We discussed our initial thoughts about ProFrac Holding’s (ACDC) Q1 2023 performance in our short article a few days ago. This article will dive deeper into the industry and its current outlook.

Frac’ing Update And Strategy

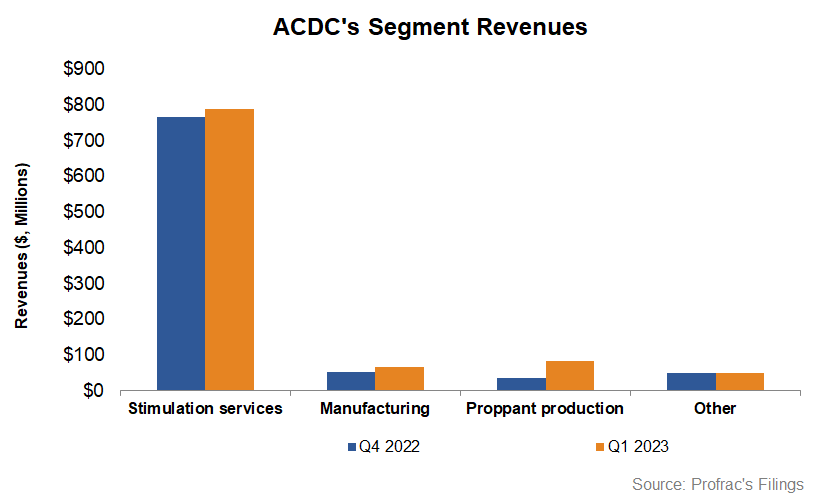

ACDC has significantly increased its frac spread count over the past year through various acquisitions (Flotek, U.S. Well Services, Producers Service), as discussed in our previous article. With an expanded asset base, it is now positioned to cross-sell sand and logistics. Demand for its in-basin sand and frac service has remained robust. It has been upgrading its legacy Tier 2 equipment to Tier 4 dual fuel and building a new electric fleet. It has deployed an e-fleet on a dedicated basis and plans to deploy another shortly. On top of that, higher demand for next-generation equipment resulted in fuel cost savings, leading to improved equipment utilization and superior pricing. Based on the current momentum, the management expects its Q2 revenues to increase compared to Q1.

Two of the company’s key objectives are to insulate the business from cyclicality through vertically integrating the supply chain and return free cash flow to the shareholders. Its Tier 4 dual fuel and electric frac spreads portfolio delivered significant cost savings and reductions in emissions. Because ACDC lowered the customers’ completion cost per lateral foot, it earned premium margins. The other critical advantage the company has is the effect of the vertical integration strategy on its supply chain. It has one of the largest in-basin sand footprints, with an annual production capacity of 23 million tons annually. It has carefully calibrated its inventory build with market demand, allowing it to improve cash flow throughout market cycles.

The company estimates that each frac spread can generate $25 million in annualized gross profit for every fleet supply. It has captured the margin from selling sand with logistics and providing chemicals to enhance cash flows. Because it has integrated fluid ends, power ends, and high-pressure iron, it can build and refurbish its own pump units and blenders, which keeps maintenance costs low. Vertical integration has shorter lead times, leading to shorter white space and higher utilization.

Industry Update

In the drilling and completion industry, the supply-demand fundamentals are tight. Due to the rapid attrition of legacy equipment, new horsepower is entering the market to serve as replacement capacity. ACDC, on its part, retired three legacy fleets earlier in 2023. The industry also features capital scarcity and supply chain tightness. On the pricing side, OPEC’s production restraint and US shale producers’ capital discipline will maintain a floor for crude oil prices, despite the current volatility. A relatively steady crude oil price will maintain returns. It will also prevent oversupply.

On the other hand, natural gas prices have declined due to lower demand. However, the company expects the weakness to be transitory. The growth of LNG export capacity reflects a shortage of natural gas. Global demand for power generation will increase natural gas demand and represents a multi-decade growth opportunity for US producers.

