We seem to be at the interregnum where global markets and asset prices will either start to shed fears of a recession or will officially enter one. For now the later seems to be true as Europe entered one a few days ago along with New Zealand. Australia seems to be nearing one. However, there are also talks about a Rolling Recovery. The oil markets are also giving mixed signals. There was some interesting development in Russia that might not have had a significant impact right now but has definitely raised questions for the longer run (pertaining to the power equation in Russia).

Rolling Recovery/Expansion?

The U.S. economy, which experienced a sector-based ‘rolling recession’, is now transitioning into a ‘rolling expansion’, as sectors that were previously affected are starting to recover. This is according to market expert Ed Yardeni, President of Yardeni Research.

One of the first sectors to take a hit during the rolling recession was single-family housing. This was largely due to the aggressive interest rate hikes by the Federal Reserve. However, recent data reveals that the housing market is bouncing back. In May, housing starts, which represent the beginning of new home construction, surged by 21.7% compared to April, reaching a seasonally adjusted annual rate of around 1.63 million. This was the highest level since April 2022 and the largest monthly gain since October 2016. Single-family starts, which usually make up the majority of new construction, rose about 18.5% to a seasonally adjusted annual rate of 997,000, marking the highest level since June 2022.

The National Association of Home Builders/Wells Fargo Housing Market Index soared 77% since December and moved above the neutral level of 50 for the first time since July 2022, reflecting home builders’ positive outlook. An index below 50 indicates negativity, while above 50 suggests positivity. The turnaround in the housing market is attributed to the existing home shortage which has boosted demand for new homes, despite mortgage rates averaging 6.69%.

Another sector showing signs of recovery is consumer goods. Contrary to the common belief that consumers would deplete their savings by the year’s end, leading to an economic slowdown, Yardeni remains optimistic. He argues that the labor market is robust with wages and salaries growing. Additionally, consumers have other income sources such as interest, dividends, and rents, which are at record highs. He also notes that the retiring baby boomer population, estimated at 49 million, is contributing to spending, especially in restaurants, travel, and healthcare.

However, commercial real estate is one sector that remains weak. Despite this, Yardeni believes that the weakness in commercial real estate is likely to be offset by the continued onshoring trend and increased fiscal spending. The Atlanta Fed’s GDPNow model estimates a second-quarter GDP growth of 1.9%. Encouraged by strong housing starts, it also estimates that nonresidential structures investment will grow 17.5% in the second quarter.

While there might be a technical correction in the stock market, Yardeni opines that solid economic fundamentals will limit any significant downside. The rolling expansion across different sectors will likely contribute positively to the ongoing economic recovery.

Wagner Group

Yevgeny Prigozhin, a well-known Russian mercenary leader, recently caused turmoil by sending an armored convoy towards Moscow, raising doubts about Russian President Vladimir Putin’s control over the country. Prigozhin has been known for his role in Russia’s military campaign in Ukraine, leading the Wagner mercenary group, which consists of thousands of recruits, including many from Russian prisons.

Prigozhin’s convoy moved from eastern Ukraine to the southern Russian city of Rostov-on-Don, then advanced towards Moscow, coming within 200 km (124 miles) of the capital. This dramatic action appeared as a potential challenge to Putin’s government. However, the movement came to a sudden halt, allegedly due to an agreement brokered by Belarusian leader Alexander Lukashenko. Prigozhin announced that he and his forces did not shed blood and termed the event as “a march for justice.”

The background to this event involves Prigozhin’s frustration with Russia’s military leaders, particularly Defense Minister Sergei Shoigu and armed forces chief Valery Gerasimov. Prigozhin accused them of failing to adequately supply his mercenaries. Additionally, when Putin endorsed a deadline to incorporate all mercenary groups in Ukraine under the defense ministry’s contracts, Prigozhin saw it as an affront to his authority.

Despite Prigozhin’s claims that he was not challenging Putin’s rule, but rather the military leadership and their handling of the war, the event raised questions about Putin’s control. Prigozhin will now be heading to Belarus, and his fighters have been offered amnesty, and he will not face criminal charges, as per the reported deal.

