Frac’ing Outlook

We discussed our initial thoughts about NOV’s (NOV) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

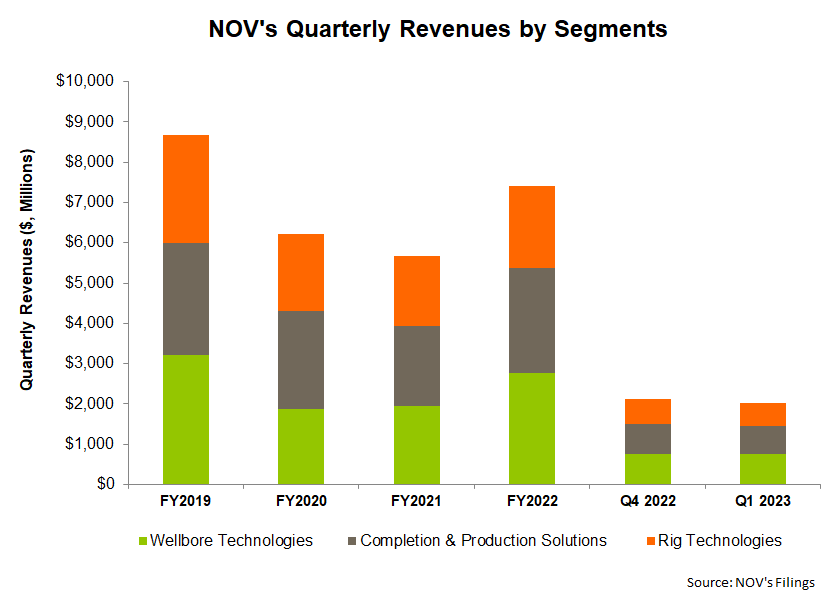

The Completion & Production Solutions (or CAPS) segment’s Intervention and Stimulation Equipment business saw demand for higher efficiency and lower emission technologies. This pushed quotations up by 31% in Q1 over Q4 2022. So, the business recorded a “low double-digit” percent revenue increase, driven by strong shipments of conventional DGB and eFrac pressure pumping equipment. During Q1, it shipped 50,000 horsepower of pressure pumping equipment, including 10,000 horsepower of eFrac units. It also shipped its first all-electric ideal processing plant.

Despite oil price volatility and low natural gas prices, the book-to-bill remained above 100%, which signifies a healthy revenue potential. A slowly softening market notwithstanding, we can expect demand for replacement equipment in the US to grow. Although expansion capacity has largely been put on hold, replacing legacy equipment with efficient dual-fuel or electric capabilities has gained momentum. You may read more about the company in our previous article here.

Completion & Production Solutions

In the CAPS segment, the inventory balance increased owing to securing allocation from polymer vendors to meet the 2023 production schedule. Revenues in this segment decreased by 3% in Q1 compared to a quarter ago, while operating income declined by 12% as cost over inventory build-up increased. Also, orders in this segment decreased in Q1 while book-to-bill fell below 100% (96% in Q1). One of the reasons for low orders is the loss of a customer that backtracked from a $100 million project in Q1.

In Q2, the company expects revenues to increase by “a mid-single-digit” while the EBITDA can improve by ~30%. The company is winding down lower-margin projects and bringing in higher-margin projects. Here, it expects higher levels of offshore FIDs later in 2023. These FIDs are tied to higher LNG production, which will require demand for flexible pipe for deepwater developments and rising demand for gas processing technologies. Over 2023, it expects the margin to improve due to better quality projects and achieve an EBITDA margin in the “low-double digits.”

Rig Technologies Segment: Performance And Outlook

In Q1, NOV’s inventory of castings and forgings products increased, resulting in a high backlog of spare parts, rig refurbishment, and equipment repair. Although this increased cost, in Q2, higher revenue will support revenue growth. In Q1, revenues in this segment decreased by 11% quarter-over-quarter because the offshore projects and the onshore rig out of inventory fell compared to a quarter ago.

In Q2, NOV’s management expects an improvement in aftermarket operations and higher backlog-to-revenue conversion of capital equipment. So, in Q2, revenues can increase by “5% to 10% with incremental margins in the mid-20% range.”

In Q1, revenues in the Wellbore segment decreased marginally (2% down) quarter-over-quarter, but operating income dipped sharply (13% down). The company’s management anticipates weakness in its profitability stemming from environmental accrual, litigation costs, and supply chain issues in the drill pipe business. A lack of raw materials for drill pipe connected to bar stock for tool joint material affected the most. These factors led to the Wellbore Technologies segment inventory build-up.

