Building on the recent theme of whether the global economy is heading for a soft landing or not I will focus on the European economy in this article. Starting off with this strange headline from CNN:

I almost laugh reading this article as the data-points and indicators I will be mentioning below presents an utter opposite picture of the European economy.

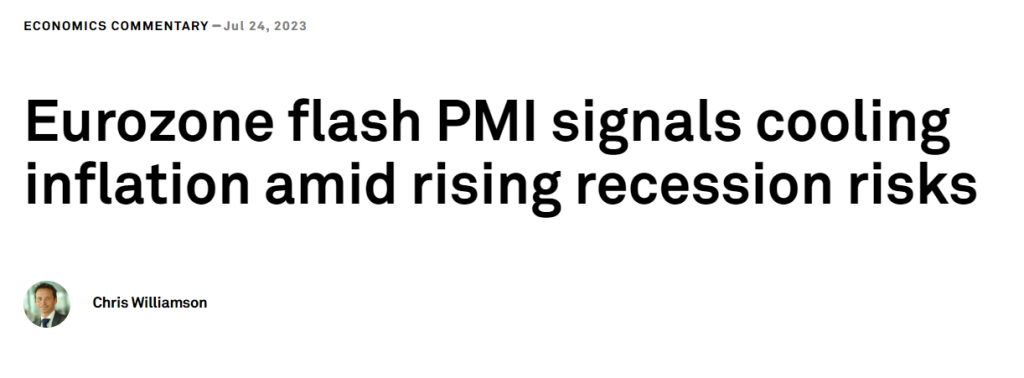

Eurozone business output has plunged in the recent months. The business output as measured by HCOB flash PMI registered its fastest decline in previous 8 months since July. HCOB Flash Eurozone Composite PMI Output Index fell to 48.9 in July from 50 in June and signals a second consecutive fall in activity preceded by a 5-month expansion. Prices charged by manufacturers touched levels not seen since 2008 Financial Crisis. Amidst these concerning signs one can take peace in the fact that consumer price inflation cooled to acceptable levels.

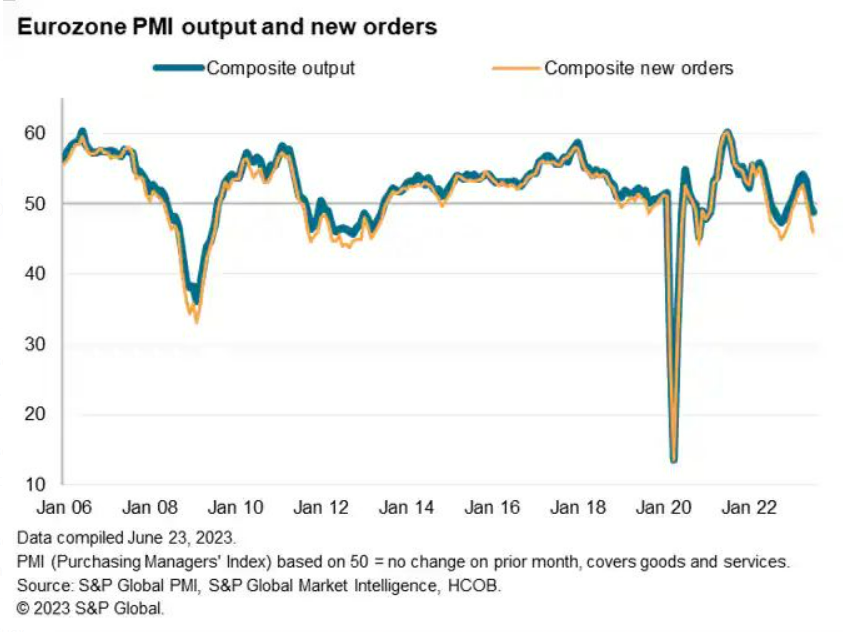

New orders fell by steepest levels since 2009 and service sector orders dropped first time in seven months. This slowdown also hit the labor markets as backlogs of work was down to the lowest level since February 2013.

Economic pressures eased in July, with deflation in manufacturing and a slowdown in service sector inflation. July’s rate of input cost inflation across both sectors decreased for the tenth consecutive month, reaching its lowest point since November 2020.

The average prices charged for goods and services increased at the slowest pace in 29 months. Based on these figures, it seems likely that the 5.5% annual consumer price inflation seen in June will gradually cool towards approximately 3% by year’s end.

In manufacturing, we saw a decrease in input demand and improved supply conditions, which led to more supply chain discounting. In fact, the rate of decline in average factory input prices in July was the second steepest recorded in the survey’s 25-year history. These lower costs subsequently led to decreased manufacturing selling prices for the third month in a row.

While the service sector continues to experience rising input costs, primarily due to wage pressures, the rate of increase slowed for the fifth consecutive month. The inflation rate for service prices also declined, hitting its lowest point since October 2021.

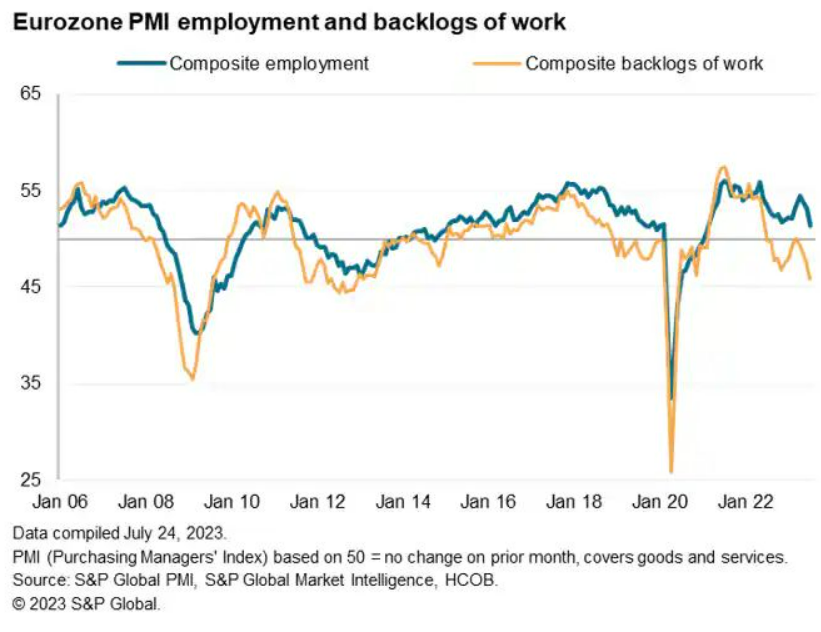

Regionally, output contracted sharply in France, marking the second consecutive monthly decline and the steepest rate since May 2013, if pandemic factors are excluded. Both the manufacturing and service sectors saw an acceleration in their contraction rates.

Germany also experienced a contraction in output, the first since January, with a particularly significant drop in factory output. This downturn was coupled with a deceleration in services activity growth due to a significant decrease in new service orders.

The rest of the Eurozone only saw minimal growth for the second consecutive month, marking the weakest performance so far this year. This is a result of a severe downturn in manufacturing and weaker demand growth for services.

So the question is: Do you think that Europe will not face a recession?