Q1 Results And Drivers

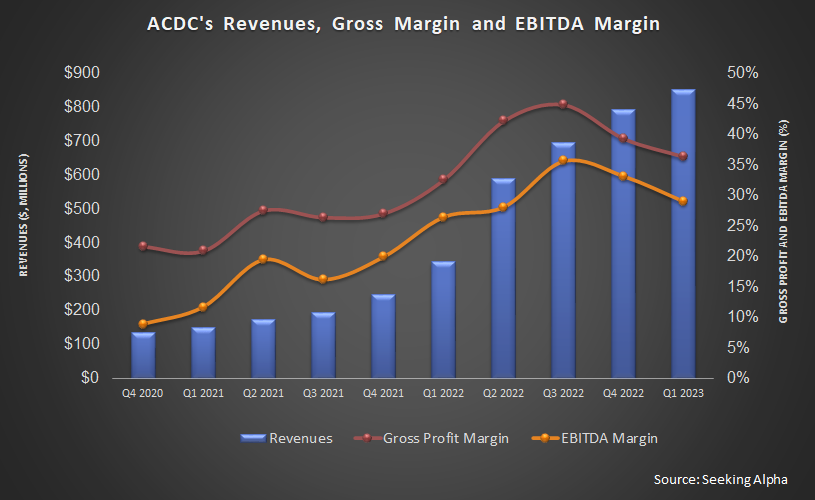

As we discussed in our short article, in Q1, quarter-over-quarter, ProFrac’s revenues increased by 7.3% in Q1. It operated 40.7 active frac spreads on average in Q1 2023 compared to an average of 29.9 frac spreads in FY2022. Its costs increased significantly related to the acquisitions of US Well Services, Monarch Silica, REV, Performance Proppants, and Producers. It kept on upgrading and standardizing its assets. Plus, it added sand capacity and relocated fleets to position them better to integrate its bundled services.

However, ProFrac’s adjusted EBITDA (annualized basis) per average active fleet decreased to $25.1 million compared to $27.9 million in Q4. To improve this, it plans to increase the annualized gross profit generated from fleets that pump its sand and use its logistics and chemicals. From using only four fleets using sand produced by its own mine in Q4, its number of fleets using sand mines more than tripled in Q1. So, the company expects to grow profits per fleet with this strategy. The addition of fleets and mines and the retirement of acquired assets since Q3 2022 has led to a $20 million cost absorption. However, this cost is non-recurring.

Cash Flows And Debt

Excluding the acquisitions, the company’s year-over-year free cash flow improved tremendously following a substantial increase in cash flow from operations. In Q1, it constructed four e-fleets and pursued an engine upgrade program. Over the next two quarters, ACDC’s capex can accelerate over the next two quarters, given the anticipated timing of project completions. Later, it expects to reduce capital spending based on total fleet activity and improve return on capital investment. Its recent inventory builds will reduce cash requirements and improve cash flow generation in the coming quarters.

ACDC’s debt-to-equity ratio was 0.8x as of March 31, 2023. Its liquidity amounted to $169 million but was much lower than its net debt of $1.04 billion as of that date. So, a degree of financial risk remains for the company.

Relative Valuation

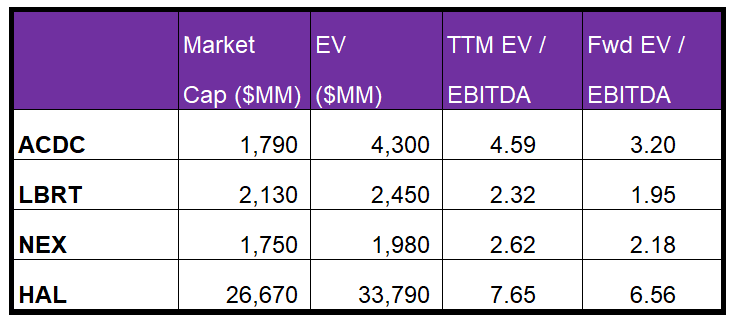

ACDC is currently trading at an EV-to-adjusted EBITDA multiple of 4.6x. Based on sell-side analysts’ EBITDA estimates, the forward EV/EBITDA multiple is 3.2x.

ACDC’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is much steeper than peers because its EBITDA is expected to increase more sharply than its peers in the next year. This typically results in a much higher EV/EBITDA multiple than its peers. However, the stock’s EV/EBITDA multiple is marginally higher than its peers’ (LBRT, NEX, and HAL) average. So, the stock is undervalued versus its peers.

Final Commentary

Over the past year, ACDC has significantly increased its frac spread count. Higher demand for its in-basin sand and frac service allowed it to upgrade the legacy Tier 2 equipment to Tier 4 dual fuel and build a new electric fleet. As its business model upgrades, it vertically integrated the supply chain and returned free cash flow to the shareholders. In Q1, ProFrac’s adjusted annualized EBITDA per average active fleet decreased. So it focuses on cost reductions. It can build and refurbish its pump units and blenders with integrated fluid ends, power ends, and high-pressure iron. So, it can generate $25 million in annualized gross profit for every fleet supply.

Although natural gas prices decline has created a headwind, capital scarcity, supply chain tightness, and OPEC’s decision to curtail production will stabilize crude oil prices. Over the medium term, the global demand for power generation will increase natural gas demand. In Q1, its free cash flow improved tremendously following a substantial increase in cash flow from operations. However, it has a considerable debt load compared to its liquidity, which can be a warning sign for investors. The stock is undervalued versus its peers.