This incident has left many speculating about the implications for Putin’s authority. On one side, he may appear weakened and reliant on external assistance, as evidenced by Lukashenko’s role in brokering a resolution. However, another perspective suggests that Russians may have seen the chaos that could arise in the absence of Putin’s leadership, and this may strengthen his position in some quarters. Moreover, with Prigozhin moving to Belarus, a potential threat in the form of the Wagner group’s 25,000 mercenaries might be neutralized under the military’s control.

Oil Markets

Oil markets are giving mixed signals. My personally view is that the bearish factors are winning over the bullish one. John Kemp has highlighted these factors in his newsletter(s).

The oil market is showing signs of balance, with Brent prices and spreads reflecting that upside risks from low inventories and supply limitations by Saudi Arabia and OPEC+ are being countered by concerns over a slowing global economy. Although OPEC+ announced output cuts in early April and Saudi Arabia announced an additional voluntary cut in June, these measures have not led to the quick increase in prices that producers and investors were hoping for.

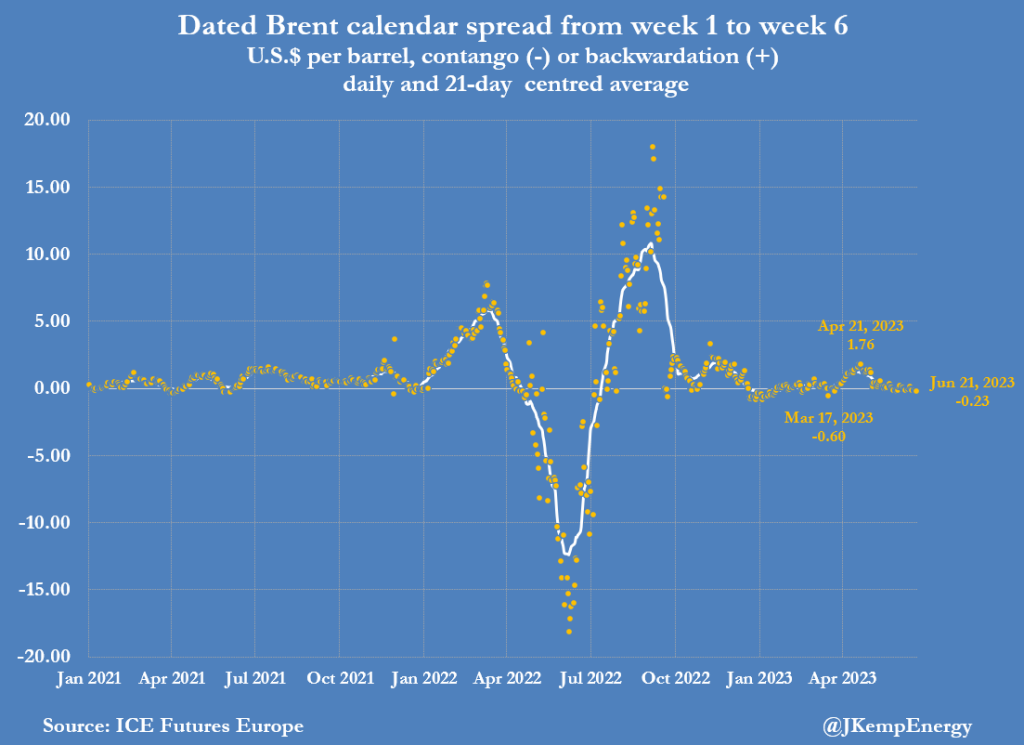

In the physical market, dated Brent prices are in contango, meaning that traders expect ample crude supply in the near future. The spread between dated prices for July and August was nearly flat as of June 21, having moved from a state of backwardation, which would indicate a tighter market.

On the financial side, the futures spread from August to September also shows a shift from backwardation to contango. The spread for Q4 is in backwardation of less than $1, indicating that the market is expected to tighten slowly.

However, this balance could be fragile. Global petroleum inventories, especially for refined fuels such as diesel and gas oil, are significantly below the long-term average. If the global economy rebounds without entering a recession, these low inventories could lead to a sharp increase in prices.

Conversely, the global economic outlook has been weakening since the beginning of the year, which has subdued bullish sentiments. Persistent inflation in North America and Europe is pushing interest rates up, potentially leading to a more extended slowdown in demand. Additionally, expectations for a strong economic and oil consumption recovery in China have been delayed.