth in 2022 would be 4.3%. Given the actual fall in GDP ranging between 2.1% and 4.5%, the impact on growth constitutes an effective reduction in GDP from forecast of 7-10%. We still have to see this translate into lower activity in its oil sector.

Although GDP and fixed capital formation have held up better than expected, they have required highly proactive policies by the Russian government and central bank, with a major fiscal support package for companies and active monetary policies to maintain the value of the ruble. The forecasts of inflation and the fall in imports and exports were close to predictions. Critics argue that the short-run impact of sanctions is inevitably limited and that they will only work in the longer run – something that I agree with. The coalition of Western powers against Russia has remained relatively solid, but concerns remain that the sanctioning nations may gradually lose the willpower to keep restrictions in place, particularly in the face of the resulting disruption to the world economy and supply chains, especially in the energy and agriculture markets.

Another important post sanctions trend has been that Russia has been transitioning towards a “command economy,” leading to a larger percentage of GDP being produced by the state. According to an analysis of Russia’s 2023 public budget, a 50% increase in spending on “security,” was registered while health spending saw a decline of 9%. Further more education sector experienced a 2% decrease in spending alongwith a 24% decrease in infrastructure spending, and a 19% reduction in industrial spending. The higher share of GDP being allocated to the public budget and increased spending on security are likely to constrain private consumption.

Read this article for further breakdown of Russia’s economy and its the impact of sanctions. Here are some interesting charts:

Global Economy

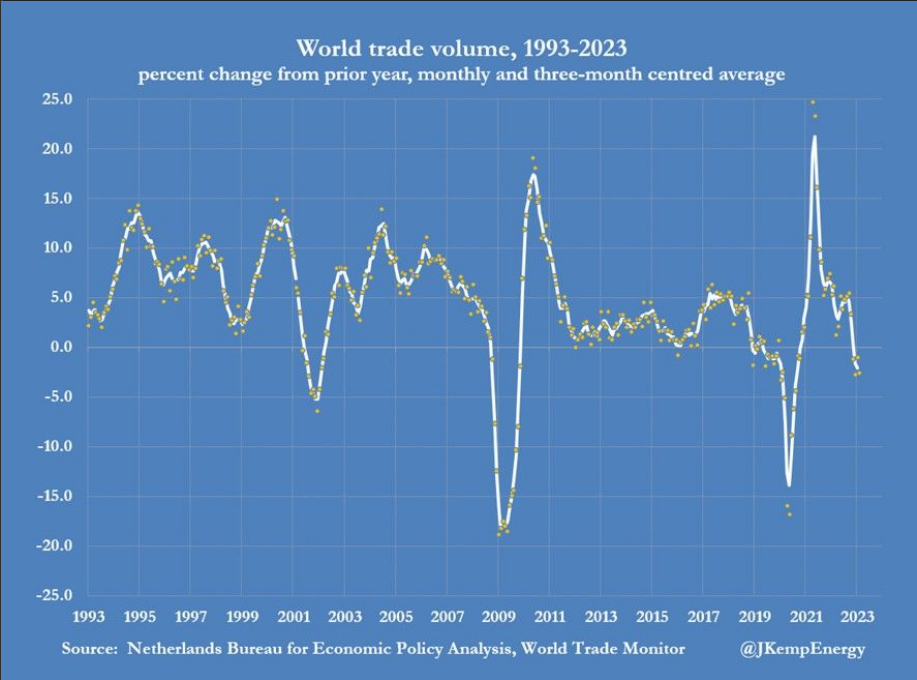

The state of the global economy more or less remains the same. Something that recently caught my attention and it fits neatly into my story of an impending recession that I continue to remind through the Monday Macro View show.

Global freight volumes have been falling the fastest in last 30 years.

1) According to CPB Netherlands Bureau for Economic Policy Analysis‘s World Trade Monitor, freight volumes plunged 2.1 percent from Dec till February – last time the volumes fell this much was in 2001, 2008 and 2020 recessions.

2) Cargo at London Heathrow dropped 9 percent in March vs last year while there was a 22 percent drop in shipping containers handled at 9 largest ports in the U.S.

3) World trade volume decreased 0.9 percent with “most noteworthy” changes in imports of advanced economies: U.S. -4.2 percent, UK -6 percent, Eurozone -1.6 percent. China registered an increase on both (imports and exports) of +0.6 percent.

Before going here is some news on climate that will have a profound effect on global markets as well:

I will try and write more about it next week.

Wishing you a great week ahead! Happy Reading!