In my latest Monday Macro View, I discuss the recent outlook by World Bank on Global Economy and the bottom-line is that things don’t look quite promising. OECD also released its global economic outlook which seems to be in line with that of World Bank. I will be highlighting some interesting charts below and also present an update of the oil markets.

This content is locked

Login To Unlock The Content!

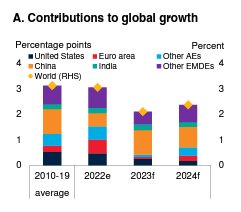

The World Bank has indicated a deceleration in global economic growth, forecasting a slowdown to 2.1% in 2023 from 3.1% in 2022, due to tighter monetary policies to curb soaring inflation. The growth is expected to recover modestly to 2.4% in 2024.

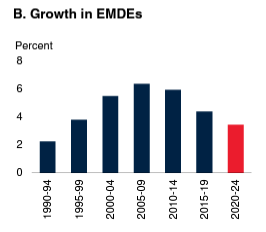

Factors like stringent global financial conditions and diminished external demand are likely to impact the growth in emerging markets and developing economies (EMDEs). Initial 2023 projections received an uplift due to strong data at the beginning of the year, but this is expected to be overshadowed by subsequent downgrades. Inflation, though high, is anticipated to taper off gradually, contingent on the stability of long-term inflation expectations.

The global economy may face further headwinds if the banking sector encounters more stress or if inflation pressures necessitate even tighter monetary policies. Additionally, long-term growth potential is hindered by the combined effects of the pandemic, geopolitical tensions such as Russia’s invasion of Ukraine, and tightening global financial conditions. The recent banking issues underscore the urgency for worldwide financial regulatory reforms. To tackle these challenges, policy responses must emphasize global cooperation for clean energy transitions, climate change mitigation, and debt relief.

The financial landscape is strained owing to policy rate hikes and intermittent financial instability. The steep rise in policy interest rates led banks to suffer significant unrealized losses. Concerns regarding banks’ balance sheets triggered market fluctuations and deposit withdrawals in the United States and Europe earlier this year, which were controlled through prompt and comprehensive policy actions. The repercussions on EMDEs have been somewhat contained, but countries with marked macroeconomic vulnerabilities have faced slower growth and greater financial strains.

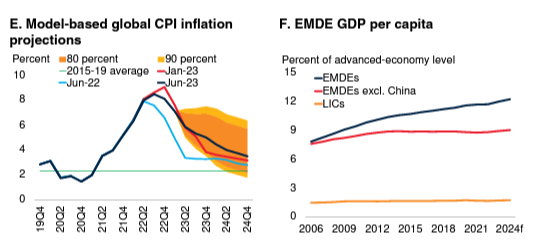

Additionally, energy prices have declined since their peak in 2022 due to an easing in global growth prospects and a milder Northern winter that lowered natural gas and electricity demands. Conversely, metal prices rose in early 2023 because of a more robust recovery in China but have since declined. Agricultural prices are also easing due to favorable crop production prospects.

In conclusion, the World Bank’s latest outlook reflects a cautious global economic scenario marked by slowing growth, inflationary pressures, and heightened financial risks. Effective policies and global cooperation are critical to safeguard macroeconomic and financial stability and foster a resilient and inclusive global economic environment.

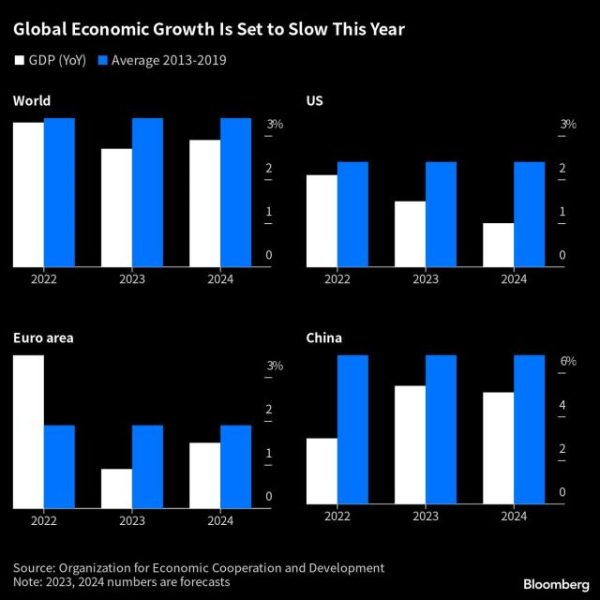

OECD Outlook:

The Organisation for Economic Co-operation and Development (OECD) has projected a frail recovery for the global economy, which is grappling with the repercussions of the COVID-19 pandemic and the conflict in Ukraine. In its latest Economic Outlook, the OECD forecasts that the global economy will grow by 2.7% in 2023 and will experience only a slight uptick to 2.9% in 2024. These rates are underwhelming compared to the 3.4% average growth witnessed in the seven years before the pandemic. Major economies such as the US, the Eurozone, and China are expected to have similarly lackluster recoveries.

Inflation remains a major concern, proving to be more obstinate than anticipated. The restrictive monetary policies implemented by central banks in an effort to manage inflation are further complicating the economic landscape. OECD Chief Economist Clare Lombardelli emphasized the importance of a balanced approach by central banks, cautioning against tightening policies to an extent that could stymie growth. She asserted that central banks must maintain a restrictive stance until there is concrete evidence that inflation has steadily returned to target levels, including core inflation.