It lost manufacturing time and faced higher costs as it procured more expensive supplies from alternative vendors, reducing the profit margin. The drill pipe inventory issue can continue to affect its Q2 results adversely. The disruptions may continue to affect the unit’s Q2 results. The management expects to resolve the problems by Q3.

But NOV expects an improvement in supply chain challenges because freight reliability has resumed and costs have improved. It may, however, require further improvement in engines, electrical components, and certain elastomers deliveries to resolve the situation sufficiently.

Capex And Leverage

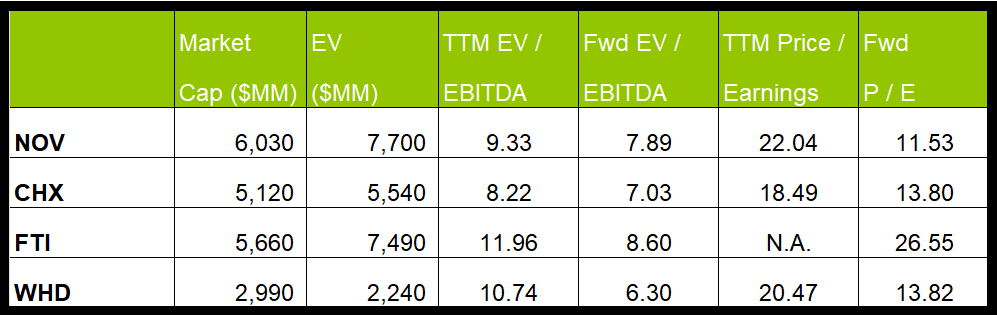

NOV’s cash flow from operations remained negative and deteriorated further in Q1 2023 compared to a year ago. Its FCF also fell year-over-year. Its liquidity totaled $2.66 billion as of March 31, 2023 (excluding working capital). Its debt-to-equity (0.33x) exceeds its competitors (CHX, FTI, and WHD). Given the debt level and liquidity, the company is relatively free from financial risks, although negative cash flows can be a concern.

Relative Valuation

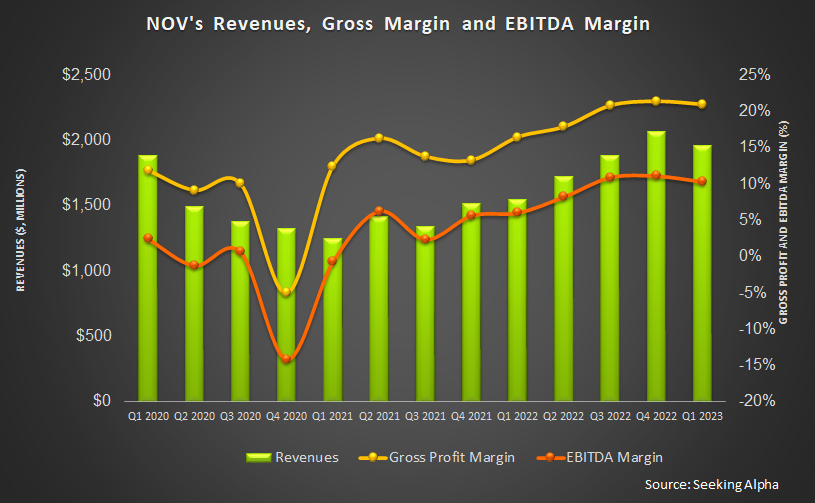

NOV is currently trading at an EV-to-adjusted EBITDA multiple of 9.3x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 7.9x. The current multiple is lower than its past five-year average EV/EBITDA multiple of 34.1x.

NOV’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is less steep than peers because its EBITDA is expected to increase less sharply than its peers in the next year. This typically results in a lower EV/EBITDA multiple than its peers. The stock’s EV/EBITDA multiple is slightly lower than its peers’ (CHX, FTI, and WHD) average. So, the stock is reasonably valued versus its peers with a negative bias.

Final Commentary

Replacing legacy equipment with efficient dual-fuel or electric capabilities has gained momentum. In the current environment, demand for higher efficiency and lower emission technologies are on the rise. So, NOV’s Intervention and Stimulation Equipment business had traction in Q1, driven by strong shipments of conventional DGB and eFrac pressure pumping equipment.

Going forward, higher LNG production will require demand for flexible pipe for deepwater developments, improving the segment topline and operating margin. In the Wellbore Technologies segment, inventory built up as it procured more expensive supplies from alternative vendors, reducing the profit margin. On the other hand, the company’s Completion & Production Solutions segment book-to-bill fell below 100% because one of its customers backtracked from a significant project. The situation is unlikely to resolve before Q3. The company is relatively free from financial risks due to its low leverage and robust liquidity. The stock is reasonably valued versus its peers.