The OECD’s warning follows a similar alert from the World Bank about the fragile state of the global economy and the impending slowdown due to interest rate hikes. Major central banks like the Federal Reserve and the European Central Bank are at a crossroads, deciding whether to pause or proceed with a rapid cycle of rate increases, reminiscent of the 1980s.

The OECD acknowledges that previous rate hikes are starting to have a ripple effect, notably in the property and financial markets. However, the full impact of these hikes is expected to materialize later in 2023 and into 2024. The situation is further muddied by uncertainties regarding the magnitude of the impact and the possibility that inflation could remain elevated for a longer period.

Additionally, the OECD calls for more focused fiscal support, advising governments to concentrate aid on the most vulnerable sections of the population. This targeted approach is especially relevant in the context of assistance provided to offset energy costs, which, if left unchecked, can strain public finances that are already encumbered with higher debt levels due to the pandemic.

Oil Markets:

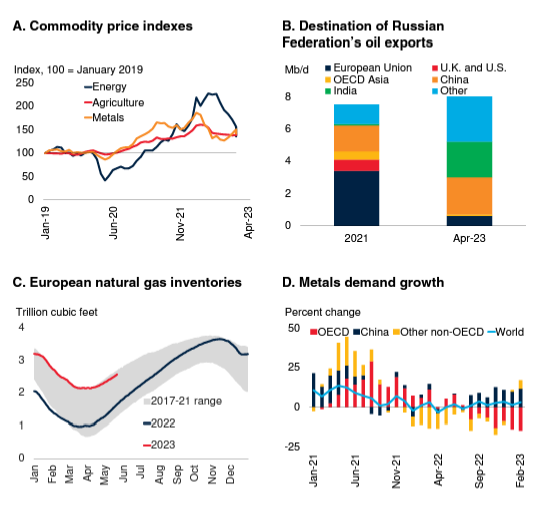

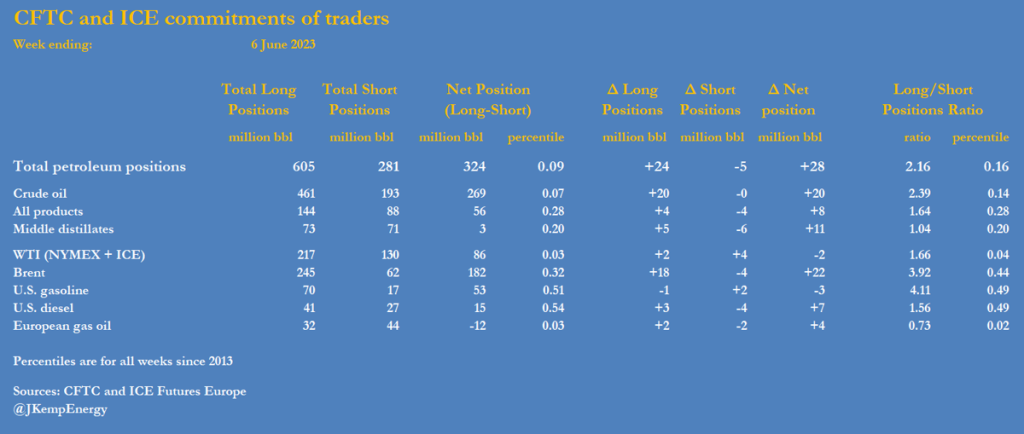

In the week leading up to June 6, hedge funds and money managers acquired the equivalent of 28 million barrels across six major petroleum futures and options contracts. Specifically, they bought into Brent (+22 million barrels), U.S. diesel (+7 million barrels), and European gas oil (+4 million barrels), while selling NYMEX and ICE WTI (-2 million) and U.S. gasoline (-3 million).

The cumulative net position across all six contracts stood at 324 million barrels, which is in the 9th percentile compared to all weeks since 2013. Bullish long positions exceeded bearish short positions by a ratio of 2.16:1, placing it in the 16th percentile.

Portfolio investors displayed a particularly pessimistic outlook on crude, with a net position of 269 million barrels (7th percentile) and a long-short ratio of 2.39:1 (14th percentile).

Saudi Arabia’s Oil Minister characterized the current OPEC+ policy as “proactive, preemptive, and precautionary” at a business conference in Riyadh on June 11.

Despite the fact that Saudi Arabia’s cut will eliminate 30 million barrels from the production-consumption balance in Q3, it did not trigger much optimism regarding crude prices, though it might have prevented a more severe decline.

Premium/Monthly

https://primaryvision.co/wp-admin/admin.php?page=ihc_manage&tab=extended-shortcodes-for-ultimate-membership-pro

https://primaryvision.co/wp-admin/admin.php?page=ihc_manage&tab=user_shortcodes

In NYMEX WTI, funds continued to have a gross short position of 93 million barrels, wagering on further price decreases, a slight reduction from 98 million barrels the previous week.

The hedge fund sector has displayed a notably negative sentiment regarding European gas oil, in light of signs that the region is possibly entering a recession. Funds were net short by 12 million barrels (3rd percentile) with a long-short ratio of 0.73:1 (2nd percentile).